Global Lactose Intolerance Treatment Market

Market Size in USD Billion

CAGR :

%

USD

33.85 Billion

USD

57.25 Billion

2024

2032

USD

33.85 Billion

USD

57.25 Billion

2024

2032

| 2025 –2032 | |

| USD 33.85 Billion | |

| USD 57.25 Billion | |

|

|

|

|

Lactose Intolerance Treatment Market Size

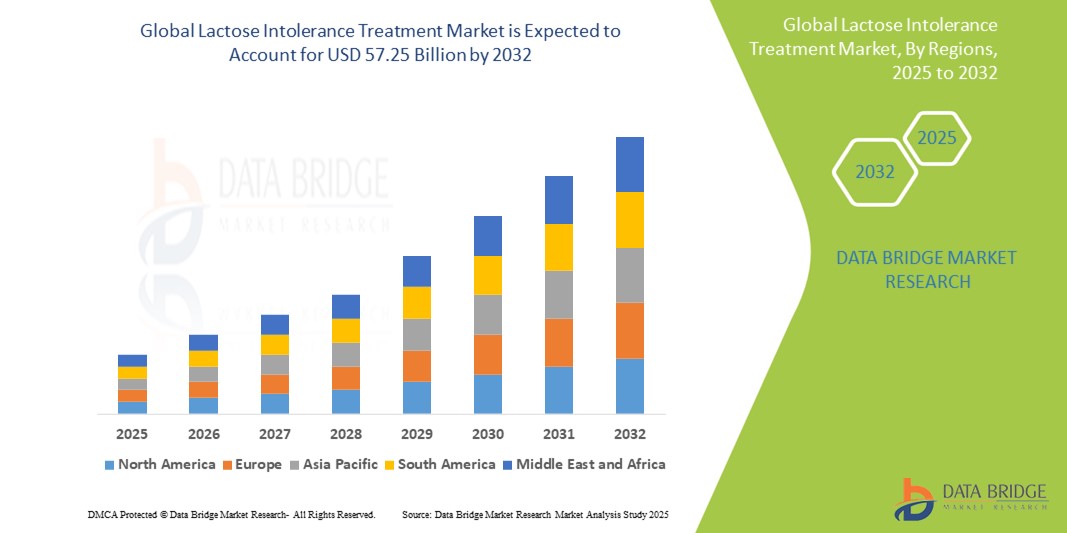

- The global lactose intolerance treatment market size was valued at USD 33.85 billion in 2024 and is expected to reach USD 57.25 billion by 2032, at a CAGR of 6.79% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings. This connection stems from a broader societal shift towards health and wellness, where consumers are increasingly using technology to manage personal health conditions, including dietary intolerances

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing smart solutions as the modern access control system of choice. This emphasis on convenience and control in daily life is mirrored in the healthcare sphere, where consumers seek accessible and effective ways to manage conditions such as lactose intolerance. These converging factors are accelerating the uptake of Lactose Intolerance Treatment solutions, thereby significantly boosting the industry's growth, as individuals become more aware of and proactive in managing their dietary needs through readily available and technologically advanced options

Lactose Intolerance Treatment Market Analysis

- Lactose intolerance treatment, encompassing dietary supplements, enzyme replacements, and lactose-free food and beverage alternatives, is becoming an increasingly essential aspect of modern digestive health management due to rising awareness, growing health consciousness, and the expanding availability of suitable consumer products in both clinical and retail environments

- The escalating demand for lactose intolerance treatments is primarily fueled by the increasing global prevalence of lactose malabsorption, greater consumer shift towards preventive healthcare, and the growing availability of appealing lactose-free alternatives in mainstream grocery and foodservice outlets

- North America dominates the lactose intolerance treatment market with the largest revenue share of 62.3% in 2024, characterized by early awareness and diagnosis of digestive disorders, high consumer spending on health and wellness products, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest growing region in the lactose intolerance treatment market during the forecast period, with a market share of 8.7%, due to increasing urbanization, changing dietary patterns, and a high prevalence of lactose intolerance in countries such as China, India, and Japan

- Primary Lactose Intolerance segment dominates the lactose intolerance treatment market, with 65.2% market share. This is driven by its high prevalence rate globally, as it typically develops with age due to a natural decrease in lactase enzyme production

Report Scope and Lactose Intolerance Treatment Market Segmentation

|

Attributes |

Lactose Intolerance Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lactose Intolerance Treatment Market Trends

“Personalized Nutrition and AI-Driven Digestive Health Solutions”

- A significant and accelerating trend in the global Lactose Intolerance Treatment market is the growing integration of artificial intelligence (AI) and personalized nutrition platforms, enabling tailored digestive health solutions for individuals based on genetics, microbiome data, and lifestyle habits

- For instance, companies such as ZOE and DayTwo are leveraging AI algorithms and gut microbiome testing to provide personalized dietary guidance, including recommendations for lactose-free alternatives that align with individual digestive profiles

- AI-driven apps are increasingly used to track symptoms, analyze dietary intake, and recommend enzyme supplements or specific lactose-free foods. Some platforms even integrate wearable data to monitor digestive responses and adjust dietary suggestions in real-time

- These smart systems allow users to manage lactose intolerance proactively, offering greater control and convenience through mobile apps that connect with food scanners, smart kitchen devices, and digital health platforms

- This convergence of AI, biotechnology, and nutrition science is reshaping consumer expectations by offering customized, data-backed approaches to managing lactose intolerance. Leading companies are now investing in digital tools that allow consumers to identify tolerable lactose thresholds and optimize dietary plans accordingly

- The demand for intelligent, personalized lactose intolerance solutions is growing rapidly across global markets, as health-conscious consumers seek tailored, tech-enabled ways to improve digestive well-being and reduce dietary restrictions

Lactose Intolerance Treatment Market Dynamics

Driver

“Growing Demand Driven by Rising Digestive Health Awareness and Dietary Shifts”

- The increasing global awareness of digestive health and the growing number of individuals diagnosed with lactose intolerance are significant drivers for the demand for lactose intolerance treatment solutions

- For instance, in March 2024, Nestlé Health Science expanded its portfolio of lactose-free nutritional products across Europe and Asia, reflecting the rising consumer demand for accessible and convenient digestive health options. Such strategic moves by key players are expected to drive the Lactose Intolerance Treatment industry growth during the forecast period

- As consumers become more informed about the symptoms of lactose intolerance and seek to improve their overall gut health, there is a surge in the use of lactose-free dairy alternatives, enzyme supplements, and probiotic solutions tailored to individual digestive needs

- Furthermore, the global shift towards plant-based diets and the increasing popularity of wellness-oriented lifestyles are making lactose-free and dairy-alternative products essential in both developed and emerging markets

- The convenience of widely available lactose-free food and beverage options, over-the-counter enzyme supplements, and mobile apps to track intolerances are key factors propelling adoption. The trend toward preventive health and clean-label consumption further supports the growth of the Lactose Intolerance Treatment market across multiple demographics

Restraint/Challenge

“Limited Consumer Awareness and Perceived Inconvenience of Dietary Changes”

- A major restraint to the widespread adoption of lactose intolerance treatments is the limited awareness in many regions regarding the condition, its symptoms, and available treatment or dietary management options. This gap in education leads many individuals to continue consuming lactose-containing foods without recognizing the cause of their discomfort

- For instance, studies in parts of Asia and Africa show a high prevalence of lactose intolerance but low diagnosis rates, limiting demand for targeted treatment solutions

- In addition, some consumers perceive the transition to lactose-free or dairy-alternative products as inconvenient, citing taste differences, limited availability in rural areas, and confusion over food labeling as barriers

- Overcoming these challenges requires investment in consumer education, clearer food labeling standards, and efforts by food manufacturers to enhance the taste and nutritional value of lactose-free alternatives

- Price sensitivity in certain markets also poses a challenge, as lactose-free products and enzyme supplements often carry a price premium compared to conventional dairy items

- Companies must focus on improving affordability and accessibility to drive broader market penetration and sustained growth in underserved regions

Lactose Intolerance Treatment Market Scope

The market is segmented on the basis of type, treatment, route of administration and end user.

• By Type

On the basis of type, the lactose intolerance treatment market is segmented into primary lactose intolerance, secondary lactose intolerance, congenital lactose intolerance, and developmental lactose intolerance. The primary lactose intolerance segment dominated the largest market revenue share of 65.2% in 2024, driven by its high global prevalence, especially among Asian, African, and Hispanic populations. Individuals with this form of intolerance experience reduced lactase production after childhood, necessitating long-term dietary adjustments and treatment.

The Secondary Lactose Intolerance segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising incidences of gastrointestinal disorders such as Crohn’s disease and celiac disease. This form of intolerance is often temporary but requires prompt dietary management, increasing the demand for diagnostic support and enzyme-based supplements.

• By Treatment

On the basis of treatment, the lactose intolerance treatment market is segmented into food supplements, enzymatic lactase supplements, and others. The enzymatic lactase supplements segment held the largest market revenue share in 2024, driven by growing consumer preference for digestive enzyme products that allow them to consume dairy without discomfort. These supplements are widely available, affordable, and easy to incorporate into daily routines.

The food supplements segment is anticipated to witness the fastest CAGR from 2025 to 2032 due to increasing consumer awareness of gut health and the rising popularity of probiotics and prebiotics in managing lactose intolerance symptoms naturally. The market sees growing demand for functional foods that promote digestive well-being.

• By Route of Administration

On the basis of route of administration, the lactose intolerance treatment market is segmented into oral and injectable. The oral segment held the largest market share in 2024, driven by the convenience, affordability, and wide availability of chewable tablets, capsules, and liquid drops. Oral lactase supplements are the preferred choice among consumers for on-the-go lactose management.

The injectable segment is expected to witness the fastest CAGR from 2025 to 2032 due to its limited application in lactose intolerance. However, ongoing research in enzyme therapy may lead to niche demand in severe congenital cases, with future innovations potentially expanding its usage.

• By End Users

On the basis of end users, the lactose intolerance treatment market is segmented into hospitals, homecare, specialty clinics, and others. The homecare segment held the largest market revenue share in 2024, driven by the increasing consumer shift towards self-management of dietary intolerances using over-the-counter products and home-based diagnostic kits.

Specialty Clinics are expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing demand for personalized digestive health consultations and nutrition therapy. These clinics play a critical role in diagnosing underlying causes and tailoring effective, patient-specific management plans.

Lactose Intolerance Treatment Market Regional Analysis

- North America dominates the Lactose Intolerance Treatment market with the largest revenue share of 62.3% in 2024, driven by increasing awareness of digestive health issues and the high prevalence of lactose intolerance, particularly among adult populations

- Consumers in the region highly value the availability of lactose-free dairy alternatives, enzyme-based supplements, and personalized dietary guidance, which align with growing trends in health-conscious living and preventive healthcare

- This widespread adoption is further supported by well-established healthcare infrastructure, high disposable incomes, and the presence of major players offering innovative product solutions, positioning North America as a key hub for lactose intolerance diagnosis and treatment

U.S. Lactose Intolerance Treatment Market Insight

The U.S. lactose intolerance treatment market captured the largest revenue share of 64.3% in 2024 within North America, fueled by the high prevalence of lactose intolerance among the adult population and growing consumer awareness of digestive health. The widespread availability of lactose-free dairy products, enzymatic lactase supplements, and physician-prescribed dietary modifications supports market growth. Rising demand for clean-label and plant-based alternatives, along with proactive healthcare approaches, further accelerates the market. In addition, the presence of major pharmaceutical and nutraceutical companies enhances product availability and accessibility across retail and online platforms.

Europe Lactose Intolerance Treatment Market Insight

The Europe lactose intolerance treatment market is projected to expand at a CAGR of 6.7% throughout the forecast period, primarily driven by increasing diagnosis rates and growing demand for functional food solutions. Countries such as Germany, France, and Italy are witnessing an uptick in demand for enzyme supplements and lactose-free dairy due to rising health consciousness. Favorable regulatory environments, rising consumer education, and the presence of key players in the European food and pharma industries further boost growth. The market is gaining momentum across both adult and pediatric populations.

U.K. Lactose Intolerance Treatment Market Insight

The U.K. lactose intolerance treatment market is anticipated to grow at a CAGR of 6.2% during the forecast period, supported by growing consumer demand for dairy alternatives and increased awareness of gastrointestinal health. The popularity of plant-based diets, combined with a well-established retail presence for lactose-free and enzymatic products, is fueling the market. In addition, awareness campaigns and healthcare provider recommendations are increasing diagnosis rates, encouraging individuals to adopt tailored dietary and supplementation approaches.

Germany Lactose Intolerance Treatment Market Insight

The Germany lactose intolerance treatment market is expected to expand at a CAGR of 6.5% during the forecast period, driven by a high prevalence of lactose intolerance and growing demand for natural health solutions. The country’s strong pharmaceutical and nutraceutical manufacturing base supports the availability of advanced enzymatic therapies. Moreover, the rising preference for organic and allergen-free dietary supplements is propelling market growth. Germany's health-focused population is also driving the uptake of lactose-free dairy products and specialized nutrition plans.

Asia-Pacific Lactose Intolerance Treatment Market Insight

The Asia-Pacific lactose intolerance treatment market is poised to grow at the segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, due to the high incidence of lactose intolerance in countries such as China, Japan, and India. Cultural dietary shifts, rising healthcare spending, and increasing adoption of Western dietary habits are fueling demand for lactose-free alternatives and supplements. Government-led public health awareness programs and the expansion of domestic nutraceutical brands are also contributing to growth, with urban consumers particularly driving demand in the retail and e-commerce sectors.

Japan Lactose Intolerance Treatment Market Insight

The Japan lactose intolerance treatment market is gaining momentum, with an expected CAGR of 7.1%, supported by the country’s aging population and high prevalence of adult lactose intolerance. Japanese consumers are increasingly turning to enzyme supplements and lactose-free dairy as awareness of digestive wellness rises. The market is further fueled by innovation in functional foods and a preference for convenient, health-enhancing products. In addition, the integration of lactose intolerance treatments into everyday health routines is becoming more common due to education and accessibility.

China Lactose Intolerance Treatment Market Insight

The China lactose intolerance treatment market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a high prevalence of lactose intolerance among adults and infants, combined with increased healthcare awareness and urbanization. The rapid growth of the middle class and dietary diversification are increasing demand for both pharmaceutical-grade enzymatic treatments and plant-based dairy alternatives. Domestic production capabilities and strong distribution networks through e-commerce are accelerating market expansion. Government initiatives aimed at improving nutrition and gut health also support growth in this segment.

Lactose Intolerance Treatment Market Share

The lactose intolerance treatment industry is primarily led by well-established companies, including:

- Johnson & Johnson Services, Inc (U.S.)

- Abbott (U.S.)

- Astrazeneca (U.K.)

- Amgen Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- Macleods Pharmaceuticals Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Lupin Pharmaceuticals, Inc. (U.S.)

- Walter Bushnell (India)

- Nature's Way Brands, LLC (U.S.)

- Profarma (U.S.)

- Recordati Industria Chimica e Farmaceutica S.p.A (Italy)

- Novozymes A/S (Denmark)

Latest Developments in Global Lactose Intolerance Treatment Market

- In April 2023, MEGGLE GmbH & Co. KG announced an extension to its InhaLac product family with a new milled lactose grade, indicating ongoing advancements in lactose derivatives for pharmaceutical and other applications

- In March 2022, Arla Foods Ingredients Group P/S launched two new organic products, Lacroprodan and Premium Lactose Organic, aimed at expanding its product portfolio within the organic sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR XX

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY TYPE

15.1 OVERVIEW

15.2 PRIMARY LACTOSE INTOLERANCE

15.3 SECONDARY LACTOSE INTOLERANCE

15.4 CONGENITAL LACTOSE INTOLERANCE

15.5 DEVELOPMENTAL LACTOSE INTOLERANCE

16 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY TREATMENT

16.1 OVERVIEW

16.2 MEDICATIONS

16.2.1 VITAMIN D

16.2.1.1. BY FORM

16.2.1.1.1. VITAMIN D2 (“ERGOCALCIFEROL” OR PRE-VITAMIN D)

16.2.1.1.2. VITAMIN D3 (“CHOLECALCIFEROL”).

16.2.1.2. BY DOSAGE FORM

16.2.1.2.1. TABLETS

16.2.1.2.2. CAPSULES

16.2.1.2.3. POWDER

16.2.1.3. BY PACKAGING

16.2.1.3.1. BLISTER PACK

16.2.1.3.2. SACHETS

16.2.1.3.3. OTHERS

16.2.1.4. OTHERS

16.2.2 CALCIUM

16.2.2.1. BY FORM

16.2.2.1.1. CALCIUM CARBONATE

16.2.2.1.2. CALCIUM CITRATE

16.2.2.2. BY DOSAGE FORM

16.2.2.2.1. TABLETS

16.2.2.2.2. CAPSULES

16.2.2.2.3. POWDER

16.2.2.3. BY PACKAGING

16.2.2.3.1. BLISTER PACK

16.2.2.3.2. BOTTLE PACK

16.2.2.3.3. OTHERS

16.2.2.4. OTHERS

16.2.3 LACTASE TABLET

16.2.3.1. BY DOSAGE FORM

16.2.3.1.1. TABLET

16.2.3.1.2. CAPSULE

16.2.3.2. BY PACKAGING

16.2.3.2.1. BOX PACK

16.2.3.2.2. BOTTLE PACK

16.2.3.2.3. OTHERS

16.2.3.3. OTHERS

16.3 FOOD SUPPLEMENTS

16.3.1 MILK SUBSTITUTES

16.3.1.1. SOY MILK

16.3.1.1.1. BY TASTE

16.3.1.1.1.1 UNSWEETENED

16.3.1.1.1.2 SWEETENED

16.3.1.1.2. BY FLAVOUR

16.3.1.1.2.1 VANILLA

16.3.1.1.2.2 CHOCOLATE

16.3.1.1.2.3 OTHERS

16.3.1.2. ALMOND MILK

16.3.1.2.1. BY TASTE

16.3.1.2.1.1 SWEETENED

16.3.1.2.1.2 UNSWEETENED

16.3.1.2.2. BY FLAVOUR

16.3.1.2.2.1 VANILLA

16.3.1.2.2.2 CHOCOLATE

16.3.1.2.2.3 OTHERS

16.3.1.3. COCONUT MILK

16.3.1.3.1. BY TASTE

16.3.1.3.1.1 SWEETENED

16.3.1.3.1.2 UNSWEETENED

16.3.1.3.2. BY FLAVOUR

16.3.1.3.2.1 PISTHA

16.3.1.3.2.2 ROSE

16.3.1.3.2.3 CHOCOLATE

16.3.1.3.2.4 OTHERS

16.3.1.4. RICE MILK

16.3.1.4.1. UNSWEETENED

16.3.1.4.2. SWEETENED

16.3.1.5. OTHERS

16.3.2 NUTS

16.3.2.1. BRAZIL NUTS

16.3.2.2. DRIED BEANS

16.3.2.3. ALMONDS

16.3.2.4. OTHERS

16.3.3 CALCIUM-FORTIFIED CEREALS

16.3.4 CALCIUM-FORTIFIED JUICES

16.3.5 OTHERS

16.4 ENZYMATIC LACTASE SUPPLEMENTS

16.4.1 BY BRAND

16.4.1.1. COLIEF

16.4.1.2. LACTAID ORIGINAL

16.4.1.3. LACTAID FAST ACT CHEWABLES

16.4.1.4. LACTAID FAST ACT CAPLETS

16.4.2 BY FORM

16.4.2.1. TABLETS

16.4.2.2. CAPSULES

16.4.2.3. DROPS

16.4.2.4. POWDER

16.4.3 OTHERS

16.5 PROBIOTICS

16.5.1 BY PACKAGING

16.5.1.1. BOTTLE

16.5.1.2. BOX

16.5.2 BY DOSAGE FORM

16.5.2.1. CAPSULE/SOLID

16.5.2.2. DRINKS/LIQUID

16.6 OTHERS

17 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

17.1 OVERVIEW

17.2 ORAL

17.2.1 TABLET

17.2.2 POWDER

17.2.3 SOLUITION

17.2.4 OTHERS

17.3 PARENTERAL

17.3.1 INTRAVENOUS

17.3.2 SUBCUTANEOUS

17.3.3 OTHERS

17.4 OTHERS

18 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY MODE OF PURCHASE

18.1 OVERVIEW

18.2 PRESCRIPTION DRUGS

18.3 OVER THE COUNTER

19 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY POPULATION TYPE

19.1 OVERVIEW

19.2 PEDIATRIC

19.2.1 PRIMARY LACTOSE INTOLERANCE

19.2.2 SECONDARY LACTOSE INTOLERANCE

19.2.3 CONGENITAL LACTOSE INTOLERANCE

19.2.4 DEVELOPMENTAL LACTOSE INTOLERANCE

19.3 ADULTS

19.3.1 PRIMARY LACTOSE INTOLERANCE

19.3.2 SECONDARY LACTOSE INTOLERANCE

19.3.3 CONGENITAL LACTOSE INTOLERANCE

19.3.4 DEVELOPMENTAL LACTOSE INTOLERANCE

19.4 GERIATRIC

19.4.1 PRIMARY LACTOSE INTOLERANCE

19.4.2 SECONDARY LACTOSE INTOLERANCE

19.4.3 CONGENITAL LACTOSE INTOLERANCE

19.4.4 DEVELOPMENTAL LACTOSE INTOLERANCE

20 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY GENDER

20.1 OVERVIEW

20.2 MALE

20.3 FEMALE

21 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITAL

21.2.1 PRIVATE

21.2.2 GOVERNMENT

21.3 SPECIALTY CLINICS

21.4 HOME HEALTHCARE

21.5 OTHERS

22 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAIL SALES

22.3.1 HOSPITAL PHARMACY

22.3.2 ONLINE PHARMACY

22.3.3 MEDICINE STORES

22.4 OTHERS

23 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS

23.8 REGULATORY CHANGES

23.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, BY GEOGRAPHY

GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1 NORTH AMERICA

24.1.1 U.S.

24.1.2 CANADA

24.1.3 MEXICO

24.2 EUROPE

24.2.1 GERMANY

24.2.2 U.K.

24.2.3 ITALY

24.2.4 FRANCE

24.2.5 SPAIN

24.2.6 RUSSIA

24.2.7 SWITZERLAND

24.2.8 TURKEY

24.2.9 BELGIUM

24.2.10 NETHERLANDS

24.2.11 DENMARK

24.2.12 SWEDEN

24.2.13 POLAND

24.2.14 NORWAY

24.2.15 FINLAND

24.2.16 REST OF EUROPE

24.3 ASIA-PACIFIC

24.3.1 JAPAN

24.3.2 CHINA

24.3.3 SOUTH KOREA

24.3.4 INDIA

24.3.5 SINGAPORE

24.3.6 THAILAND

24.3.7 INDONESIA

24.3.8 MALAYSIA

24.3.9 PHILIPPINES

24.3.10 AUSTRALIA

24.3.11 NEW ZEALAND

24.3.12 VIETNAM

24.3.13 TAIWAN

24.3.14 REST OF ASIA-PACIFIC

24.4 SOUTH AMERICA

24.4.1 BRAZIL

24.4.2 ARGENTINA

24.4.3 REST OF SOUTH AMERICA

24.5 MIDDLE EAST AND AFRICA

24.5.1 SOUTH AFRICA

24.5.2 EGYPT

24.5.3 BAHRAIN

24.5.4 UNITED ARAB EMIRATES

24.5.5 KUWAIT

24.5.6 OMAN

24.5.7 QATAR

24.5.8 SAUDI ARABIA

24.5.9 REST OF MIDDLE EAST AND AFRICA

24.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL LACTOSE INTOLERANCE TREATMENT MARKET, COMPANY PROFILE

26.1 JOHNSON & JOHNSON INC.

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 ABBOTT

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 MCNEIL NUTRITIONALS, LLC

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 SANOTACT GMBH

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 QUEST VITAMINS LIMITED

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 ADVACARE PHARMA

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 BAYER AG

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 VELNEX MEDICARE

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 VIENCEE PHARMA SCIENCE

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 FEMCORP

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 NOVALAB HEALTHCARE

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 WREN LABORATORIES

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 KERRY’S PROACTIVE HEALTH

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 OSTELIN

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 MACLEODS PHARMACEUTICALS LTD.

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 LUPIN

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 NATURE'S WAY BRANDS

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 NOVOZYMES A/S

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 ADM

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 RECORDATI S.P.A.

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 THE QUAKER OATS COMPANY (PEPSICO, INC.)

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 TARGET BRANDS, INC. (DAYTON HUDSON CORP.)

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 GENERAL MILLS

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.