Global Laminated Veneer Lumber Market

Market Size in USD Billion

CAGR :

%

USD

4.72 Billion

USD

8.09 Billion

2025

2033

USD

4.72 Billion

USD

8.09 Billion

2025

2033

| 2026 –2033 | |

| USD 4.72 Billion | |

| USD 8.09 Billion | |

|

|

|

|

Laminated Veneer Lumber Market Size

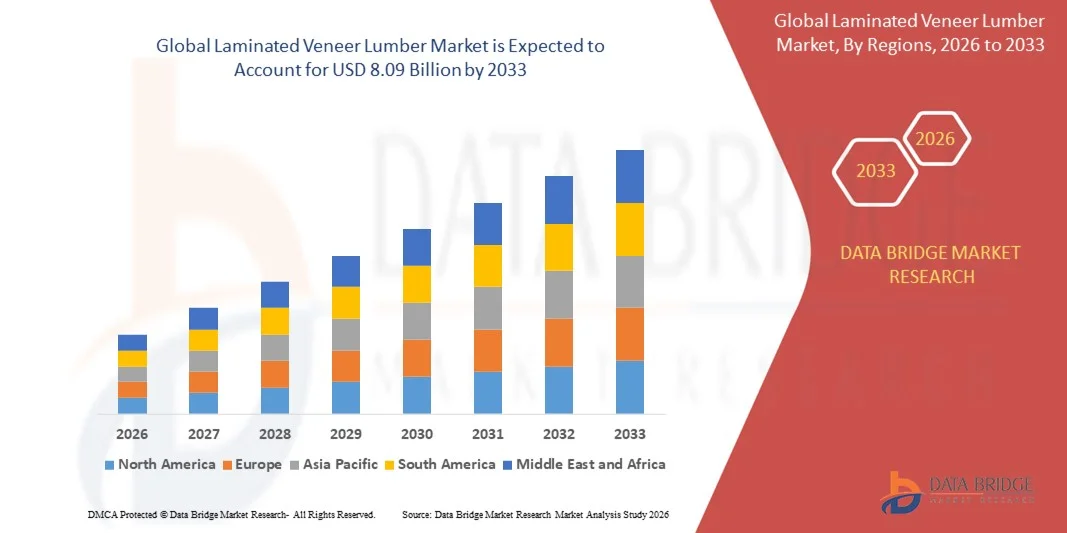

- The global laminated veneer lumber market size was valued at USD 4.72 billion in 2025 and is expected to reach USD 8.09 billion by 2033, at a CAGR of 6.95% during the forecast period

- The market growth is largely fueled by the increasing demand for engineered wood products in residential and commercial construction, driven by the need for stronger, lighter, and more sustainable building materials

- Furthermore, rising focus on sustainable construction practices and the use of certified timber products is encouraging the adoption of LVL as an eco-friendly alternative to traditional solid wood, thereby significantly boosting the industry’s growth

Laminated Veneer Lumber Market Analysis

- Laminated veneer lumber, a high-strength engineered wood product made from thin wood veneers bonded under heat and pressure, is increasingly preferred for structural applications such as beams, headers, and columns due to its uniformity, dimensional stability, and superior load-bearing capacity

- The escalating demand for laminated veneer lumber is primarily driven by the construction sector’s emphasis on durable, lightweight, and sustainable materials, growing residential and commercial building projects, and the need for consistent quality and precision in structural components

- North America dominated the laminated veneer lumber market with a share of around 40% in 2025, due to increasing construction activities, adoption of engineered wood in residential and commercial buildings, and growing awareness of sustainable building materials

- Asia-Pacific is expected to be the fastest growing region in the laminated veneer lumber market during the forecast period due to rapid urbanization, rising construction investments, and increasing adoption of engineered wood in countries such as China, Japan, and India

- Cross-banded laminated veneer lumber segment dominated the market with a market share of 44% in 2025, due to its superior structural strength, dimensional stability, and versatility in construction applications. Builders and contractors often prefer Cross-Banded LVL for load-bearing components due to its uniformity and high bending strength compared to solid wood. The segment also sees strong adoption owing to its ability to reduce waste, ease of handling, and compatibility with large-scale prefabricated construction projects. Cross-Banded LVL’s consistent quality and long-span capabilities make it suitable for beams, headers, and columns in both residential and commercial projects

Report Scope and Laminated Veneer Lumber Market Segmentation

|

Attributes |

Laminated Veneer Lumber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laminated Veneer Lumber Market Trends

Growing Use of Engineered Wood in Sustainable Construction

- A significant trend in the laminated veneer lumber market is the increasing adoption of engineered wood solutions in sustainable construction, driven by the rising emphasis on eco-friendly and resilient building materials. LVL is increasingly preferred for beams, headers, and structural panels due to its high strength-to-weight ratio and consistent performance across applications

- For instance, Boise Cascade supplies LVL products widely used in residential and commercial construction projects across North America, offering structural stability while supporting green building certifications such as LEED. Their products contribute to longer-lasting structures with reduced timber consumption

- The market is witnessing rising use of LVL in modular and prefabricated construction where standardized components accelerate project timelines and improve on-site efficiency. This trend is positioning LVL as a critical material for modern construction methodologies

- Infrastructure projects are incorporating LVL for bridges, flooring, and roof systems where engineered wood provides superior load-bearing capacity and dimensional stability. This adoption reinforces the shift toward sustainable yet high-performance construction solutions

- In commercial construction, developers are favoring LVL for high-rise wooden structures that demand predictable performance and design flexibility. Its engineered composition reduces warping and splitting, enhancing structural reliability

- The demand for LVL is also growing in renovation and retrofit applications where traditional timber is insufficient for specific structural requirements. This trend highlights LVL’s role as a versatile and environmentally responsible material for expanding construction needs

Laminated Veneer Lumber Market Dynamics

Driver

Rising Demand for Durable and Eco-Friendly Structural Materials

- The growing need for sustainable building practices and long-lasting construction materials is driving demand for laminated veneer lumber, which combines durability with reduced environmental impact. LVL offers consistent mechanical properties and less material wastage compared to solid timber

- For instance, Weyerhaeuser manufactures LVL products for large-scale residential and commercial projects, supporting green building initiatives and offering materials with predictable structural performance. These products help builders achieve both strength and sustainability goals

- Architects and contractors are increasingly specifying LVL for beams, columns, and headers where high strength and dimensional stability are required. Its engineered composition ensures uniform quality across large-scale applications

- The adoption of LVL in earthquake-prone regions is rising as engineered wood provides resilience and energy absorption superior to conventional timber. This application demonstrates LVL’s suitability for safety-critical structures

- The overall preference for LVL in modern construction continues to expand as developers and designers seek materials that balance performance, sustainability, and long-term cost-effectiveness. Its versatility and reliability reinforce its adoption across multiple building sectors

Restraint/Challenge

High Production Costs and Reliance on Quality Timber

- The laminated veneer lumber market faces challenges from the high production costs associated with processing veneers, adhesive application, and pressing operations. These costs are further influenced by the need for consistently high-quality timber to ensure product performance

- For instance, Boise Cascade invests in advanced LVL manufacturing facilities to maintain strict quality standards and produce structurally reliable beams and panels. The requirement for high-grade logs and sophisticated equipment elevates overall production expenditure

- Manufacturers also encounter challenges in sourcing sustainable raw materials, as supply shortages or variability in wood quality can impact LVL consistency and performance. These supply constraints can slow production and increase costs

- The capital-intensive nature of LVL production, including kilns, presses, and quality testing equipment, limits entry for smaller players and affects overall market pricing. Operational efficiency must be balanced against structural integrity requirements

- The market continues to face cost pressures as demand grows for affordable, eco-friendly materials without compromising performance. Companies must innovate and optimize production processes to reduce expenses while maintaining high-quality LVL products

Laminated Veneer Lumber Market Scope

The market is segmented on the basis of product, application, and end-use.

- By Product

On the basis of product, the Laminated Veneer Lumber market is segmented into Cross-Banded Laminated Veneer Lumber (LVL) and Laminated Strand Lumber (LSL). The Cross-Banded LVL segment dominated the market with the largest market revenue share of 44% in 2025, driven by its superior structural strength, dimensional stability, and versatility in construction applications. Builders and contractors often prefer Cross-Banded LVL for load-bearing components due to its uniformity and high bending strength compared to solid wood. The segment also sees strong adoption owing to its ability to reduce waste, ease of handling, and compatibility with large-scale prefabricated construction projects. Cross-Banded LVL’s consistent quality and long-span capabilities make it suitable for beams, headers, and columns in both residential and commercial projects.

The Laminated Strand Lumber (LSL) segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for engineered wood products in sustainable construction. For instance, companies such as Weyerhaeuser are promoting LSL for residential framing and modular construction due to its light weight, cost-effectiveness, and efficient use of wood fibers. LSL offers design flexibility for complex structures and reduces reliance on large solid timber, making it increasingly popular in eco-conscious building projects. Its rising adoption in North America and Europe is also driven by initiatives encouraging green building practices.

- By Application

On the basis of application, the Laminated Veneer Lumber market is segmented into concrete formwork, house beams, purlins, truss chords, scaffold boards, and others. The house beams segment dominated the market in 2025, driven by its critical role in structural framing and load distribution in residential and commercial buildings. Builders prefer LVL house beams due to their consistent quality, long-span capabilities, and resistance to warping and splitting compared to solid timber. The segment also benefits from the growing trend of modular and prefabricated homes, which require standardized, high-strength engineered wood components for quick and reliable assembly. House beams made from LVL offer durability, dimensional stability, and easy integration with other construction materials.

The truss chords segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in roof trusses and large-span structures. For instance, Boise Cascade promotes LVL truss chords in commercial and residential roofing applications for their high load-bearing capacity and design adaptability. The segment benefits from construction projects requiring efficient, lightweight structural elements that maintain strength over long spans. Rising demand in Asia-Pacific and Europe for modular and energy-efficient construction solutions further propels the adoption of LVL truss chords.

- By End-Use

On the basis of end-use, the Laminated Veneer Lumber market is segmented into residential, commercial, and industrial sectors. The residential segment dominated the market in 2025, driven by increasing construction of single-family homes, multi-story buildings, and modular housing projects. Homebuilders prefer LVL for residential construction due to its uniformity, structural reliability, and ability to replace traditional timber in beams, headers, and floor joists. The segment also benefits from rising awareness of sustainable building materials and stricter building codes that favor engineered wood products over conventional timber. LVL provides a combination of strength, durability, and ease of installation, making it the preferred choice for modern residential construction projects.

The commercial segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the expansion of offices, retail spaces, and hospitality structures. For instance, Boral Timber offers LVL products tailored for commercial applications such as multi-story office frameworks and hotel construction due to their long-span capabilities and high load-bearing performance. The growth is supported by increasing urbanization, infrastructure development, and the adoption of engineered wood in high-rise and sustainable commercial projects. Rising awareness of LVL’s efficiency and durability in commercial structures is expected to drive long-term market growth.

Laminated Veneer Lumber Market Regional Analysis

- North America dominated the laminated veneer lumber market with the largest revenue share of around 40% in 2025, driven by increasing construction activities, adoption of engineered wood in residential and commercial buildings, and growing awareness of sustainable building materials

- Builders and contractors in the region highly value LVL for its structural strength, dimensional stability, and ability to replace traditional timber in beams, trusses, and purlins, enhancing overall construction efficiency

- This widespread adoption is further supported by advanced manufacturing infrastructure, strong building codes favoring engineered wood, and rising demand for modular and prefabricated construction solutions, establishing LVL as a preferred choice for various structural applications

U.S. Laminated Veneer Lumber Market Insight

The U.S. laminated veneer lumber market captured the largest revenue share in 2025 within North America, fueled by growing residential and commercial construction, particularly in multi-story and modular projects. Builders increasingly prefer laminated veneer lumber for load-bearing beams, headers, and trusses due to its consistent quality and long-span performance. The rising focus on sustainable construction materials and government incentives promoting eco-friendly building practices further drive the market. Moreover, the integration of laminated veneer lumber in prefabricated housing and commercial frameworks is enhancing efficiency, reducing construction time, and minimizing waste, thereby supporting market expansion.

Europe Laminated Veneer Lumber Market Insight

The Europe laminated veneer lumber market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent building codes, the push for sustainable construction, and growing adoption of engineered wood in residential and commercial buildings. Urbanization and increasing construction of multi-story apartments and office spaces are boosting laminated veneer lumber demand. European builders favor laminated veneer lumber due to its structural reliability, dimensional stability, and ease of use in modular construction systems. The market is also witnessing significant growth in renovations and retrofitting projects, where laminated veneer lumber replaces conventional timber for better performance and sustainability.

U.K. Laminated Veneer Lumber Market Insight

The U.K. laminated veneer lumber market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising residential and commercial construction, increasing urbanization, and a growing focus on sustainable and efficient building materials. Concerns regarding structural durability, fire safety, and long-term performance are encouraging builders to adopt laminated veneer lumber in beams, trusses, and purlins. The U.K.’s modern construction infrastructure, coupled with robust adoption of modular building techniques, is expected to continue stimulating market growth, particularly in high-density urban areas.

Germany Laminated Veneer Lumber Market Insight

The Germany laminated veneer lumber market is expected to expand at a considerable CAGR during the forecast period, fueled by strong construction activity, stringent quality standards, and increasing awareness of engineered wood benefits. Germany’s emphasis on eco-friendly and sustainable building solutions, alongside advanced manufacturing capabilities, promotes the adoption of laminated veneer lumber in residential, commercial, and industrial projects. The use of laminated veneer lumber in long-span structural components and prefabricated modules is gaining popularity, aligning with local consumer expectations for safety, durability, and sustainability.

Asia-Pacific Laminated Veneer Lumber Market Insight

The Asia-Pacific laminated veneer lumber market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising construction investments, and increasing adoption of engineered wood in countries such as China, Japan, and India. Government initiatives promoting sustainable construction and the development of prefabricated housing are accelerating laminated veneer lumber demand. Furthermore, as APAC emerges as a hub for laminated veneer lumber manufacturing, the availability of cost-effective and high-quality laminated veneer lumber products is expanding across the region, making engineered wood more accessible for both residential and commercial projects.

Japan Laminated Veneer Lumber Market Insight

The Japan laminated veneer lumber market is gaining momentum due to increasing urbanization, high demand for earthquake-resistant and high-strength building materials, and the growing trend of modular and prefabricated construction. Japanese builders prefer laminated veneer lumber for structural components such as beams and trusses due to its uniformity, durability, and ease of installation. The integration of laminated veneer lumber with modern construction practices, such as timber-based high-rise buildings and eco-friendly residential projects, is fueling growth. Aging population trends are also promoting the use of lightweight, easy-to-handle laminated veneer lumber components to simplify construction and maintenance.

China Laminated Veneer Lumber Market Insight

The China laminated veneer lumber market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing middle class, and increasing construction of residential, commercial, and infrastructure projects. Builders and developers are adopting laminated veneer lumber for its high load-bearing capacity, consistency, and suitability for prefabricated and modular structures. The push towards sustainable and eco-friendly building practices, coupled with a strong domestic manufacturing base, is expanding laminated veneer lumber availability and affordability. Growing government initiatives supporting modern timber construction and smart urban development further propel market growth in China.

Laminated Veneer Lumber Market Share

The laminated veneer lumber industry is primarily led by well-established companies, including:

- Forest and Wood Products Australia Limited (Australia)

- Metsä Board (Finland)

- Weyerhaeuser Company (U.S.)

- Nelson Pine Industries Limited (New Zealand)

- Clarke Veneers and Plywood (Australia)

- Brisco Manufacturing Ltd (New Zealand)

- MJB Wood Group, LLC (U.S.)

- Roseburg Forest Products (U.S.)

- Boise Cascade Company (U.S.)

- West Fraser Timber Co. Ltd. (Canada)

- STEICO SE (Germany)

- Stora Enso Oyj (Finland)

- VMG Lignum (Lithuania)

Latest Developments in Global Laminated Veneer Lumber Market

- In January 2024, Boise Cascade announced new investments in Alabama and Louisiana as part of its engineered wood products (EWP) growth strategy. This strategic expansion is expected to strengthen Boise Cascade’s market position in the southeastern U.S. by increasing production capacity and meeting rising demand for LVL and other engineered wood solutions. The investments aim to enhance operational efficiency, improve distribution capabilities, and support long-term growth in the construction and timber materials market

- In February 2024, Boise Cascade unveiled plans to invest $75 million to expand and modernize key machine centers at its Oakdale facility in Allen Parish. This modernization initiative is anticipated to boost production efficiency and product quality, enabling the company to better serve both residential and commercial construction markets. By upgrading core manufacturing capabilities, Boise Cascade positions itself to capture a larger share of the growing demand for sustainable, high-performance engineered wood products

- In March 2023, Stora Enso announced the installation of its first mass timber elements in Katajanokka, Helsinki, for its new head office. The building will utilize Stora Enso’s newly launched Sylva™ product, showcasing the company’s innovative timber solutions. This milestone demonstrates the increasing adoption of mass timber in commercial construction, highlighting Stora Enso’s role in advancing sustainable building practices and expanding its presence in the European engineered wood market

- In December 2022, Trifecta Collective LLC, backed by GreyLion, finalized the acquisition of the International Mass Timber Conference (IMTC) and International Mass Timber Report (IMTR) from Forest Business Network. This acquisition strengthens Trifecta Collective’s position in the timber and mass timber information market by consolidating key industry resources, enhancing visibility, and facilitating networking within the growing mass timber sector. The move is strategic in capitalizing on the rising interest in engineered wood and sustainable construction trends

- In December 2022, Boise Cascade completed the acquisition of 45 acres of land in Walterboro, South Carolina, along with an additional 34-acre parcel in Hondo, Texas. This strategic expansion of its distribution facilities allows Boise Cascade to enter previously untapped local markets, improving its supply chain reach and operational footprint. By enhancing regional presence, the company is better positioned to meet growing demand for LVL and other engineered wood products in key residential, commercial, and industrial construction markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Laminated Veneer Lumber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laminated Veneer Lumber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laminated Veneer Lumber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.