Global Lancet And Pen Needles Market

Market Size in USD Billion

CAGR :

%

USD

3.77 Billion

USD

7.69 Billion

2025

2033

USD

3.77 Billion

USD

7.69 Billion

2025

2033

| 2026 –2033 | |

| USD 3.77 Billion | |

| USD 7.69 Billion | |

|

|

|

|

Lancet and Pen Needles Market Size

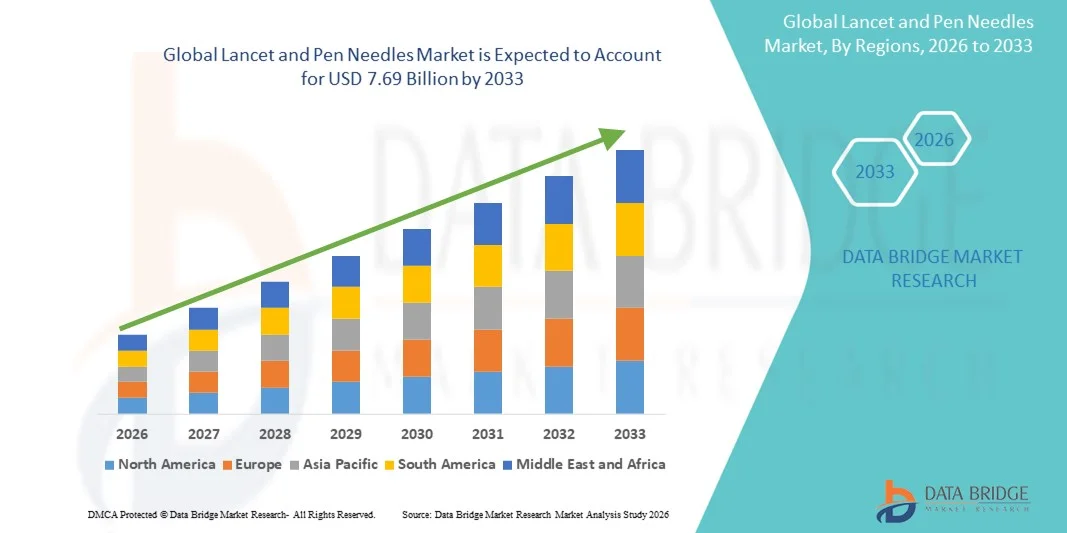

- The global Lancet and Pen Needles market size was valued at USD 3.77 billion in 2025 and is expected to reach USD 7.69 billion by 2033, at a CAGR of 9.33% during the forecast period

- The market growth is largely fueled by the rising prevalence of diabetes and other chronic diseases requiring frequent blood glucose monitoring and insulin administration, driving widespread adoption of lancets and pen needles across both developed and developing regions

- Furthermore, increasing patient preference for minimally invasive, user-friendly, and technologically advanced devices is positioning lancets and pen needles as essential tools for effective disease management. These converging factors are accelerating the uptake of lancet and pen needle solutions, thereby significantly boosting the industry's growth

Lancet and Pen Needles Market Analysis

- Lancet and pen needles, essential tools for blood glucose monitoring and insulin delivery, are increasingly vital components of diabetes management in both home-care and clinical settings due to their ease of use, enhanced patient comfort, and improved safety features

- The escalating demand for lancet and pen needles is primarily fueled by the growing global prevalence of diabetes, rising awareness about self-monitoring of blood glucose, and technological advancements such as ultra-thin, painless needles and safety-engineered lancets

- North America dominated the lancet and pen needles market with the largest revenue share of approximately 40.5% in 2025, supported by a high prevalence of diabetes, strong adoption of advanced self‑care devices, and well‑developed healthcare infrastructure driving demand for lancet and pen needle products.

- Asia‑Pacific is expected to be the fastest‑growing region in the lancet and pen needles market during the forecast period, with rapid urbanization, rising disposable incomes, increasing healthcare spending, and a growing diabetic population in countries such as China and India contributing to strong market growth

- The Retail segment dominated with a revenue share of 62.1% in 2024, driven by wide availability through pharmacies, online platforms, and home-care supply stores. Patients prefer retail purchase for convenience and immediate access.

Report Scope and Lancet and Pen Needles Market Segmentation

|

Attributes |

Lancet and Pen Needles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Lancet and Pen Needles Market Trends

Growing Adoption Due to Rising Diabetes Prevalence and Advancements in Needle Technology

- A significant and accelerating trend in the global lancet and pen needles market is the increasing demand driven by the rising prevalence of diabetes worldwide, along with greater awareness of self-monitoring of blood glucose and insulin administration. This is pushing both patients and healthcare providers to adopt lancets and pen needles as essential tools for effective diabetes management

- For instance, in March 2023, BD (Becton, Dickinson and Company) announced the launch of its latest pen needle technology designed to minimize injection pain and improve patient comfort, reinforcing the importance of product innovation in this segment. Similarly, companies such as Novo Nordisk and Ypsomed are investing in ultra-thin, painless pen needles to enhance the treatment experience

- The adoption of safety-engineered lancets and pen needles is accelerating due to rising regulatory emphasis on reducing needlestick injuries among healthcare professionals. These devices integrate protective mechanisms, ensuring both patient comfort and healthcare worker safety, thereby boosting demand in hospital and clinical settings

- Technological progress is enabling the development of shorter, finer, and sharper pen needles, which provide effective insulin delivery while reducing pain perception. These innovations are gaining preference among both children and elderly diabetic patients, enhancing compliance with prescribed therapies

- The increasing availability of lancets and pen needles through hospital pharmacies, retail pharmacies, and online channels is further expanding access. E-commerce growth, particularly in developing markets, is making it easier for patients to procure diabetes care products conveniently and at competitive prices

- This trend towards more patient-friendly, safer, and easily accessible lancets and pen needles is fundamentally reshaping user expectations in diabetes care. Consequently, key manufacturers are focusing on innovation, affordability, and wide distribution networks to cater to a growing global diabetic population

- The demand for advanced lancet and pen needle solutions is growing rapidly across both developed and emerging regions, as consumers increasingly prioritize comfort, safety, and effective self-management of diabetes

Lancet and Pen Needles Market Dynamics

Driver

Growing Need Due to Rising Diabetes Cases and Self-Monitoring Adoption

- The increasing prevalence of diabetes globally, coupled with the accelerating adoption of self-monitoring and insulin delivery solutions, is a significant driver for the heightened demand for lancets and pen needles

- For instance, in May 2023, Becton, Dickinson and Company (BD) introduced an advanced pen needle technology designed to minimize injection pain and enhance patient comfort. Such innovations by key companies are expected to drive the Lancet and Pen Needles industry growth during the forecast period

- As patients and healthcare providers become more aware of the importance of effective glucose monitoring and safe insulin administration, lancets and pen needles are being increasingly adopted as essential tools in diabetes care, providing a compelling upgrade over traditional syringes

- Furthermore, the growing popularity of minimally invasive, shorter, and finer needles is making pen needles a preferred choice among both patients and clinicians, ensuring improved adherence to prescribed treatments

- The convenience of disposable lancets, safety-engineered designs, and the increasing availability of products through hospital pharmacies, retail outlets, and online platforms are key factors propelling the adoption of lancets and pen needles across both developed and developing markets. The trend towards home-based diabetes care and user-friendly product innovations further contribute to market growth

Restraint/Challenge

Concerns Regarding Needle Phobia and Cost of Advanced Products

- Concerns surrounding needle phobia and patient discomfort during injections pose a significant challenge to broader market penetration. Despite advancements in fine-gauge technology, many patients still hesitate to adopt lancets and pen needles due to fear of pain or anxiety linked with frequent use

- For instance, surveys have highlighted that needle-related anxiety leads to poor adherence to insulin therapy in a subset of diabetic patients, undermining treatment effectiveness

- Addressing these concerns through ultra-thin, painless designs, patient education, and supportive healthcare practices is crucial for improving compliance and building patient trust. Companies such as Novo Nordisk and Terumo are investing in ultra-fine, pain-minimizing technologies to overcome this challenge

- In addition, the relatively high cost of advanced lancets and pen needles compared to basic variants can act as a barrier in price-sensitive markets, particularly in low- and middle-income countries. While standard products are widely accessible, premium solutions with enhanced safety or comfort features often come with a higher price tag

- While affordability is gradually improving with increased competition and local manufacturing, the perceived cost burden can still hinder widespread adoption. Expanding insurance coverage, introducing cost-effective alternatives, and promoting awareness of long-term health benefits will be vital for sustained market growth

Lancet and Pen Needles Market Scope

The market is segmented on the basis of type, length, therapy, mode of purchase, end user, and gauge

- By Type

On the basis of type, the market is segmented into Lancet and Pen Needles. The Pen Needles segment dominated the market with a revenue share of 52.4% in 2024, driven by their wide usage in insulin administration and compatibility with multiple pen devices. Pen needles are preferred for their safety features, precision, and ease of use, especially in home-care settings. They are extensively used in hospitals and clinics for routine injections and are favored by patients for their minimal pain and comfort. The availability of different lengths and gauges makes them versatile for various patient requirements. Pen needles also benefit from strong brand presence and established distribution channels globally. Their adoption is supported by rising awareness about chronic disease management and adherence to insulin therapy. In addition, healthcare providers often recommend pen needles due to their ease of handling and consistent dosing.

The Lancet segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, driven by increasing adoption in self-monitoring of blood glucose, rising awareness of minimally invasive blood sampling, and innovations in safety and pain-minimizing lancets. The segment growth is supported by rising diabetic populations, especially in emerging economies. Patients are increasingly preferring lancets that reduce discomfort and allow safe, easy home testing. New product launches with ergonomic designs and adjustable penetration depths are attracting more users. The segment is also expanding due to growing healthcare programs promoting regular blood glucose monitoring. Technological improvements in lancets, such as automatic depth adjustment and integrated safety caps, are further fueling adoption. Home-care settings, hospitals, and diagnostic centers are increasingly standardizing lancet use.

- By Length

On the basis of length, the market is segmented into 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm. The 6mm segment dominated the market with a share of 36.7% in 2024, as it provides an optimal balance between minimal pain and sufficient depth for subcutaneous injection. It is widely recommended by healthcare professionals and has extensive adoption in both hospitals and home-care settings. 6mm needles are suitable for adult patients across insulin, GLP-1, and growth hormone therapies. The segment benefits from compatibility with most pen devices and high patient comfort. 6mm needles are also preferred in pediatric care when proper guidance is provided. Their adoption is further supported by clinical guidelines recommending moderate needle lengths for routine injections. Distribution through retail pharmacies and online platforms ensures accessibility.

The 4mm segment is expected to witness the fastest CAGR of 18.5% from 2025 to 2032, fueled by increasing patient preference for shorter needles to reduce injection pain and anxiety. This segment is expanding rapidly in pediatric and geriatric populations due to safety and comfort considerations. Rising awareness of needle phobia and patient-centric care is driving demand. Healthcare providers are recommending shorter needles for home-care users. Technological innovations in micro-needle design and thin-wall construction ensure effective drug delivery even at shorter lengths. Adoption is further supported by rising home-care and self-administration trends. Shorter needles are also easier to dispose of safely, improving compliance with medical waste protocols.

- By Therapy

On the basis of therapy, the market is segmented into Insulin, GLP-1, Growth Hormone Therapy, Glucose-Like Peptide (GLP), and Skin Testing. The Insulin segment dominated with a market share of 57.8% in 2024, due to the high prevalence of diabetes globally and increasing patient reliance on insulin pens. Insulin therapy represents the largest and most mature segment, with steady demand from hospitals, clinics, and home-care users. The segment benefits from robust distribution networks and strong manufacturer support. Insulin pen needles are designed for precision dosing and minimal discomfort, enhancing patient adherence. Growth is supported by ongoing public health initiatives and awareness programs. The segment also enjoys innovation in needle safety and anti-leak designs.

The GLP-1 segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, propelled by the rising adoption of GLP-1 analogs for obesity management and type 2 diabetes. Increasing patient preference for minimally invasive injections is boosting demand. The segment growth is supported by the introduction of pen-compatible GLP-1 therapies. Rising healthcare expenditure and expanding awareness campaigns contribute to adoption. The segment also benefits from home-care users seeking convenience and pain reduction. Furthermore, ongoing innovations in needle design and safety features are enhancing patient compliance. Strong support from healthcare providers and growing reimbursement programs in key markets are further accelerating the segment’s growth.

- By Mode of Purchase

On the basis of mode of purchase, the market is segmented into Retail and Non-Retail. The Retail segment dominated with a revenue share of 62.1% in 2024, driven by wide availability through pharmacies, online platforms, and home-care supply stores. Patients prefer retail purchase for convenience and immediate access. Retail channels also allow access to multiple brands and product variants. The segment benefits from strong brand visibility and marketing campaigns targeting home users. Distribution through retail ensures regular replenishment for daily insulin and glucose monitoring needs. The segment’s dominance is supported by patient awareness programs and home-care initiatives.

The Non-Retail segment is expected to witness the fastest CAGR of 17.6% from 2025 to 2032, driven by bulk procurement by hospitals, clinics, and diagnostic centers. Institutional purchasing ensures consistent supply and adherence to safety standards. Growing hospital infrastructure in emerging regions is boosting demand. Non-retail buyers prefer standardized products for multiple patients. The segment benefits from government healthcare initiatives and bulk discounts. Increasing adoption in clinical research and hospital pharmacies further supports growth. In addition, rising partnerships between suppliers and healthcare institutions are streamlining procurement processes. Enhanced focus on quality control and compliance in institutional settings is further propelling the segment’s expansion.

- By End User

On the basis of end user, the market is segmented into Hospitals & Clinics, Diagnostic Centers & Medical Institutions, Home Care & Home Diagnostics, and Research & Academic Laboratories. The Home Care & Home Diagnostics segment dominated with a market share of 48.5% in 2024, fueled by the rising trend of self-monitoring of blood glucose, growing adoption of insulin pens, and increasing patient awareness for convenient at-home care. The segment benefits from accessibility of retail channels and patient education. Adoption is further driven by the convenience of home-care solutions and cost-effectiveness.

The Hospitals & Clinics segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, driven by the expansion of healthcare infrastructure, increasing outpatient treatments, and institutional adoption of advanced pen needles and lancets. Hospitals prefer standardized, safe, and bulk-supplied devices for efficiency and compliance. Rising healthcare budgets and growing awareness of proper injection protocols are supporting growth. In addition, the adoption of digital inventory management systems in hospitals is improving supply chain efficiency. Continuous training programs for healthcare staff on safe injection practices are further driving the segment’s growth.

- By Gauge

On the basis of gauge, the market is segmented into 17/18G, 21G, 23G, 25G, 28G, and 30G. The 25G segment dominated the market with a share of 41.3% in 2024, owing to its optimal diameter for insulin injections and other subcutaneous therapies. This gauge effectively balances minimal pain with accurate drug delivery, making it highly preferred by patients and healthcare providers alike. Its adoption is further supported by compatibility with a wide range of pen devices, clinical guidelines recommending 25G for routine injections, and its suitability for both adult and pediatric patients. The segment benefits from strong distribution networks across hospitals, clinics, and home-care settings. Consistent patient comfort, ease of use, and proven reliability make 25G the standard choice for many therapies. Its widespread acceptance in both developed and emerging markets reinforces its dominance in the lancet and pen needle market.

The 30G segment is expected to witness the fastest CAGR of 22.0% from 2025 to 2032, driven by growing demand for ultra-fine needles in pediatric, geriatric, and sensitive patient populations. The ultra-thin diameter ensures minimal pain and enhances patient comfort, encouraging adherence to long-term therapies such as insulin and GLP-1 injections. Innovations in ultra-thin-wall and high-flow technology further improve drug delivery efficiency, making injections faster and less painful. Rising awareness about patient-centric care and home-based therapy adoption is boosting demand. Healthcare providers increasingly recommend 30G needles for patients requiring frequent injections, and new product designs focusing on safety and ease of handling are accelerating market growth.

Lancet and Pen Needles Market Regional Analysis

- North America dominated the lancet and pen needles market with the largest revenue share of 40.5% in 2024, characterized by a high diabetic population, strong adoption of advanced self-care devices, and the presence of major industry players

- The market experienced substantial growth in at-home diabetes care, supported by favourable reimbursement policies.

- Increasing awareness of diabetes management, and growing access to innovative lancets and pen needles that improve patient comfort and adherence

U.S. Lancet and Pen Needles Market Insight

The U.S. lancet and pen needles market captured the largest revenue share in 2025 within North America, driven by the rapid adoption of at-home self-monitoring solutions and increased demand for convenient, safe, and precise injection devices. Patients and caregivers are increasingly prioritizing products that reduce pain and improve ease of use, while healthcare providers emphasize adherence and patient compliance. The presence of advanced distribution networks and strong partnerships with healthcare institutions further supports the market's growth.

Europe Lancet and Pen Needles Market Insight

The Europe lancet and pen needles market is projected to expand at a substantial CAGR during the forecast period, driven by a rising prevalence of diabetes, increasing awareness about self-administration, and government initiatives promoting diabetes care. Urbanization and increasing healthcare infrastructure are encouraging adoption across both residential and clinical settings. Countries such as Germany, France, and Italy are witnessing higher demand for safe and ergonomic lancets and pen needles in hospitals, clinics, and retail channels.

U.K. Lancet and Pen Needles Market Insight

The U.K. lancet and pen needles market is expected to grow at a noteworthy CAGR during the forecast period, supported by the rising incidence of diabetes and an emphasis on convenient home-based care. Healthcare providers and patients are increasingly opting for ergonomic, pain-minimizing devices that ensure safe and accurate insulin delivery. The well-established retail and e-commerce networks in the U.K. facilitate easy access to lancets and pen needles, promoting wider adoption.

Germany Lancet and Pen Needles Market Insight

The Germany lancet and pen needles market is anticipated to expand at a considerable CAGR, driven by a highly aware diabetic population and strong healthcare infrastructure. The demand for advanced, high-quality, and safe injection devices is rising, with hospitals, clinics, and home-care settings integrating modern lancets and pen needles into standard diabetes management practices. Sustainability and patient-centric design are increasingly influencing purchasing decisions.

Asia-Pacific Lancet and Pen Needles Market Insight

The Asia-Pacific lancet and pen needles market is expected to be the fastest-growing region, projected to expand at a CAGR of over 11% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and the increasing burden of diabetes in countries such as China and India. The region is witnessing a surge in demand for convenient, safe, and cost-effective lancets and pen needles for at-home diabetes care. Government initiatives, growing healthcare awareness, and expanding distribution networks further support market growth.

Japan Lancet and Pen Needles Market Insight

The Japan lancet and pen needles market is gaining momentum due to a high prevalence of diabetes, an aging population, and strong patient awareness regarding self-care. The demand for ergonomic and pain-minimizing devices is rising, particularly in home-care settings. Integration with local healthcare programs and availability in retail and hospital pharmacies are further boosting adoption.

China Lancet and Pen Needles Market Insight

The China lancet and pen needles market accounted for the largest market revenue share in the Asia-Pacific region in 2025, driven by the country’s growing diabetic population, rapid urbanization, and increasing disposable incomes. The push for home-based diabetes management, coupled with a rising focus on patient comfort and safety, has accelerated demand. Expansion of domestic manufacturing and competitive pricing are making lancets and pen needles increasingly accessible to a wider population.

Lancet and Pen Needles Market Share

The Lancet and Pen Needles industry is primarily led by well-established companies, including:

- BD (U.S.)

- Novo Nordisk A/S (Denmark)

- Ypsomed Holding AG (Switzerland)

- B. Braun SE (Germany)

- GlucoRx Limited (U.K.)

- ARKRAY, Inc. (Japan)

- UltiMed, Inc. (U.S.)

- Owen Mumford Ltd. (U.K.)

- Terumo Corporation (Japan)

- Artsana S.p.A (Italy)

Latest Developments in Global Lancet and Pen Needles Market

- In June 2023, NanoDrop, a developer of innovative blood sampling devices, received the CE Mark for its NanoDrop device, enabling pain-free blood sampling. This approval marked a significant advancement in lancet technology, offering a more comfortable experience for patients requiring frequent blood tests

- In August 2024, MTD, a global medical device company, acquired Ypsomed's Pen Needles and Glucose Monitoring business. This strategic acquisition aimed to enhance MTD's portfolio in diabetes care, expanding its capabilities in insulin delivery and glucose monitoring solutions

- In July 2024, Embecta, the world's largest maker of disposable insulin pen needles and syringes for diabetics, hired advisers from Centerview Partners to explore a possible sale of the business. This move followed two years of lackluster share price performance after the company was spun out of Becton Dickinson in 2022. The potential sale was considered due to declining profits and a significant drop in share price, with sales affected by the rise of GLP-1 drugs like Novo Nordisk's Ozempic impacting traditional insulin treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.