Global Landing String Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.82 Billion

USD

2.72 Billion

2024

2032

USD

1.82 Billion

USD

2.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.82 Billion | |

| USD 2.72 Billion | |

|

|

|

|

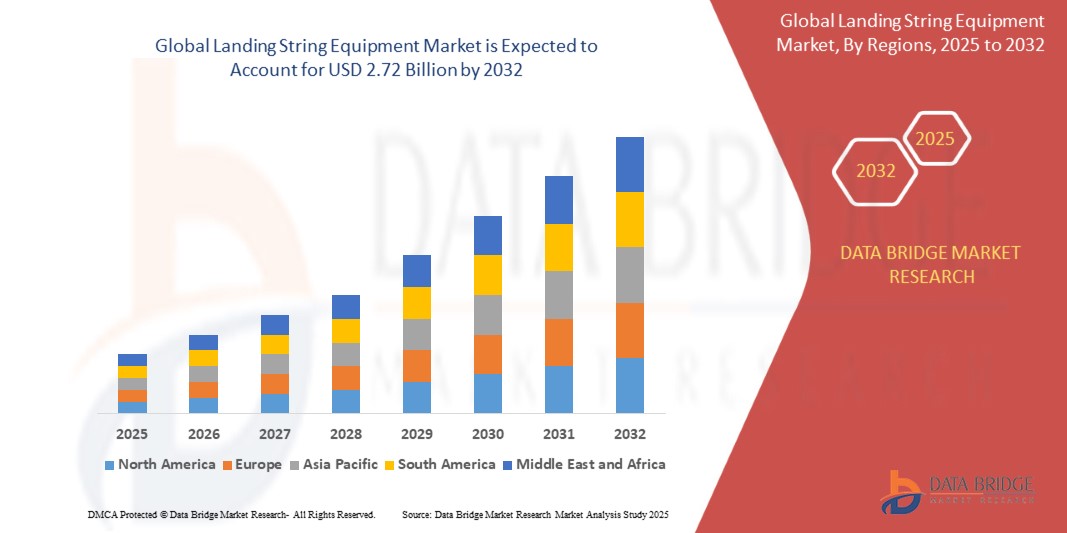

What is the Global Landing String Equipment Market Size and Growth Rate?

- The global landing string equipment market size was valued at USD 1.82 billion in 2024 and is expected to reach USD 2.72 billion by 2032, at a CAGR of 5.10% during the forecast period

- Market growth is driven by increasing adoption of connected home devices and advancements in smart home technology, resulting in greater digitalization across residential and commercial sectors

- In addition, rising consumer preference for secure, user-friendly, and integrated access control solutions is positioning landing string equipment as a preferred choice, accelerating market demand and growth

What are the Major Takeaways of Landing String Equipment Market?

- Landing string equipment provides electronic access control for doors and gates, playing a crucial role in modern home security and automation across residential and commercial applications due to convenience and remote access features

- The growing adoption of smart home technologies, heightened security awareness, and increasing preference for keyless entry are key factors fueling the rising demand for landing string equipment

- North America dominated the landing string equipment market with the largest revenue share of 33.24% in 2024, driven by rising demand for home automation and smart security solutions

- Asia-Pacific region is poised to grow at the fastest CAGR of 7.24% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The subsea test tree segment dominated the subsea equipment market with the largest market revenue share of 38.5% in 2024, driven by its critical role in controlling well pressure and flow during subsea operations

Report Scope and Landing String Equipment Market Segmentation

|

Attributes |

Landing String Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Landing String Equipment Market?

Advancements in Remote Operation and Real-Time Monitoring

- A major and growing trend in the global landing string equipment market is the increasing incorporation of remote operation technologies combined with real-time monitoring capabilities. These advancements allow operators to control and monitor subsea landing string systems from surface vessels or onshore control centers, enhancing safety and operational efficiency

- For instance, companies such as Optime Subsea have introduced wireless electric subsea control and intervention systems (eSCILS), enabling operators to manage landing string functions remotely with improved precision and reliability

- Integration of advanced sensors and IoT technologies into landing string equipment supports condition-based maintenance by providing real-time data on pressure, temperature, and mechanical integrity, reducing downtime and operational risks

- This trend is driving digitalization within offshore oil and gas operations, enabling centralized control over subsea equipment and fostering improved coordination between subsea systems and surface operations

- Manufacturers such as Interventek and Halliburton are focusing on developing subsea landing string solutions that combine remote control, automation, and advanced diagnostics to meet the evolving demands of deepwater drilling and well intervention

- Growing demand for safer, more efficient offshore operations and the need to reduce costly subsea intervention are accelerating adoption of these intelligent landing string systems across the oil and gas industry

What are the Key Drivers of Landing String Equipment Market?

- Increasing offshore oil and gas exploration and production activities, especially in deepwater and ultra-deepwater regions, are major drivers of demand for advanced landing string equipment

- In April 2024, Onity, Inc. (Honeywell International) announced integration of IoT-enabled sensors in subsea security solutions, reflecting the industry-wide focus on smart monitoring technologies that also influence landing string equipment design and use

- The growing emphasis on operational safety and environmental compliance requires reliable subsea equipment with remote monitoring to minimize human intervention and reduce risks.

- Advances in subsea technology and automation allow operators to improve efficiency and reduce costs by optimizing landing string deployment, control, and retrieval operations

- Increased investments by oilfield service companies and oil & gas operators in upgrading subsea infrastructure to support longer well life and complex completions further propel market growth

- Demand for modular, flexible landing string solutions that can adapt to varied well conditions and reduce rig downtime supports continuous innovation and adoption in the market

Which Factor is challenging the Growth of the Landing String Equipment Market?

- The high capital expenditure and complex engineering requirements associated with advanced landing string equipment pose a significant challenge for wider market penetration, especially among smaller operators

- Concerns about equipment reliability and maintenance in harsh subsea environments may delay adoption, as operators seek proven, durable solutions

- Limited availability of skilled personnel for operating and maintaining sophisticated remote-controlled landing string systems can restrict market growth in certain regions

- Economic volatility and fluctuating oil prices influence offshore exploration budgets, affecting investments in subsea equipment upgrades

- The long lead times required for manufacturing, testing, and certification of landing string equipment impact project schedules and can hinder rapid deployment

- Addressing these challenges through improved design standardization, enhanced operator training, and cost-effective modular solutions will be crucial for sustained growth of the landing string equipment market

How is the Landing String Equipment Market Segmented?

The market is segmented on the basis of equipment type, application, and end-user.

• By Equipment Type

On the basis of equipment type, the subsea equipment market is segmented into lubricator valve, retainer valve, subsea test tree, shear sub, slick joint, and others. The subsea test tree segment dominated the subsea equipment market with the largest market revenue share of 38.5% in 2024, driven by its critical role in controlling well pressure and flow during subsea operations. Its robust design and reliability make it an indispensable component for deepwater drilling projects, contributing to strong demand across offshore oil and gas exploration activities

The lubricator valve segment is anticipated to witness the fastest growth rate of 19.3% from 2025 to 2032, fueled by increasing deployment in complex well intervention and maintenance operations, offering enhanced safety and operational efficiency.

• By Application

On the basis of application, the subsea equipment market is segmented into shallow water, deep water, and ultra-deepwater. The deepwater segment accounted for the largest market revenue share in 2024, reflecting the increasing exploration and production activities in offshore deepwater regions where advanced subsea equipment is essential to manage harsh environments and high pressures

The ultra-deepwater segment is expected to witness the fastest CAGR from 2025 to 2032, driven by technological advancements enabling oil and gas extraction at greater depths and the rising demand for untapped resources located in ultra-deepwater fields.

• By End-User

On the basis of end-user, the subsea equipment market is segmented into oil & gas companies, oilfield service companies, and research & development institutions. The oil & gas companies segment held the largest market revenue share in 2024, attributed to their direct involvement in exploration, drilling, and production activities requiring extensive subsea equipment

Oilfield service companies are expected to witness the fastest growth rate during the forecast period, as they provide critical installation, maintenance, and specialized services supporting subsea infrastructure, enabling efficient project execution and operational continuity.

Which Region Holds the Largest Share of the Landing String Equipment Market?

- North America dominated the landing string equipment market with the largest revenue share of 33.24% in 2024, driven by rising demand for home automation and smart security solutions

- Consumers in the region highly value the convenience, advanced security features, and seamless integration of Landing String Equipments with other smart devices such as thermostats and lighting systems

- This widespread adoption is supported by high disposable incomes, tech-savvy populations, and increasing preference for remote monitoring and control, making Landing String Equipments a favored choice for both residential and commercial properties

U.S. Landing String Equipment Market Insight

The U.S. landing string equipment market captured the largest revenue share of 81% within North America in 2024, fueled by rapid adoption of connected devices and growing trends in home automation. Consumers prioritize intelligent, keyless entry systems to enhance home security. The popularity of DIY smart home setups, voice control integration, and mobile app management further drive market expansion. Integration with platforms such as Alexa, Google Assistant, and Apple HomeKit significantly contributes to growth.

Europe Landing String Equipment Market Insight

Europe is projected to experience substantial CAGR growth, driven by strict security regulations and increased demand for enhanced security in residential and commercial sectors. Urbanization and rising adoption of connected devices encourage Landing String Equipment use. Consumers value convenience and energy efficiency, supporting growth in new builds and renovations across homes, offices, and multi-family dwellings.

U.K. Landing String Equipment Market Insight

The U.K. market is expected to grow steadily due to rising home automation adoption and increased focus on security and convenience. Concerns about burglary and safety are driving homeowners and businesses towards keyless entry solutions. The U.K.’s strong e-commerce ecosystem and adoption of connected technologies further stimulate the market.

Germany Landing String Equipment Market Insight

Germany’s landing string equipment market is growing steadily, driven by rising awareness of digital security and demand for eco-friendly, technologically advanced solutions. Strong infrastructure and emphasis on innovation foster adoption, especially in residential and commercial buildings. Integration with home automation systems and preference for privacy-centric solutions align well with local consumer expectations.

Which Region is the Fastest Growing Region in the Landing String Equipment Market?

Asia-Pacific region is poised to grow at the fastest CAGR of 7.24% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Government initiatives supporting digitalization and smart home adoption boost demand. APAC’s role as a manufacturing hub enhances affordability and accessibility, expanding consumer reach.

Japan Landing String Equipment Market Insight

Japan’s market is gaining momentum due to its tech-forward culture, urbanization, and demand for convenient, secure access. Increasing smart home adoption and integration with IoT devices such as security cameras and lighting systems fuel growth. An aging population also drives demand for easy-to-use, secure access solutions in residential and commercial settings.

China Landing String Equipment Market Insight

China accounted for the largest Asia-Pacific market revenue share in 2024, supported by a growing middle class, urbanization, and strong technology adoption. It is one of the largest markets for smart home devices, with rising use in residential, commercial, and rental properties. Smart city initiatives and competitive domestic manufacturers further propel the market, alongside affordable product options.

Which are the Top Companies in Landing String Equipment Market?

The landing string equipment industry is primarily led by well-established companies, including:

- Expro Group Holdings N.V. (U.S.)

- Nov, Inc. (U.S.)

- TechnipFMC plc (U.K.)

- SLB (U.S.)

- Aker Solutions (Norway)

- ExPert E&P Companies, LLC. (U.S.)

- Interventek Subsea Engineering (Scotland)

- Hilong Holding Limited (China)

- Yantai Enerserva Machinery Co., Ltd. (China)

- Optime Subsea (Norway)

- Expro Holdings UK 2 Ltd. (U.K.)

- National Oilwell Varco Inc. (U.S.)

- Superior Energy Services Inc. (U.S.)

- Vallourec SA (France)

- Yantai Enerserva Machinery Co Ltd. (China)

- Enovate Systems Ltd. (U.K.)

- Quail Tools (U.S.)

- Schlumberger Ltd. (U.S.)

- Thyssenkrupp AG (Germany)

- Technip FMC (U.K.)

- Interventek Subsea Engineering (Scotland)

- Aker Solutions (Norway)

- Hilong Holding Limited (China)

- Optime Subsea (Norway)

- WellPartner AS (Norway)

- Quail Tools LP (U.S.)

- Interventek Subsea Engineering (Scotland)

What are the Recent Developments in Global Landing String Equipment Market?

- In February 2023, Optime Subsea signed an agreement with Wintershall Holding GmbH to lease three landing string systems along with two wireless electric subsea control and intervention systems (eSCILS), marking a strategic move to expand their operational capabilities in subsea technology

- In November 2021, Expro, headquartered in Aberdeen, U.K., secured subsea well access contracts worth over USD 50 million across Southeast Asia and Australia, strengthening its market presence in the Asia-Pacific region

- In October 2021, Interventek launched a new API 17G-certified in-riser subsea landing string system, enhancing its portfolio with cutting-edge well access solutions to meet industry demands for advanced technology

- In April 2021, Halliburton Company partnered with Optime Subsea to implement Optime’s remotely operated control system into Halliburton’s completion landing string services, highlighting a significant collaboration aimed at improving subsea operation efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.