Global Lanthanum Nitrate Market

Market Size in USD Million

CAGR :

%

USD

850.00 Million

USD

1,314.40 Million

2024

2032

USD

850.00 Million

USD

1,314.40 Million

2024

2032

| 2025 –2032 | |

| USD 850.00 Million | |

| USD 1,314.40 Million | |

|

|

|

|

Lanthanum Nitrate Market Size

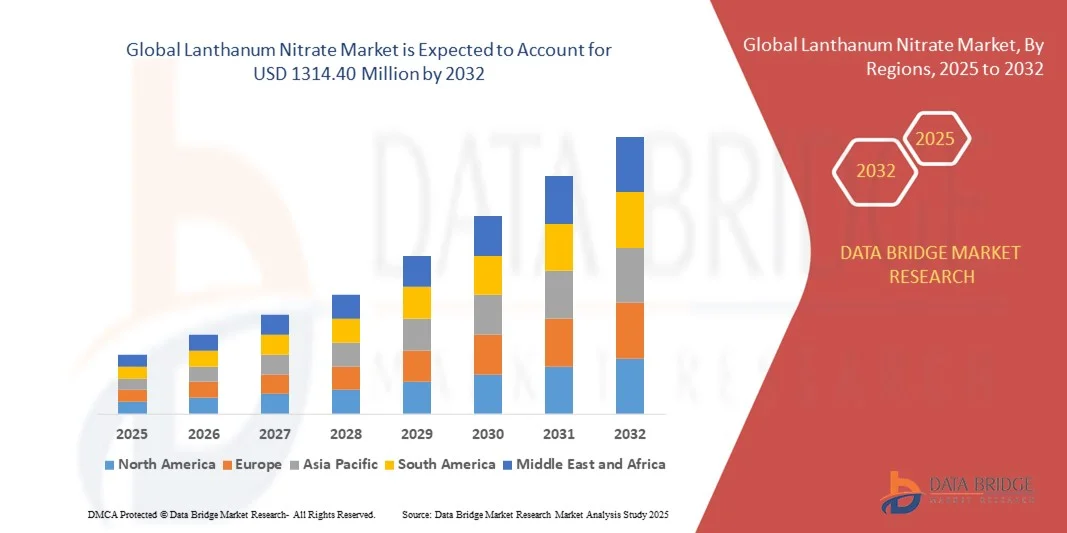

- The global lanthanum nitrate market size was valued at USD 850 million in 2024 and is expected to reach USD 1314.40 million by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the increasing utilization of lanthanum nitrate in various industrial applications such as catalysts, ceramics, and specialty glass manufacturing, driven by its superior chemical stability and optical properties that enhance product performance and quality

- Furthermore, rising demand from the electronics and water treatment industries, where lanthanum nitrate is used as a key component in polishing compounds and purification agents, is significantly accelerating market expansion and strengthening its position in high-value applications

Lanthanum Nitrate Market Analysis

- Lanthanum nitrate, an inorganic compound widely used in catalysts, optical glass, and advanced ceramics, plays a vital role in improving catalytic efficiency, light transmission, and overall product durability across multiple industries

- The market growth is primarily driven by increasing industrialization, growing research in rare earth materials, and rising investments in clean energy and advanced electronics sectors, which are expanding the demand for high-purity lanthanum-based compounds globally

- North America dominated the lanthanum nitrate market in 2024, due to growing demand across the chemical and water treatment sectors

- Asia-Pacific is expected to be the fastest growing region in the lanthanum nitrate market during the forecast period due to increasing industrialization, expanding rare earth production, and rising demand from end-use sectors such as electronics and water treatment

- Liquid segment dominated the market with a market share of 63.9% in 2024, due to its higher solubility and easier blending in aqueous and chemical formulations. It is extensively used in catalyst preparation, glass polishing solutions, and water treatment applications where uniform dispersion is crucial. The growing adoption of liquid lanthanum nitrate in environmental management processes, particularly in phosphate removal systems, further supports its strong market presence

Report Scope and Lanthanum Nitrate Market Segmentation

|

Attributes |

Lanthanum Nitrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lanthanum Nitrate Market Trends

Increasing Use of Lanthanum Nitrate in Advanced Materials

- The lanthanum nitrate market is witnessing steady growth due to its expanding use in advanced material applications, especially in the production of catalysts, optical glasses, ceramics, and specialty alloys. The compound’s ability to enhance physical and chemical properties makes it a key ingredient in high-performance materials utilized across electronics, automotive, and chemical sectors

- For instance, Solvay S.A. has been developing high-purity lanthanum nitrate for use in catalyst precursor formulations that support petroleum refining and emission control applications. This improved material performance has driven greater adoption of lanthanum compounds in industries focusing on cleaner and energy-efficient technologies

- Lanthanum nitrate is increasingly being employed in advanced ceramics and optical materials due to its role in improving dielectric properties and thermal stability. Its inclusion in ceramic capacitors and optical coatings is supporting miniaturization trends in electronics and high-definition display manufacturing

- The compound’s compatibility with other rare earth elements, such as cerium and neodymium, has expanded its use in alloy and glass applications requiring high clarity and durability. This has proven particularly valuable in the production of lenses, laser components, and radiation shielding materials used in high-precision optical systems

- Growing demand for clean energy technologies is further supporting the adoption of lanthanum-based materials in fuel cells and hybrid vehicle components. For instance, Hitachi Metals, Ltd. has been investing in rare earth material research, utilizing lanthanum nitrate derivatives for electrode materials used in advanced batteries and energy storage systems

- The increasing utilization of lanthanum nitrate in multifunctional and high-performance materials underscores its growing importance in advanced manufacturing. As the global demand for specialty materials continues to rise, its role as a critical rare earth compound will remain vital in enabling technological innovation across strategic industrial sectors

Lanthanum Nitrate Market Dynamics

Driver

Rising Demand for Rare Earth Compounds in Electronics

- The surging demand for rare earth compounds in the electronics industry is one of the primary drivers of the lanthanum nitrate market. These compounds offer unique magnetic, catalytic, and optical properties that enhance the performance and miniaturization of modern electronic components

- For instance, companies such as Neo Performance Materials Inc. are expanding their production of lanthanum-based compounds to meet the rising needs of display, semiconductor, and battery manufacturers. Lanthanum nitrate is a crucial raw material used in the synthesis of high-refractive-index glass and dielectric materials for electronic circuits

- The rapid growth of consumer electronics, electric vehicles, and renewable energy technologies is heightening the need for reliable rare earth materials capable of supporting energy-efficient performance. Lanthanum nitrate plays a key role in enabling high-capacity capacitors, sensors, and luminescent components essential to these advanced systems

- Technological advancements in optoelectronics and nanotechnology are further expanding the application scope of lanthanum nitrate in thin-film coatings and photonic devices. These uses help manufacturers achieve enhanced light transmission, improved heat management, and superior material consistency

- As global electronic production continues to accelerate, driven by connected devices and smart technology expansion, the demand for rare earth compounds such as lanthanum nitrate will remain strong. Its consistent performance and compatibility with modern electronic manufacturing requirements ensure its sustained importance in the evolving materials market

Restraint/Challenge

Limited Availability of Rare Earth Resources

- The limited availability and uneven distribution of rare earth resources pose a major challenge to the lanthanum nitrate market. A significant portion of rare earth extraction and processing capacity is concentrated in a few regions, leading to supply chain vulnerabilities and price fluctuations

- For instance, fluctuations in mining output from major producers such as China, which dominates global rare earth supply, have periodically affected availability and pricing of lanthanum-based materials worldwide. Trade restrictions and export control policies further exacerbate the imbalance in global supply chains

- The extraction and processing of rare earths, including lanthanum, are also capital-intensive and environmentally challenging. Stringent environmental regulations and rising operational costs related to waste management and refining processes make raw material sourcing increasingly complex for producers

- Dependence on limited resource availability discourages smaller manufacturers from entering the market, ultimately constraining production scalability and innovation potential. The resulting supply uncertainty impacts downstream industries reliant on lanthanum nitrate for electronics, catalysts, and glass manufacturing

- To overcome these constraints, companies and governments are investing in rare earth recycling, alternative sourcing, and sustainable extraction technologies. Diversifying supply sources and promoting circular economy practices will be crucial to ensuring long-term availability and price stability in the global lanthanum nitrate market

Lanthanum Nitrate Market Scope

The market is segmented on the basis of type, form, application, and end-user.

- By Type

On the basis of type, the Lanthanum Nitrate market is segmented into Purity 98%, Purity 99%, and Others. The Purity 99% segment dominated the market in 2024, accounting for the largest revenue share due to its extensive use in high-performance catalysts, specialty chemicals, and electronic component manufacturing. Its superior purity level ensures consistent chemical reactivity and high yield in precision applications, making it highly preferred by industries requiring stringent quality standards. The growing use of high-purity lanthanum nitrate in optical coatings, fuel cells, and phosphor production is also driving its demand globally, especially across advanced manufacturing economies.

The Purity 98% segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by its expanding use in cost-sensitive industrial and laboratory applications. It serves as an efficient intermediate for producing various lanthanum compounds and catalysts used in petroleum refining and ceramics. The segment’s affordability and sufficient chemical stability make it attractive for large-scale operations in developing markets, where price competitiveness and reliable performance are key decision factors.

- By Form

On the basis of form, the Lanthanum Nitrate market is segmented into Liquid and Powder. The Liquid segment dominated the market with a share of 63.9% in 2024, driven by its higher solubility and easier blending in aqueous and chemical formulations. It is extensively used in catalyst preparation, glass polishing solutions, and water treatment applications where uniform dispersion is crucial. The growing adoption of liquid lanthanum nitrate in environmental management processes, particularly in phosphate removal systems, further supports its strong market presence.

The Powder segment is projected to register the fastest growth from 2025 to 2032 due to its superior stability and ease of storage compared to liquid formulations. Powdered lanthanum nitrate is increasingly used in research, material synthesis, and nanotechnology applications, offering flexibility in solid-state reactions and custom formulations. The rising demand from advanced material manufacturers and laboratories for consistent and high-purity powdered reagents is expected to accelerate its market expansion.

- By Application

On the basis of application, the Lanthanum Nitrate market is segmented into Solvent, Intermediates, Reagent, and Others. The Reagent segment dominated the market in 2024, primarily due to its widespread use in analytical chemistry, catalyst testing, and laboratory synthesis. Its ability to produce highly controlled reactions makes it essential for quality assurance and precision research in academic and industrial laboratories. The segment’s dominance is further strengthened by the increasing demand from pharmaceutical and environmental testing sectors requiring high-purity lanthanum reagents.

The Intermediates segment is anticipated to witness the fastest growth rate during 2025–2032, supported by its vital role in producing other lanthanum compounds and rare earth materials. This segment benefits from the rising use of intermediates in ceramics, catalysts, and phosphor materials essential for energy-efficient lighting and display technologies. The growing need for intermediate-grade lanthanum nitrate in chemical synthesis and advanced manufacturing applications continues to drive its market growth globally.

- By End Users

On the basis of end users, the Lanthanum Nitrate market is segmented into Chemical Industry, Water Treatment, and Others. The Chemical Industry segment dominated the market in 2024, attributed to its critical role in catalyst formulation, glass manufacturing, and specialty chemical synthesis. Lanthanum nitrate serves as a key precursor for producing other lanthanum-based materials, widely utilized in high-performance industrial processes. The increasing investment in rare earth chemical production and advancements in catalyst technologies have reinforced this segment’s leadership.

The Water Treatment segment is expected to exhibit the fastest growth from 2025 to 2032, driven by the escalating need for efficient phosphate removal and environmental protection measures. Lanthanum nitrate is recognized as an effective agent for reducing phosphate levels in lakes, reservoirs, and wastewater systems. The global focus on sustainable water management and regulatory initiatives to minimize eutrophication are significantly fueling the adoption of lanthanum-based water treatment solutions.

Lanthanum Nitrate Market Regional Analysis

- North America dominated the lanthanum nitrate market with the largest revenue share in 2024, driven by growing demand across the chemical and water treatment sectors

- The region’s advanced industrial infrastructure and focus on sustainable material applications contribute significantly to market expansion

- High investments in rare earth element research and increasing adoption in catalyst manufacturing and optical materials further support regional growth. The rise of environmental initiatives encouraging the use of lanthanum-based compounds in wastewater management is also strengthening the market outlook

U.S. Lanthanum Nitrate Market Insight

The U.S. accounted for the largest revenue share within North America in 2024, propelled by strong industrial demand and advanced chemical production capabilities. The U.S. market benefits from the widespread application of lanthanum nitrate in catalytic converters, specialty glasses, and water purification systems. Increasing investment in clean energy technologies and the presence of leading manufacturers focusing on high-purity compounds drive the market further. Moreover, the growing emphasis on environmental compliance and green chemistry practices reinforces its position as a leading consumer of lanthanum nitrate.

Europe Lanthanum Nitrate Market Insight

The Europe Lanthanum Nitrate market is expected to expand at a steady CAGR during the forecast period, driven by stringent environmental regulations and the rising demand for high-performance materials. The growing utilization of lanthanum nitrate in glass polishing, ceramics, and emission control catalysts contributes to regional growth. European industries are increasingly adopting rare earth-based compounds for clean technologies, supported by EU sustainability initiatives. The market is gaining traction across chemical, automotive, and energy sectors, emphasizing innovation and material efficiency.

U.K. Lanthanum Nitrate Market Insight

The U.K. market is projected to grow at a notable CAGR during 2025–2032, supported by its strong research base and expanding application in specialty chemicals and environmental management. Demand for lanthanum nitrate is particularly high in analytical laboratories and industrial wastewater treatment systems. The country’s commitment to carbon reduction and circular economy principles enhances its adoption in green chemistry solutions. In addition, advancements in optical coatings and catalyst development are fostering market penetration.

Germany Lanthanum Nitrate Market Insight

The Germany Lanthanum Nitrate market is anticipated to witness substantial growth during the forecast period, attributed to its robust chemical industry and innovation-driven economy. The country’s strong focus on precision materials and technological progress fuels the use of lanthanum nitrate in catalysts, optics, and electronic applications. Government-backed sustainability policies and high investments in renewable energy are accelerating its integration into eco-friendly industrial processes. Germany’s emphasis on product quality and environmental safety continues to support long-term market demand.

Asia-Pacific Lanthanum Nitrate Market Insight

The Asia-Pacific region is poised to register the fastest CAGR from 2025 to 2032, driven by increasing industrialization, expanding rare earth production, and rising demand from end-use sectors such as electronics and water treatment. Countries such as China, Japan, and India are at the forefront of growth due to their large-scale manufacturing capabilities and government initiatives promoting sustainable material use. The region’s competitive production costs and growing export capacity make it a major hub for lanthanum nitrate supply.

China Lanthanum Nitrate Market Insight

China dominated the Asia-Pacific market in 2024, holding the largest regional share, owing to its strong rare earth production base and expanding industrial applications. The nation’s leadership in electronics, catalyst manufacturing, and glass production is driving substantial lanthanum nitrate demand. Increasing government support for environmental management and clean technologies further amplifies market growth. China’s integrated supply chain and rising domestic consumption continue to position it as the world’s leading producer and consumer of lanthanum compounds.

Japan Lanthanum Nitrate Market Insight

The Japan market is experiencing steady growth, supported by technological innovation and the country’s focus on high-purity materials. Lanthanum nitrate is extensively used in optics, advanced ceramics, and environmental technologies. Japan’s emphasis on research-driven industrial solutions and sustainable development is fueling product demand. Moreover, its role in developing high-precision electronic components and clean manufacturing processes contributes to consistent market expansion across multiple sectors.

Lanthanum Nitrate Market Share

The lanthanum nitrate industry is primarily led by well-established companies, including:

- Star Earth Minerals Private Limited (India)

- Alpha Chemika (India)

- Career Henan Chemical Co. Ltd. (China)

- Chemwill Asia Co., Ltd. (China)

- Shanghai Danfan Network Science & Technology Co., Ltd. (China)

- Zhejiang NetSun Co., Ltd. (China)

- Alfa Aesar (U.S.)

- Advanced Technology & Industrial Co., Ltd. (China)

- Merck KGaA (Germany)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- VWR International, LLC (U.S.)

- Jiangsu Baicheng Chemical Technology Co., Ltd. (China)

- Avalon Advanced Materials Inc. (Canada)

- Cathay Advanced Materials Limited (China)

- Chemamde (China)

- Metall Rare Earth Limited (China)

- HEFA Rare Earth Canada Co., Ltd. (Canada)

- Less Common Metals (U.K.)

- Haihang Industry (China)

- Alkane Resources Ltd. (Australia)

- Arafura Resources (Australia)

Latest Developments in Global Lanthanum Nitrate Market

- In October 2025, USA Rare Earth, Inc. completed the acquisition of Less Common Metals (LCM), a U.K.-based producer of rare-earth metals and alloys, for approximately USD 100 million in cash and 6.74 million shares. This acquisition enhances USA Rare Earth’s vertical integration across the rare-earth supply chain, securing reliable access to lanthanum and related compounds. By strengthening upstream material availability, the move is expected to stabilize raw material pricing and bolster production efficiency for downstream products such as lanthanum nitrate, reinforcing the company’s position in the rare-earth materials market

- In October 2025, Northern Gold Dragon (Baotou) Rare Earth Co., Ltd., a joint venture between China Northern Rare Earth Group High-Tech Co., Ltd. and Fujian Jinlong Rare Earth Co., Ltd., received government approval to build a 5,000 t/year rare-earth oxide separation facility in Baotou, China. This large-scale project aims to expand lanthanum oxide production capacity under China’s capacity-replacement policy. The development is expected to improve the availability of high-quality lanthanum feedstock, reduce production costs, and strengthen the downstream supply chain for compounds such as lanthanum nitrate in domestic and international markets

- In July 2025, China’s Ministry of Industry and Information Technology (MIIT) introduced new rare-earth mining and smelting quotas for the year, tightening oversight of domestic extraction and processing activities. This policy move enhances regulatory control and ensures sustainable resource utilization, indirectly affecting lanthanum nitrate production. By promoting responsible mining practices and steady resource allocation, the initiative supports long-term market stability while encouraging downstream manufacturers to invest in efficient, compliant production processes

- In January 2025, China Northern Rare Earth Group High-Tech Co., Ltd. announced a CNY 153 million joint venture with Fujian Jinlong Rare Earth Co., Ltd. to establish a 5,000 t/year rare-earth oxide separation line. The project is designed to increase the production of high-purity lanthanum oxide, a key precursor for lanthanum nitrate manufacturing. This expansion is expected to improve material throughput, reduce supply chain constraints, and meet the rising global demand for lanthanum-based chemicals used in catalysts, electronics, and environmental technologies

- In August 2023, Rare Earth Salts Separations & Refining LLC commenced commercial-scale production of purified rare earth elements, including lanthanum, from recycled feedstock using proprietary separation technology. This milestone marks a significant step toward sustainable resource utilization in the rare-earth industry. By ensuring a consistent and eco-friendly supply of lanthanum raw materials, the development strengthens the foundation for lanthanum nitrate production and supports the growing demand for high-purity compounds across industrial and environmental applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lanthanum Nitrate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lanthanum Nitrate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lanthanum Nitrate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.