Global Large Blow Molded Products Market

Market Size in USD Billion

CAGR :

%

USD

1.94 Billion

USD

2.56 Billion

2024

2032

USD

1.94 Billion

USD

2.56 Billion

2024

2032

| 2025 –2032 | |

| USD 1.94 Billion | |

| USD 2.56 Billion | |

|

|

|

|

Large Blow Molded Products Market Size

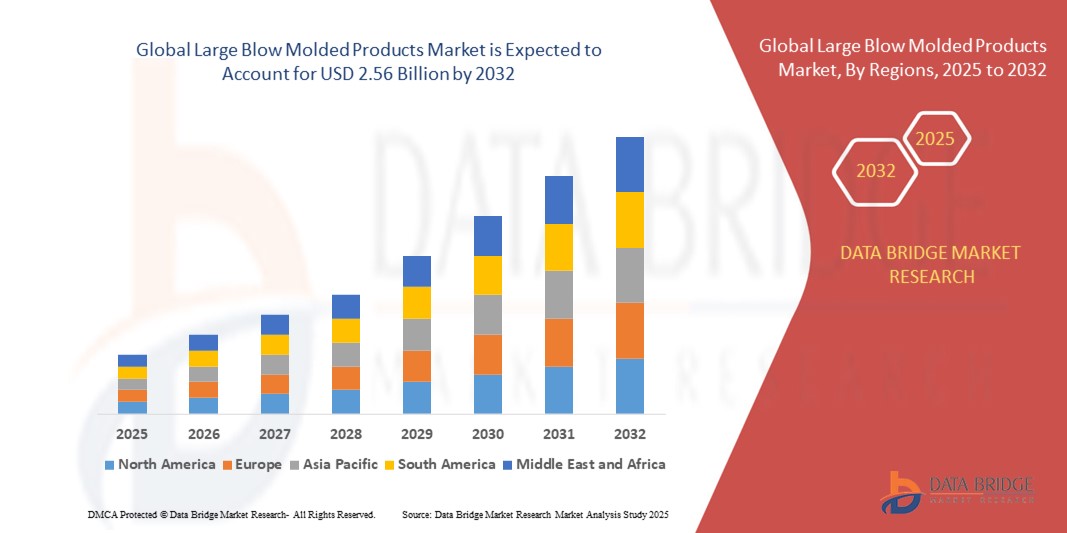

- The global large blow molded products market size was valued at USD 1.94 billion in 2024 and is expected to reach USD 2.56 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is primarily driven by increasing demand for lightweight, durable, and cost-effective plastic products across industries such as automotive, packaging, construction, and industrial applications

- In addition, the shift towards sustainable manufacturing and the use of recyclable and bio-based polymers are fostering innovation within blow molding processes. These developments are enhancing product performance and design flexibility, thereby propelling the widespread adoption of large blow molded products and boosting overall market expansion

Large Blow Molded Products Market Analysis

- Large blow molded products, essential for manufacturing hollow plastic components such as tanks, containers, automotive parts, and industrial drums, play a critical role across various end-use industries due to their lightweight, durability, and design flexibility

- The increasing need for cost-effective and sustainable plastic solutions in automotive, packaging, and industrial sectors is a key driver of market growth, supported by advancements in polymer technology and blow molding processes

- North America dominated the large blow molded products market with the largest revenue share of 42.1% in 2024, driven by robust demand for industrial bulk containers and automotive components, along with a strong manufacturing infrastructure across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the large blow molded products market during the forecast period, fueled by rapid industrialization, expanding packaging applications, and rising construction activities in emerging economies

- Polyethylene (PE) segment dominated the large blow molded products market by material type with a market share of 37.7% in 2024, owing to its versatility, cost-efficiency, and extensive usage in packaging and industrial applications

Report Scope and Large Blow Molded Products Market Segmentation

|

Attributes |

Large Blow Molded Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Large Blow Molded Products Market Trends

Sustainability and Shift Toward Bio-Based Plastics

- A significant and evolving trend in the global large blow molded products market is the increasing shift toward sustainable and eco-friendly materials, particularly bio-based and recyclable plastics. This trend is driven by mounting environmental concerns, tightening regulatory standards, and growing consumer demand for green packaging and products

- For instance, companies such as ALPLA and Greiner Packaging are investing in research and development to produce large blow molded products using recycled PET (rPET) and bio-based polyethylene (Bio-PE), offering alternatives with lower carbon footprints

- The demand for sustainable blow molded products is especially prominent in the packaging industry, where major brands are committing to 100% recyclable or reusable packaging materials. This includes bulk containers, drums, and storage tanks made using high-density polyethylene (HDPE) and PET variants that support circular economy goals

- In addition, many manufacturers are adopting advanced blow molding machinery that supports multi-layer structures and thinner walls, reducing material use without compromising product strength

- These technological advances allow for reduced plastic waste and better energy efficiency during production. As sustainability becomes a key competitive factor, industry leaders such as Berry Global and Logoplaste are focusing on scalable, environmentally friendly production solutions to meet client expectations and regulatory demands

- The move toward greener materials and efficient blow molding processes is expected to shape long-term product innovation, driving both commercial success and environmental responsibility across end-use sectors

Large Blow Molded Products Market Dynamics

Driver

Rising Demand in Automotive and Industrial Packaging Applications

- The growing demand for lightweight, durable, and cost-effective components in the automotive and industrial sectors is a major driver fueling the large blow molded products market

- For instance, leading auto manufacturers are increasingly using blow molded plastic parts such as air ducts, fuel tanks, and fluid reservoirs to reduce vehicle weight and improve fuel efficiency, contributing to regulatory compliance and performance

- In parallel, industries such as chemicals, agriculture, and logistics are expanding their use of large blow molded containers, drums, and intermediate bulk containers (IBCs) for efficient storage and transportation of liquids and granules

- In addition, the growth of global trade and industrialization is increasing demand for robust packaging and shipping solutions. The adaptability of blow molding for both custom and high-volume production makes it the process of choice for these applications

- As a result, manufacturers such as Mauser Packaging Solutions and Greif are expanding their large-format blow molding capabilities to meet rising client demands in key markets such as North America and Asia-Pacific

Restraint/Challenge

Volatility in Raw Material Prices and Environmental Regulations

- A key challenge faced by the large blow molded products market is the volatility in raw material prices, particularly for petroleum-based resins such as PE, PP, and PVC

- Fluctuations in crude oil prices directly impact production costs, making it difficult for manufacturers to maintain stable pricing and profit margins

- In addition, stringent environmental regulations concerning plastic waste management and the use of virgin polymers pose compliance challenges for blow molding companies, especially in Europe and North America

- For instance, regulations such as the EU Single-Use Plastics Directive and extended producer responsibility (EPR) frameworks are pressuring manufacturers to reduce plastic use, enhance recyclability, and invest in eco-friendly alternatives

- Addressing these challenges requires a dual focus on securing sustainable raw material supply chains and innovating in recyclable and bio-based resin technologies

- Companies that can proactively adapt to these pressures through circular production models, recycled resin use, and investment in sustainable blow molding practices will be better positioned for long-term resilience and growth

Large Blow Molded Products Market Scope

The market is segmented on the basis of type, process, and end use.

- By Type

On the basis of type, the large blow molded products market is segmented into Polyethylene (PE), Polypropylene (PP), Polycarbonate (PC), Polystyrene (PS), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Nylon (PA), Acrylonitrile Butadiene Styrene (ABS), and Others. The polyethylene (PE) segment dominated the market with the largest market revenue share of 37.7% in 2024, owing to its superior flexibility, durability, and resistance to chemicals and moisture. PE is widely used in packaging containers, storage tanks, and automotive components, making it the most preferred material in large blow molding applications due to its versatility and low cost.

The polypropylene (PP) segment is expected to witness the fastest growth rate of 20.3% from 2025 to 2032, driven by its excellent mechanical properties, high fatigue resistance, and increasing use in automotive parts, industrial containers, and medical devices. PP's recyclability and adaptability to complex shapes further contribute to its growing appeal in sustainable product development.

- By Process

On the basis of process, the large blow molded products market is segmented into extrusion blow molding, injection blow molding, and stretch blow molding. Extrusion blow molding held the largest market revenue share of 51.8% in 2024, attributed to its high efficiency in producing large, hollow plastic parts such as drums, tanks, and containers with uniform wall thickness. This process is widely adopted for its cost-effectiveness and adaptability across various industrial and packaging applications.

Injection blow molding is projected to be the fastest-growing segment during the forecast period, owing to its ability to deliver high-precision components with excellent surface finish, making it ideal for medical and small-format packaging products. The rising demand for intricately shaped, high-quality molded items in niche sectors is propelling its adoption.

- By End Use

On the basis of end use, the large blow molded products market is segmented into automotive, medical, packaging, electronic appliances, industrial bulk containers, plastic drums, storage tanks, and others. The packaging segment dominated the market with a revenue share of 38.4% in 2024, driven by increasing demand for lightweight and durable containers in the food, beverage, chemical, and pharmaceutical industries. The scalability and customizability of blow molded packaging solutions support high-volume production and sustainability goals, enhancing their widespread use.

The automotive segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by the industry's focus on vehicle lightweighting, emission control, and cost reduction. Blow molded parts such as air ducts, fluid reservoirs, and fuel tanks are replacing traditional metal components, particularly in electric and hybrid vehicles, where weight reduction is critical.

Large Blow Molded Products Market Regional Analysis

- North America dominated the large blow molded products market with the largest revenue share of 42.1% in 2024, driven by robust demand for industrial bulk containers and automotive components, along with a strong manufacturing infrastructure across the U.S. and Canada

- The region’s manufacturers benefit from access to advanced blow molding technologies and a strong distribution network, enabling the large-scale production of storage tanks, bulk containers, and automotive components that meet evolving industry standards

- High industrial activity, rising focus on lightweight and recyclable materials, and growing use of blow molded products in transportation and logistics applications are further driving regional growth, positioning North America as a leading hub for innovation and consumption in the global market

U.S. Large Blow Molded Products Market Insight

The U.S. large blow molded products market captured the largest revenue share of 78.3% in 2024 within North America, driven by robust demand in automotive, industrial packaging, and construction sectors. The country benefits from advanced manufacturing infrastructure, a well-established petrochemical supply chain, and strong innovation in polymer processing. The increasing use of lightweight plastic components in vehicles and the growing popularity of sustainable packaging options are also accelerating the adoption of blow molded products. Moreover, heightened focus on circular economy practices and recycled resin usage further contributes to market expansion.

Europe Large Blow Molded Products Market Insight

The Europe large blow molded products market is projected to grow at a steady CAGR throughout the forecast period, driven by stringent environmental regulations and a strong demand for recyclable and lightweight materials. The region's packaging and automotive sectors are key contributors, with rising adoption of blow molded containers, tanks, and under-the-hood automotive parts. EU policies encouraging sustainable material use and reduction in carbon emissions are prompting manufacturers to invest in bio-based and recycled resin alternatives. Growing infrastructure development and a mature industrial base also support market growth.

U.K. Large Blow Molded Products Market Insight

The U.K. large blow molded products market is anticipated to expand at a notable CAGR during the forecast period, supported by increasing demand for sustainable industrial packaging, logistics solutions, and automotive parts. The country’s growing emphasis on eco-friendly practices and domestic manufacturing resilience is driving the need for recyclable plastic products. Moreover, government support for industrial modernization and green technologies is encouraging the use of blow molded components in construction, waste management, and agriculture.

Germany Large Blow Molded Products Market Insight

The Germany large blow molded products market is expected to grow steadily during the forecast period, fueled by the country's engineering excellence, automotive leadership, and environmental consciousness. With a strong focus on precision manufacturing and innovation in polymer processing, Germany leads in producing high-performance blow molded automotive and industrial parts. In addition, the country’s stringent sustainability regulations are pushing firms toward circular product designs and increased use of recycled materials, further reinforcing market demand.

Asia-Pacific Large Blow Molded Products Market Insight

The Asia-Pacific large blow molded products market is projected to grow at the fastest CAGR of 23.1% from 2025 to 2032, driven by rapid industrialization, urban development, and rising consumption in countries such as China, India, and Southeast Asia. The region benefits from abundant raw material supply, cost-efficient labor, and expanding automotive and packaging industries. Governments promoting infrastructure development and environmental sustainability are boosting demand for blow molded tanks, containers, and lightweight parts across multiple sectors.

Japan Large Blow Molded Products Market Insight

The Japan large blow molded products market is growing steadily, supported by its advanced manufacturing sector, high-quality standards, and demand for precision-engineered plastic components. Japan’s emphasis on eco-conscious industrial practices and automation technologies is facilitating the production of durable and lightweight blow molded parts. Applications in medical devices, automotive components, and specialty packaging continue to expand, driven by an aging population and increasing healthcare and transportation needs.

India Large Blow Molded Products Market Insight

The India large blow molded products market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the country's booming manufacturing sector, expanding automotive industry, and growing infrastructure needs. Rising demand for affordable packaging solutions and durable plastic products across agriculture, construction, and logistics is propelling market growth. India’s position as a key player in global polymer production and the government's “Make in India” initiative further enhance domestic production capacity and product adoption.

Large Blow Molded Products Market Share

The large blow molded products industry is primarily led by well-established companies, including:

- Agri-Industrial Plastics (U.S.)

- APEX Plastics (U.S.)

- Comar (Ireland)

- Haldia Petrochemicals Limited (India)

- Creative Blow Mold Tooling (U.S.)

- Custom-Pak, Inc (U.S.)

- Exxon Mobil Corporation (U.S.)

- Garrtech Inc. (Canada)

- Gemini Group Inc. (U.S.)

- Inpress Plastics Ltd. (U.K.)

- North American Plastics (U.S.)

- PET ALL Manufacturing Inc., (Canada)

- INEOS AG (U.K.)

- Solvay (Belgium)

- Eastman Chemical Company (U.S.)

- China National Petroleum Corporation (China)

- Formosa Plastics Corporation (U.S.)

- Westlake Corporation (U.S.)

- Lyondellbasell Industries Holdings B.V. (U.K.)

What are the Recent Developments in Global Large Blow Molded Products Market?

- In April 2023, ALPLA Group, a global leader in plastic packaging solutions, inaugurated a new manufacturing facility in Kansas, USA, dedicated to the production of large blow molded containers. The plant is focused on supplying sustainable and lightweight packaging solutions for the food, beverage, and household product sectors. This expansion reinforces ALPLA’s commitment to regional manufacturing and sustainability through localized production and the use of recycled materials

- In March 2023, Greif, Inc., a global industrial packaging leader, announced the launch of its EcoBalance® line of intermediate bulk containers (IBCs), made using post-consumer recycled resin through blow molding technology. This initiative supports Greif’s environmental goals while offering customers sustainable packaging options that maintain strength and reliability. The development marks a significant step toward closed-loop production in industrial packaging

- In February 2023, Berry Global Group, Inc. collaborated with Repsol to introduce large blow molded packaging solutions using chemically recycled polyolefins. The partnership is aimed at scaling circular economy practices in Europe and reducing carbon emissions in the production of drums, storage tanks, and containers. This development showcases Berry’s commitment to innovation and environmentally responsible product design

- In January 2023, Mauser Packaging Solutions expanded its global reconditioning network for industrial packaging with the installation of advanced blow molding lines at its France facility. These lines are capable of producing UN-certified plastic drums and IBCs with enhanced performance and reduced material usage. The investment aligns with Mauser’s vision of delivering reliable and sustainable bulk packaging solutions to global markets

- In January 2023, Time Technoplast Ltd., an India-based polymer product manufacturer, launched a new range of multi-layer large blow molded fuel tanks for commercial vehicles. These tanks offer improved durability, weight reduction, and compatibility with alternative fuels, addressing the evolving needs of the transportation sector. The innovation demonstrates the growing application of blow molding technology in the automotive domain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Large Blow Molded Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Large Blow Molded Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Large Blow Molded Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.