Global Large Force Automation Market

Market Size in USD Billion

CAGR :

%

USD

3.07 Billion

USD

11.61 Billion

2025

2033

USD

3.07 Billion

USD

11.61 Billion

2025

2033

| 2026 –2033 | |

| USD 3.07 Billion | |

| USD 11.61 Billion | |

|

|

|

|

What is the Global Large Force Automation Market Size and Growth Rate?

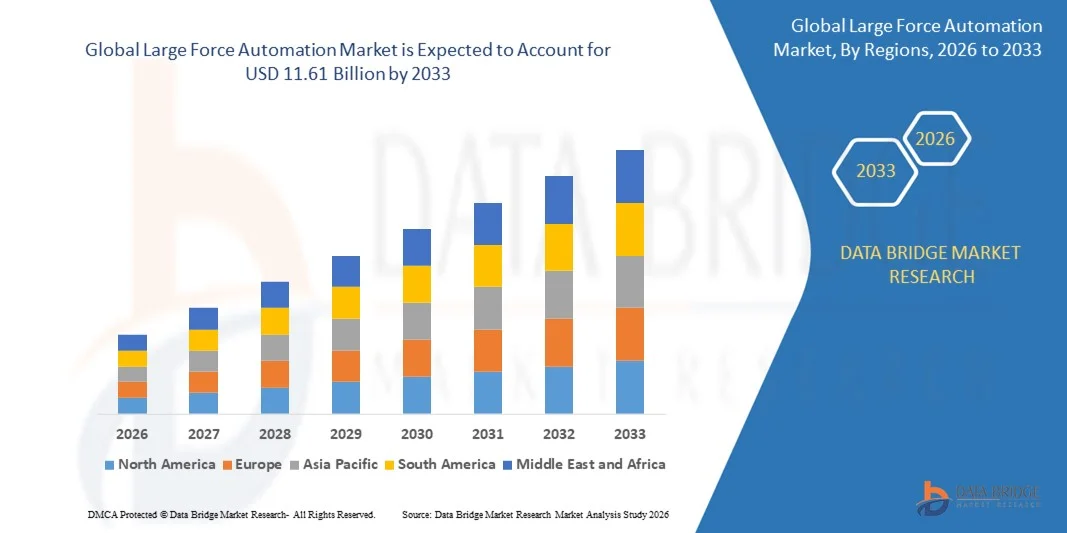

- The global large force automation market size was valued at USD 3.07 billion in 2025 and is expected to reach USD 11.61 billion by 2033, at a CAGR of18.10% during the forecast period

- Increasing demand for robust solutions to maximize the efficiency of field forces in real-time, growing adoption of cloud-based enterprise mobility solutions, increasing penetration of connected devices and robust connectivity technologies across the globe, increased the demand for automation solution across multiple industry verticals, high adoption rate of automation solutions by companies due to their ability to simplify complex work operations, improve business productivity, map the performance of field agents are some of the major as well as vital factors which will likely to augment the growth of the large force automation market

What are the Major Takeaways of Large Force Automation Market?

- Rising adoption of artificial intelligence and machine learning along with integration of internet of things for improved automation which will further contribute by generating massive opportunities that will lead to the growth of the large force automation market

- Increasing need of high investments for ensuring the security of mobile devices along with less adoption of automated solutions which will likely to act as market restraints factor for the growth of the large force automation in the above mentioned projected timeframe. Selecting a robust mobile workforce solution that perfectly aligns with the business objectives which will become the biggest and foremost challenge for the growth of the market

- North America dominated the large force automation market with a 39.38% revenue share in 2025, driven by rapid expansion of hyperscale facilities, enterprise data centres, edge computing deployments, and rising adoption of high-density IT hardware across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, fueled by rapid digitalization, cloud expansion, 5G deployment, and growing investments in data centre infrastructure across China, Japan, India, Singapore, and South Korea

- The Software segment dominated the market with a 62.5% revenue share in 2025, driven by increasing adoption of digital tools, cloud-based solutions, and integrated software platforms for sales order processing, customer service, and lead management

Report Scope and Large Force Automation Market Segmentation

|

Attributes |

Large Force Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Large Force Automation Market?

Rising Adoption of Modular, High-Density, and Cable-Optimized Open-Frame Rack Systems

- The large force automation market is witnessing increased deployment of modular, high-density, and airflow-optimized rack systems designed to support AI workloads, edge computing, and hyperscale IT environments

- Manufacturers are launching tool-less, flexible, and multi-purpose rack designs that simplify server integration, improve cable management, and enhance cooling efficiency in enterprise and colocation facilities

- Demand for cost-efficient, space-saving, and easily maintainable rack systems is driving adoption in cloud data centres, edge nodes, and hybrid IT infrastructures

- For instance, Vertiv, Schneider Electric, Rittal, and Dell have upgraded their open-frame rack portfolios with integrated cable pathways, enhanced load-bearing capacities, and high-density PDU support

- Growing need for quick installation, modularity, and optimized airflow management is accelerating adoption of open-frame architectures

- As data centres evolve toward scalable, modular, and high-density IT deployments, Large Force Automation solutions are expected to remain central to infrastructure modernization

What are the Key Drivers of Large Force Automation Market?

- Rising demand for flexible, cost-effective, and easily configurable rack systems to support rapid deployment of IT equipment across small, medium, and large-scale facilities

- For instance, in 2025, Schneider Electric, Cisco, and Rittal enhanced their rack solutions for edge computing, AI-ready workloads, and hybrid cloud environments

- Rapid expansion of cloud services, colocation centres, and digital transformation initiatives is driving global adoption across the U.S., Europe, and Asia-Pacific

- Advances in thermal management, rack design, and mounting technologies have improved load capacity, equipment accessibility, and cooling performance

- Growing deployment of IoT, 5G infrastructure, and AI-based applications is creating demand for high-density, modular open-frame structures for efficient operations

- Supported by continuous product innovation, strategic partnerships, and global distribution, the large force automation market is expected to sustain strong growth

Which Factor is Challenging the Growth of the Large Force Automation Market?

- High upfront costs associated with premium, heavy-duty, and high-load open-frame racks limit adoption among smaller enterprises and budget-sensitive facilities

- For instance, during 2024–2025, fluctuations in raw material costs, supply chain delays, and steel prices impacted production expenses for several global manufacturers

- Compliance with strict load ratings, safety, and data centre infrastructure regulations increases operational complexity

- Limited awareness in emerging markets about structured data centre design, airflow optimization, and rack standards slows adoption

- Competition from enclosed racks, micro-data centre cabinets, and pre-configured modular solutions creates pricing pressure and reduces differentiation

- To address these challenges, manufacturers are focusing on scalable production, cost-efficient designs, regulatory compliance, and training programs to boost global adoption of high-performance Large Force Automation solutions

How is the Large Force Automation Market Segmented?

The market is segmented on the basis of component, platform, pricing model, deployment type, application, type, and industry vertical.

- By Component

On the basis of component, the market is segmented into Software and Services. The Software segment dominated the market with a 62.5% revenue share in 2025, driven by increasing adoption of digital tools, cloud-based solutions, and integrated software platforms for sales order processing, customer service, and lead management. Organizations prefer ready-to-use software solutions due to faster deployment, scalability, and reduced operational complexity.

The Services segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for consulting, implementation, customization, training, and support services. As companies adopt advanced CRM solutions and digital transformation initiatives, service offerings are gaining traction globally, enabling businesses to optimize workflow and maximize ROI on software investments.

- By Platform

On the basis of platform, the market is segmented into Mobile Platform and Web-Based Solution. The Web-Based Solution segment dominated with a 58.3% share in 2025, favored for accessibility across devices, ease of updates, and centralized management capabilities. Web platforms enable real-time collaboration, cloud integration, and robust security features suitable for enterprises of all sizes.

The Mobile Platform segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising smartphone penetration, BYOD (Bring Your Own Device) policies, and demand for on-the-go access to CRM, sales, and service management tools. Increasing reliance on mobile apps for field operations, sales tracking, and instant customer support drives strong adoption globally.

- By Pricing Model

On the basis of pricing model, the market is segmented into Free, Quote-Based, and Subscription-Based. The Subscription-Based segment dominated the market with a 55.7% share in 2025, driven by predictable cost structures, flexibility in scaling user licenses, and integrated maintenance services. Subscription models are preferred by SMBs and large enterprises asuch as for budget predictability and continuous software upgrades.

The Quote-Based segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by customization demand, enterprise-specific requirements, and complex solution deployment. Organizations increasingly opt for tailored software packages that meet industry-specific workflows, compliance needs, and enterprise-scale operations.

- By Deployment Type

On the basis of deployment type, the market is segmented into On-Cloud and On-Premises. The On-Cloud segment dominated with a 60.2% share in 2025, supported by lower upfront costs, rapid deployment, easy updates, and global accessibility. Cloud deployment enables remote workforce management, data analytics, and integration with third-party systems, enhancing operational efficiency.

The On-Premises segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by data security concerns, regulatory compliance, and enterprise preference for internal IT control. Organizations with sensitive customer or financial data increasingly adopt on-premises solutions for enhanced privacy, customizability, and long-term infrastructure investment.

- By Application

On the basis of application, the market is segmented into Sales Order Management, Customer Service, and Lead Management. The Customer Service segment dominated with a 53.6% share in 2025, fueled by the need to improve client satisfaction, retention, and real-time support. Advanced software solutions enable ticketing, chatbots, and automated workflow, streamlining support across industries.

The Sales Order Management segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by the rising adoption of automated order processing, real-time inventory integration, and CRM-enabled sales tracking. Enterprises increasingly leverage software tools to optimize sales cycles, reduce manual errors, and accelerate order fulfillment.

- By Type

On the basis of type, the market is segmented into Wi-Fi, 3G, and General Packet Radio Services (GPRS). The Wi-Fi segment dominated with a 57.1% share in 2025, due to its high-speed connectivity, low latency, and widespread integration with mobile and web-based platforms. Wi-Fi supports real-time updates, cloud synchronization, and multi-device access, making it the preferred connectivity option for enterprise CRM and service management applications.

The 3G segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by ongoing network expansion in developing regions, enhanced mobile coverage, and adoption of IoT-enabled devices for remote field operations.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into BFSI, IT & Telecom, Healthcare & Life Sciences, Manufacturing, Transportation & Logistics, Construction & Real Estate, Energy & Utilities, and Others. The IT & Telecom segment dominated with a 36.4% share in 2025, driven by high digital transformation adoption, cloud migration, and advanced IT infrastructure.

The BFSI segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for secure, scalable, and real-time software solutions to manage digital banking, insurance, fintech applications, and AI-powered analytics. BFSI institutions prioritize software and service solutions to enhance operational efficiency, risk management, and customer experience.

Which Region Holds the Largest Share of the Large Force Automation Market?

- North America dominated the large force automation market with a 39.38% revenue share in 2025, driven by rapid expansion of hyperscale facilities, enterprise data centres, edge computing deployments, and rising adoption of high-density IT hardware across the U.S. and Canada

- Strong investments in AI-driven workloads, multi-cloud architectures, and digital transformation initiatives continue to accelerate rack installations across both enterprise and colocation environments

- Leading players are expanding open-frame rack portfolios through innovations in airflow optimization, cable management, modular assembly, and compatibility with AI/GPU servers. Regulatory emphasis on energy-efficient data centres, sustainability, and green IT infrastructure further strengthens regional leadership. High IT spending, network modernization initiatives, and rapid migration toward cloud-native architectures continue to fuel long-term growth

U.S. Large Force Automation Market Insight

The U.S. is the largest contributor in North America, supported by large-scale hyperscale cloud deployments, enterprise modernization, and rising demand for rack-level scalability. Adoption of open-frame racks is driven by their superior cooling efficiency, modularity, and cost-effectiveness for AI clusters, edge data centres, and colocation facilities. Advanced manufacturing capabilities, strong digital infrastructure, and high IT expenditure further reinforce regional dominance.

Canada Large Force Automation Market Insight

Canada contributes significantly to regional growth, driven by cloud adoption, government digitalization programs, and expansion of colocation and telecom data centres. Data centre operators increasingly deploy open-frame racks for high-density servers, optimized airflow, and flexible configurations. Energy efficiency initiatives, sustainability programs, and modular IT infrastructure preference support strong adoption across enterprise and hyperscale environments.

Asia-Pacific Large Force Automation Market Insight

Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, fueled by rapid digitalization, cloud expansion, 5G deployment, and growing investments in data centre infrastructure across China, Japan, India, Singapore, and South Korea. Rising demand for scalable, cost-efficient, and energy-optimized racks accelerates adoption across hyperscale, enterprise, and telecom environments. E-commerce growth, AI-based applications, fintech expansion, and digital payments further drive regional deployment.

China Large Force Automation Market Insight

China is the largest contributor in Asia-Pacific, supported by fast-growing hyperscale data centres, government-backed digital initiatives, and large-scale AI and cloud infrastructure investments. Increasing adoption of GPU racks, AI servers, and high-density computing systems fuels strong demand for open-frame racks. Local manufacturing capabilities, R&D investments, and competitive pricing enhance both domestic and export market growth.

Japan Large Force Automation Market Insight

Japan shows steady growth driven by modernization of enterprise data centres, demand for low-latency cloud services, and advanced telecom networks. Focus on premium-quality infrastructure, compact designs, and energy efficiency drives adoption of high-performance open-frame racks. Regulatory standards on data protection and resilient IT architecture further support expansion.

India Large Force Automation Market Insight

India is emerging as a key growth hub, propelled by government cloud initiatives, enterprise digital infrastructure expansion, and hyperscale facility development. Growing deployment of colocation and edge facilities boosts demand for modular, flexible open-frame racks. Expansion of fintech, e-commerce, and digital services accelerates widespread adoption across the country.

South Korea Large Force Automation Market Insight

South Korea contributes significantly due to strong demand for high-performance computing, 5G infrastructure, and data-intensive platforms. Increasing AI server installation, cloud-native workloads, and advanced edge deployments drive preference for racks with optimized thermal management, modularity, and cable organization. Technology-driven markets and premium IT infrastructure adoption further propel regional growth.

Which are the Top Companies in Large Force Automation Market?

The large force automation industry is primarily led by well-established companies, including:

- ServiceMax, Inc. (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- Industrial and Financial Systems, IFS AB (publ) (Sweden)

- Salesforce (U.S.)

- Trimble Inc. (U.S.)

- SAP SE (Germany)

- BT (U.K.)

- Accruent (U.S.)

- Acumatica, Inc. (U.S.)

- FieldEZ (India)

- Folio3 Software Inc. (U.S.)

- LeadSquared (India)

- Mize, Inc. (U.S.)

- Kloudq (U.S.)

- Appobile Labs (India)

- Channelplay Limited (U.K.)

- Nimap Infotech (India)

- AT&T Intellectual Property (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

What are the Recent Developments in Global Large Force Automation Market?

- In April 2024, Microsoft introduced enhanced capabilities in Dynamics 365 Field Service, enabling technicians and managers to efficiently access information, resolve issues faster, and improve overall productivity, marking a significant advancement in field service management solutions

- In March 2024, SAP SE announced the launch of SAP Commerce Cloud, a new payment solution integrating multiple third-party payment service providers to offer diverse payment options such as buy now, pay later, and more, fostering profitable digital commerce growth with a flexible, modular approach globally

- In March 2024, Oracle introduced upgraded generative AI features in the Oracle Fusion Cloud Applications Suite, designed to enhance decision-making and improve employee and customer experiences across finance, supply chain, HR, sales, marketing, and service workflows, strengthening enterprise automation and intelligence

- In November 2023, Amazon Web Services, Inc. (AWS) and Salesforce, Inc. expanded their partnership, improving integrations in data and AI platforms to allow customers to securely manage data across both environments while safely incorporating the latest generative AI technologies, enhancing enterprise workflow efficiency

- In August 2023, Tech Mahindra partnered with IFS, becoming the exclusive distributor of the IFS cloud platform to deliver automation across field service management, fostering workforce productivity and operational excellence, and accelerating adoption of integrated cloud solutions in enterprise environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.