Global Large Format Printer Market

Market Size in USD Billion

CAGR :

%

USD

4.91 Billion

USD

8.96 Billion

2025

2033

USD

4.91 Billion

USD

8.96 Billion

2025

2033

| 2026 –2033 | |

| USD 4.91 Billion | |

| USD 8.96 Billion | |

|

|

|

|

Large Format Printer Market Size

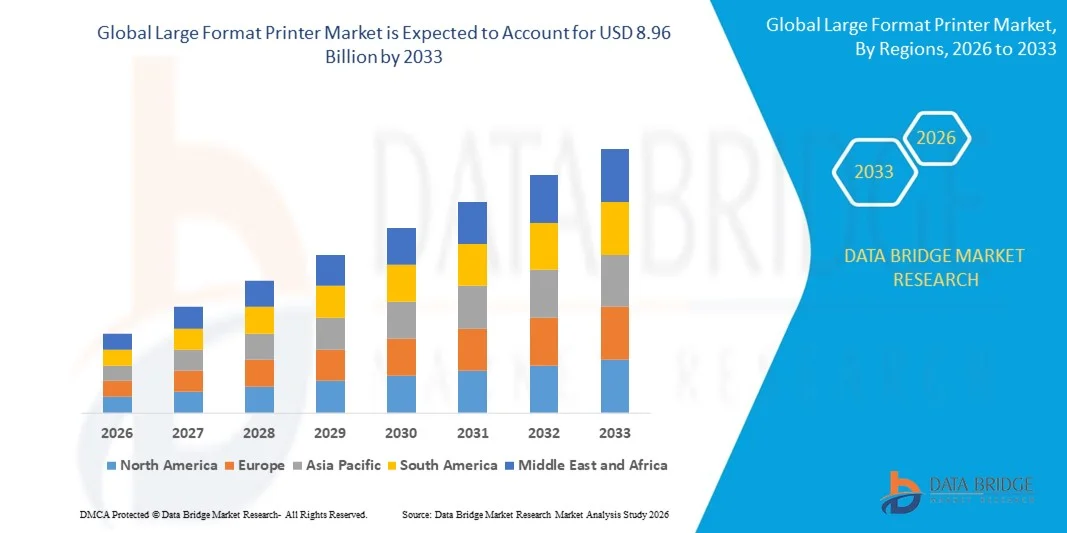

- The global large format printer market size was valued at USD 4.91 billion in 2025 and is expected to reach USD 8.96 billion by 2033, at a CAGR of 7.79% during the forecast period

- The market growth is largely fuelled by the increasing adoption of wide-format printing solutions in signage, advertising, and textile applications, along with rising demand for high-quality and customized print outputs

- Growing investments in advanced printing technologies such as UV-curable, latex, and dye-sublimation printers are accelerating market expansion, enabling faster production, reduced operational costs, and sustainable printing solutions

Large Format Printer Market Analysis

- The market is witnessing strong traction due to technological advancements, expanding applications across various industries, and rising consumer preference for high-resolution and eco-friendly printing solutions

- Increasing investments in R&D for developing energy-efficient, high-speed, and multi-functional large format printers are expected to further strengthen the market, creating opportunities for both established players and new entrants

- North America dominated the large format printer market with the largest revenue share of 38.75% in 2025, driven by the strong presence of commercial printing firms, growing demand for high-resolution signage, and widespread adoption of advanced printing technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global large format printer market, driven by increasing demand for large-scale signage, promotional displays, and textile printing, coupled with the expansion of local manufacturing capabilities and technological advancements

- The UV-Curable segment held the largest market revenue share in 2025, driven by its fast-drying capabilities, high-resolution output, and versatility across indoor and outdoor printing applications. UV-curable printers are particularly favored by commercial print service providers for their ability to produce durable, vibrant prints on a variety of substrates. In addition, these printers require minimal post-processing and are compatible with multiple rigid and flexible materials, increasing workflow efficiency. The high demand for high-quality advertising, décor, and industrial applications further supports UV-Curable adoption

Report Scope and Large Format Printer Market Segmentation

|

Attributes |

Large Format Printer Key Market Insights |

|

Segments Covered |

• By Type: Aqueous, Solvent, UV-Curable, Latex, and Dye-Sublimation • By Offering: Printers, RIP Software, and After-Sales Services • By Print Materials: Porous/Corrugated Materials and Non-Porous Materials • By Print Width: 17-24”, 24-36”, 36-44”, 44-60”, 60-72”, and 72” and Above • By Ink Type: Aqueous, Solvent, UV-Curable, Latex, and Dye-Sublimation • By Printing Technology: Ink-based (Inkjet) Printers and Toner-based (Laser) Printers • By Application: Apparel and Textile, Signage, Advertising, Décor, and CAD and Technical Printing |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Large Format Printer Market Trends

Rise of Advanced Wide-Format Printing Solutions

- The growing adoption of advanced large format printers is transforming the printing landscape by enabling high-resolution, large-scale output for signage, décor, apparel, and technical applications. The speed, precision, and versatility of modern printers allow for faster production, reduced operational costs, and minimized material waste, improving overall efficiency, customer satisfaction, and business competitiveness

- The increasing demand for eco-friendly and sustainable printing solutions is accelerating the adoption of UV-curable, latex, and aqueous ink-based printers. These solutions reduce environmental impact, lower energy consumption, and minimize waste, while also complying with regulatory standards, helping businesses achieve sustainability goals and attract environmentally conscious clients

- The affordability and ease of integration of modern large format printers are making them attractive for both commercial print houses and small-to-medium enterprises. Businesses benefit from high-quality output, reduced dependency on third-party printing services, and the ability to expand service offerings without major infrastructure investments, boosting market penetration

- For instance, in 2023, several print service providers in North America upgraded their operations with UV-curable and latex-based large format printers, reporting faster turnaround times, lower operational costs, improved print quality for both indoor and outdoor applications, and increased customer satisfaction

- While large format printers are witnessing strong adoption across multiple industries, their impact depends on continued technological innovation, operator training, and cost efficiency. Manufacturers must focus on developing versatile, durable, energy-efficient, and user-friendly printing solutions to fully capitalize on growing demand and evolving market requirements

Large Format Printer Market Dynamics

Driver

Rising Demand for High-Resolution, Large-Scale Printing Across Industries

- The increasing emphasis on high-quality visuals in advertising, signage, décor, and textile printing is driving investment in advanced large format printers. Features such as high resolution, vibrant color reproduction, wide-format capabilities, and fast print speeds are critical for meeting industry demands and maintaining competitive advantage

- Businesses are increasingly aware of the operational and financial advantages of modern large format printers, including faster production cycles, reduced material waste, lower maintenance costs, and enhanced print consistency. This awareness is driving adoption across commercial printing, apparel, technical printing, and interior décor sectors

- Growing government and private initiatives promoting sustainable and eco-friendly printing practices are encouraging the use of low-emission, energy-efficient, and solvent-free printers. Compliance with environmental regulations, green certifications, and corporate sustainability targets is further accelerating investment in modern printing solutions

- For instance, in 2022, several European and North American printing firms received incentives to adopt low-VOC ink, UV-curable, and latex-based printing technologies, boosting demand for sustainable, high-performance large format printers and enhancing operational efficiency

- While rising quality, speed, and sustainability awareness is driving market growth, there is still a need to ensure affordability, widespread deployment, and skilled operator availability. Manufacturers must balance performance, cost, and usability to sustain adoption and drive long-term expansion

Restraint/Challenge

High Equipment Costs and Technical Complexity Limiting Adoption

- The high capital investment required for advanced large format printers, including UV-curable, latex, dye-sublimation, and hybrid models, makes them less accessible to small print service providers, startups, and budget-constrained operations. Cost remains a major barrier to widespread adoption, limiting market penetration

- In many regions, a lack of trained operators, service technicians, and technical support limits the effective utilization of high-end printing equipment. Improper handling or lack of maintenance knowledge can lead to operational inefficiencies, increased downtime, higher maintenance costs, and reduced printer lifespan

- Supply chain limitations and restricted availability of specialized inks, substrates, and printing media in remote or emerging markets further constrain adoption. Many smaller operators continue to rely on conventional or lower-end printers, which restricts technological advancement and market growth

- For instance, in 2023, several print service providers in Asia-Pacific reported delays in upgrading to UV-curable, latex, and dye-sublimation large format printers due to high equipment costs, insufficient technical expertise, and limited local support networks

- While printing technologies continue to advance, addressing cost, technical complexity, operator training, and supply chain challenges remains critical. Market stakeholders must focus on modular, user-friendly, energy-efficient, and cost-effective solutions to bridge adoption gaps, enhance performance, and maximize long-term growth potential

Large Format Printer Market Scope

The market is segmented on the basis of type, offering, print materials, print width, ink type, printing technology, and application

- By Type

On the basis of type, the large format printer market is segmented into Aqueous, Solvent, UV-Curable, Latex, and Dye-Sublimation. The UV-Curable segment held the largest market revenue share in 2025, driven by its fast-drying capabilities, high-resolution output, and versatility across indoor and outdoor printing applications. UV-curable printers are particularly favored by commercial print service providers for their ability to produce durable, vibrant prints on a variety of substrates. In addition, these printers require minimal post-processing and are compatible with multiple rigid and flexible materials, increasing workflow efficiency. The high demand for high-quality advertising, décor, and industrial applications further supports UV-Curable adoption.

The Latex segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its eco-friendly formulation, low odor, and compatibility with flexible and rigid media. Latex printers are increasingly adopted for signage, décor, and textile printing due to their high-quality output, ease of operation, and regulatory compliance with environmental standards. The technology also supports faster print speeds and reduced maintenance costs, making it ideal for small and medium print houses. Growing awareness of sustainable printing solutions is further accelerating the adoption of latex printers.

- By Offering

On the basis of offering, the market is segmented into Printers, RIP Software, and After-Sales Services. The Printers segment accounted for the largest revenue share in 2025 due to high demand for new installations in commercial and industrial printing setups. Printers with advanced capabilities, including high-speed printing and multi-material support, are preferred by large-scale operators to improve operational efficiency and reduce turnaround times. The segment growth is further supported by increasing demand for high-quality visuals across advertising, signage, and textile applications.

The RIP Software segment is expected to witness the fastest growth from 2026 to 2033, driven by the need for efficient workflow management, color accuracy, and production optimization across large-scale printing operations. Software tools enhance print quality by providing color management, layout optimization, and automation features. Increasing adoption of cloud-based printing solutions and integration with printing hardware is further boosting growth in this segment.

- By Print Materials

On the basis of print materials, the market is segmented into Porous/Corrugated Materials and Non-Porous Materials. The Non-Porous Materials segment held the largest share in 2025, driven by the growing use of rigid substrates in signage, advertising, and décor applications. Non-porous materials, such as acrylic, PVC, and metal sheets, offer superior print quality and durability, meeting commercial and industrial requirements. High demand for long-lasting outdoor advertisements and architectural prints also contributes to the dominance of this segment.

The Porous/Corrugated Materials segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by demand for customized packaging, cardboard displays, and sustainable corrugated printing solutions. These materials are increasingly used for eco-friendly packaging, point-of-sale displays, and promotional materials. Lightweight nature, ease of handling, and recyclability of corrugated substrates are key factors driving adoption.

- By Print Width

On the basis of print width, the market is segmented into 17-24”, 24-36”, 36-44”, 44-60”, 60-72”, and 72” and Above. The 44-60” segment accounted for the largest market share in 2025, driven by its compatibility with commercial signage and textile printing requirements. This width range offers an ideal balance between media size, print speed, and operational efficiency, making it suitable for both indoor and outdoor applications. The segment is widely adopted by print service providers for banners, posters, and exhibition graphics.

The 72” and Above segment is expected to witness the fastest growth from 2026 to 2033 due to increasing demand for large-format outdoor banners, billboards, and architectural graphics. The capability to print extremely wide materials supports large-scale advertising campaigns and industrial décor projects. Growing urbanization and outdoor marketing activities are further fueling adoption of super-wide format printers.

- By Ink Type

On the basis of ink type, the market is segmented into Aqueous, Solvent, UV-Curable, Latex, and Dye-Sublimation. The UV-Curable ink segment held the largest revenue share in 2025, owing to its durability, fast drying time, and suitability for multiple media types. It is widely used for signage, decorative panels, and industrial printing, where long-lasting and high-quality prints are essential. The segment is further supported by the increasing adoption of high-speed printers capable of handling large volumes efficiently.

The Latex ink segment is expected to witness the fastest growth from 2026 to 2033, driven by its environmental benefits, high color vibrancy, and adoption across commercial printing applications. Latex inks are low-VOC, odorless, and compatible with flexible and rigid materials. Increasing demand for sustainable printing solutions in signage, apparel, and décor markets is propelling the growth of this segment.

- By Printing Technology

On the basis of printing technology, the market is segmented into Ink-based (Inkjet) Printers and Toner-based (Laser) Printers. Inkjet printers dominated the market in 2025 due to their high resolution, versatility, and ability to print on a wide range of substrates. They are widely used for commercial signage, textile printing, and décor applications where precision and vibrant colors are critical. The increasing availability of affordable inkjet printers for small and medium enterprises is also contributing to their dominance.

Laser printers is expected to witness the fastest growth from 2026 to 2033, fueled by their efficiency in high-volume production, low maintenance requirements, and suitability for industrial printing applications. Toner-based technology ensures consistent quality, faster turnaround, and lower operational costs, making it attractive for large print service providers. Growing industrial applications in CAD, technical, and commercial printing are driving this segment.

- By Application

On the basis of application, the market is segmented into Apparel and Textile, Signage, Advertising, Décor, and CAD and Technical Printing. The Signage segment accounted for the largest market revenue share in 2025, driven by high demand for indoor and outdoor commercial signage. Retail, transportation, and real estate sectors are increasingly investing in printed signage to attract customers and improve visibility. Advancements in UV-curable and latex printing further enhance print quality, durability, and color accuracy.

The Apparel and Textile segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing customization, fashion trends, and demand for vibrant, high-quality fabric prints. The growth is supported by the adoption of digital textile printing in small and large-scale apparel manufacturing. Rising consumer preference for personalized and on-demand clothing is accelerating the adoption of large format printers in the textile industry.

Large Format Printer Market Regional Analysis

- North America dominated the large format printer market with the largest revenue share of 38.75% in 2025, driven by the strong presence of commercial printing firms, growing demand for high-resolution signage, and widespread adoption of advanced printing technologies

- Businesses in the region highly value the speed, precision, and versatility offered by modern large format printers, which allow for high-quality output across signage, décor, textile, and CAD applications

- This widespread adoption is further supported by advanced infrastructure, high technological readiness, and the growing demand for eco-friendly and energy-efficient printing solutions, establishing large format printers as a preferred choice for commercial and industrial printing needs

U.S. Large Format Printer Market Insight

The U.S. large format printer market captured the largest revenue share in 2025 within North America, fueled by rapid industrialization, increasing demand for high-quality graphics, and the proliferation of printing applications in retail, advertising, and textiles. Businesses are increasingly prioritizing faster production and operational efficiency through the adoption of UV-curable, latex, and aqueous printers. In addition, government initiatives promoting green printing and sustainability are further encouraging the adoption of low-VOC and energy-efficient printing technologies. Integration with software solutions and advanced RIP systems is also driving growth.

Europe Large Format Printer Market Insight

The Europe large format printer market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations, rising demand for visually appealing signage, and growing industrial printing applications. Increasing urbanization, coupled with the expansion of the retail and advertising sectors, is fostering large format printer adoption. European businesses are also adopting eco-friendly and energy-efficient printers to comply with regulatory requirements and reduce operational costs. The region is experiencing notable growth in commercial print houses and design studios that rely on advanced printing technologies.

U.K. Large Format Printer Market Insight

The U.K. large format printer market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for high-quality indoor and outdoor advertising materials, enhanced print services, and increased adoption of eco-friendly inks and sustainable printers. In addition, the growing e-commerce and retail sectors are boosting the need for personalized packaging and promotional materials. The U.K.’s emphasis on innovation and technological integration is accelerating printer adoption among commercial print providers. The availability of skilled operators and modern printing infrastructure further supports market expansion.

Germany Large Format Printer Market Insight

The Germany large format printer market is expected to witness the fastest growth rate from 2026 to 2033, fueled by high industrial output, technological advancements in print production, and strong government focus on sustainability. Germany’s well-established manufacturing and commercial sectors are increasingly investing in large format printers to enhance production efficiency, output quality, and cost-effectiveness. The adoption of UV-curable and latex printers is gaining traction, particularly in signage, décor, and textile printing applications. Integration with software solutions for design, workflow management, and color accuracy further supports market growth.

Asia-Pacific Large Format Printer Market Insight

The Asia-Pacific large format printer market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrialization, rapid urbanization, and rising demand for high-quality commercial and industrial prints in countries such as China, Japan, and India. The region’s expanding advertising, textile, and retail sectors are boosting printer adoption. Government initiatives promoting digitalization and eco-friendly technologies are supporting the deployment of energy-efficient printers. Furthermore, Asia-Pacific’s growing role as a manufacturing hub for printer components is improving affordability and accessibility, encouraging wider adoption across small and medium enterprises.

Japan Large Format Printer Market Insight

The Japan large format printer market is expected to witness the fastest growth rate from 2026 to 2033, owing to the country’s advanced technological landscape, high adoption of automation, and demand for precision in commercial printing. Japanese businesses prioritize high-quality output, speed, and reliability, driving the demand for UV-curable, latex, and aqueous large format printers. Integration with CAD and textile printing solutions enhances operational efficiency, while eco-conscious production practices align with regulatory standards. In addition, Japan’s aging workforce is prompting demand for user-friendly and automated printing solutions across industries.

China Large Format Printer Market Insight

The China large format printer market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s booming manufacturing sector, rapid urbanization, and high adoption of advanced printing technologies. China has emerged as a significant hub for commercial printing, textile printing, and outdoor advertising applications. The growing middle class, increased disposable incomes, and rising investment in retail and advertising are fueling the demand for large format printers. Availability of affordable printer models, strong domestic manufacturers, and government support for sustainable and high-quality printing solutions are key factors propelling market growth in China.

Large Format Printer Market Share

The Large Format Printer industry is primarily led by well-established companies, including:

• HP Development Company, L.P. (U.S.)

• Canon India Pvt Ltd. (India)

• Seiko Epson Corporation (Japan)

• MIMAKI ENGINEERING CO., LTD (Japan)

• Roland Corporation (Japan)

• Ricoh (Japan)

• Durst Phototechnik (Italy)

• Xerox Corporation (U.S.)

• Konica Minolta, Inc. (Japan)

• Agfa-Gevaert Group (Belgium)

• Electronics For Imaging, Inc. (U.S.)

• KYOCERA Corporation (Japan)

• Lexmark International, Inc. (U.S.)

• MUTOH INDUSTRIES LTD (Japan)

• ARC Document Solutions, LLC (U.S.)

• Dilli (India)

• swissQprint AG (Switzerland)

• Shenyang Sky Air-Ship Digital Printing Equipment Co.,Ltd (China)

• Seiko Instruments Inc. (Japan)

• Oki Electric Industry Co., Ltd. (Japan)

Latest Developments in Global Large Format Printer Market

- In January 2024, Canon launched its new large-format imagePROGRAF printer range, introducing three inkjet models: the 44-inch PRO-4600, 60-inch PRO-6600, and 24-inch PRO-2600. The printers are designed for fine art and photography applications, featuring Canon's Lucia Pro II pigment ink to enhance image quality and improve black density on art paper. This development strengthens Canon’s position in the creative printing segment and supports high-quality output for professional users

- In September 2023, H.P. Development Company, L.P., expanded its Latex printer portfolio with the Latex 630 series, integrating white ink technology for print service providers of all sizes. The series enables sustainable printing using water-based latex inks with minimal odors and certified environmental compliance. This innovation broadens H.P.’s market reach and promotes eco-friendly printing solutions

- In April 2023, Dover Corporation introduced the 9750+ continuous inkjet (CIJ) printer, combining dye and pigment inks for marking and coding applications. The printer aims to reduce inventory needs and operational costs for Markem-Imaje’s customers, enhancing efficiency and reinforcing Dover’s market presence in industrial printing solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Large Format Printer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Large Format Printer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Large Format Printer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.