Global Laron Syndrome Market

Market Size in USD Billion

CAGR :

%

USD

2.70 Billion

USD

3.98 Billion

2025

2033

USD

2.70 Billion

USD

3.98 Billion

2025

2033

| 2026 –2033 | |

| USD 2.70 Billion | |

| USD 3.98 Billion | |

|

|

|

|

Laron Syndrome Market Size

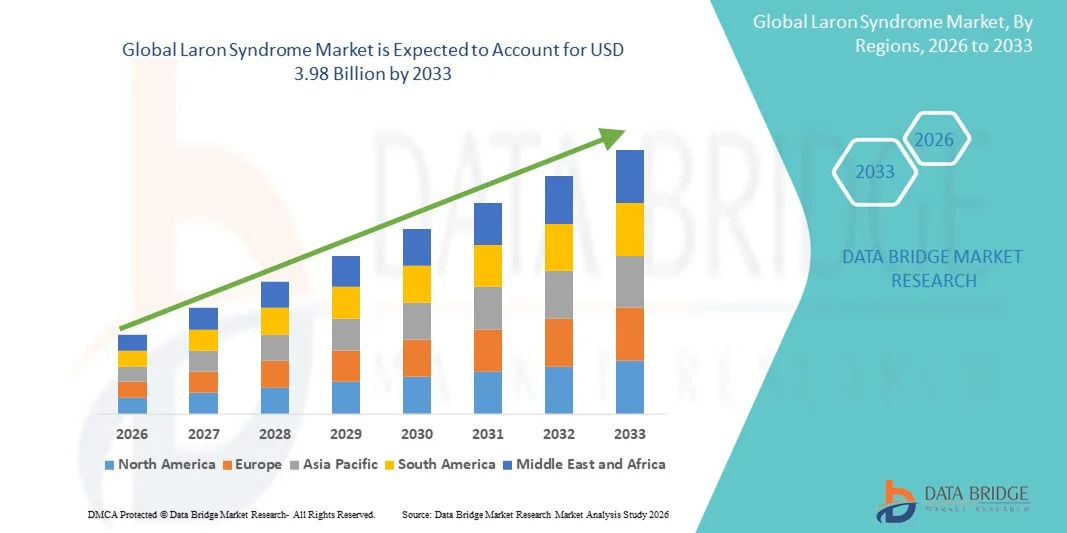

- The global Laron Syndrome market size was valued at USD 2.70 billion in 2025 and is expected to reach USD 3.98 billion by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by increasing advancements in genetic research, improved diagnostic capabilities, and the rising awareness of rare endocrine disorders, leading to earlier identification and treatment of Laron Syndrome

- Furthermore, growing demand for effective therapeutic solutions, expanding clinical research focused on growth hormone receptor (GHR) deficiencies, and supportive government initiatives for rare disease management are significantly accelerating the adoption of Laron Syndrome treatment options, thereby boosting overall market growth

Laron Syndrome Market Analysis

- Laron Syndrome, a rare genetic disorder caused by growth hormone receptor (GHR) deficiency, is gaining increased clinical attention due to advancements in molecular diagnostics, early genetic screening, and rising awareness of rare endocrine conditions. These developments are making disease identification faster and more accurate, thereby contributing to market growth

- The accelerating demand for effective therapies, especially IGF-1–based treatments such as mecasermin, is primarily fueled by expanding research into growth hormone pathway disorders, growing investment in rare disease drug development, and increasing availability of patient-support programs that improve treatment access

- North America dominated the laron syndrome market with the largest revenue share of approximately 38.5% in 2025, supported by strong healthcare infrastructure, higher diagnosis rates, active clinical research programs, and presence of leading biotechnology companies working on rare endocrine disorders. The U.S. leads the region due to growing adoption of advanced genetic testing and favorable rare-disease reimbursement frameworks

- Asia-Pacific is expected to be the fastest-growing region with a projected CAGR during the forecast period, driven by increasing awareness of rare genetic diseases, improving access to specialty endocrinology clinics, expanding healthcare expenditure, and government initiatives supporting rare-disease management

- The Subcutaneous segment dominated the largest revenue share of 82.4% in 2025, as this route remains the only clinically approved method for IGF-I therapy

Report Scope and Laron Syndrome Market Segmentation

|

Attributes |

Laron Syndrome Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laron Syndrome Market Trends

Growing Focus on Advanced Growth Hormone Replacement and Precision Therapeutics

- A significant and accelerating trend in the global Laron Syndrome market is the increasing emphasis on biologics-based growth hormone replacement therapies and precision-targeted treatments designed to address severe growth hormone insensitivity. Pharmaceutical companies and research institutions are directing notable investments toward developing long-acting IGF-1 formulations, improved recombinant therapies, and next-generation analogues capable of enhancing patient outcomes and long-term safety

- For instance, in March 2024, Ascendis Pharma announced progress in its TransCon IGF-1 program, aimed at offering a more sustained and regulated IGF-1 release mechanism for children with growth hormone insensitivity, marking a major step toward improving treatment convenience and therapeutic precision in Laron Syndrome

- The increasing use of genetic testing and molecular diagnostics to confirm GH receptor mutations is further supporting this trend, enabling clinicians to personalize treatment strategies tailored to individual patient profiles. Moreover, global patient registries and real-world evidence programs are expanding, allowing researchers to better understand disease progression and optimize treatment pathways

- Integration of telemedicine and digital monitoring for pediatric endocrine care is enabling remote assessment of growth parameters and treatment response. This shift is streamlining disease management while providing accessible follow-up for patients in underserved or remote areas

- This trend toward more advanced, evidence-driven, and personalized therapeutic approaches is fundamentally transforming expectations for managing growth hormone insensitivity disorders. Consequently, key companies and research centers are increasingly prioritizing long-acting IGF-1 therapies, recombinant biologics, and optimized dosing regimens to enhance efficacy and patient adherence

- The demand for innovative therapies, robust genetic screening, and improved clinical monitoring continues to rise across major healthcare markets, as clinicians and families seek more reliable and comprehensive treatment options for Laron Syndrome

Laron Syndrome Market Dynamics

Driver

Increasing Diagnosis Rates and Advancements in Endocrine Disorder Management

- The growing awareness of rare endocrine disorders, coupled with improved diagnostic capabilities, is significantly driving the Laron Syndrome market. Pediatricians and endocrinologists are increasingly incorporating genetic testing, IGF-1 deficiency screening, and receptor mutation analysis to ensure accurate and early diagnosis

- For instance, in April 2025, the Pediatric Endocrine Society expanded its clinical guidelines to include updated protocols for diagnosing severe primary IGF-1 deficiency, supporting wider recognition and earlier treatment of Laron Syndrome. Such initiatives are expected to strengthen market growth over the forecast period

- As parents and healthcare providers become more informed about the implications of untreated growth hormone insensitivity, the demand for effective IGF-1 replacement therapies continues to rise

- Furthermore, advancements in pediatric growth monitoring technologies and integration of digital health tools are allowing clinicians to track growth velocity and treatment response more accurately, enabling timely therapeutic decisions

- The availability of specialized endocrine care centers, improved referral pathways, and increased government and organizational support for rare disease management are additional factors propelling adoption of Laron Syndrome treatments globally

Restraint/Challenge

Concerns Regarding Limited Therapeutic Options and High Treatment Costs

- One of the major challenges restraining the Laron Syndrome market is the limited availability of therapeutic options, as only recombinant IGF-1 therapies are currently approved for treating the disorder. This narrow treatment landscape restricts clinicians’ ability to personalize care, particularly for patients who show suboptimal response or experience side effects

- For instance, clinical reviews published in 2023 highlighted gaps in long-term safety data for recombinant IGF-1 therapy, raising concerns among clinicians and caregivers regarding sustained use in pediatric patients

- Addressing these concerns requires stronger pharmaceutical pipeline development, long-term clinical research, and improved post-marketing surveillance. Additionally, the high cost of recombinant IGF-1 therapy presents a significant barrier, especially in low- and middle-income countries where reimbursement systems may not fully cover rare disease treatments

- While global awareness is improving, diagnostic delays and limited access to specialized pediatric endocrine facilities still hinder widespread adoption of therapy

- Overcoming these constraints through expanded clinical trials, affordability programs, enhanced insurance coverage, and broader availability of genetic testing will be crucial for supporting long-term market growth

Laron Syndrome Market Scope

The market is segmented on the basis of treatment, diagnosis, demographic, symptoms, dosage, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Laron Syndrome market is segmented into Recombinant Human IGF-I, Mecasermin, Caloric Diet, and Others. The Recombinant Human IGF-I segment dominated the largest market revenue share of 58.4% in 2025, driven by its position as the primary therapy that directly compensates for IGF-I deficiency. Increasing clinical evidence supporting height improvement and metabolic stability strengthens physician preference. Earlier diagnosis and structured care pathways also enhance adoption. Expanded insurance coverage for biologics continues to facilitate access. Growth in pediatric endocrinology services further boosts utilization. Cold-chain improvements ensure consistent availability across regions. R&D advancements that refine recombinant protein purity support demand. Increasing global awareness of rare growth disorders drives testing and subsequent treatment uptake. Key hospitals continue to adopt standardized IGF-I therapy protocols. Partnerships with biotech companies ensure stable supply chains. Rising inclusion of IGF-I therapy in treatment guidelines further consolidates segment dominance.

The Mecasermin segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033, driven by increasing approvals of biosimilar IGF-I formulations improving affordability. Its strong efficacy in preventing hypoglycemia and accelerating growth in early-diagnosed patients supports rapid adoption. Expansion of pediatric endocrine units in emerging markets enhances access. Awareness campaigns by rare-disease foundations improve recognition and early intervention. Advances in extended-release mecasermin formulations create new opportunities. Genetic screening programs identifying IGF-I pathway disruptions support earlier therapeutic initiation. Pharmacies increasingly stock ready-to-administer formulations, improving patient convenience. Clinical trials exploring improved safety profiles stimulate physician confidence. Government programs supporting rare-disease treatment accelerate market expansion. Partnerships between hospitals and biotech players strengthen distribution reach. Rising telemedicine-based monitoring supports consistent therapy adherence.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Genetic Tests, Hormone Tests, and Others.

The Genetic Tests segment dominated the largest revenue share of 52.7% in 2025, driven by increasing adoption of whole-exome sequencing and targeted IGF1R mutation panels. Declining sequencing costs make genetic testing more accessible. Pediatricians increasingly prefer molecular confirmation to prevent misdiagnosis and enable early therapeutic decision-making. National rare-disease screening initiatives increase test volumes. Hospitals partner with genomic laboratories for integrated diagnosis. Awareness among parents regarding hereditary growth disorders enhances testing demand. Rapid advancements in next-generation sequencing improve accuracy and turnaround time. The rise of precision medicine supports genetic profiling as a standard approach. Government research grants for rare diseases encourage adoption. Tele-genetics platforms help expand access to rural areas. Growing use of genetic reporting in treatment planning strengthens dominance.

The Hormone Tests segment is expected to witness the fastest CAGR of 10.9% from 2026 to 2033, supported by the increasing adoption of IGF-I and GH stimulation assays across primary and specialty care. Affordable immunoassay kits increase accessibility for mid-sized healthcare facilities. Growth-monitoring programs incorporate hormone analysis into routine pediatric assessments. Developing countries adopt hormonal testing as first-line evaluation due to cost efficiency. Rising physician awareness of endocrine disorders drives test utilization. Improvements in assay sensitivity enhance diagnostic reliability. Government healthcare strengthening programs expand laboratory availability. Pediatric clinics increasingly integrate on-site hormone analyzers. Tele-endocrinology services facilitate remote test interpretation. Clinical guidelines emphasize IGF–GH axis testing for early detection. This segment benefits from rising diagnosis of unexplained growth delays.

- By Demographic

On the basis of demographic, the market is segmented into Infancy and Neonatal. The Infancy segment dominated the largest market revenue share of 61.3% in 2025, as most clinical symptoms become evident during early childhood prompting medical evaluation. Pediatricians increasingly screen infants for abnormal growth metrics. Early intervention guidelines emphasize beginning IGF-I therapy during infancy for best height outcomes. Parents show growing awareness of developmental delays, leading to earlier consultations. Hospitals conduct combined genetic and endocrine evaluations for infants with growth failure. National health registries support tracking of rare disorders in children. Improved access to pediatric endocrinologists enhances diagnostic accuracy. Growth monitoring programs in clinics identify at-risk infants quickly. Genetic counseling services reinforce early testing adoption. Expanded healthcare coverage for childhood disorders supports treatment initiation. Increasing clinical research on early-onset endocrine disorders boosts segment strength.

The Neonatal segment is expected to witness the fastest CAGR of 12.4% from 2026 to 2033, driven by rising adoption of newborn genetic screening panels worldwide. Technological advancements in neonatal genomic sequencing enable rapid diagnosis within days of birth. Hospitals integrate endocrine screening into routine newborn assessments. Research indicates clinically significant benefits of earliest IGF-I therapy initiation, increasing neonatal testing demand. Government rare-disease detection programs further promote universal newborn screening. Pediatric ICUs are increasingly trained to identify early signs of congenital IGF-I deficiency. Maternity hospitals collaborate with biotech firms to access rapid test kits. Parents prefer early-life diagnosis to avoid long-term complications. Expansion of neonatal care infrastructure in developing countries accelerates adoption. Tele-neonatology platforms ensure expert interpretation. Increasing publications highlighting neonatal biochemical marker patterns support clinical vigilance.

- By Symptoms

On the basis of symptoms, the market is segmented into Short Stature, Reduced Muscle Strength, Hypoglycemia in Infancy, Delayed Puberty, Thin-fragile Hair, Small Genitals, Short Limbs, Dental Abnormalities, Distinctive Facial Features, Obesity, and Others. The Short Stature segment dominated the largest revenue share of 47.9% in 2025, as it remains the earliest visible indicator driving parents to seek medical attention. Schools and pediatric clinics conduct growth monitoring that quickly identifies abnormal height patterns. Physicians prioritize short stature as a key diagnostic criterion for Laron Syndrome. Awareness campaigns emphasizing early height evaluation increase medical visits. Genetic and hormonal testing for short stature has become standard in pediatric endocrinology. Psychological and social concerns motivate families toward rapid diagnosis. Increased inclusion of growth disorders in pediatric health policies boosts testing rates. Clinics frequently refer children with short stature for endocrine assessments. Height evaluation tools are now widely accessible. Long-term data supporting IGF-I therapy benefits strengthen treatment initiation. Early intervention programs promote active symptom screening.

The Hypoglycemia in Infancy segment is expected to witness the fastest CAGR of 13.3% from 2026 to 2033, driven by growing recognition of metabolic instability as a critical early symptom. Hospitals routinely screen glucose levels in infants with suspected endocrine disorders. Pediatricians are increasingly aware of IGF-I deficiency–related hypoglycemia patterns. Advancements in neonatal metabolic testing allow rapid identification. Emergency departments quickly identify persistent hypoglycemia cases for referral. Research publications highlight strong correlation between Laron Syndrome and early hypoglycemia. Increasing use of continuous glucose monitoring in infants supports early diagnosis. Improved NICU infrastructure enhances early metabolic screening. Awareness programs help parents recognize early warning signs. Inclusion of glucose panels in newborn health packages fuels adoption. Strengthening clinical protocols for metabolic disorder evaluation accelerates segment growth.

- By Dosage

On the basis of dosage, the market is segmented into Injection and Others. The Injection segment dominated the largest revenue share of 78.6% in 2025, as IGF-I therapy is exclusively available in injectable format. Consistent bioavailability and proven efficacy ensure physician preference. Parents receive structured training for safe home administration. Cold-chain infrastructure improvements support stable biologic distribution. Hospitals maintain controlled storage environments for injectable biologics. Regulatory guidelines mandate injectable delivery for recombinant IGF-I. Increasing awareness of proper injection techniques enhances adherence. Biotech companies improve pre-filled syringe and pen design for ease of use. Clinics increasingly provide injection-support programs. Treatment protocols emphasize precise dosing achievable only through injections. Rising diagnosis rates ensure consistent demand for injectable formulations.

The Others segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, driven by ongoing R&D for alternative delivery systems such as intranasal and oral formulations. Pharmaceutical innovators explore peptide stabilization technologies enabling non-invasive administration. Needle-free delivery significantly appeals to pediatric patients and caregivers. Early clinical studies show potential improvements in long-term adherence. Nano-carrier research may enable high absorption rates. Rare-disease incentives support development of novel dosages. Biotech start-ups collaborate with academic institutions for next-generation IGF-I therapies. Government research grants accelerate development of innovative drug delivery systems. Patients increasingly prefer alternatives to daily injections. Oral and inhaled delivery routes gain attention in pre-clinical research pipelines. Potential for long-acting formulations stimulates investment.

- By Route of Administration

On the basis of route of administration, the market is segmented into Subcutaneous and Others. The Subcutaneous segment dominated the largest revenue share of 82.4% in 2025, as this route remains the only clinically approved method for IGF-I therapy. Predictable absorption profiles ensure stable therapeutic outcomes. Pediatric endocrinologists universally recommend subcutaneous dosing for safety. Parents receive formal training to administer injections at home. Pharmaceutical companies offer improved subcutaneous injection devices for children. Home-care programs facilitate safe ongoing treatment. Hospitals maintain strong protocols for initial dosing supervision. Clinical guidelines continue to support subcutaneous IGF-I delivery. The route’s high bioavailability ensures consistent adoption. Patient monitoring programs assess subcutaneous injection outcomes. Expanded distribution networks support availability of subcutaneous formulations.

The Others segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by experimental approaches such as intradermal and infusion-based administration. Research explores higher absorption efficiency through alternative routes. Pediatric-friendly devices are under development for improved comfort. Pharmaceutical collaborations accelerate innovation in delivery mechanisms. Academic institutions conduct trials for advanced delivery technologies. Needle-free systems gain traction in pediatric endocrinology research. Alternative routes aim to reduce dosing frequency. Regulatory incentives for rare-disease innovation support R&D. Early pre-clinical data shows potential for improved safety profiles. Patient demand for non-traditional administration options strengthens interest. Start-ups invest in micro-infusion systems tailored for children.

- By End-Users

On the basis of end-users, the market is segmented into Clinic, Hospital, and Others. The Hospital segment dominated the largest revenue share of 54.1% in 2025, supported by availability of advanced genetic and hormonal diagnostic facilities. Pediatric endocrinologists are primarily concentrated in hospitals. Complex cases with severe symptoms require hospital evaluation. Hospitals conduct initial IGF-I therapy initiation and monitoring. Multidisciplinary teams provide comprehensive care, boosting preference. Genetic laboratories often function within hospital systems, ensuring rapid test results. Parents trust hospital-based specialists for rare-disease care. Research collaborations between hospitals and biotech firms support treatment innovations. Hospitals maintain structured care pathways for growth disorders. Government-funded children’s hospitals enhance accessibility. Robust infrastructure ensures proper biologic storage, maintaining treatment consistency.

The Clinic segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, driven by decentralization of pediatric endocrine care. Clinics increasingly offer outpatient diagnostic services including genetic test facilitation. Families prefer clinics for convenience and short waiting times. Pediatric specialty clinics expand in urban regions. Clinics collaborate with laboratories for quick test turnaround. Growth-monitoring programs integrated into clinics support early detection. Telemedicine enhances specialist access in clinic settings. Clinics provide cost-effective follow-ups and injection training support. Governments invest in strengthening primary healthcare clinics. Rising diagnosis rates increase clinic-based consultations. Clinics also adopt structured referral pathways to hospitals, improving care continuity.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated the largest market revenue share of 49.6% in 2025, as hospital pharmacies maintain controlled storage for temperature-sensitive biologic IGF-I therapies. Physicians prefer hospital dispensing for monitoring initial doses. Pharmacists provide adherence counseling to parents and caregivers. Strict regulatory guidelines require hospital oversight for rare-disease biologics. Hospitals maintain stable stock levels to prevent shortages. Complex cases necessitate hospital-based dispensing. Patient trust in hospital pharmacy safety standards strengthens dominance. Integration of electronic health records enhances safe distribution. Hospitals offer multidisciplinary support for medication management. Increased diagnosis in hospital settings naturally channels dispensing through hospital pharmacies. Cold-chain logistics are more reliable in hospital systems.

The Online Pharmacy segment is expected to witness the fastest CAGR of 14.4% from 2026 to 2033, fueled by rapid growth in digital prescription platforms. Online pharmacies offer convenient home delivery of monthly biologic supplies. Advancements in insulated packaging technologies support safe biologic shipping. Patients prefer digital ordering for recurring prescriptions. Tele-endocrinology growth supports remote prescription verification. Online pharmacies enhance accessibility in remote regions. Competitive pricing and subscription models increase adoption. Regulatory approvals for e-pharmacy operations expand globally. Parents value real-time shipment tracking for critical therapies. Digital platforms enable auto-refill services improving adherence. Growing acceptance of e-health services in emerging markets accelerates segment momentum.

Laron Syndrome Market Regional Analysis

- North America dominated the laron syndrome market with the largest revenue share of approximately 38.5% in 2025

- Supported by strong healthcare infrastructure, higher diagnosis rates, active clinical research programs, and the presence of leading biotechnology companies working on rare endocrine disorders

- The region benefits from advanced genetic testing availability, strong reimbursement frameworks for rare diseases, and growing physician awareness, which together enhance early detection and treatment uptake

U.S. Laron Syndrome Market Insight

The U.S. laron syndrome market accounted for nearly 81% of the North American revenue share in 2025, driven by the widespread availability of specialized endocrinology centers, rapid adoption of genomic testing, and robust investment in R&D for IGF-1–based therapies. Increasing patient enrollment in observational studies and clinical trials, along with supportive rare-disease reimbursement policies, continues to accelerate market growth in the U.S.

Europe Laron Syndrome Market Insight

The Europe laron syndrome market is projected to record substantial CAGR growth during the forecast period, owing to rising awareness of rare genetic disorders, improving access to molecular diagnostic tools, and strong government initiatives supporting rare-disease registries. Countries across Europe are increasingly adopting structured care pathways and multidisciplinary management practices, driving greater identification and treatment of Laron Syndrome.

U.K. Laron Syndrome Market Insight

The U.K. laron syndrome market is expected to grow at a notable CAGR, supported by improved genetic screening programs, an expanding network of specialist endocrine clinics, and active participation in rare-disease research collaborations. Public awareness of growth disorders and improved patient referral systems further contribute to rising diagnosis and treatment rates.

Germany Laron Syndrome Market Insight

The Germany laron syndrome market is projected to expand significantly, fuelled by growing emphasis on precision medicine, a strong diagnostics industry, and government support for rare-disease initiatives. High healthcare expenditure, adoption of advanced hormone testing technologies, and increasing clinician training in the management of rare endocrine conditions support steady market growth.

Asia-Pacific Laron Syndrome Market Insight

The Asia-Pacific laron syndrome market is forecasted to grow at the fastest CAGR during 2026–2033, driven by improving access to pediatric endocrinologists, rising awareness of genetic growth disorders, and increasing healthcare investments in countries such as China, Japan, India, and South Korea. Government-led rare-disease policies and expansion of genetic testing laboratories are key growth accelerators.

Japan Laron Syndrome Market Insight

The Japan laron syndrome market is showing strong momentum, supported by advanced healthcare technologies, high adoption of genetic screening, and strong public health infrastructure. Increasing focus on early intervention for congenital and genetic disorders contributes to steady market expansion. Japan’s aging population also encourages broader adoption of specialized hormone therapies and long-term care pathways.

China Laron Syndrome Market Insight

The China laron syndrome market held the largest revenue share within the Asia-Pacific region in 2025, driven by growing investments in genetic research, rapidly expanding healthcare infrastructure, and strong government support for rare-disease diagnosis frameworks. Rising awareness among pediatric and endocrine specialists, along with increased affordability of genetic testing, is expanding the patient pool receiving diagnosis and treatment.

Laron Syndrome Market Share

The Laron Syndrome industry is primarily led by well-established companies, including:

• Pfizer Inc. (U.S.)

• Ferring Pharmaceuticals (Switzerland)

• Ipsen Pharma (France)

• Novo Nordisk A/S (Denmark)

• Eli Lilly and Company (U.S.)

• Genentech, Inc. (U.S.)

• BioMarin Pharmaceutical Inc. (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Merck & Co., Inc. (U.S.)

• OPKO Health, Inc. (U.S.)

• Zydus Lifesciences (India)

• Dr. Reddy’s Laboratories (India)

• Sun Pharmaceutical Industries Ltd. (India)

• Torrent Pharmaceuticals (India)

• Hanmi Pharmaceutical (South Korea)

• LG Chem (South Korea)

• Roche Holding AG (Switzerland)

• Abbott Laboratories (U.S.)

• Siemens Healthineers (Germany)

• Thermo Fisher Scientific Inc. (U.S.)

Latest Developments in Global Laron Syndrome Market

- In February 2022, researchers published the first demonstration that AAV-based gene therapy could restore growth-hormone receptor function in a Laron-syndrome mouse model — a single liver-directed AAV-GHR injection increased IGF-1 levels and produced measurable gains in weight and length in GHR-deficient mice, marking the first preclinical proof-of-concept that gene therapy might eventually be translated into a disease-modifying approach for growth-hormone-resistance (Laron) patients

- In February 2021, an observational registry analysis of recombinant human IGF-1 (mecasermin, Increlex) therapy reported real-world effectiveness and safety data in children with severe primary IGF-1 deficiency (including patients with Laron syndrome), showing that rhIGF-1 promotes linear growth in most treatment-naïve/prepubertal patients while documenting the known safety profile (notably hypoglycaemia and other predictable adverse events). This publication reinforced mecasermin’s role as the established therapeutic option for Laron syndrome and informed clinical monitoring recommendations

- In October 2024, Eton Pharmaceuticals announced it had entered into an asset purchase agreement to acquire Increlex® (mecasermin injection) from Ipsen (transaction completed in December 2024), a commercial milestone that shifts ownership of the only approved rhIGF-1 product for severe IGF-1 deficiency and is likely to affect global supply, access programs, and commercialization strategies for Laron-syndrome therapy

- In May 2024, Ascendis Pharma highlighted expansion of its TransCon rare endocrinology portfolio at ENDO 2024 (including long-acting growth/IGF-related programs and presentations on TransCon technology), signalling intensified industry investment in long-acting growth/IGF biology platforms that could influence future therapeutic approaches for growth-disorders broadly (including translational interest for conditions like Laron syndrome)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.