Global Larvicides Market

Market Size in USD Million

CAGR :

%

USD

970.00 Million

USD

1,420.00 Million

2024

2032

USD

970.00 Million

USD

1,420.00 Million

2024

2032

| 2025 –2032 | |

| USD 970.00 Million | |

| USD 1,420.00 Million | |

|

|

|

|

Larvicides Market Analysis

The larvicides market has seen significant advancements with the integration of precision agriculture technologies and biopesticides. The latest methods involve drones and remote sensing technologies to identify larval habitats, ensuring targeted larvicide application. Smart irrigation systems integrated with larvicide delivery mechanisms optimize water usage while controlling larvae populations. Innovations such as controlled-release formulations enhance efficacy by providing prolonged action against larvae.

Biotechnology developments have led to the creation of environmentally friendly larvicides, such as those derived from Bacillus thuringiensis israelensis (Bti), which specifically target mosquito larvae without harming non-target species. AI-powered data analytics are now used to predict larval outbreaks, enabling proactive interventions.

The growth in the larvicides market is driven by increasing demand for effective vector control amidst rising vector-borne diseases such as malaria, dengue, and Zika virus. Governments and private sectors are heavily investing in research and public health initiatives. Emerging markets in Asia-Pacific and Africa contribute significantly due to their tropical climate, fostering larval breeding, thus enhancing the market’s expansion potential.

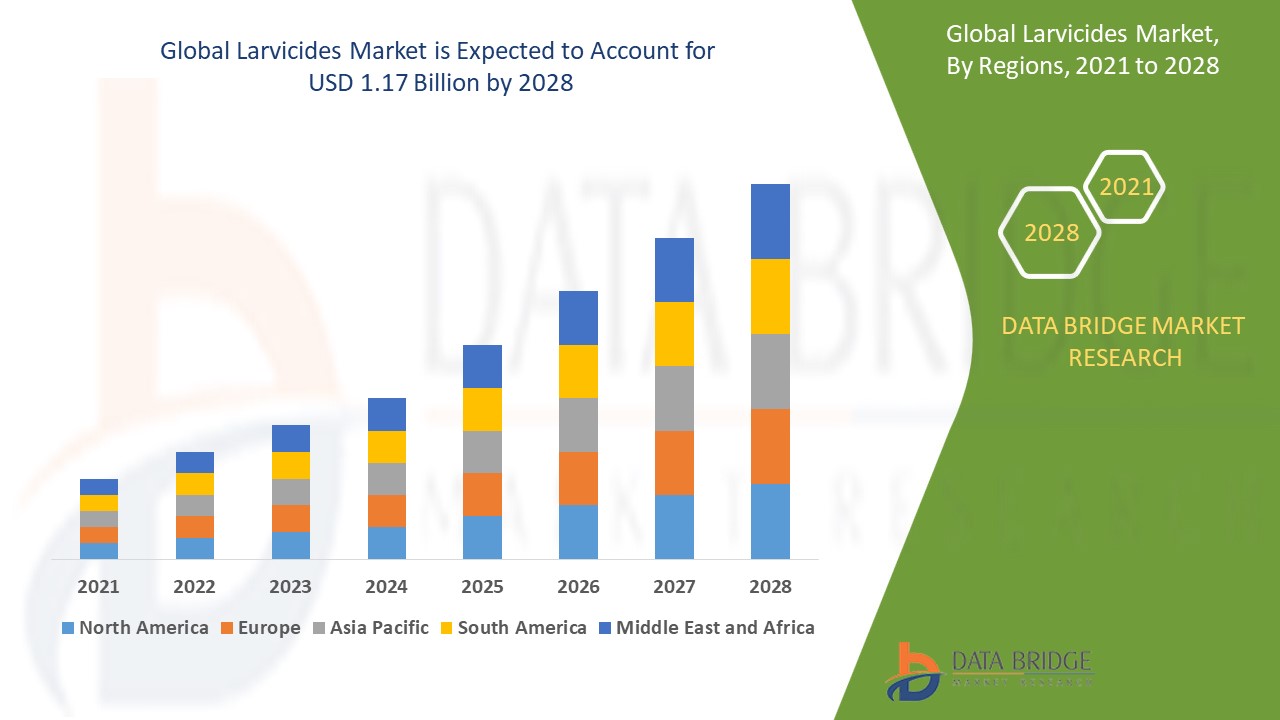

Larvicides Market Size

The global larvicides market size was valued at USD 970 million in 2024 and is projected to reach USD 1,420 million by 2032, with a CAGR of 4.90% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Larvicides Market Trends

“Growing Adoption of Biological Larvicides”

A key trend driving growth in the larvicides market is the increasing adoption of biological larvicides. These environmentally friendly solutions use natural agents such as bacteria (Bacillus thuringiensis israelensis) to target mosquito larvae without harming other organisms. With rising awareness of the adverse effects of chemical larvicides on ecosystems and human health, biological alternatives are gaining traction. For instance, the introduction of VectoBac by Valent BioSciences, a bio-larvicide, has been widely implemented in mosquito control programs globally. This trend is fueled by growing regulatory support for sustainable pest control measures, further propelling market growth in agricultural and public health applications.

Report Scope and Larvicides Market Segmentation

|

Attributes |

Larvicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), ADAMA India Private Limited (India), Sumitomo Chemical (UK) plc (U.K.), Certis USA L.L.C. (U.S.), Summit Chemical, Inc. (U.S.), Central Garden & Pet Company (U.S.), Nufarm Australia (Australia), Russell IPM Ltd (U.K.), Gowan Company (U.S.), Valent BioSciences LLC (U.S.), Clarke (U.S.), Central Life Sciences (U.S.), Kadant Inc. (U.S.), BÁBOLNA BIO Kft. (Hungary), McLaughlin Gormley King Company (U.S.), AllPro Vector Group (U.S.), and Eli Lilly and Company (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Larvicides Market Definition

Larvicides are chemical or biological agents specifically designed to target and kill insect larvae before they mature into adults. They are primarily used in pest control to reduce the population of disease-carrying insects such as mosquitoes, which can transmit malaria, dengue, and other diseases. Larvicides can be applied to standing water, soil, or breeding areas where insects lay eggs. Common types include synthetic chemicals such as organophosphates, insect growth regulators (IGRs), and natural agents such as Bacillus thuringiensis israelensis (Bti). They disrupt the larvae's growth, feeding, or respiratory systems, preventing further infestation. Larvicides play a crucial role in integrated pest management strategies worldwide.

Larvicides Market Dynamics

Drivers

- Rising Prevalence of Vector-Borne Diseases

The increasing prevalence of vector-borne diseases, such as malaria, dengue, and Zika virus, significantly boosts the demand for larvicides. Mosquitoes, being primary disease vectors, thrive in stagnant water, creating a pressing need for effective vector control solutions. For instance, according to the World Health Organization, malaria caused over 247 million cases globally in 2022, with tropical and subtropical regions being the most affected. Countries such as India and Brazil have intensified larvicide usage in public health programs to mitigate these outbreaks. In addition, urban areas in Southeast Asia and Africa are heavily investing in larvicide-based prevention programs, driving the global market's growth and adoption of advanced formulations.

- Expansion of Biopesticides

The growing preference for biological larvicides is significantly driving the larvicides market. These eco-friendly alternatives are gaining traction as they effectively target larvae without harming non-target organisms or the environment. Biopesticides, derived from natural sources such as bacteria, fungi, and plant extracts, address the rising demand for sustainable pest control solutions. Governments and environmental organizations are promoting their use to minimize chemical pollution, further bolstering market adoption. In addition, advancements in biotechnology have improved the efficacy and cost-efficiency of these products, enhancing their appeal. For instance, Bacillus thuringiensis (Bt)-based larvicides are widely used to combat mosquito larvae in both agricultural and urban settings, supporting market growth globally.

Opportunities

- Advancements in Larvicide Formulations

The development of eco-friendly and long-lasting larvicides is transforming the market, especially in environmentally sensitive regions. These advancements focus on biodegradable and non-toxic formulations, reducing harm to non-target species and ecosystems. For instance, larvicides based on Bacillus thuringiensis israelensis (Bti) offer effective control of mosquito larvae while being safe for the environment. Such innovations are gaining traction as governments and organizations prioritize sustainable vector control methods. The rising awareness among consumers about environmental protection further accelerates the adoption of these advanced products. This shift presents significant opportunities for manufacturers to invest in research, cater to eco-conscious markets, and expand their global reach.

- Increased Awareness About Preventative Measures

Rising awareness about preventative measures against vector-borne diseases is creating significant opportunities in the larvicides market. Public and private initiatives, such as community education programs and campaigns, are emphasizing the importance of larvicides in reducing mosquito populations at the larval stage. For instance, global organizations such as WHO and local health agencies promote larvicide use in vulnerable regions. Such efforts increase consumer understanding and acceptance, driving product demand. In addition, collaborations between governments and manufacturers to supply affordable and eco-friendly larvicides further expand market potential. As communities become proactive in preventing outbreaks, the market is poised for growth through higher adoption of larvicide products in both urban and rural areas.

Restraints/Challenges

- High Production Costs

High production costs are a significant challenge for the larvicides market, particularly when it comes to developing environmentally friendly and effective solutions. The manufacturing of eco-friendly larvicides often requires advanced technologies and raw materials that are more expensive compared to conventional chemical alternatives. These higher costs can make the final product less affordable, especially in price-sensitive regions where budget constraints limit the ability of local governments and organizations to invest in these solutions. As a result, the adoption of environmentally safe larvicides may be slow, hindering overall market growth and restricting access to more sustainable pest control options in economically constrained areas.

- Resistance Development

Resistance development is a significant challenge in the larvicides market. Overuse of chemical larvicides can lead to the development of resistance among insect populations, making the treatments less effective over time. As resistance increases, the need for more advanced or frequent applications arises, leading to higher operational costs. This escalating need for stronger or alternative treatments increases the financial burden on manufacturers and users. In addition, resistance can reduce the overall efficacy of larvicides, making them less reliable in controlling insect populations. This cycle of increasing resistance and costs creates a barrier to market growth, limiting the effectiveness of existing solutions and challenging industry sustainability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Larvicides Market Scope

The market is segmented on the basis of target, control method, form, and end use sector. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Target

- Mosquitoes

- Flies

- Others

- Ants

- Fleas

- Thrips

- Fungus Gnats

- Nematodes

- Beetles

Form

- Solid

- Liquid

Control Method

- Bio control Agents

- Bacillus Spp.

- Others

- Chemical Agents

- Organophosphates

- Others

- Insect Growth Regulators

- Methoprene

- Pyriproxyfen

- Diflubenzuron

- Others

- Other Control Methods

- Surface Oils and Films

- Mechanical Control

End Use Sector

- Public Health

- Agricultural

- Commercial

- Residential

- Livestock

Larvicides Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, target, control method, form, and end use sector as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the larvicides market during the forecast period due to the presence of several national and multinational companies. The region benefits from advanced research and development capabilities, a strong regulatory framework, and high demand for effective pest control solutions in agriculture and public health. In addition, increased awareness of vector-borne diseases and government initiatives to combat these issues further contribute to the growth of the larvicides market in North America.

Asia-Pacific is expected to show significant growth in the larvicides market during the forecast period, driven by a surge in mosquito-borne diseases such as dengue and malaria. The region's growing personal disposable income also contributes to the demand for improved health and pest control solutions. As governments and individuals invest more in prevention, the larvicides market is set to experience a high compound annual growth rate (CAGR) throughout this period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Larvicides Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Larvicides Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta (Switzerland)

- ADAMA India Private Limited (India)

- Sumitomo Chemical (UK) plc (U.K.)

- Certis USA L.L.C. (U.S.)

- Summit Chemical, Inc. (U.S.)

- Central Garden & Pet Company (U.S.)

- Nufarm Australia (Australia)

- Russell IPM Ltd (U.K.)

- Gowan Company (U.S.)

- Valent BioSciences LLC (U.S.)

- Clarke (U.S.)

- Central Life Sciences (U.S.)

- Kadant Inc. (U.S.)

- BÁBOLNA BIO Kft. (Hungary)

- McLaughlin Gormley King Company (U.S.)

- AllPro Vector Group (U.S.)

- Eli Lilly and Company (U.S.)

Latest Developments in Larvicides Market

- In September 2023, Safeway Pest Control Limited, a private company based in Bangladesh, launched three Bacillus Thuringiensis Israelensis (BTI) products aimed at managing mosquito larvae. The company highlighted that these larvicides are both effective and environmentally friendly, providing a sustainable solution for controlling mosquito populations and helping to combat the spread of dengue fever

- In May 2020, ADAMA Ltd, a global agricultural solutions company, acquired Alfa Agricultural Supplies SA, Greece's top supplier of crop protection products and related agricultural inputs. This strategic acquisition enabled ADAMA to expand its product portfolio, enhancing its market position and providing access to new agricultural markets in Greece and surrounding regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.