Global Laser Cladding Market

Market Size in USD Million

CAGR :

%

USD

627.00 Million

USD

1,312.11 Million

2024

2032

USD

627.00 Million

USD

1,312.11 Million

2024

2032

| 2025 –2032 | |

| USD 627.00 Million | |

| USD 1,312.11 Million | |

|

|

|

|

Laser Cladding Market Size

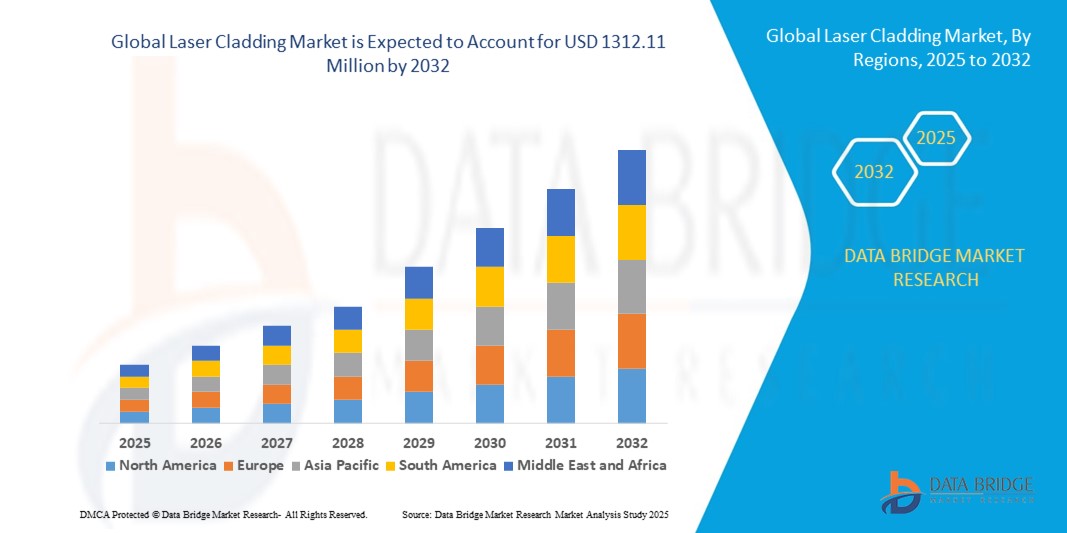

- The global laser cladding market size was valued at USD 627 million in 2024 and is expected to reach USD 1312.11 million by 2032, at a CAGR of 9.67% during the forecast period

- The market growth is largely fueled by the increasing adoption of laser cladding technology across aerospace, automotive, and oil & gas industries, where precision surface enhancement, repair, and coating applications are critical for improving component performance and longevity

- Furthermore, rising industrial demand for high-performance coatings with enhanced wear, corrosion, and thermal resistance is driving manufacturers to adopt laser cladding solutions. These converging factors are accelerating the uptake of laser cladding systems, thereby significantly boosting the market's growth

Laser Cladding Market Analysis

- Laser cladding is an additive manufacturing process that deposits a material onto a substrate using a high-powered laser, creating a metallurgically bonded coating or component. This technology is used to repair, enhance, or fabricate components with high precision and durability across multiple industries

- The escalating demand for laser cladding is primarily fueled by the need for surface repair and refurbishment, advancements in laser and automation technologies, and a growing emphasis on sustainability by reducing material waste and extending equipment life

- Asia-Pacific dominated the laser cladding market with a share of 38.6% in 2024, due to rapid industrialization, expansion of aerospace and automotive manufacturing, and a strong presence of heavy engineering and power generation hubs

- North America is expected to be the fastest growing region in the laser cladding market during the forecast period due to rising demand for surface engineering solutions in aerospace, automotive, and power generation sectors

- Diode lasers segment dominated the market with a market share of 43.5% in 2024, due to rising demand for compact, cost-effective, and energy-efficient laser systems. Diode lasers are increasingly adopted in small-to-medium manufacturing units due to their portability, low power consumption, and straightforward integration with automated systems. The flexibility in beam shaping and precise heat input control allows diode lasers to handle sensitive substrates without distortion, driving their adoption in niche applications

Report Scope and Laser Cladding Market Segmentation

|

Attributes |

Laser Cladding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Laser Cladding Market Trends

Rising Adoption of Laser Cladding in Aerospace and Automotive Sectors

- Laser cladding is increasingly applied in aerospace and automotive industries for high-precision coating and repair, offering superior wear resistance and corrosion protection in critical components subjected to extreme operating conditions

- For instance, GE Aviation incorporates laser cladding techniques to restore turbine blades and engine parts, enhancing performance and extending service life while reducing downtime and maintenance costs

- Advances in laser technology, including fiber lasers and diode-pumped systems, improve process speed, coating quality, and material compatibility, enabling wider adoption across complex geometries and lightweight alloys

- The automotive industry is adopting laser cladding for engine components, drive shafts, and brake systems, achieving improved hardness and reduced friction to meet stringent performance and efficiency standards

- Research into novel cladding materials, such as metal matrix composites and ceramic-reinforced alloys, is expanding application scopes by enhancing thermal stability and mechanical properties of coated surfaces

- Growing environmental regulations promoting component refurbishment and sustainability over replacement are encouraging adoption of laser cladding as a greener alternative to conventional machining or coatings

Laser Cladding Market Dynamics

Driver

Increasing Demand for Surface Repair and Enhancement Solutions

- Growing requirements for surface repair, restoration, and enhancement in heavy machinery, aerospace, and automotive sectors drive demand for laser cladding, offering cost-effective solutions that minimize equipment downtime and extend component life

- For instance, Trumpf has collaborated with aerospace manufacturers to provide laser cladding solutions for repair of turbine disks and compressor components, significantly reducing refurbishment time and improving coating integrity

- Increasing maintenance budgets focused on extending asset lifecycle and reducing operational disruptions boost investments in technologies that restore worn or damaged parts with minimal secondary processing

- Surface enhancement with laser cladding improves abrasion, corrosion, and fatigue resistance, leading to improved reliability and performance in critical infrastructure and transportation equipment

- Growing complexity and cost of advanced engineering materials amplify the value proposition of laser cladding by offering precision restoration compatible with high-performance alloys and composites

Restraint/Challenge

High Initial Investment and Equipment Costs

- The capital-intensive nature of laser cladding systems, including lasers, motion control units, and auxiliary equipment, creates significant barriers for small and medium enterprises and slow adoption particularly in emerging markets

- For instance, manufacturers in developing regions report that the acquisition costs of systems supplied by companies such as Coherent or IPG Photonics can limit their ability to replace traditional coating or welding methods despite long-term advantages

- Complex installation requirements and need for skilled operators increase upfront expenses and necessitate training programs, adding to initial adoption hurdles

- Rapid technology evolution also imposes upgrade demands to maintain competitive edge, resulting in recurrent capital expenditure pressures for equipment owners

- Challenges in securing financing or leasing options for high-cost laser cladding systems constrain market growth, especially for new entrants or companies with limited access to investment capital

Laser Cladding Market Scope

The market is segmented on the basis of type, material, and end-use.

- By Type

On the basis of type, the laser cladding market is segmented into diode lasers, fiber lasers, CO2 lasers, YAG lasers, and others. The diode lasers segment dominated the largest market revenue share of 43.5% in 2024, driven by rising demand for compact, cost-effective, and energy-efficient laser systems. Diode lasers are increasingly adopted in small-to-medium manufacturing units due to their portability, low power consumption, and straightforward integration with automated systems. The flexibility in beam shaping and precise heat input control allows diode lasers to handle sensitive substrates without distortion, driving their adoption in niche applications.

The fiber lasers segment is expected to witness the fastest growth rate from 2025 to 2030, fueled by their high precision, efficiency, and adaptability across various industrial applications. Fiber lasers are highly favored due to their ability to deliver consistent cladding quality, low maintenance requirements, and compatibility with diverse laser cladding materials. Their superior beam quality and energy efficiency make them ideal for applications requiring complex shapes and fine surface finishes, enhancing productivity and reducing operational costs. Industries such as aerospace, automotive, and power generation prefer fiber lasers for critical component repair and surface enhancement.

- By Material

On the basis of material, the laser cladding market is segmented into cobalt-based alloys, nickel-based alloys, iron-based alloys, carbide & carbide blends, and others. The nickel-based alloys segment held the largest revenue share in 2024, owing to its excellent corrosion resistance, high-temperature strength, and wear resistance. These properties make nickel-based alloys highly suitable for critical components in aerospace, power generation, and oil & gas industries, where durability and reliability are paramount. The extensive application of nickel alloys in repairing and upgrading machinery components further strengthens their market position.

The carbide & carbide blends segment is projected to witness the fastest growth from 2025 to 2030, driven by increasing demand for high-wear-resistant coatings in industrial machinery and tooling applications. Carbide blends provide exceptional hardness and surface protection, extending component life and reducing maintenance costs. Their ability to enhance abrasion resistance and withstand harsh operating conditions makes them a preferred choice in automotive, mining, and heavy engineering sectors, boosting their adoption across emerging markets.

- By End-use

On the basis of end-use, the laser cladding market is segmented into aerospace & defense, oil & gas, automotive, power generation, medical, and others. The aerospace & defense segment dominated the largest revenue share in 2024, supported by the stringent requirements for precision, durability, and performance of aircraft components. Laser cladding is widely used to repair and enhance critical parts such as turbine blades, landing gear, and engine components, providing cost-effective solutions while maintaining high structural integrity. The ability to apply advanced materials with minimal thermal distortion further strengthens its adoption in aerospace applications.

The automotive segment is expected to witness the fastest growth from 2025 to 2030, driven by increasing demand for lightweight, wear-resistant, and high-performance vehicle components. Laser cladding is increasingly used for engine parts, molds, and dies, enabling manufacturers to improve component longevity and reduce production costs. The growing adoption of electric vehicles and advanced manufacturing processes also contributes to the rising need for precision cladding solutions in the automotive sector.

Laser Cladding Market Regional Analysis

- Asia-Pacific dominated the laser cladding market with the largest revenue share of 38.6% in 2024, driven by rapid industrialization, expansion of aerospace and automotive manufacturing, and a strong presence of heavy engineering and power generation hubs

- The region’s cost-effective manufacturing landscape, increasing investments in advanced manufacturing technologies, and growing exports of high-value engineered components are accelerating market growth

- Availability of skilled labor, favorable government policies, and adoption of cutting-edge materials are contributing to the rising consumption of laser cladding solutions across aerospace, automotive, and energy sectors

China Laser Cladding Market Insight

China held the largest share in the Asia-Pacific laser cladding market in 2024, owing to its leadership in aerospace, automotive, and industrial manufacturing. The country’s strong industrial base, government incentives for high-tech manufacturing, and rapid adoption of advanced surface engineering technologies are major growth drivers. Demand is further supported by increasing investments in repair, maintenance, and high-performance component manufacturing for domestic and export markets.

India Laser Cladding Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising demand for advanced surface engineering in automotive, power generation, and heavy machinery sectors. Government initiatives supporting Make in India and industrial modernization are strengthening the adoption of laser cladding. In addition, increasing investments in R&D, growing infrastructure projects, and rising exports of engineered components are contributing to robust market expansion.

Europe Laser Cladding Market Insight

The Europe laser cladding market is expanding steadily, supported by stringent quality and environmental regulations, strong aerospace and automotive manufacturing sectors, and growing adoption of advanced surface repair technologies. The region emphasizes precision, durability, and sustainability, particularly in high-value industries. Increasing use of laser cladding in custom manufacturing, component repair, and high-performance coatings is further driving growth.

Germany Laser Cladding Market Insight

Germany’s market is driven by its leadership in precision engineering, aerospace, and automotive manufacturing. Strong R&D networks, collaboration between industry and academia, and a focus on high-performance materials foster continuous innovation in laser cladding applications. Demand is particularly strong for high-wear components, turbine repair, and surface enhancement in industrial machinery.

U.K. Laser Cladding Market Insight

The U.K. market benefits from a mature aerospace and defense industry, increasing adoption of advanced repair and coating solutions, and investments in industrial R&D. Focus on high-value manufacturing, sustainable production processes, and development of specialized components are boosting the adoption of laser cladding. Growing collaboration between manufacturers and research institutions further enhances innovation in material and process development.

North America Laser Cladding Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for surface engineering solutions in aerospace, automotive, and power generation sectors. Increasing focus on component repair, efficiency improvements, and adoption of advanced manufacturing technologies are boosting market growth. Investments in high-precision laser systems and rising collaborations between industrial and research institutions support market expansion.

U.S. Laser Cladding Market Insight

The U.S. accounted for the largest share in the North American market in 2024, underpinned by its advanced aerospace, defense, and automotive industries. Strong R&D infrastructure, significant investment in high-performance materials, and growing adoption of laser-based surface engineering technologies are major growth drivers. Presence of key market players, technological advancements, and a mature industrial ecosystem further solidify the U.S.'s leading position in the region.

Laser Cladding Market Share

The laser cladding industry is primarily led by well-established companies, including:

- TRUMPF (Germany)

- OC Oerlikon Management AG (Switzerland)

- Höganäs AB (Sweden)

- Coherent Corp (U.S.)

- Jenoptik (Germany)

- IPG Photonics Corporation (U.S.)

- Hayden Corp (U.S.)

- Titanova, Inc (U.S.)

- Swanson Industries (U.S.)

- American Cladding Technologies (U.S.)

- Alabama Laser (U.S.)

- Kondex Corporation U.S.A. (U.S.)

- HORNET LASER CLADDING (U.S.)

- TopClad (U.S.)

- Laserline GmbH (Germany)

Latest Developments in Global Laser Cladding Market

- In October 2024, Laserline, a global specialist in fiber lasers, announced a €15 million investment to expand its production facility in Germany. The expansion is focused on increasing the company’s manufacturing capacity for laser cladding systems to meet the growing industrial demand. This move reflects the rising adoption of laser cladding technology for precision surface enhancement, repair, and coating applications in sectors such as aerospace, automotive, and energy. The enhanced production capability is expected to reduce lead times, improve customization options, and strengthen Laserline’s competitive position in the global laser cladding market

- In July 2024, Oerlikon Metco, a global leader in surface solutions, formed a strategic partnership with Linde plc to jointly develop and commercialize advanced thermal spray coatings using Oerlikon’s laser cladding technology. This collaboration is expected to accelerate innovation in high-performance surface treatments, enabling the development of new applications across aerospace, automotive, and industrial sectors. By combining Oerlikon’s expertise in laser cladding with Linde’s capabilities in industrial gases and process technology, the partnership aims to enhance the efficiency, quality, and scalability of laser cladding processes, thereby expanding the market reach and adoption of laser cladding equipment worldwide

- In January 2024, TRUMPF inaugurated its first manufacturing facility in India, located in Pune, Maharashtra. This strategic move enables TRUMPF to produce cutting-edge laser cutting and bending machines locally, enhancing its responsiveness to the growing demand in the Indian market. The facility is expected to produce 300 machines annually, with plans to expand production to include the TruLaser 1000 series in 2025. This expansion strengthens TRUMPF's market presence in India and also optimizes its global supply chain by reducing lead times and fostering closer customer relationships

- In January 2022, SKF completed the acquisition of Laser Cladding Venture n.v. (LCV), a Belgium-based additive manufacturing company specializing in laser cladding technologies. This acquisition bolstered SKF's service and remanufacturing offerings, enabling the company to provide advanced repair solutions and extend the lifespan of critical components. By integrating LCV's expertise, SKF reinforced its commitment to sustainability and circular economy principles, aligning with its broader strategic goals

- In March 2021, Lumibird acquired Saab's defense laser rangefinder business, a key component supplier for over 15 years. This acquisition marked a significant step in consolidating Lumibird's position in the European defense laser market. The integration of Saab's technologies expanded Lumibird's product portfolio, enhancing its capabilities in providing advanced laser solutions for defense applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Laser Cladding Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laser Cladding Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laser Cladding Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.