Global Laser Dentistry Devices Market

Market Size in USD Million

CAGR :

%

USD

379.30 Million

USD

1,491.87 Million

2024

2032

USD

379.30 Million

USD

1,491.87 Million

2024

2032

| 2025 –2032 | |

| USD 379.30 Million | |

| USD 1,491.87 Million | |

|

|

|

|

Laser Dentistry Devices Market Size

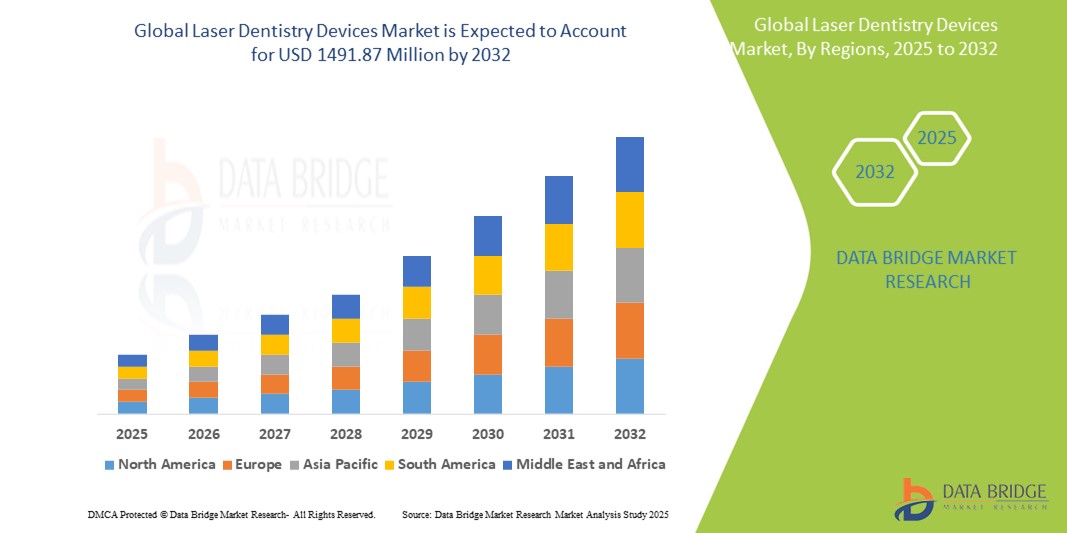

- The global laser dentistry devices market size was valued at USD 379.3 million in 2024 and is expected to reach USD 1,491.87 million by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive dental procedures and significant technological advancements in laser equipment, leading to enhanced precision, reduced pain, and faster recovery for patients

- Furthermore, rising patient demand for comfortable, efficient, and less painful dental treatments, coupled with increasing awareness of the benefits of laser dentistry (such as reduced bleeding and infection risk), is establishing laser dentistry devices as the modern standard of care. These converging factors are accelerating the uptake of Laser Dentistry Devices, thereby significantly boosting the industry's growth

Laser Dentistry Devices Market Analysis

- Laser dentistry devices, offering precise and minimally invasive treatment options for various dental procedures, are increasingly vital components of modern dental care and cosmetic dentistry due to their enhanced patient comfort, reduced healing times, and expanded range of applications

- The escalating demand for laser dentistry devices is primarily fueled by the growing awareness of the benefits of laser dentistry among both practitioners and patients, a rising preference for minimally invasive procedures, and continuous technological advancements in laser systems

- North America dominates the laser dentistry devices market with the largest revenue share of 45.94% in 2024, characterized by a high adoption rate of advanced dental technologies, strong awareness of oral health, and a significant presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region in the laser dentistry devices market during the forecast period, with a projected CAGR of 8.1% from 2025 to 2032, due to increasing urbanization, rising disposable incomes, and a growing emphasis on advanced dental care in countries such as China and India

- Dental surgical lasers segment dominates the global dental laser market with a market share of 80.9% of the share in 2024, driven by its widespread use in soft and hard tissue procedures, including gum surgeries, cavity preparations, and periodontal treatments

Report Scope and Laser Dentistry Devices Market Segmentation

|

Attributes |

Laser Dentistry Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laser Dentistry Devices Market Trends

“Advanced Connectivity and Digital Integration in Laser Dentistry Devices”

- A significant and accelerating trend in the global laser dentistry devices market is the deepening integration with digital dentistry platforms and advanced connectivity solutions. This fusion of technologies is significantly enhancing procedural precision, workflow efficiency, and overall patient outcomes in dental practices

- For instance, modern laser dentistry systems are increasingly designed to seamlessly integrate with digital impression systems, CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) software, and 3D imaging technologies. This allows dentists to precisely plan and execute procedures based on detailed digital models of the patient's oral anatomy. Technologies such as Dentsply Sirona's CEREC system or Planmeca Romexis exemplify this integration, streamlining workflows from diagnosis to treatment

- The integration of advanced software in laser dentistry devices enables features such as real-time feedback mechanisms that monitor tissue response during procedures, allowing for dynamic adjustment of laser parameters to optimize treatment. For instance, some laser systems can provide real-time thermal monitoring to prevent overheating of tissues, while others offer automated settings for specific procedures. This digital control helps standardize clinical outcomes, reduce human error, and enhance the safety and predictability of laser treatments

- The seamless integration of laser dentistry devices with broader practice management software and digital health platforms facilitates centralized data management and improved patient record keeping. Through a unified digital interface, dental professionals can access patient history, treatment plans, diagnostic images, and even manage appointments, creating a cohesive and efficient practice environment

- This trend towards more intelligent, intuitive, and interconnected dental systems is fundamentally reshaping the landscape of dental care. Consequently, companies are developing laser dentistry devices with features such as automated parameter selection, guided treatment protocols based on digital scans, and enhanced reporting capabilities for comprehensive patient records

- The demand for laser dentistry solutions that offer seamless digital integration and advanced connectivity is growing rapidly across various dental specialties, as practitioners increasingly prioritize precision, efficiency, and improved patient experiences in their practices

Laser Dentistry Devices Market Dynamics

Driver

“Growing Adoption of Minimally Invasive Procedures and Aesthetic Dentistry”

- The increasing patient demand for minimally invasive and painless dental treatments, coupled with the accelerating growth of cosmetic and aesthetic dentistry, is a significant driver for the heightened demand for laser dentistry devices

- For instance, patients are increasingly seeking procedures such as laser teeth whitening, gum contouring, and cavity preparation that offer reduced pain, faster healing, and less discomfort compared to traditional methods. This shift is also driven by greater awareness among patients about the benefits of laser technology, such as reduced bleeding and infection risk

- As dental professionals become more aware of the advantages of laser technology, including enhanced precision and efficiency, they are increasingly adopting these devices to improve patient outcomes and expand their service offerings

- Furthermore, the convenience of faster procedures, often with less or no need for anesthesia, is making laser dentistry an appealing option for a wider range of patients. The trend towards advanced, patient-centric dental care further contributes to the market growth

Restraint/Challenge

“High Initial Costs and Training Requirements”

- Concerns surrounding the high initial cost of advanced laser dentistry devices and the need for specialized training and expertise to operate these systems effectively pose a significant challenge to broader market penetration

- For instance, premium laser systems can represent a substantial investment for dental practices, particularly smaller clinics or those in developing regions. While basic models might be more affordable, cutting-edge features and advanced capabilities often come with a higher price tag

- Addressing these cost and training concerns through the development of more affordable and user-friendly devices, alongside accessible training programs and certification, is crucial for building wider adoption. Dental professionals need to invest time and resources in acquiring the necessary skills to maximize the benefits of laser technology

- While prices are gradually decreasing due to technological advancements and increased competition, the perceived premium for laser technology can still hinder widespread adoption, especially for those who do not immediately see a return on investment for the advanced features offered

Laser Dentistry Devices Market Scope

The global laser dentistry devices market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the laser dentistry devices market is segmented into soft tissue dental lasers, all tissue dental lasers, dental welding lasers, and dental surgical lasers. Dental surgical lasers segment dominates the global dental laser market with a market share of 80.9% of the share in 2024, driven by its widespread use in soft and hard tissue procedures, including gum surgeries, cavity preparations, and periodontal treatments.

The all tissue dental lasers segment is anticipated to witness the fastest growth rate, fueled by their versatility in performing procedures on both hard (for instance, enamel, dentin) and soft tissues, offering a comprehensive solution for various dental treatments with enhanced precision and reduced patient discomfort.

- By Application

On the basis of application, the laser dentistry devices market is segmented into conservative dentistry, endodontic treatment, periodontics, oral surgery, implantology, peri-implantitis, tooth whitening, and others. The periodontics segment holds a significant market share of 24.5% in 2024, driven by the high global prevalence of periodontal diseases and the effectiveness of laser technology in non-surgical and surgical periodontal therapies, offering precise tissue removal, bacterial reduction, and faster healing.

The implantology segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for dental implants and the benefits of lasers in various stages of implant procedures, including site preparation, soft tissue management, and treatment of peri-implantitis, enhancing precision and patient outcomes.

- By End User

On the basis of end user, the laser dentistry devices market is segmented into dental clinics, hospitals, and others. The dental clinics segment holds the largest market revenue share of 75.4% in 2024, driven by the increasing adoption of advanced laser technologies by private dental practitioners due to the rising patient demand for less invasive procedures, shorter treatment times, and enhanced aesthetic outcomes in routine dental care.

The hospitals segment is anticipated to witness a substantial growth rate, fueled by the growing complexity of oral surgeries, the integration of advanced laser systems for specialized procedures, and the increasing patient volume requiring multi-specialty dental care.

Laser Dentistry Devices Market Regional Analysis

- North America dominates the laser dentistry devices market with the largest revenue share of 45.94% in 2024, driven by a high adoption rate of advanced dental technologies, strong awareness of oral health, and a significant presence of key industry players

- Consumers in the region highly value the precision, reduced discomfort, and faster healing times offered by laser dentistry, leading to its widespread integration into various dental procedures

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and increasing investment in dental R&D, establishing laser dentistry devices as a favored solution for both general dentistry and specialized procedures

U.S. Laser Dentistry Devices Market Insight

The U.S. laser dentistry devices market captured the largest revenue share of 74.5% in 2024 within north america, fueled by the swift uptake of advanced dental technologies and the expanding trend of minimally invasive procedures. Dental professionals are increasingly prioritizing the enhancement of patient comfort and treatment efficacy through intelligent laser systems. The growing preference for advanced dental setups, combined with robust demand for precise and efficient procedures, further propels the Laser Dentistry Devices industry. Moreover, the increasing integration of laser technology with digital dentistry workflows, such as CAD/CAM and 3D imaging, is significantly contributing to the market's expansion.

Europe Laser Dentistry Devices Market Insight

The Europe laser dentistry devices market is projected to expand at a substantial CAGR of 7.8% from 2025 to 2032 primarily driven by the escalating need for enhanced precision and patient-friendly treatments in dental practices. The increase in urbanization, coupled with the demand for advanced dental care, is fostering the adoption of laser dentistry. European consumers are also drawn to the convenience and clinical benefits these devices offer. The region is experiencing significant growth across various dental applications, with laser dentistry being incorporated into both routine procedures and specialized treatments.

U.K. Laser Dentistry Devices Market Insight

The U.K. laser dentistry devices market is anticipated to grow at a noteworthy CAGR during the forecast period. This growth is driven by the escalating trend of advanced dental care and a desire for heightened patient comfort and efficiency. In addition, increasing awareness regarding the benefits of laser treatments is encouraging both patients and practitioners to choose these modern solutions. The UK’s embrace of innovative dental technologies, alongside its robust healthcare infrastructure, is expected to continue to stimulate market growth.

Germany Laser Dentistry Devices Market Insight

The Germany laser dentistry devices market is expected to expand at a considerable CAGR from 2025 to 2032 fueled by increasing awareness of advanced dental solutions and the demand for technologically advanced, high-quality treatments. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and clinical excellence, promotes the adoption of laser dentistry, particularly in specialized dental clinics and hospitals. The integration of laser systems with digital dental workflows is also becoming increasingly prevalent, with a strong preference for precise and predictable outcomes aligning with local patient and practitioner expectations.

Asia-Pacific Laser Dentistry Devices Market Insight

The Asia-Pacific laser dentistry devices market is poised to grow at the fastest CAGR of 8.1% from 2025 to 2032 driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards advanced dental care, supported by government initiatives promoting healthcare infrastructure development, is driving the adoption of laser dentistry. Furthermore, as APAC emerges as a manufacturing hub for dental equipment components and systems, the affordability and accessibility of laser dentistry devices are expanding to a wider consumer base.

Japan Laser Dentistry Devices Market Insight

The Japan laser dentistry devices market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for advanced dental solutions. The Japanese market places a significant emphasis on precision and patient comfort, and the adoption of laser dentistry is driven by the increasing number of modern dental clinics and hospitals. The integration of laser systems with other digital dental technologies, such as intraoral scanners and imaging systems, is fueling growth. Moreover, Japan's aging population, with over 29% of its population aged 65 and older (as of 2024), is likely to spur demand for more comfortable and efficient dental treatments in both general and specialized dental practices.

China Laser Dentistry Devices Market Insight

The China laser dentistry devices market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for advanced dental equipment, and laser dentistry devices are becoming increasingly popular in dental clinics and hospitals. The push towards modern dental care and the availability of increasingly affordable laser dentistry options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Laser Dentistry Devices Market Share

The laser dentistry devices industry is primarily led by well-established companies, including:

- BIOLASE, Inc. (U.S.)

- Fotona (U.S.)

- Dentsply Sirona (U.S.)

- Convergent Dental (U.S.)

- J. Morita Corp. (Japan)

- THE YOSHIDA DENTAL MFG. CO., LTD. (Japan)

- amdlasers (U.S.)

- Gigaalaser (China)

- Den-Mat Holdings, LLC (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- Intense Medical & Dental System Pvt Limited (India)

- NANTECH Solutions (U.S.)

- Light Instruments LTD. (Israel)

- Medency (Italy)

- Henry Schein, Inc. (U.S.)

- PIOON (China)

Latest Developments in Global Laser Dentistry Devices Market

- In April 2023, Lumenis Be Ltd., a leading medical laser company, acquired Lightcure, a developer of dental laser systems. This acquisition aimed to expand Lumenis's product portfolio and diversify its dental laser offerings, enhancing patient satisfaction through precise and less discomforting dental laser treatments

- In Feb 2024, BIOLASE, Inc., a prominent medical device company specializing in dental lasers, launched the Waterlase iPlus Premier Edition. This state-of-the-art all-tissue laser system aims to accelerate the adoption of lasers in dentistry by providing enhanced user experience with a larger touchscreen, improved graphic user interface, and on-board technique animations and protocol guides. This launch highlights BIOLASE's commitment to elevating patient care with biologically and clinically superior performance, less pain, and faster recovery times

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.