Global Laser Endomicroscopy Market

Market Size in USD Billion

CAGR :

%

USD

2.95 Billion

USD

6.23 Billion

2025

2033

USD

2.95 Billion

USD

6.23 Billion

2025

2033

| 2026 –2033 | |

| USD 2.95 Billion | |

| USD 6.23 Billion | |

|

|

|

|

Laser Endomicroscopy Market Size

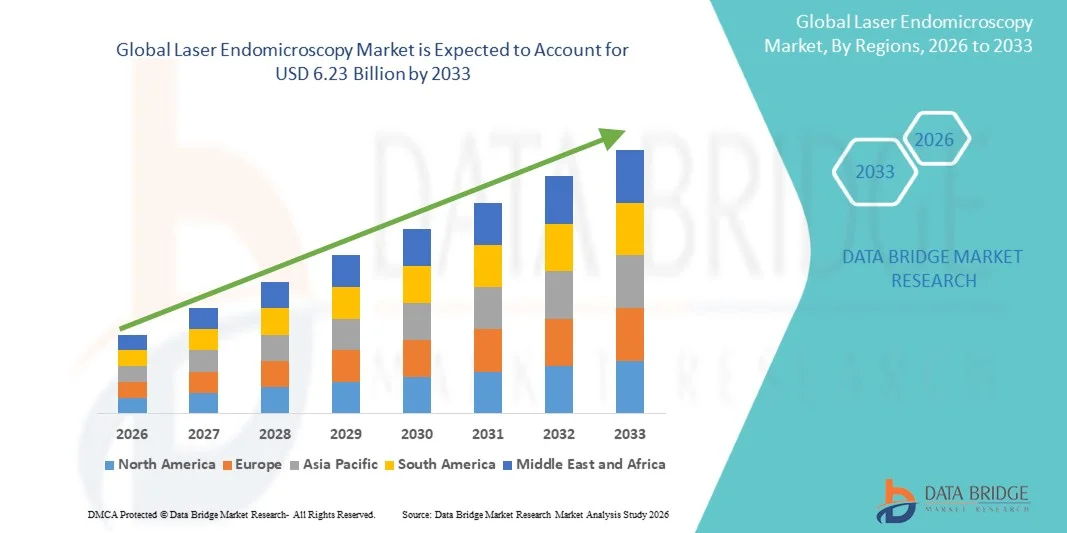

- The global laser endomicroscopy market size was valued at USD 2.95 billion in 2025 and is expected to reach USD 6.23 billion by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging technologies and continuous technological progress in optical diagnostics, which are enabling real-time, high-resolution visualization of tissues at a cellular level. This rising shift toward minimally invasive and precision-based diagnostic procedures is driving the integration of laser endomicroscopy across hospitals, research centers, and specialty clinics

- Furthermore, the growing demand for accurate, user-friendly, and rapid diagnostic solutions that reduce the need for biopsies is strengthening the position of laser endomicroscopy as a preferred imaging tool across various medical specialties. These converging factors are accelerating the uptake of Laser Endomicroscopy solutions, thereby significantly boosting the industry’s growth

Laser Endomicroscopy Market Analysis

- Laser endomicroscopy, enabling real-time in vivo microscopic imaging during endoscopic procedures, has become an important tool in modern diagnostic workflows across gastroenterology, pulmonology, oncology, and urology. Its ability to provide instant cellular-level visualization without the need for multiple biopsies significantly enhances diagnostic accuracy and procedure efficiency

- The growing demand for minimally invasive diagnostics, early cancer detection, and precision-guided therapies is one of the primary factors driving the adoption of laser endomicroscopy. Increasing clinician preference for high-resolution, user-friendly, and integrated imaging systems is further accelerating market growth

- North America dominated the laser endomicroscopy market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, early adoption of innovative imaging technologies, high healthcare spending, and strong clinical research activity across major hospitals and academic centers in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the laser endomicroscopy market during the forecast period, driven by increasing investments in healthcare modernization, rising incidence of gastrointestinal and respiratory disorders, greater adoption of advanced diagnostic tools, and expanding medical tourism in countries such as China, India, South Korea, and Singapore

- The CLE segment dominated the largest market revenue share of 62.4% in 2025, driven by its proven ability to deliver real-time, high-resolution cellular imaging during endoscopic procedures, enabling near-histological evaluation without physical biopsies

Report Scope and Laser Endomicroscopy Market Segmentation

|

Attributes |

Laser Endomicroscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laser Endomicroscopy Market Trends

“Enhanced Diagnostic Precision Through AI-Driven Image Analysis”

- A significant and accelerating trend in the global laser endomicroscopy market is the increasing integration of artificial intelligence (AI) into real-time image processing, enabling clinicians to detect abnormalities with greater speed and accuracy. AI-supported laser endomicroscopy systems allow automated recognition of tissue patterns, reducing interpretation variability and enhancing diagnostic confidence

- For instance, several advanced platforms now incorporate AI-based algorithms capable of classifying benign vs. malignant tissue in seconds during endoscopic procedures, thereby supporting faster clinical decisions and targeted biopsies

- AI integration enables features such as real-time image enhancement, automated annotation, and predictive analytics, significantly improving disease detection in gastrointestinal cancers, Barrett’s esophagus, inflammatory bowel disease (IBD), and other mucosal abnormalities

- Furthermore, AI-driven systems improve workflow efficiency by reducing operator dependence and helping less-experienced clinicians achieve expert-level interpretation accuracy

- The seamless integration of AI with laser endomicroscopy platforms also allows synchronization with electronic health records (EHRs), digital pathology systems, and cloud-based analytical platforms for comprehensive diagnostic assessment

- This trend toward more intelligent, automated, and high-precision imaging platforms is transforming clinician expectations in minimally invasive diagnostics. Consequently, companies are investing heavily in AI-enabled imaging modules and next-generation laser scanning technologies to improve image resolution and diagnostic outcomes

- The demand for AI-powered laser endomicroscopy systems is expanding rapidly across hospitals and advanced endoscopy centers, as healthcare providers increasingly emphasize early disease detection, precision diagnostics, and reduced biopsy burden

Laser Endomicroscopy Market Dynamics

Driver

“Growing Need for Real-Time, High-Accuracy Diagnostic Imaging in Gastrointestinal and Respiratory Disorders”

- The rising global burden of gastrointestinal (GI) cancers, inflammatory bowel disease (IBD), colorectal lesions, and pulmonary abnormalities is significantly increasing the demand for real-time, high-resolution imaging technologies, including laser endomicroscopy

- For instance, recent research shows that laser endomicroscopy allows “optical biopsies,” reducing the need for physical tissue sampling and enabling immediate clinical decision-making, which is a major driver of adoption across hospitals and endoscopy centers

- As clinicians seek more precise tools to visualize cellular-level structures, laser endomicroscopy offers a major advantage by providing near-histological images during endoscopic procedures

- The growing emphasis on early cancer detection, particularly in Barrett’s esophagus and colorectal diseases, is boosting the adoption of advanced imaging systems integrated with targeted diagnostic capabilities

- Technical advancements such as improved laser scanning mechanisms, enhanced fluorescent contrast agents, and AI-supported image interpretation are further accelerating market growth

- Increased training initiatives and awareness among gastroenterologists and pulmonologists are improving the acceptance of laser endomicroscopy as a superior alternative to standard endoscopic visualization

- The shift toward minimally invasive diagnostics, coupled with rising patient preference for accurate and faster evaluations, is expected to drive market expansion in the forecast period

- Investments from medical device manufacturers in R&D, as well as collaborations between endoscopy companies and digital imaging firms, significantly strengthen the development of high-performance laser endomicroscopy systems

Restraint/Challenge

“High Equipment Costs, Limited Reimbursement, and Technical Complexities in Clinical Adoption”

- One of the major restraints affecting the laser endomicroscopy market is the high initial investment cost of advanced systems, which limits adoption among smaller hospitals and healthcare centers, especially in cost-sensitive regions

- Laser endomicroscopy platforms require specialized hardware, fluorescence agents, and high-precision optics, contributing to elevated procurement and maintenance expenses

- In addition, limited or insufficient reimbursement for laser-based optical biopsies creates financial barriers for providers, discouraging rapid adoption despite clear clinical benefits

- The complexity of the technology also poses training challenges, as clinicians must develop proficiency in both image acquisition and interpretation, which can slow procedural workflow in early adoption stages

- Technical issues such as sensitivity to motion artifacts, dependency on optimal staining techniques, and variability in imaging outcomes between operators can further limit widespread utilization

- Another challenge is the lack of standardized clinical guidelines for integrating laser endomicroscopy findings into routine diagnostic pathways, which may cause inconsistency in clinical decision-making

- While innovations are improving accessibility and ease of use, overcoming these barriers will require advancements in automated imaging systems, expanded reimbursement coverage, and broader clinician training programs

- Addressing these challenges through cost-effective product development, increased digital automation, and structured clinical protocols will be crucial for sustained market growth

Laser Endomicroscopy Market Scope

The market is segmented on the basis of type, CLE product type, CLE application, and end-users.

• By Type

On the basis of type, the Laser Endomicroscopy market is segmented into Confocal Laser Endomicroscopy (CLE) and Volumetric Laser Endomicroscopy (VLE). The CLE segment dominated the largest market revenue share of 62.4% in 2025, driven by its proven ability to deliver real-time, high-resolution cellular imaging during endoscopic procedures, enabling near-histological evaluation without physical biopsies. CLE is widely adopted in gastroenterology for diagnosing Barrett’s esophagus, gastric lesions, IBD, and colorectal neoplasia, owing to its validated accuracy and clinical familiarity among endoscopists. Its strong dominance is also supported by the availability of both probe-based and endoscopy-based CLE systems, giving clinicians flexibility based on workflow requirements. Advanced fluorescent contrast agents and improved laser scanning modules have further strengthened CLE’s diagnostic utility. The segment continues to remain the preferred choice due to extensive clinical evidence, regulatory approvals, ease of integration with standard endoscopy systems, and high physician confidence that reinforces widespread adoption in hospitals and tertiary care centers.

The VLE segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by increasing interest in wide-field, deeper-tissue imaging capabilities that allow clinicians to visualize subsurface abnormalities up to 3 mm depth—far beyond the reach of CLE. VLE is gaining traction especially in Barrett’s esophagus surveillance programs, where its ability to detect buried glands and dysplastic tissue makes it highly valuable. The growing preference for minimally invasive optical biopsies, rising demand for enhanced mapping of esophageal lesions, and technological advancements such as automated algorithm-based tissue interpretation support strong market growth. Its adoption is also increasing due to the growing availability of high-speed scanning catheters and integration with AI-assisted diagnostic workflows in specialized GI centers.

• By CLE Product Type

On the basis of CLE product type, the Laser Endomicroscopy market is segmented into Probe-Based and Endoscopy-Based systems. The Probe-Based CLE (pCLE) segment dominated the market with the largest revenue share of 57.1% in 2025, owing to its ability to integrate seamlessly with existing endoscopes across multiple specialties including gastroenterology, pulmonology, and urology. pCLE offers high flexibility, as physicians can use thin probes that can be inserted through the working channel of standard endoscopes, making it suitable for real-time cellular imaging in difficult-to-reach areas. Its dominance is reinforced by broad clinical adoption, portability, and availability of multiple probe types optimized for various anatomical sites. Strong research evidence supporting pCLE’s diagnostic accuracy in GI tumors, biliary diseases, pancreatic lesions, and lung nodules also contributes to its market leadership. Moreover, its lower acquisition cost compared to endoscopy-based CLE platforms makes it an attractive option for mid-sized hospitals and ambulatory centers.

The Endoscopy-Based CLE (eCLE) segment is expected to witness the fastest CAGR of 17.6% from 2026 to 2033, driven by advancements in integrated systems that provide superior image stability, larger fields of view, and enhanced ergonomics. eCLE platforms offer higher laser power, improved signal-to-noise ratios, and more consistent image quality, making them ideal for high-precision diagnostic settings. The segment’s rapid growth is supported by increasing adoption in tertiary hospitals, particularly for advanced GI diagnostics, mucosal lesion characterization, and targeted biopsies. Integration with digital imaging suites, AI-based decision-support modules, and automated reporting workflows further accelerates demand. The rising focus on precision endoscopy and higher diagnostic confidence provided by integrated systems will continue to drive strong segment expansion.

• By CLE Application

On the basis of CLE application, the Laser Endomicroscopy market is segmented into Pancreatic, Luminal, Biliary, and Others. The Luminal application segment dominated the largest revenue share of 48.5% in 2025, due to extensive utilization of CLE in diagnosing luminal GI disorders such as Barrett’s esophagus, gastric cancer, colonic polyps, and inflammatory bowel disease. Luminal applications benefit from the broadest clinical validation, regular use in endoscopy units, and strong demand for real-time, in vivo optical biopsies that reduce the need for physical sampling. Increasing awareness of early cancer detection programs, especially for esophageal abnormalities, continues to reinforce market dominance. The segment further benefits from advancements in fluorescence agents, expanded probe compatibility, and growing physician training programs that enhance diagnostic accuracy and workflow efficiency.

The Pancreatic application segment is expected to witness the fastest CAGR of 19.4% from 2026 to 2033, driven by increasing adoption of CLE during endoscopic ultrasound-guided fine-needle aspiration (EUS-FNA) for characterizing pancreatic cystic lesions. CLE’s ability to differentiate benign from precancerous or malignant pancreatic cysts in real time significantly reduces diagnostic uncertainty and enhances treatment planning. Rising prevalence of pancreatic cancer, growing need for early detection, and advancements in ultra-thin probes designed for pancreatic ducts are contributing to strong demand. The integration of AI-assisted image interpretation and predictive lesion classification tools is also accelerating growth, particularly in specialized GI oncology centers.

• By End User

On the basis of end user, the Laser Endomicroscopy market is segmented into Diagnostic Clinics, Hospitals, and Ambulatory Surgical Centers (ASCs). The Hospital segment dominated the market with the largest revenue share of 54.7% in 2025, driven by the high availability of advanced imaging infrastructure, the presence of skilled gastroenterologists, and strong demand for precision diagnostics in tertiary care settings. Hospitals perform the highest number of complex endoscopic procedures, including those requiring real-time optical biopsies, making them the primary adopters of CLE and VLE technologies. Large hospitals also benefit from research funding, clinical trials, and integrated oncology programs that encourage the use of advanced imaging tools for early cancer detection and treatment guidance.

The Ambulatory Surgical Centers (ASCs) segment is expected to witness the fastest CAGR of 18.2% from 2026 to 2033, fueled by the shift toward outpatient, minimally invasive endoscopic procedures that offer reduced costs and shorter patient recovery times. ASCs are increasingly adopting compact, probe-based CLE systems due to their portability, lower acquisition cost, and suitability for high-throughput GI procedures. Growing emphasis on same-day diagnosis, improved workflow efficiency, and rising patient preference for outpatient care further support strong growth in this segment.

Laser Endomicroscopy Market Regional Analysis

North America dominated the laser endomicroscopy market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, early adoption of high-end imaging technologies, and strong investments in precision diagnostics. The region benefits from a large presence of academic research institutions, clinical trials, and hospitals equipped with technologically sophisticated endoscopy systems.

U.S. Laser Endomicroscopy Market Insight

The U.S. laser endomicroscopy market accounted for approximately 80.2% of North America’s Laser Endomicroscopy revenue in 2025, driven by rapid integration of minimally invasive diagnostic tools across gastroenterology, pulmonology, and oncology. Rising incidence of gastrointestinal cancers, increasing demand for early-stage tumor detection, and strong reimbursement support for advanced endoscopic procedures contribute to market expansion. Furthermore, partnerships between device manufacturers and leading U.S. medical centers are accelerating innovation and clinical adoption of both CLE and VLE systems

Europe Laser Endomicroscopy Market Insight

The European laser endomicroscopy market is projected to grow at a strong CAGR during the forecast period, driven by rising demand for real-time, high-resolution diagnostic imaging in gastrointestinal and respiratory care. The region’s strict clinical guidelines for early cancer detection, along with increased investment in endoscopy infrastructure, are boosting technology uptake. Hospitals and research centers across Western Europe, especially Germany, France, and the U.K., are increasingly adopting CLE and VLE systems for enhanced diagnostic accuracy.

U.K. Laser Endomicroscopy Market Insight

The U.K. laser endomicroscopy market is expected to expand notably, supported by strong adoption of advanced diagnostic systems in NHS and private hospitals. Rising awareness of early cancer screening, growing clinical research programs, and national digital-health initiatives are further driving uptake.

Germany Laser Endomicroscopy Market Insight

Germany laser endomicroscopy market is witnessing significant growth due to its strong medical technology ecosystem, high-quality healthcare infrastructure, and emphasis on precision diagnostics. Increasing adoption of minimally invasive imaging solutions in gastroenterology and oncology is contributing to steady market expansion.

Asia-Pacific Laser Endomicroscopy Market Insight

Asia-Pacific is laser endomicroscopy market expected to be the fastest-growing region, projected to register a robust CAGR of 23.8% during 2026–2033. Growth is driven by rising healthcare modernization efforts, increasing prevalence of gastrointestinal and respiratory disorders, and expanding medical tourism in countries like China, India, South Korea, Thailand, and Singapore. Improving hospital infrastructure, greater investment in advanced imaging systems, and rising demand for accurate, minimally invasive diagnostics are creating strong market momentum.

Japan Laser Endomicroscopy Market Insight

Japan laser endomicroscopy market is experiencing strong adoption because of its technologically advanced healthcare system, high focus on early disease detection, and high acceptance of innovative diagnostic tools in hospitals and specialty clinics.

China Laser Endomicroscopy Market Insight

China laser endomicroscopy market held the largest revenue share in the Asia-Pacific Laser Endomicroscopy Market in 2025, driven by rapid healthcare expansion, government-backed medical modernization initiatives, and the presence of a large patient pool requiring endoscopic procedures. Increasing local manufacturing capability and growing investment in endoscopic imaging technologies are further supporting market growth.

Laser Endomicroscopy Market Share

The Laser Endomicroscopy industry is primarily led by well-established companies, including:

- Mauna Kea Technologies (France)

- NinePoint Medical (U.S.)

- Boston Scientific Corporation (U.S.)

- Pentax Medical (Japan)

- Fujifilm Holdings Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- Olympus Corporation (Japan)

- Cook Medical (U.S.)

- Stryker Corporation (U.S.)

- Medtronic plc (Ireland)

- Richard Wolf GmbH (Germany)

- Conmed Corporation (U.S.)

- Bracco Imaging S.p.A (Italy)

- Optiscan Imaging (Australia)

- Cellvizio (France)

- EndoChoice (U.S.)

- HOYA Group (Japan)

- Intuitive Surgical (U.S.)

- Vision-Sciences, Inc. (U.S.)

- Sinolight Medical (China)

Latest Developments in Global Laser Endomicroscopy Market

- In January 2023, Mauna Kea Technologies announced publication of results from the first-in-human clinical study combining robotic-assisted bronchoscopy and needle-based Confocal Laser Endomicroscopy for lung cancer diagnosis, demonstrating the feasibility and safety of real-time imaging feedback to improve targeting of peripheral lung nodules during diagnostic procedures

- In October 2023, Mauna Kea Technologies reported positive results from a large randomized controlled trial showing that Cellvizio-guided transbronchial cryobiopsy significantly improved diagnostic yield and safety outcomes compared to X-ray fluoroscopy in the diagnosis of Interstitial Lung Disease (ILD). The study indicated that CLE can sharpen the precision and reduce complications in lung tissue sampling procedures, opening new clinical opportunities in respiratory diagnostic

- In May 2024, Mauna Kea Technologies announced nine scientific presentations at Digestive Disease Week 2024 demonstrating the clinical value of the Cellvizio laser endomicroscopy platform, with abstracts focusing on applications including artificial intelligence, pancreatic cystic lesions, pancreatic cancer, and gastrointestinal disorders. These presentations underscored ongoing clinical validation and research engagement with endomicroscopy technologies

- In July 2025, Mauna Kea Technologies reported first-half-2025 financial results, noting robust U.S. sales growth for Cellvizio systems, particularly for pancreatic cyst indications, and increased usage at new clinical centers, reflecting ongoing commercial uptake of laser endomicroscopy systems despite macroeconomic challenges

- In December 2025, Mauna Kea Technologies secured regulatory approval from China’s National Medical Products Administration (NMPA) for its next-generation Cellvizio Gen 3 confocal laser endomicroscopy platform, reopening the Chinese market and authorizing commercialization of the advanced system across a full range of confocal probes — a major milestone for market expansion in Asia

- In February 2025, Apollo Gleneagles Hospitals in Kolkata, India, launched India’s first Cellvizio probe-based Confocal Laser Endomicroscopy (pCLE) system, providing clinicians with high-resolution, in-vivo cellular imaging capability to support real-time diagnosis of gastrointestinal and other internal tissue abnormalities. This launch marks an important geographical expansion of advanced endomicroscopy technology into South Asia, enhancing diagnostic precision for conditions such as pancreatic and GI lesions in the region

- In May 2025, Mauna Kea Technologies hosted the largest annual Pancreatic Cyst Consortium at the Digestive Disease Week (DDW) Conference, drawing more than 75 physicians to discuss cutting-edge advancements in needle-based Confocal Laser Endomicroscopy (nCLE) and its role in early and accurate diagnosis of pancreatic cystic lesions. The event highlighted strong clinician interest and growing adoption of laser endomicroscopy technologies in pancreatic diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.