Global Laser Guide Star Adaptive Optics Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

10.42 Billion

2025

2033

USD

1.27 Billion

USD

10.42 Billion

2025

2033

| 2026 –2033 | |

| USD 1.27 Billion | |

| USD 10.42 Billion | |

|

|

|

|

Laser Guide Star Adaptive Optics Market Size

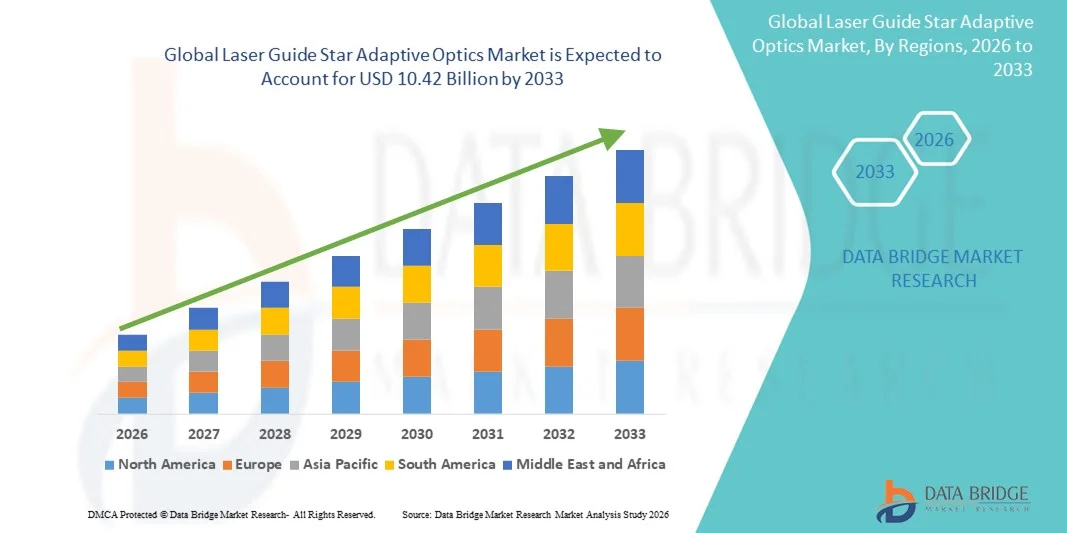

- The global laser guide star adaptive optics market size was valued at USD 1.27 billion in 2025 and is expected to reach USD 10.42 billion by 2033, at a CAGR of 30.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of high-precision optical systems and advancements in adaptive optics technology, enabling real-time correction of atmospheric distortions in ground-based telescopes and high-resolution imaging applications. The growing demand for enhanced imaging performance in astronomy, defense, and scientific research is driving investments in laser guide star adaptive optics systems

- Furthermore, rising requirements for ultra-precise imaging and target acquisition in both military and astronomical applications are establishing laser guide star adaptive optics as a critical technology for achieving high-resolution, distortion-free observations. These converging factors are accelerating the deployment of advanced adaptive optics solutions, significantly boosting the market's growth

Laser Guide Star Adaptive Optics Market Analysis

- Laser guide star adaptive optics systems, which use artificial laser-generated reference stars to correct atmospheric turbulence in real time, are becoming increasingly essential for large telescopes, defense surveillance systems, and high-end imaging instruments due to their ability to enhance image clarity and accuracy

- The escalating demand for these systems is primarily driven by advancements in deformable mirrors, wavefront sensors, and control algorithms, alongside increased investment in astronomical observatories, defense projects, and high-resolution imaging technologies. The technology’s capability to improve optical performance across various applications continues to strengthen its adoption globally

- North America dominated the laser guide star adaptive optics market with a share of 48.5% in 2025, due to strong investments in astronomical research, defense applications, and advanced imaging technologies

- Asia-Pacific is expected to be the fastest growing region in the laser guide star adaptive optics market during the forecast period due to expanding astronomical research programs, defense modernization, and technological advancements in countries such as China, Japan, and India

- Wave front sensors segment dominated the market with a market share of 45.5% in 2025, due to their essential role in detecting distortions in incoming light to enable precise correction. High adoption in astronomical observatories and high-resolution imaging systems enhances optical performance and image clarity. Technological advancements improving sensitivity, accuracy, and integration with adaptive optics systems reinforce their market dominance. Growing demand for real-time imaging and precision targeting in defense and space research also supports strong adoption. Their compatibility with various adaptive optics configurations ensures versatile deployment across optical systems. Miniaturized and high-speed variants further expand their use in compact and mobile platforms

Report Scope and Laser Guide Star Adaptive Optics Market Segmentation

|

Attributes |

Laser Guide Star Adaptive Optics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Laser Guide Star Adaptive Optics Market Trends

Rising Adoption in Astronomy and Defense Imaging

- A significant trend in the Laser Guide Star Adaptive Optics market is the increasing deployment of adaptive optics systems in astronomical observatories, defense surveillance platforms, and high-resolution imaging applications. This trend is driven by the need for precise real-time correction of atmospheric distortions, enabling sharper and more accurate imaging in both scientific and defense domains

- For instance, Boston Micromachines Corporation and HOLOEYE Photonics AG supply high-performance deformable mirrors and wavefront sensors that are widely used in observatories and military imaging systems. Such components improve image quality and operational accuracy under challenging atmospheric conditions

- The adoption of laser guide star adaptive optics is growing rapidly in ground-based and space-assisted telescopes, where artificial guide stars allow astronomers to observe fainter celestial objects with enhanced resolution. This is positioning adaptive optics as critical for advancing astronomical research and high-precision observational capabilities

- Defense agencies are increasingly integrating adaptive optics with surveillance and targeting systems to improve detection accuracy and real-time response. This is driving investments in high-order deformable mirrors, wavefront modulators, and laser guide star solutions for enhanced situational awareness

- Research institutions and academic observatories are adopting adaptive optics to facilitate advanced imaging experiments in both visible and infrared wavelengths. The technology supports detailed study of distant celestial bodies, improving the quality of scientific data and broadening research potential

- The market is witnessing strong growth in high-resolution optical systems where deformable mirrors, wavefront sensors, and control algorithms collectively contribute to superior imaging performance. This rising adoption of laser guide star adaptive optics is reinforcing the overall transition toward ultra-precise, distortion-free imaging across scientific, defense, and industrial applications

Laser Guide Star Adaptive Optics Market Dynamics

Driver

Increasing Demand for Real-Time Atmospheric Distortion Correction

- The growing need for precise, real-time correction of atmospheric distortions in astronomical and defense imaging is driving demand for laser guide star adaptive optics systems. These systems enhance resolution and accuracy for telescopes, surveillance platforms, and high-power laser applications

- For instance, Northrop Grumman and Thorlabs, Inc. provide integrated AO solutions that enable real-time wavefront correction for ground-based telescopes and military imaging systems. Such solutions improve operational efficiency and enable detailed observation of distant or fast-moving targets

- The rising demand for adaptive optics is fueled by investments in large-scale observatories, space exploration initiatives, and defense modernization programs. High-precision imaging requirements necessitate advanced AO systems capable of rapid, accurate adjustments

- Increasing adoption of laser guide star technology supports both research and operational missions by improving imaging quality under turbulent atmospheric conditions. This is reinforcing the strategic importance of adaptive optics in high-stakes scientific and defense applications

- The need for enhanced situational awareness, real-time data acquisition, and precision observation continues to strengthen market growth. Institutions and agencies are increasingly prioritizing AO integration to maintain competitive capabilities in imaging and surveillance

Restraint/Challenge

High Costs and Integration Complexity

- The Laser Guide Star Adaptive Optics market faces challenges due to the high cost of components such as deformable mirrors, wavefront sensors, and high-power lasers. These costs, combined with the complexity of integrating AO systems into existing observatories or defense platforms, limit adoption in smaller or resource-constrained setups

- For instance, implementing high-order AO systems in telescopes requires precision alignment, software calibration, and specialized maintenance, increasing operational complexity. Such requirements elevate both upfront investment and ongoing operational expenses

- The reliance on advanced materials, precise actuators, and sophisticated control algorithms increases production difficulty and limits cost flexibility. Manufacturers must balance performance, reliability, and affordability to meet diverse customer needs

- Scaling AO systems for larger telescopes or multi-platform defense applications further complicates integration, as each system must be customized to its optical environment. This technical challenge can slow deployment timelines and affect overall market growth

- The market continues to encounter constraints in reducing system costs while maintaining high imaging accuracy and reliability. These factors collectively create a barrier for broader adoption across emerging observatories and smaller defense installations

Laser Guide Star Adaptive Optics Market Scope

The market is segmented on the basis of component and end-user.

- By Component

On the basis of component, the Laser Guide Star Adaptive Optics market is segmented into wave front sensors, mirrors, and wave front modulators. The wave front sensors segment dominated the market with the largest share of 45.5% in 2025, driven by their essential role in detecting distortions in incoming light to enable precise correction. High adoption in astronomical observatories and high-resolution imaging systems enhances optical performance and image clarity. Technological advancements improving sensitivity, accuracy, and integration with adaptive optics systems reinforce their market dominance. Growing demand for real-time imaging and precision targeting in defense and space research also supports strong adoption. Their compatibility with various adaptive optics configurations ensures versatile deployment across optical systems. Miniaturized and high-speed variants further expand their use in compact and mobile platforms.

The mirrors segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in high-power laser systems and advanced optical instrumentation. For instance, Northrop Grumman develops lightweight, high-precision deformable mirrors to improve system responsiveness and accuracy. Mirrors offer rapid shape adjustment to correct wave front distortions, enhancing imaging quality. Rising demand for mirrors with high reflectivity and low thermal expansion properties drives growth in scientific and military applications. Integration with real-time control systems allows precise manipulation of optical paths. Innovations in actuator technologies and materials further boost performance in extreme conditions.

- By End-User

On the basis of end-user, the market is segmented into healthcare, military & defense, and manufacturing. The healthcare segment dominated in 2025, driven by adoption in ophthalmology and laser-based imaging systems. Adaptive optics enables detailed retinal imaging, improving diagnostics and treatment outcomes. Technological advancements allow non-invasive, real-time imaging, enhancing clinical capabilities. Research funding and investments in medical imaging systems further support market dominance. Adaptive optics in surgical guidance and laser therapies also drives adoption.

The military & defense segment is expected to witness the fastest growth rate from 2026 to 2033, driven by deployment in surveillance, target acquisition, and laser communication systems. For instance, Raytheon Technologies develops adaptive optics with laser guide stars to enhance long-range targeting. The need for high-precision optical systems capable of mitigating atmospheric distortions drives demand. Integration with high-energy laser weapons and reconnaissance systems accelerates growth. Innovations in wave front modulators and deformable mirrors further support expansion in defense applications.

Laser Guide Star Adaptive Optics Market Regional Analysis

- North America dominated the laser guide star adaptive optics market with the largest revenue share of 48.5% in 2025, driven by strong investments in astronomical research, defense applications, and advanced imaging technologies

- Research institutions and defense agencies in the region highly value the precision, real-time correction capabilities, and enhanced imaging quality offered by adaptive optics systems integrated with laser guide stars

- This widespread adoption is further supported by high R&D expenditure, a technologically advanced population, and government initiatives promoting space exploration and high-resolution imaging, establishing adaptive optics as a critical solution for both scientific and military applications

U.S. Laser Guide Star Adaptive Optics Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by the presence of leading aerospace and defense companies and premier astronomical observatories. Institutions and agencies are increasingly prioritizing adaptive optics to achieve high-precision imaging and real-time atmospheric correction. The growing integration of laser guide star systems with advanced telescopes and high-power laser platforms further propels market expansion. Moreover, government-funded space and defense programs, alongside collaboration with private aerospace firms, are significantly contributing to the market's growth.

Europe Laser Guide Star Adaptive Optics Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by significant investments in astronomical research, defense modernization, and high-resolution imaging technologies. Rising government and academic initiatives to enhance optical systems are fostering adoption of laser guide star adaptive optics. European research institutions and observatories are also drawn to the precision and performance offered by these systems. The region is witnessing growth across both public and private sector projects, with adaptive optics increasingly incorporated into new observatories and optical instrumentation.

U.K. Laser Guide Star Adaptive Optics Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, driven by investments in space science, defense, and astronomical research. The adoption of adaptive optics is encouraged by the need for high-precision imaging and laser correction systems. Academic and research institutions, alongside defense agencies, are increasingly implementing laser guide star systems to improve observational accuracy. The U.K.’s strong focus on technological innovation and advanced instrumentation continues to stimulate market growth.

Germany Laser Guide Star Adaptive Optics Market Insight

The Germany market is anticipated to expand at a considerable CAGR, fueled by rising investments in optical research, defense projects, and high-precision imaging solutions. Germany’s robust R&D infrastructure, combined with its emphasis on technological advancement and innovation, promotes adoption of adaptive optics systems. Observatories and defense applications increasingly rely on laser guide star technology for real-time optical correction. The integration of adaptive optics with high-resolution imaging platforms is becoming increasingly prevalent, aligning with local institutional and industrial requirements.

Asia-Pacific Laser Guide Star Adaptive Optics Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2026–2033, driven by expanding astronomical research programs, defense modernization, and technological advancements in countries such as China, Japan, and India. The region’s growing investments in high-precision optical systems and laser applications are driving adoption of adaptive optics solutions. Furthermore, increasing collaborations between research institutions, defense agencies, and technology manufacturers are enhancing the accessibility and implementation of these systems across APAC.

Japan Laser Guide Star Adaptive Optics Market Insight

The Japan market is gaining momentum due to the country’s high-tech culture, advanced research facilities, and demand for precision imaging. Adoption is driven by astronomical observatories, defense research, and space exploration initiatives. Integration of laser guide star adaptive optics with high-resolution imaging systems and IoT-enabled monitoring platforms is fueling growth. Japan’s focus on innovation and technological advancement continues to spur demand for efficient and precise adaptive optics solutions.

China Laser Guide Star Adaptive Optics Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to increasing investments in astronomical observatories, defense technologies, and space programs. China is emerging as a key hub for high-precision optical systems, and laser guide star adaptive optics are becoming widely implemented in both scientific and defense applications. Government initiatives supporting advanced optical research, coupled with strong domestic manufacturers, are propelling the market. The push towards high-resolution imaging and smart defense applications further strengthens adoption across the country.

Laser Guide Star Adaptive Optics Market Share

The laser guide star adaptive optics industry is primarily led by well-established companies, including:

- Gel Company (U.S.)

- Benchmark Electronics (U.S.)

- Boston Micromachines Corporation (U.S.)

- HOLOEYE Photonics AG (Germany)

- Thorlabs, Inc. (U.S.)

- Northrop Grumman (U.S.)

- PHASICS CORP. (U.S.)

- Synopsys, Inc. (U.S.)

- Adaptive Optics Associates (U.S.)

- Sacher Lasertechnik GmbH (Germany)

- Iris AO, Inc. (U.S.)

- Teledyne UK Limited (U.K.)

- Edmund Optics (U.S.)

- Adaptica Srl (Italy)

- Active Optical Systems Ltd (U.K.)

- Flexible Optical B.V. (Netherlands)

- Imagine Optic (France)

Latest Developments in Global Laser Guide Star Adaptive Optics Market

- In November 2025, the European Southern Observatory (ESO) activated four new lasers at its Paranal site to generate artificial guide stars for the GRAVITY+ system. This enhancement significantly increases sky coverage for the Very Large Telescope Interferometer (VLTI), allowing adaptive optics correction across a wider portion of the sky. As a result, astronomers can conduct high-resolution observations of fainter and more distant celestial objects, strengthening the observatory’s research capabilities and positioning the region as a leader in advanced ground-based optical systems. This development also stimulates demand for high-performance laser guide star adaptive optics technologies globally

- In September 2025, the GRAVITY+ adaptive optics system achieved “first light” on VLTI’s 8-meter Unit Telescopes, delivering a substantial improvement in sensitivity, imaging contrast, and sky coverage. This milestone demonstrates the effectiveness of high-order laser guide star adaptive optics in achieving ultra-precise optical correction in real-time. The breakthrough enhances the scientific output of the VLTI and also reinforces market confidence in deploying next-generation AO systems for large-scale observatories, encouraging further investments and technology adoption in the sector

- In June 2025, Bertin ALPAO delivered two advanced deformable-mirror adaptive optics systems — a 3,228-actuator mirror for the MAVIS project at the VLT and a 2,844-actuator mirror for Keck Observatory. These systems provide unprecedented precision in wavefront correction, enabling observatories to achieve sharper and more stable images. This delivery strengthens the market position of high-actuator-count deformable mirrors as critical components of modern AO systems and drives demand for advanced optical solutions in astronomical and defense applications

- In 2025, TNO’s high-performance deformable mirror technology was selected for a secondary mirror upgrade at Keck Observatory. This adoption highlights the growing market preference for innovative deformable mirrors that offer enhanced performance, reliability, and integration with existing AO infrastructure. The upgrade supports higher-order adaptive optics correction, allowing observatories to conduct more complex experiments and maintain competitiveness in high-resolution imaging, which in turn drives further development and commercialization of advanced AO components

- In 2025, the Subaru Telescope completed a major AO upgrade under the AO3k project, incorporating a 3,224-actuator deformable mirror and enhanced wavefront sensors. This improvement provides extreme-adaptive optics capability, significantly boosting correction speed and image quality even under turbulent atmospheric conditions. The upgrade expands the telescope’s capacity for high-resolution imaging across both visible and infrared wavelengths, reinforcing its scientific relevance and stimulating global interest in adopting similar high-performance laser guide star adaptive optics systems in other observatories and research facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.