Global Laser Headlight Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

25.34 Billion

2025

2033

USD

3.10 Billion

USD

25.34 Billion

2025

2033

| 2026 –2033 | |

| USD 3.10 Billion | |

| USD 25.34 Billion | |

|

|

|

|

Laser Headlight Market Size

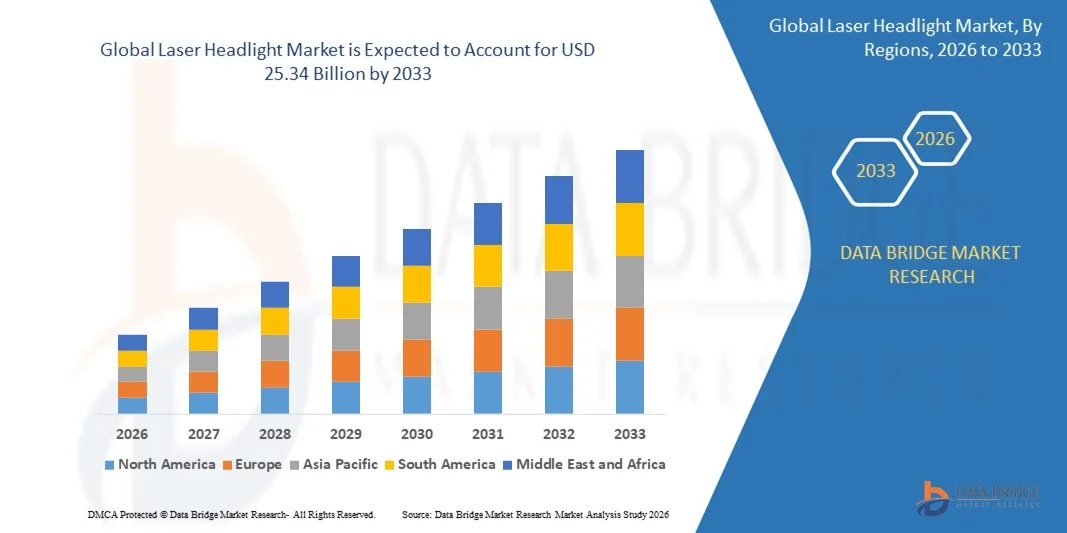

- The global laser headlight market size was valued at USD 3.10 billion in 2025 and is expected to reach USD 25.34 billion by 2033, at a CAGR of 30.00% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced automotive lighting technologies, rising demand for energy-efficient and high-performance headlights, and growing focus on vehicle safety and design

- Increasing penetration of premium and electric vehicles equipped with advanced driver assistance systems (ADAS) is driving demand for laser headlights, which offer higher luminance and longer range than traditional lighting systems

Laser Headlight Market Analysis

- The market is witnessing rapid technological advancements, including adaptive and matrix laser headlights, which enhance visibility, reduce glare, and improve driving safety

- Growing consumer preference for premium automotive features and aesthetic lighting solutions is pushing manufacturers to integrate laser headlights into both luxury and mid-range vehicles

- North America dominated the laser headlight market with the largest revenue share of 38.50% in 2025, driven by the growing adoption of premium and electric vehicles, as well as increasing demand for energy-efficient, high-performance automotive lighting systems

- Asia-Pacific region is expected to witness the highest growth rate in the global laser headlight market, driven by rapid urbanization, rising disposable incomes, strong automotive manufacturing capabilities, and accelerated adoption of advanced lighting technologies

- The 35W segment held the largest market revenue share in 2025, driven by its energy efficiency and suitability for standard passenger vehicles. Headlights in this segment are widely adopted due to their optimal balance of brightness, lower power consumption, and cost-effectiveness

Report Scope and Laser Headlight Market Segmentation

|

Attributes |

Laser Headlight Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• OSRAM (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Laser Headlight Market Trends

Rise of Advanced Laser Lighting Technology

• The growing adoption of laser headlights is transforming the automotive lighting landscape by enabling high-intensity, long-range illumination with lower energy consumption. These systems provide improved visibility during night driving and adverse weather conditions, enhancing road safety and driver confidence. In addition, laser headlights allow precise beam control, reducing glare for oncoming traffic and contributing to overall traffic safety. Their integration with adaptive lighting systems further improves driving comfort and situational awareness

• Increasing demand for luxury and premium vehicles is accelerating the deployment of laser headlights, as these lighting solutions are often positioned as advanced, high-performance features. Automotive OEMs are integrating laser technology to differentiate their models and meet consumer expectations for innovative lighting solutions. Furthermore, the aesthetic appeal of laser lighting adds to vehicle design value, attracting tech-savvy consumers who prioritize modern and futuristic car features

• The compact size, durability, and energy efficiency of laser headlights are making them attractive for both electric and conventional vehicles, enabling enhanced vehicle design flexibility. Manufacturers benefit from reduced weight and improved aerodynamics while maintaining optimal illumination. The extended lifespan of laser components compared to traditional lighting solutions also lowers maintenance costs and improves the vehicle's total cost of ownership

• For instance, in 2023, several European automotive manufacturers reported enhanced night-driving safety and customer satisfaction after implementing laser headlight systems in flagship models. The deployment contributed to better vehicle safety ratings and market competitiveness. Customer surveys also indicated increased trust in vehicle safety and preference for models featuring laser lighting, boosting brand loyalty and market share

• While laser headlights are accelerating adoption of advanced automotive lighting, their impact depends on ongoing R&D, cost reduction, and regulatory approvals. Companies must focus on miniaturization, thermal management, and mass production to fully capitalize on market growth. Continuous improvements in adaptive lighting and integration with autonomous driving systems are also expected to expand the application of laser headlights across vehicle segments

Laser Headlight Market Dynamics

Driver

Rising Demand for Energy-Efficient and High-Performance Automotive Lighting

• The increasing emphasis on energy efficiency in vehicles is driving OEMs to adopt laser headlights as a low-power, high-output lighting solution. Laser systems consume less energy than traditional LEDs and halogen lights while delivering superior illumination. This efficiency contributes to longer battery life in electric vehicles, further aligning with global sustainability and emissions reduction targets

• Consumers are increasingly aware of the safety benefits and performance advantages offered by laser headlights, such as longer visibility range, precise beam control, and reduced glare. This awareness is boosting demand across premium and mid-range vehicle segments. Growing consumer interest in advanced driving assistance systems (ADAS) also encourages the integration of laser headlights into next-generation vehicles

• Government regulations and safety standards promoting advanced automotive lighting systems are strengthening market growth. Initiatives targeting improved road safety and reduced vehicle energy consumption encourage the adoption of laser headlight technology. Supportive policies, subsidies for EVs, and incentives for high-efficiency lighting systems are further motivating OEMs to implement laser lighting in new models

• For instance, in 2022, several countries in Europe and North America introduced updated headlamp regulations supporting high-performance lighting technologies, driving automotive OEMs to integrate laser headlights into new models. These regulatory shifts have accelerated adoption rates among luxury, mid-range, and even select mass-market vehicles

• While technological advancements and regulatory support are driving the market, challenges remain in high production costs, thermal management, and consumer awareness to ensure sustained adoption. Market participants must continue investing in R&D, optimize production techniques, and educate consumers to facilitate broader acceptance of laser headlight technology

Restraint/Challenge

High Cost of Laser Headlight Systems and Complex Integration Requirements

• The high manufacturing cost of laser headlights, including lasers, optics, and cooling systems, limits adoption among budget-conscious vehicle segments. Premium vehicle models remain the primary users, restricting widespread deployment. In addition, the initial R&D investment and specialized assembly processes add to OEMs’ overall project costs, delaying adoption in mid-market vehicles

• Integration of laser headlights into vehicle design requires specialized engineering for thermal management, electronics, and optical alignment. Many OEMs face challenges in retrofitting or mass-producing these systems efficiently. Any design misalignment or heat dissipation issue can compromise performance, necessitating careful testing and quality assurance

• Market penetration is also restricted by consumer unfamiliarity and concerns regarding long-term reliability, maintenance, and repair costs. End-users often prefer traditional LED or halogen systems in mid-range vehicles. Lack of widespread awareness regarding energy efficiency and safety advantages of laser systems slows adoption among general consumers

• For instance, in 2023, several Asian automotive manufacturers reported delayed implementation of laser headlights in mainstream models due to high integration costs and technical complexity. Pilot programs highlighted challenges in mass deployment, emphasizing the need for modular, scalable solutions

• While laser technology continues to advance with improved efficiency and reduced costs, addressing affordability, integration challenges, and consumer perception remains essential to unlocking the full potential of the global laser headlight market. OEMs and component manufacturers are focusing on innovations in miniaturization, adaptive lighting integration, and cost-effective production techniques to facilitate broader adoption

Laser Headlight Market Scope

The laser headlight market is segmented on the basis of power type, technology, vehicle type, application, and sales channel

- By Power Type

On the basis of power type, the market is segmented into 35W, 40W, and 60W. The 35W segment held the largest market revenue share in 2025, driven by its energy efficiency and suitability for standard passenger vehicles. Headlights in this segment are widely adopted due to their optimal balance of brightness, lower power consumption, and cost-effectiveness.

The 60W segment is expected to witness the fastest growth rate from 2026 to 2033, driven by demand for high-intensity illumination in premium vehicles and commercial applications. Higher power headlights offer longer-range visibility and enhanced safety features, attracting OEMs and consumers seeking advanced lighting solutions.

- By Technology

On the basis of technology, the market is segmented into intelligent and conventional laser headlights. The conventional segment dominated in 2025, due to its widespread adoption in existing vehicle models and relatively lower integration costs.

The intelligent segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by demand for adaptive, AI-enabled lighting systems that provide dynamic beam control, energy efficiency, and integration with advanced driver-assistance systems (ADAS). Intelligent laser headlights enhance night-driving safety and contribute to smarter, connected vehicle ecosystems.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into commercial vehicles and passenger vehicles. The passenger vehicle segment held the largest share in 2025, driven by increasing demand for premium and mid-range vehicles equipped with advanced lighting solutions.

The commercial vehicle segment is expected to witness the fastest growth from 2026 to 2033, as long-haul trucks, buses, and fleet vehicles adopt laser headlights for better visibility, fuel efficiency, and safety during extended night operations.

- By Application

On the basis of application, the market is segmented into tail lights and head lights. The headlight segment dominated in 2025, due to its critical role in vehicle safety and visibility enhancement during night driving and adverse weather conditions.

The tail light segment is expected to witness the fastest growth rate from 2026 to 2033, driven by automotive OEMs incorporating laser technology to enhance vehicle aesthetics, signaling efficiency, and compliance with updated safety regulations across global markets.

- By Sales Channel

On the basis of sales channel, the market is segmented into aftermarket and original equipment manufacturer (OEM). The OEM segment held the largest revenue share in 2025, driven by partnerships with vehicle manufacturers and the integration of laser headlights in new vehicle models at the factory level.

The aftermarket segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by retrofitting demand for advanced lighting solutions in existing vehicles, increasing awareness of safety benefits, and growing consumer preference for energy-efficient, high-performance headlight upgrades.

Laser Headlight Market Regional Analysis

- North America dominated the laser headlight market with the largest revenue share of 38.50% in 2025, driven by the growing adoption of premium and electric vehicles, as well as increasing demand for energy-efficient, high-performance automotive lighting systems

- Consumers in the region highly value advanced illumination features, improved night-driving visibility, and reduced energy consumption offered by laser headlight technology.

- This widespread adoption is further supported by stringent vehicle safety regulations, high disposable incomes, and a preference for technologically advanced vehicles, establishing laser headlights as a preferred choice for both passenger and commercial vehicles

U.S. Laser Headlight Market Insight

The U.S. laser headlight market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of electric and luxury vehicles. Automakers are increasingly integrating laser headlights to enhance vehicle safety, performance, and aesthetic appeal. Growing consumer demand for longer-range and precise illumination, coupled with the popularity of connected and autonomous vehicles, further drives market expansion. Moreover, supportive government regulations and incentives for energy-efficient lighting solutions contribute to broader adoption across vehicle segments.

Europe Laser Headlight Market Insight

The Europe laser headlight market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent automotive lighting regulations and high adoption of electric and premium vehicles. Increasing urbanization, vehicle safety mandates, and consumer preference for advanced lighting solutions are encouraging the integration of laser headlights. The region is experiencing notable growth in passenger cars, SUVs, and commercial vehicle segments, with manufacturers focusing on innovative and energy-efficient lighting technologies.

U.K. Laser Headlight Market Insight

The U.K. laser headlight market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising trend of luxury and electric vehicles along with regulatory support for advanced automotive lighting. Concerns regarding road safety, fuel efficiency, and vehicle performance are driving consumers and OEMs to adopt laser lighting solutions. The U.K.’s growing automotive R&D infrastructure and strong retail and automotive manufacturing networks are expected to continue stimulating market growth.

Germany Laser Headlight Market Insight

The Germany laser headlight market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing awareness of vehicle safety and energy efficiency. Germany’s emphasis on automotive innovation, premium car production, and environmental sustainability promotes the adoption of laser headlights across passenger and commercial vehicles. Integration with adaptive lighting systems and smart vehicle technologies is also becoming more common, aligning with local consumer expectations and regulatory standards.

Asia-Pacific Laser Headlight Market Insight

The Asia-Pacific laser headlight market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing vehicle production, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing automotive industry, supportive government policies for electric vehicles, and demand for high-performance lighting solutions are accelerating laser headlight adoption. In addition, APAC is emerging as a manufacturing hub for automotive lighting components, making laser headlights more accessible and affordable for a broader consumer base.

Japan Laser Headlight Market Insight

The Japan laser headlight market is expected to witness the fastest growth rate from 2026 to 2033, due to the country’s high-tech automotive culture, increasing production of electric vehicles, and demand for enhanced road safety. Japanese consumers and OEMs prioritize long-range illumination, precision beam control, and energy-efficient lighting solutions. The integration of laser headlights with smart vehicle systems, autonomous driving technologies, and advanced driver-assistance systems (ADAS) is also driving market growth.

China Laser HeadlightS Market Insight

The China laser headlight market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle-class population, rapid urbanization, and high vehicle sales. China is one of the largest automotive markets globally, and the adoption of laser headlights is increasing across passenger, commercial, and electric vehicles. Government initiatives promoting EV adoption, smart city development, and strong domestic manufacturing capabilities are key factors propelling the growth of laser headlight technology in China.

Laser Headlight Market Share

The Laser Headlight industry is primarily led by well-established companies, including:

• OSRAM (Germany)

• HELLA GmbH & Co. KGaA (Germany)

• KOITO MANUFACTURING CO., LTD. (Japan)

• Koninklijke Philips N.V. (Netherlands)

• Marelli Holdings Co., Ltd. (Japan)

• Bosch Limited (Germany)

• KYOCERA SLD Laser, Inc. (Japan)

• VALEO (France)

• ZKW (Austria)

• Palomar Technologies (United States)

• LASER COMPONENTS (Germany)

• Europa Science Ltd. (United Kingdom)

• GUANGZHOU LEDO ELECTRONIC CO., LIMITED (China)

• Zhongshan Liangjian Lighting Technology Co., Ltd. (China)

• Ningbo Beilun Bonsen Auto Electron Co., Ltd. (China)

• Mercuris Services OU (Estonia)

• Xingtai Xudong Technology Co., Ltd. (China)

Latest Developments in Global Laser Headlight Market

- In 2025, Philips is set to launch its X-tremeVision laser headlights designed to deliver powerful illumination while operating at only 30W for enhanced energy efficiency. The compact and sleek structure enables seamless integration into existing vehicle headlamp units, offering an easy upgrade path for automakers. This advancement strengthens Philips’ position in high-performance automotive lighting and is expected to contribute to improved visibility, reduced power consumption, and greater innovation within the global laser headlight market

- In January 2024, KYOCERA SLD Laser introduced its laser-based automotive headlight modules and FiberLight Grille Assemblies featuring high-brightness white and infrared dual illumination. The ultra-compact design, with a lens height below 12.7 mm, offers greater flexibility for vehicle designers and enhances night vision and sensing capabilities. This development supports improved safety, advanced illumination performance, and broader adoption of cutting-edge laser lighting solutions in the global market

- In February 2024, FORVIA HELLA unveiled a new sustainable headlamp concept incorporating recyclable materials, bio-based plastics, and an SSL48 light module for lower CO₂ emissions and lighter weight. The concept emphasizes enhanced repairability and extended lifespan, aligning with growing automotive sustainability goals. This breakthrough positions HELLA as a leader in eco-friendly lighting innovations and accelerates the shift toward greener technologies in the global laser headlight market

- In December 2024, ams OSRAM showcased its EVIYOS HD 25 micro-LED chip array featuring 25,600 individually controllable LEDs for high-resolution dynamic forward lighting. The system enables advanced Adaptive Driving Beam capabilities, delivering precise illumination while reducing glare for other drivers. This innovation significantly improves safety, enhances nighttime visibility, and strengthens the company’s role in driving intelligent headlight advancements across the global laser headlight market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.