Global Laser Interferometer Market

Market Size in USD Million

CAGR :

%

USD

306.00 Million

USD

519.89 Million

2024

2032

USD

306.00 Million

USD

519.89 Million

2024

2032

| 2025 –2032 | |

| USD 306.00 Million | |

| USD 519.89 Million | |

|

|

|

|

Laser Interferometer Market Size

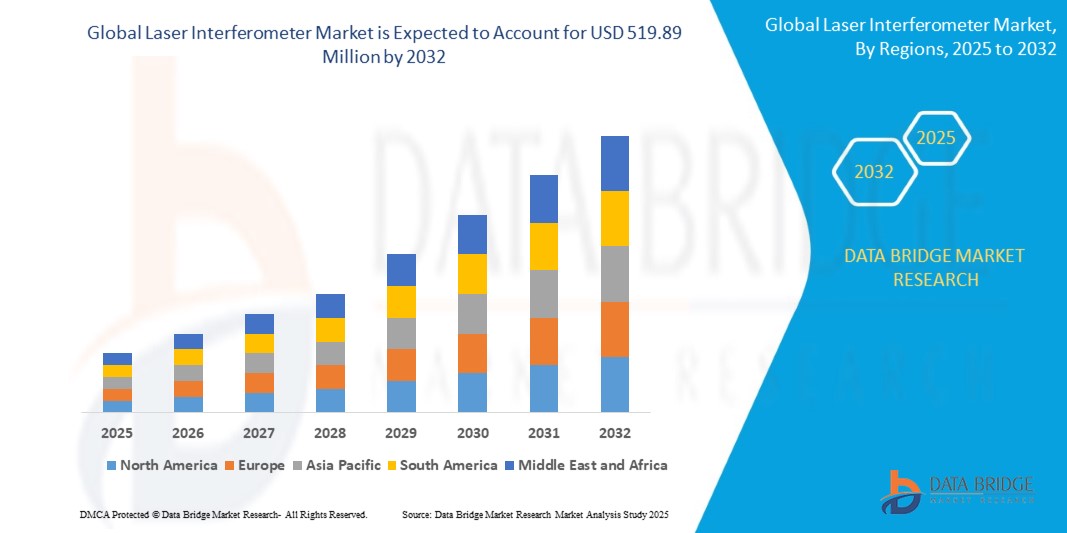

- The global laser interferometer market size was valued at USD 306 million in 2024 and is expected to reach USD 519.89 million by 2032, at a CAGR of 6.85% during the forecast period

- The market growth is largely fueled by the increasing demand for high-precision measurement and inspection solutions across industries such as semiconductor manufacturing, aerospace, automotive, and electronics, driving the adoption of laser interferometers for accuracy and efficiency

- Furthermore, ongoing technological advancements in laser interferometry, including enhanced resolution, stability, and integration with automated systems, are enabling broader applications in research, quality control, and industrial metrology, thereby significantly boosting the industry's growth

Laser Interferometer Market Analysis

- Laser interferometers are precision instruments that measure displacement, distance, and surface irregularities by using the interference of laser light waves. These systems are critical in applications requiring nanometer-level accuracy, such as semiconductor wafer inspection, optical component testing, and aerospace alignment

- The escalating demand for laser interferometers is primarily fueled by the need for ultra-precise measurements, increasing industrial automation, and the growing focus on quality control and process optimization across high-tech manufacturing sectors

- North America dominated the laser interferometer market with a share of 40.5% in 2024, due to strong adoption in aerospace, defense, semiconductor, and precision manufacturing sectors

- Asia-Pacific is expected to be the fastest growing region in the laser interferometer market during the forecast period due to increasing industrial automation, rising R&D expenditure, and adoption of high-precision measurement technologies in countries such as China, Japan, and India

- Michelson segment dominated the market with a market share of 36.1% in 2024, due to its established reputation for high-precision measurements and versatility across multiple applications, including distance, displacement, and refractive index analysis. Researchers and industrial users often prefer Michelson interferometers for their robust design, ease of alignment, and adaptability to different experimental setups. The wide availability of commercial Michelson systems and their integration with digital data acquisition systems further strengthen their dominant market position

Report Scope and Laser Interferometer Market Segmentation

|

Attributes |

Laser Interferometer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Laser Interferometer Market Trends

Rising Automation and IoT Integration

- The laser interferometer market is increasingly influenced by rising automation and IoT integration, driving demand for interoperable, real-time measurement systems that enhance precision and enable remote monitoring across manufacturing and R&D environments

- For instance, Renishaw has developed laser interferometer systems equipped with IoT connectivity that facilitate seamless data transmission to factory automation networks, supporting predictive maintenance and process optimization in smart factories

- The integration of laser interferometry with robotics and automated inspection systems improves accuracy and reduces manual errors in critical manufacturing processes such as semiconductor fabrication and precision machining

- Growing use of cloud computing and big data analytics alongside IoT-enabled interferometers is enabling advanced measurement data processing, trend analysis, and quality control across distributed production sites

- Enhanced firmware and software platforms are providing improved user interfaces, automation protocols, and programmable measurement sequences that improve efficiency and throughput

- Expansion of industrial IoT standards and protocols is driving interoperable interferometry solutions that align with evolving factory digitization and Industry 4.0 initiatives

Laser Interferometer Market Dynamics

Driver

Rising Demand for Precise Measurements

- The increasing need for highly accurate measurements in precision manufacturing, scientific research, and quality assurance is a key market driver for laser interferometers, which offer unmatched resolution and repeatability

- For instance, Keysight Technologies supplies laser interferometer systems used extensively in semiconductor wafer inspection and optical component testing, sectors where nanometer-level accuracy is critical to product quality

- Advances in aerospace and automotive industries demanding tight tolerances and stringent quality control further support adoption, where even minor measurement deviations can impact safety and performance

- Medical device manufacturing also increasingly relies on laser interferometers to ensure precision in components and assemblies, supporting regulatory compliance and product efficacy

- The expansion of electronics packaging and microelectronics manufacturing worldwide additionally fuels the need for precise dimensional and displacement measurement solutions

Restraint/Challenge

High Cost of Advanced Laser Interferometry Systems

- The considerable capital investment required to procure and maintain advanced laser interferometer setups acts as a significant barrier for many potential users, especially SMEs and research institutions with budget constraints

- For instance, universities and small laboratories often find the high price of Renishaw or Zygo interferometer systems prohibitive, limiting access to state-of-the-art measurement technologies and constraining research capabilities

- The cost includes not just hardware, but also dedicated software licenses, skilled operation, calibration services, and often customized installation, intensifying total ownership expenses

- In addition, continuous upgrades to keep pace with technological advances require recurrent capital, posing financial challenges for long-term maintenance of competitive measurement capabilities

- Limited availability of low-cost alternatives with sufficient precision restricts broader market penetration in emerging economies and cost-sensitive sectors. High initial procurement and operational costs delay return on investment and slow decision-making for capital expenditure on advanced metrology equipment

Laser Interferometer Market Scope

The market is segmented on the basis of technique, type, and component.

• By Technique

On the basis of technique, the laser interferometer market is segmented into homodyne and heterodyne. The homodyne segment dominated the largest market revenue share in 2024, driven by its simpler design, cost-effectiveness, and ability to deliver high-precision measurements in various industrial and research applications. Homodyne interferometers are often preferred for applications requiring straightforward displacement and distance measurement, and their compatibility with existing optical setups enhances adoption across laboratories and manufacturing units. Their reliability, minimal calibration requirements, and integration with modern data acquisition systems further reinforce their strong market presence.

The heterodyne segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-accuracy velocity and phase measurements in advanced scientific and industrial applications. Heterodyne interferometers provide superior noise rejection, longer measurement ranges, and the capability to measure dynamic systems, making them suitable for aerospace, precision engineering, and semiconductor industries. Growing adoption in cutting-edge metrology solutions and research facilities is expected to accelerate the uptake of heterodyne-based systems globally.

• By Type

On the basis of type, the laser interferometer market is segmented into Michelson, Fabry-Pérot, Fizeau, Mach-Zehnder, Sagnac, and Twyman-Green. The Michelson segment held the largest market revenue share of 36.1% in 2024 due to its established reputation for high-precision measurements and versatility across multiple applications, including distance, displacement, and refractive index analysis. Researchers and industrial users often prefer Michelson interferometers for their robust design, ease of alignment, and adaptability to different experimental setups. The wide availability of commercial Michelson systems and their integration with digital data acquisition systems further strengthen their dominant market position.

The Fabry-Pérot segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its ability to achieve extremely high spectral resolution and sensitivity for wavelength and frequency measurements. Fabry-Pérot interferometers are increasingly adopted in optical communications, laser characterization, and spectroscopy applications due to their superior precision and dynamic measurement capabilities. Rising investment in photonics and optical research infrastructure globally is contributing to the rapid expansion of Fabry-Pérot-based systems.

• By Component

On the basis of component, the laser interferometer market is segmented into laser source, photodetector, optical elements, control system, and software. The laser source segment dominated the largest market revenue share in 2024, supported by its critical role in determining interferometer performance, accuracy, and stability. High-quality laser sources ensure reliable measurements, long-term system stability, and compatibility with advanced optical setups, making them essential for both industrial and research applications. Continuous innovations in laser technology, such as tunable and fiber-coupled lasers, further drive the preference for laser source components.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for advanced data processing, real-time analysis, and integration with automated metrology systems. Software solutions enable enhanced visualization, error correction, and seamless control over interferometer operations, supporting applications in precision engineering, aerospace, and semiconductor industries. Increasing adoption of AI and machine learning algorithms in optical measurements is also expected to boost demand for sophisticated interferometer software solutions.

• By Application

On the basis of application, the laser interferometer market is segmented into Surface Topology, Engineering, Applied Science, Biomedical, and Semiconductor Detection. The Semiconductor Detection segment accounted for the largest market share in 2024, driven by the growing demand for precision measurement and inspection tools in semiconductor wafer fabrication and lithography processes. Increasing complexity in chip design and the miniaturization of electronic components have made interferometric solutions essential in maintaining accuracy and yield in production. The integration of interferometers in advanced semiconductor metrology tools further supports this segment’s dominance.

The Biomedical segment is projected to record the fastest CAGR from 2025 to 2032, fueled by the rising adoption of non-invasive diagnostic imaging, optical coherence tomography, and precision measurement in biomedical research. The growing investment in healthcare infrastructure and medical device innovation is driving demand for interferometer-based systems that enable highly accurate measurements at micro and nano scales. Increasing applications in life sciences, including cellular imaging and tissue analysis, are also contributing to strong growth prospects in this segment.

• By End-use Industry

On the basis of end-use industry, the laser interferometer market is categorized into Automotive, Aerospace & Defense, Industrial, Healthcare, Electronics & Semiconductor, and IT & Telecommunications. The Electronics & Semiconductor segment dominated the market in 2024, supported by rising demand for high-precision inspection and calibration systems to meet advanced production requirements. Interferometer systems are increasingly integrated into semiconductor fabrication facilities to ensure consistent quality control and defect detection, reinforcing this segment’s leadership.

The Aerospace & Defense segment is expected to exhibit the fastest CAGR during the forecast period due to increasing reliance on interferometry for material testing, optical component evaluation, and high-precision alignment in aerospace applications. Growing defense investments in advanced navigation, imaging, and targeting systems further strengthen the adoption of interferometers. This trend reflects the critical role of interferometry in ensuring accuracy and performance in mission-critical aerospace and defense technologies.

Laser Interferometer Market Regional Analysis

- North America dominated the laser interferometer market with the largest revenue share of 40.5% in 2024, driven by strong adoption in aerospace, defense, semiconductor, and precision manufacturing sectors

- The region’s emphasis on high-accuracy measurement, research and development activities, and advanced industrial automation is supporting widespread adoption of laser interferometers

- Availability of advanced infrastructure, skilled workforce, and well-established industrial and research facilities further boosts the market

U.S. Laser Interferometer Market Insight

The U.S. laser interferometer market captured the largest revenue share in North America in 2024, fueled by significant investments in R&D and the adoption of precision measurement technologies across aerospace, defense, and semiconductor industries. Growing demand for high-accuracy systems in metrology, quality control, and optical research, coupled with government initiatives promoting advanced manufacturing, is accelerating market growth. In addition, the presence of leading global interferometer manufacturers and increasing integration with automated systems are propelling the U.S. market.

Europe Laser Interferometer Market Insight

The Europe laser interferometer market is projected to grow at a substantial CAGR during the forecast period, driven by the region’s focus on precision manufacturing, aerospace, and automotive R&D. Rising adoption in laboratories, research institutions, and high-tech industries is fostering market expansion. European countries are increasingly emphasizing smart manufacturing, optical metrology, and photonics research, creating steady demand for laser interferometer systems.

U.K. Laser Interferometer Market Insight

The U.K. laser interferometer market is expected to grow at a noteworthy CAGR during the forecast period, fueled by investments in scientific research, precision engineering, and aerospace sectors. The demand for highly accurate measurement solutions and government-backed initiatives supporting advanced manufacturing and R&D are contributing to market growth. Integration of interferometers with automated inspection and metrology systems is also becoming prevalent across industrial and academic settings.

Germany Laser Interferometer Market Insight

The Germany laser interferometer market is anticipated to expand at a considerable CAGR during the forecast period, driven by the country’s strong emphasis on industrial automation, precision engineering, and photonics research. High demand from automotive, semiconductor, and aerospace sectors, along with a focus on quality and innovation, is boosting adoption. The integration of interferometer systems with smart manufacturing and digital monitoring solutions further strengthens market growth.

Asia-Pacific Laser Interferometer Market Insight

The Asia-Pacific laser interferometer market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing industrial automation, rising R&D expenditure, and adoption of high-precision measurement technologies in countries such as China, Japan, and India. Growing investments in semiconductor manufacturing, aerospace, and defense sectors, coupled with government initiatives supporting scientific research and technology development, are accelerating market penetration.

Japan Laser Interferometer Market Insight

The Japan laser interferometer market is expanding due to the country’s advanced technological infrastructure, high-precision manufacturing, and strong focus on research and development. Adoption in semiconductor fabrication, optics, and industrial automation, along with integration with smart manufacturing systems, is fueling growth. The aging workforce and the need for highly automated, precise measurement solutions in both industrial and research environments further support market demand.

China Laser Interferometer Market Insight

The China laser interferometer market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid industrialization, growth in semiconductor and precision manufacturing, and rising R&D investments. Government initiatives promoting smart manufacturing and high-tech research facilities, coupled with increasing availability of cost-effective interferometer systems, are driving widespread adoption. China’s expanding industrial base and strong domestic manufacturing capabilities further bolster market growth.

Laser Interferometer Market Share

The laser interferometer industry is primarily led by well-established companies, including:

- Renishaw (U.K.)

- Keyence Corporation (Japan)

- Thorlabs (U.S.)

- Hexagon Manufacturing Intelligence (U.S.)

- Aerotech (U.S.)

- Coherent, Inc. (U.S.)

- MSA Safety (U.S.)

- Zygo Corporation (U.S.)

- KLA Corporation (U.S.)

- Newport Corporation (U.S.)

- Bruker Corporation (U.S.)

- Polytec GmbH (Germany)

- The LIGO Scientific Collaboration (U.S.)

- 4D Technology Corporation (U.S.)

- AMETEK (U.S.)

Latest Developments in Global Laser Interferometer Market

- In 2025, MetriX secured $25 million in a Series B funding round to advance its AI-powered laser interferometer platforms. This strategic investment is expected to accelerate the development of intelligent, high-precision measurement solutions, positioning MetriX to capture a growing share of the market for automated and data-driven interferometry systems. The funding also enables expansion of its engineering capabilities, fostering innovation and supporting the broader adoption of AI-integrated laser interferometers across industrial and research applications

- In 2024, Bruker launched a high-speed laser interferometer tailored for optical surface metrology. This product introduction enhances the company’s portfolio for rapid and precise measurement of optical surfaces, catering to the increasing demand from advanced manufacturing, semiconductor, and research sectors. By offering faster data acquisition and improved accuracy, Bruker strengthens its market position in high-performance interferometry solutions and meets the growing need for efficient, high-throughput inspection technologies

- In 2024, Thorlabs unveiled a compact laser interferometer designed specifically for semiconductor wafer inspection. This development addresses the rising demand for miniaturized, high-precision metrology tools in semiconductor fabrication. By enabling accurate, space-efficient inspection of wafers, Thorlabs enhances its competitiveness in the semiconductor market, supporting manufacturers in achieving higher yields and tighter process control

- In 2024, Renishaw inaugurated a new manufacturing facility in Ireland to expand production of its metrology and laser interferometer product lines. This expansion is expected to increase global supply capacity, helping meet the rising demand for precision measurement solutions. The facility strengthens Renishaw’s ability to serve industrial and research customers, supports faster product delivery, and reinforces its leadership in the laser interferometer market

- In 2024, Renishaw launched the XK10 alignment laser system for machine tool calibration. This system enhances the accuracy and efficiency of machine tool setup, addressing the growing need for precision in advanced manufacturing environments. By improving alignment and calibration processes, the XK10 supports higher productivity and quality, reinforcing Renishaw’s position as a key provider of precision laser interferometer solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Laser Interferometer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laser Interferometer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laser Interferometer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.