Global Laser Marking In Electronics Industry Market

Market Size in USD Billion

CAGR :

%

USD

3.36 Billion

USD

5.35 Billion

2024

2032

USD

3.36 Billion

USD

5.35 Billion

2024

2032

| 2025 –2032 | |

| USD 3.36 Billion | |

| USD 5.35 Billion | |

|

|

|

|

What is the Global Laser Marking in Electronics Industry Market Size and Growth Rate?

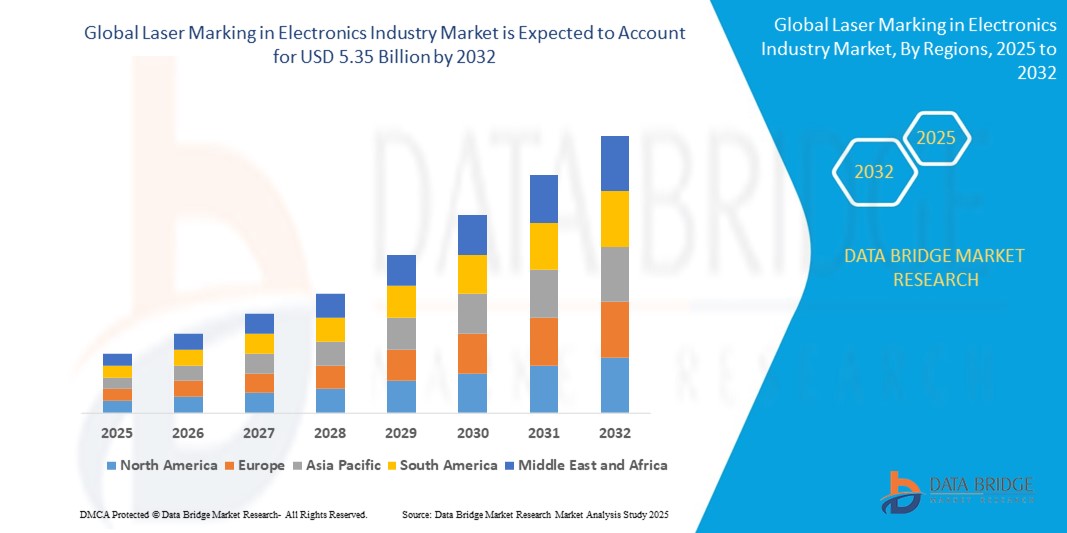

- The global laser marking in electronics industry market size was valued at USD 3.36 billion in 2024 and is expected to reach USD 5.35 billion by 2032, at a CAGR of 6.00% during the forecast period

- The laser marking market within the electronics industry is experiencing significant growth due to the increasing demand for precision, efficiency, and traceability in electronic components manufacturing

- As electronic devices become more complex and miniaturized, the need for high-quality, durable, and accurate markings on components such as circuit boards, semiconductors, and metal housings has intensified

What are the Major Takeaways of Laser Marking in Electronics Industry Market?

- Laser marking technology offers unmatched precision, ensuring that markings such as serial numbers, barcodes, and logos are consistently legible and resistant to wear and environmental factors

- The expansion of consumer electronics, automotive electronics, and telecommunications sectors is driving this market's growth. Innovations in technology, such as advancements in laser systems and the development of new laser types, are further propelling the market forward

- Asia-Pacific dominated the laser marking in electronics industry market with the largest revenue share of 41.5% in 2024, driven by the region’s robust electronics manufacturing base and widespread industrial automation. High-volume production in sectors such as semiconductors, mobile devices, and consumer electronics is fueling strong demand for precise and permanent marking technologies

- North America is expected to grow at the fastest CAGR of 12.8% from 2025 to 2032, driven by increased automation in electronics manufacturing and heightened focus on traceability and anti-counterfeiting. Rising demand for high-speed, high-resolution marking in defense electronics, aerospace components, and electric vehicles is boosting market growth

- The Fiber Laser segment dominated the market with the largest revenue share of 47.2% in 2024, attributed to its high beam quality, precision, and compatibility with a wide range of electronic components and materials

Report Scope and Laser Marking in Electronics Industry Market Segmentation

|

Attributes |

Laser Marking in Electronics Industry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Laser Marking in Electronics Industry Market?

“Smart Automation and AI-Enhanced Marking Precision”

- A prominent trend in the laser marking in electronics industry market is the integration of AI, machine vision, and automation technologies to enable higher marking accuracy, reduced human intervention, and adaptive processing across electronic manufacturing lines

- Advanced systems now use AI-driven algorithms to automatically identify components, adjust marking parameters based on material type, and detect marking errors in real time, ensuring precision without manual calibration

- Leading players such as Trumpf and Keyence are embedding vision-guided marking systems that combine real-time scanning and correction to mark even the smallest microelectronic parts flawlessly

- Integration with Industry 4.0 platforms allows laser markers to communicate with other smart factory systems, providing seamless data flow, process traceability, and remote diagnostics

- In high-speed production environments, AI enhances productivity by enabling predictive maintenance, reducing downtime, and optimizing marking operations with minimal waste

- This shift is transforming laser marking from a standalone process to an intelligent, interconnected manufacturing function, vital to the electronics industry’s pursuit of precision and scalability

What are the Key Drivers of Laser Marking in Electronics Industry Market?

- Increasing miniaturization of electronic components and the need for permanent, high-resolution markings such as barcodes, QR codes, and identification numbers are driving the adoption of laser marking systems

- In April 2024, Coherent Corp. introduced a fiber laser system designed specifically for micro-marking on PCBs and semiconductor packages, offering enhanced depth control and marking speed

- Rising demand for product traceability and anti-counterfeit solutions in the consumer electronics and semiconductor sectors is further accelerating market growth

- Unlike traditional marking methods, laser marking offers non-contact, heat-resistant, and chemical-free processing, making it ideal for sensitive circuit boards and microchips

- As automation and smart manufacturing trends expand, laser markers with integrated control software and real-time monitoring features are becoming crucial in modern production lines

- The move toward eco-friendly manufacturing is also pushing the adoption of laser marking, which eliminates the need for inks, solvents, or consumables, supporting sustainable operations.

Which Factor is challenging the Growth of the Laser Marking in Electronics Industry Market?

- A significant barrier to growth is the high capital cost of advanced laser marking systems, particularly femtosecond and ultrafast laser types needed for intricate electronic components

- While larger corporations can afford automation-focused upgrades, SMEs often face budget constraints in adopting sophisticated laser technology and the supporting infrastructure

- In addition, complex integration with existing manufacturing lines, especially in legacy plants, can be resource-intensive and require technical expertise

- Regulatory compliance for laser systems, including safety certifications and operational training, can also slow deployment, especially in regions with stringent standards

- Data protection concerns arise when laser marking systems are connected to cloud-based traceability platforms, especially in electronics manufacturing involving confidential designs or IP-sensitive components

- To address these challenges, vendors must develop scalable solutions, provide modular upgrade options, and invest in user training and cybersecurity enhancements to ensure market continuity and trust.

How is the Laser Marking in Electronics Industry Market Segmented?

The market is segmented on the basis of type and offering.

• By Laser Type

On the basis of laser type, the laser marking in electronics industry market is segmented into Fiber Laser, Diode Laser, Solid State Laser, and CO₂ Laser. The Fiber Laser segment dominated the market with the largest revenue share of 47.2% in 2024, attributed to its high beam quality, precision, and compatibility with a wide range of electronic components and materials. Fiber lasers are especially favored for their speed, low maintenance, and efficiency in marking metal surfaces and fine circuitry.

The Diode Laser segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its compact size, energy efficiency, and suitability for marking plastics and delicate substrates in consumer electronics. Their affordability and adaptability make them increasingly popular among small to medium-scale manufacturers.

• By Offering

On the basis of offering, the laser marking in electronics industry market is segmented into Hardware, Software, and Services. The Hardware segment held the largest market revenue share of 63.8% in 2024, owing to the high cost of laser marking equipment and rising demand for technologically advanced systems across electronics manufacturing facilities. Continued innovations in laser hardware design, precision optics, and integration capabilities are supporting this dominance.

The Services segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the growing need for maintenance, calibration, training, and post-installation support. As more end users seek complete marking solutions, service offerings are becoming a key differentiator for manufacturers and vendors.

Which Region Holds the Largest Share of the Laser Marking in Electronics Industry Maret?

- Asia-Pacific dominated the laser marking in electronics Industry market with the largest revenue share of 41.5% in 2024, driven by the region’s robust electronics manufacturing base and widespread industrial automation. High-volume production in sectors such as semiconductors, mobile devices, and consumer electronics is fueling strong demand for precise and permanent marking technologies

- Countries such as China, Japan, South Korea, and India are investing heavily in smart factories, quality assurance, and product traceability, accelerating laser marking adoption across the electronics value chain

- Favorable government policies, rising foreign direct investment, and increasing local production of advanced marking systems are further solidifying Asia-Pacific’s market leadership

China Laser Marking in Electronics Industry Market Insight

China led the Asia-Pacific market in 2024, supported by rapid industrialization, the expansion of consumer electronics manufacturing, and state-backed initiatives such as “Made in China 2025.” Laser marking is increasingly used in PCB tracking, component coding, and product identification. Local manufacturers are offering competitively priced solutions, enhancing affordability and adoption across domestic industries.

Japan Laser Marking in Electronics Industry Market Insight

Japan’s market is witnessing strong demand driven by its precision-focused electronics sector, especially in automotive semiconductors and medical devices. The country’s push for miniaturization and compliance with product labeling regulations is fostering the integration of compact laser systems. Strategic R&D and automation are also expanding use in robotic assembly lines.

India Laser Marking in Electronics Industry Market Insight

India is emerging as a high-potential market, supported by the growth of its consumer electronics and smartphone assembly sectors. The “Make in India” campaign and rising exports are encouraging local manufacturers to adopt marking solutions for product authenticity and compliance. Expanding contract manufacturing and EMS (Electronics Manufacturing Services) are further fueling demand.

Which Region is the Fastest-Growing in the Laser Marking in Electronics Industry Market?

North America is expected to grow at the fastest CAGR of 12.8% from 2025 to 2032, driven by increased automation in electronics manufacturing and heightened focus on traceability and anti-counterfeiting. Rising demand for high-speed, high-resolution marking in defense electronics, aerospace components, and electric vehicles is boosting market growth. The presence of global players such as IPG Photonics, Telesis Technologies, and Keyence, along with a strong regulatory focus on serialization and labeling compliance, is accelerating regional adoption.

U.S. Laser Marking in Electronics Industry Market Insight

The U.S. leads North America’s market, driven by advanced manufacturing capabilities and regulatory enforcement in sectors such as medical devices, semiconductors, and automotive electronics. Technological advancements in laser source design and software integration are enabling more efficient and flexible marking solutions tailored to industry-specific needs.

Canada Laser Marking in Electronics Industry Market Insight

Canada’s market is gaining momentum through its growing electronics and aerospace sectors. Demand for durable, tamper-proof markings on mission-critical components is rising. Government-backed innovation programs and increased focus on Industry 4.0 are encouraging adoption of automated laser marking technologies across SMEs.

Which are the Top Companies in Laser Marking in Electronics Industry Market?

The laser marking in electronics industry industry is primarily led by well-established companies, including:

- Coherent, Inc. (U.S.)

- Han’s Laser Technology Industry Group Co., Ltd (China)

- TRUMPF (Germany)

- Gravotech Marking (France)

- JENOPTIK AG (Germany)

- TYKMA Electrox, Inc. (U.S.)

- Epilog Laser (U.S.)

- MECCO (U.S.)

- LaserStar Technologies Corporation (U.S.)

- IPG Photonics Corporation (U.S.)

- Panasonic Electric Works Europe AG (Germany)

- Videojet Technologies, Inc. (U.S.)

- Telesis Technologies, Inc. (U.S.)

What are the Recent Developments in Global Laser Marking in Electronics Industry Market?

- In April 2023, InnovMetric introduced PolyWorks 2023, an upgraded version of its Universal 3D Metrology Platform, which now features a comprehensive digital ecosystem that integrates product design, process design, validation, and production stages. This launch further solidifies PolyWorks as a leading solution for precision and quality management throughout the entire manufacturing lifecycle

- In September 2022, Epilog Laser launched the Fusion Maker laser system, engineered for diverse industrial applications and built to withstand rigorous, high-volume usage. This system supports laser marking, engraving, and cutting across a wide range of materials, reinforcing Epilog's commitment to delivering robust and versatile laser solutions

- In August 2022, Foba made headlines at the International Manufacturing Technology Show (IMTS) in Chicago by unveiling the M1000 and M2000 laser marking systems from its M-series, along with the Foba Titus marking head. These innovations are tailored for seamless line integration, especially in compact environments, showcasing Foba’s continued leadership in advanced laser marking technology

- In July 2022, Hitachi Industrial Equipment Systems announced the acquisition of Telesis Technologies Inc., a prominent U.S.-based manufacturer of laser marking equipment. This acquisition enhances Hitachi’s product offerings and expands its footprint in the marking equipment market, particularly across North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Laser Marking In Electronics Industry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laser Marking In Electronics Industry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laser Marking In Electronics Industry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.