Global Laser Printer Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

5.51 Billion

2024

2032

USD

2.44 Billion

USD

5.51 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 5.51 Billion | |

|

|

|

|

Laser Printer Market Size

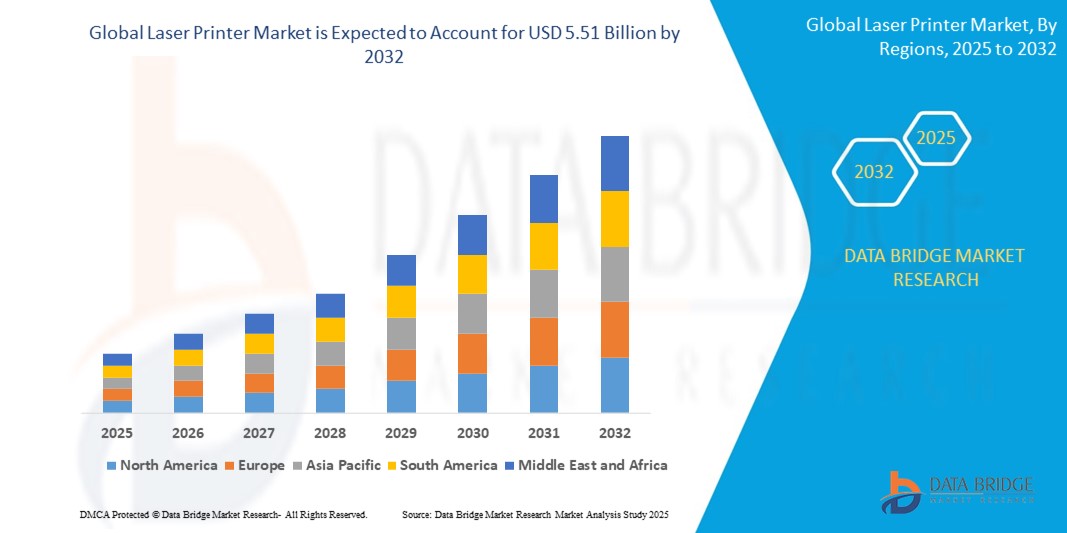

- The global laser printer market size was valued at USD 2.44 billion in 2024 and is expected to reach USD 5.51 billion by 2032, at a CAGR of 10.70 % during the forecast period

- This growth is driven by factors such as the increasing demand for high-quality printing solutions in offices and businesses, advancements in laser printing technology for improved speed and efficiency, and the rising adoption of laser printers in home offices and small businesses

Laser Printer Market Analysis

- The laser printer market is experiencing significant growth due to continuous advancements in printing technology, making devices faster and more efficient. These improvements are leading to increased adoption across various sectors such as education, healthcare, and government

- The market is also witnessing a shift towards multifunctional laser printers, combining printing, scanning, and copying in a single device. This trend is attracting both small businesses and large enterprises looking for space-saving and cost-effective solutions

- North America is expected to dominate the Laser Printers market due to the high demand for advanced printing solutions across various industries such as healthcare, education, and corporate sectors, along with the presence of major players such as HP and Xerox

- Asia-Pacific is expected to be the fastest growing region in the Laser Printer market during the forecast period due to the increasing adoption of printing technology in emerging markets, expanding small and medium-sized enterprises, and a rise in e-commerce activities

- Multi-Function segment is expected to dominate the market with a market share of 55.5 % due to its ability to offer versatile printing, scanning, copying, and faxing functionalities, making it a popular choice for businesses and offices

Report Scope and Laser Printer Market Segmentation

|

Attributes |

Laser Printer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Laser Printer Market Trends

“Rising Adoption of Multifunctional Laser Printers Across Industries”

- Businesses are increasingly adopting multifunctional laser printers to streamline operations and reduce costs by consolidating multiple functions into one device

- For instance, HP and Canon have expanded their multifunctional printer lines, catering to growing demand in small and medium enterprises

- These devices often come equipped with advanced features such as duplex printing, automatic document feeders, and cloud connectivity, enhancing productivity and workflow efficiency

- The demand for multifunctional printers is driven by the need for space-saving solutions in modern office environments, allowing businesses to optimize their workspace

- Manufacturers are responding to this trend by developing multifunctional laser printers that offer customizable features and configurations to meet the specific needs of various industries

Laser Printer Market Dynamics

Driver

“Evolving Business and Technology Landscapes”

- Continuous innovation in wireless and cloud printing is boosting the adoption of laser printers across offices and remote work setups

- For instance, HP's latest LaserJet models support mobile printing and seamless cloud integration for hybrid workplaces

- The demand for high-speed and high-volume printing in sectors such as logistics and education are driving consistent usage of laser printers

- For instance, Companies such as Canon have optimized their laser printers for bulk printing with enhanced energy efficiency

- Businesses prefer laser printers due to their lower long-term operational costs compared to inkjet alternatives

- Sustainability concerns are encouraging the shift toward energy-efficient and recyclable laser printing technologies

Opportunity

“Growing Adoption of Managed Print Services”

- Growing adoption of managed print services is opening new avenues for laser printer manufacturers to offer subscription-based solutions

- For instance, Xerox and Ricoh have expanded their managed print service offerings to cater to small and medium businesses

- The rise of e-commerce has created demand for reliable, high-speed printing of shipping labels and order documents

- Emerging markets with expanding educational and business sectors are fueling demand for affordable laser printing solutions

- For instance, HP and Epson have recently launched region-specific models targeting affordability and functionality for developing economies

- Demand for compact, energy-efficient devices is rising among startups and coworking spaces seeking space-saving solutions

- For instance, Canon introduced a new line of space-efficient laser printers aimed at meeting the needs of small office environments

Restraint/Challenge

“High Initial Purchase Cost of Laser Printers”

- High initial purchase cost of laser printers can deter small businesses and individual users from investing despite long-term benefits

- Increasing digitalization and the shift to paperless environments are reducing the need for physical document printing

- Competition from low-cost inkjet and ink tank printers offering comparable performance in smaller workloads is affecting market share

- For instance, Epson’s EcoTank series has gained popularity among home users and small offices due to its affordability

- Environmental concerns regarding toner cartridge disposal and energy consumption continue to challenge market sustainability

Laser Printer Market Scope

The market is segmented on the basis type, laser type, connectivity, output, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Laser Type |

|

|

By Connectivity |

|

|

By Output |

|

|

By End Use |

|

In 2025, the multi-function printers is projected to dominate the market with a largest share in type segment

The multi-function segment is expected to dominate the Laser Printer market with the largest share of 55.5% in 2025 due to its increasing demand for multifunctionality, space efficiency, and cost-effectiveness in office environments is propelling the adoption of MFPs.

In 2025, the wired is expected to account for the largest share during the forecast period in connectivity market

The wired segment is expected to dominate the market with the largest market share of 58.5% due to its reliable and stable connection, offering higher speeds and reduced latency compared to wireless options. This makes it the preferred choice for businesses and high-volume printing environments that require consistent and uninterrupted performance.

Laser Printer Market Regional Analysis

“North America Holds the Largest Share in the Laser Printer Market”

- North America holds the largest market share, supported by the region's advanced technological infrastructure and high demand for commercial printing solutions

- The region benefits from a mature market with a well-established customer base, including businesses in sectors such as education, healthcare, and government

- The adoption of advanced laser printing technologies, including multi-functional printers, is driving growth in the market

- Increased demand for high-quality, efficient, and cost-effective printing solutions continues to bolster North America's dominance in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Laser Printer Market”

- Asia-Pacific is experiencing rapid industrialization, which is increasing demand for reliable and high-speed printing solutions

- The growing e-commerce and retail sectors in countries such as China and India are creating new opportunities for laser printer manufacturers

- The rise in small and medium-sized businesses in emerging economies is boosting the need for affordable and compact printing solutions

- Increasing disposable income and demand for high-performance printers in both commercial and personal sectors are contributing to the market's expansion

Laser Printer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Brother Industries Ltd. (Japan)

- Xerox Corporation (U.S.)

- HP Inc. (U.S.)

- Samsung Electronics Co. Ltd. (South Korea)

- OKI Electric (Japan)

- Canon Inc. (Japan)

- Ricoh Company Ltd. (Japan)

- Epson (Japan)

- South Yuesen (China)

- Lexmark International Inc. (U.S.)

- Dell Inc. (U.S.)

- Seiko Epson Corporation (Japan)

Latest Developments in Global Laser Printer Market

- In March 2024, HP Inc. introduced the Colour LaserJet Pro 3000 series, a new line of digital colour printers designed for small and medium-sized businesses. These printers feature HP’s TerraJet toner technology, offering sharper colours and faster print speeds. The series includes models with Wi-Fi 2 connectivity, automatic reconnection, and pro-level security, all within a compact design. This launch aims to provide SMBs with high-quality, energy-efficient printing solutions that support hybrid work environments. The introduction of this product is expected to impact the market by offering affordable, reliable, and efficient printing options to growing businesses

- In June 2023, Canon launched its next-generation A4 laser printers, including the imageCLASS LBP243dw, LBP246dw, and LBP248x. These models feature print speeds of up to 65 pages per minute, automatic duplex printing, and enhanced security with TLS 1.3 encryption. The printers also support cloud solutions such as Google Drive and OneDrive, making them suitable for small businesses and large offices. This launch aims to provide efficient, secure, and cost-effective printing solutions for modern work environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Laser Printer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laser Printer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laser Printer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.