Global Lattice And Telescopic Boom Market

Market Size in USD Billion

CAGR :

%

USD

1.95 Billion

USD

2.40 Billion

2024

2032

USD

1.95 Billion

USD

2.40 Billion

2024

2032

| 2025 –2032 | |

| USD 1.95 Billion | |

| USD 2.40 Billion | |

|

|

|

|

What is the Global Lattice and Telescopic Boom Market Size and Growth Rate?

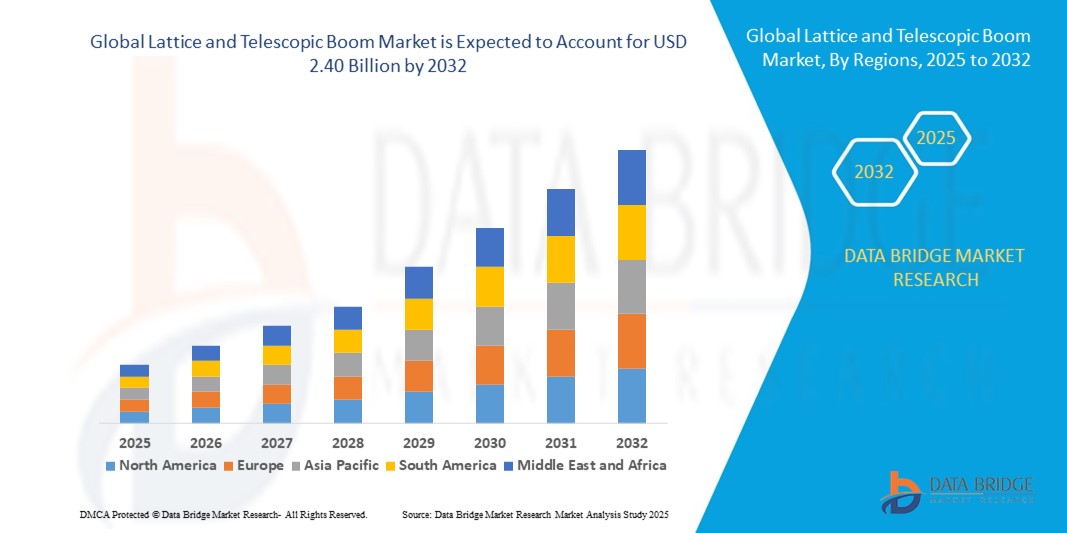

- The global lattice and telescopic boom market size was valued at USD 1.95 billion in 2024 and is expected to reach USD 2.40 billion by 2032, at a CAGR of 2.60% during the forecast period

- The largest type of mobile crane in the construction industry is the lattice boom crawler crane, also known as a crawler crane. Because of their size, it is frequently necessary to disassemble them, transport them in pieces, and then reassemble them at the site

- The lattice boom crawler crane has long been regarded as the preferred crane for energy projects and large-scale construction projects. It is a heavy-duty machine that can move a lot of weight. Due to their enormous size, crawler cranes are frequently utilized for extended periods of time

What are the Major Takeaways of Lattice and Telescopic Boom Market?

- The rise in urbanization globally, especially in Asia-Pacific has fueled the demand for various infrastructure projects, such as, roads, bridges, railways, tunnels, and others

- In addition, construction activities have also witnessed an up-trend. The medium income countries, such as India, China, Vietnam, South Korea, and others have fueled the demand for low- and high-rise buildings. Such factors are anticipated to drive the demand for mobile cranes during the forecast period. Furthermore, the manufacturing sector is witnessing a rise in Europe and Asia-Pacific regions

- Mobile cranes are extensively used for heavy load handling in the manufacturing sector, especially, for the manufacturing of heavy objects such as, cars, industrial machineries, steel, and others

- North America dominated the lattice and telescopic boom market with the largest revenue share of 36.15% in 2024, driven by rising construction activities, infrastructure modernization, and demand for heavy lifting equipment in commercial and industrial sectors

- Asia-Pacific lattice and telescopic boom market is set to grow at the fastest CAGR of 5.21% during 2025–2032, fuelled by rapid urbanization, infrastructure development, and government-backed construction projects in countries such as China, Japan, and India

- The lattice & telescopic boom segment dominated the market with a revenue share of 41.6% in 2024, owing to its versatility in construction, infrastructure, and industrial lifting operations

Report Scope and Lattice and Telescopic Boom Market Segmentation

|

Attributes |

Lattice and Telescopic Boom Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Lattice and Telescopic Boom Market?

Rising Demand for Hybrid Boom Configurations

- A major trend shaping the global lattice and telescopic boom market is the growing demand for hybrid boom cranes that combine the high lifting capacity of lattice booms with the flexibility and reach of telescopic booms. This trend is being driven by the need for versatile equipment capable of handling diverse applications in construction, oil & gas, and infrastructure projects

- For instance, Liebherr has developed advanced hybrid cranes that allow operators to switch between lattice and telescopic booms, maximizing efficiency on complex projects. Similarly, Manitowoc has introduced lattice-telescopic systems for heavy lifting in confined urban construction sites

- The adoption of hybrid boom solutions enables operators to save on costs, improve safety, and reduce downtime since the same crane can be deployed across multiple tasks. This versatility is increasingly valued by contractors facing diverse and dynamic work environments

- Moreover, rental companies are investing heavily in hybrid boom cranes to expand their fleet offerings, responding to rising customer demand for multi-functional lifting solutions

- This shift towards hybrid boom integration is expected to redefine performance benchmarks, enabling the industry to cater to projects that demand both power and adaptability

What are the Key Drivers of Lattice and Telescopic Boom Market?

- The increasing number of large-scale infrastructure projects worldwide, such as highways, bridges, and energy plants, is fueling demand for lattice and telescopic booms due to their high lifting capacity and efficiency

- For instance, in March 2024, Zoomlion Heavy Industry Science & Technology Co., Ltd. launched next-generation lattice boom crawler cranes to support infrastructure expansion in Asia-Pacific markets. Such developments highlight the growing reliance on these booms for mega projects

- The oil & gas and wind energy sectors also heavily depend on lattice and telescopic booms for installation and maintenance activities, where heavy lifting precision is critical

- In addition, the rising trend of rental and leasing services is boosting adoption, as contractors increasingly prefer renting versatile cranes rather than purchasing them outright. This allows access to advanced equipment at lower upfront costs

- The demand for efficient and adaptable lifting solutions is further accelerated by stricter project timelines, growing urbanization, and the push toward smart city development

Which Factor is Challenging the Growth of the Lattice and Telescopic Boom Market?

- One of the primary challenges facing the market is the high operational and maintenance costs associated with lattice and telescopic boom cranes. These machines require skilled operators, regular inspections, and significant upkeep, making them expensive to own and operate

- For instance, in heavy construction projects, contractors often report high fuel consumption and costly replacement parts as barriers to large-scale adoption, particularly in developing economies

- Another challenge is the space limitation in urban construction sites, where large lattice booms may not be feasible due to restricted maneuverability, pushing demand towards smaller, mobile solutions

- Moreover, fluctuations in raw material prices, particularly steel, directly impact the cost of manufacturing these cranes, making them less affordable for smaller firms

- While rental services help ease the cost burden, the capital-intensive nature of these machines continues to hinder broader market penetration. Manufacturers are thus focusing on innovations such as lightweight materials and modular boom designs to overcome these barriers

How is the Lattice and Telescopic Boom Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Mobile Cranes

On the basis of mobile cranes, the lattice and telescopic boom market is segmented into lattice & telescopic boom, crawler, rough terrain, all-terrain, and truck loader. The lattice & telescopic boom segment dominated the market with a revenue share of 41.6% in 2024, owing to its versatility in construction, infrastructure, and industrial lifting operations. These cranes are widely preferred for their high lifting capacity, ease of mobility, and adaptability across various terrains. Demand is further supported by large-scale infrastructure projects in emerging economies, where quick setup and efficient load handling are crucial.

The crawler crane segment is anticipated to record the fastest growth from 2025 to 2032, driven by its stability and suitability for heavy-duty lifting in energy and mining projects. Rising global investments in renewable energy installations, particularly wind farms, are also boosting crawler crane adoption, making it a key driver for future market expansion.

- By Fixed Cranes

The fixed cranes segment is categorized into industrial, tower, and ship-to-shore cranes. Among these, the tower crane segment held the largest market share of 38.9% in 2024, primarily due to its indispensable role in high-rise construction and urban infrastructure development. Tower cranes are preferred for their ability to lift heavy loads at significant heights, which is essential for skyscrapers, residential complexes, and commercial real estate projects.

Ship-to-shore cranes are expected to grow at the fastest CAGR from 2025 to 2032, fueled by the global expansion of seaborne trade and modernization of port infrastructure. As countries enhance their maritime logistics capabilities, demand for advanced and automated ship-to-shore cranes is accelerating. Industrial cranes, though smaller in scale, continue to support manufacturing, automotive, and warehouse operations, adding stability to the segment. Overall, fixed cranes remain a cornerstone for both construction and logistics, ensuring long-term demand.

- By Operation

Based on operation, the market is segmented into hydraulic and electric cranes. The hydraulic segment accounted for the dominant market share of 55.7% in 2024, driven by its widespread application across construction, oil & gas, and mining industries. Hydraulic cranes are valued for their robust lifting power, adaptability, and reliability in heavy-duty operations, making them a preferred choice for contractors and project managers worldwide.

The electric crane segment is projected to witness the fastest growth between 2025 and 2032, supported by the global transition toward sustainability and green construction practices. Electric cranes offer lower emissions, reduced operating costs, and compliance with strict environmental regulations, especially in Europe and North America. Increasing integration of smart technologies, automation, and energy-efficient systems is further accelerating electric crane adoption. As industries prioritize decarbonization, electric cranes are expected to transform the operational landscape and steadily capture more market share.

Which Region Holds the Largest Share of the Lattice and Telescopic Boom Market?

- North America dominated the lattice and telescopic boom market with the largest revenue share of 36.15% in 2024, driven by rising construction activities, infrastructure modernization, and demand for heavy lifting equipment in commercial and industrial sectors

- The region benefits from advanced technologies, strong investments in oil & gas, and the growing need for efficient lifting solutions in large-scale projects

- High equipment replacement rates, coupled with the presence of key manufacturers, further strengthen North America’s position as the leading market hub

U.S. Lattice and Telescopic Boom Market Insight

The U.S. captured the largest revenue share in 2024 within North America, supported by large-scale construction projects, industrial expansion, and strong adoption of advanced lifting machinery. The oil & gas industry’s reliance on lattice and telescopic booms, along with investments in infrastructure renewal, are fueling demand. Furthermore, government-backed projects and a preference for automation and digital monitoring systems in heavy equipment operations continue to expand market penetration.

Europe Lattice and Telescopic Boom Market Insight

Europe is projected to register steady growth during the forecast period, driven by stringent safety standards, infrastructure upgrades, and the adoption of energy-efficient equipment. Growing investments in renewable energy projects, including wind farms, are significantly boosting demand for heavy-duty cranes. In addition, European manufacturers emphasize sustainability, leading to advanced lattice and telescopic booms designed for durability and compliance with eco-regulations.

U.K. Lattice and Telescopic Boom Market Insight

The U.K. market is expected to expand at a notable CAGR, propelled by large-scale infrastructure projects, urban redevelopment initiatives, and increased demand from logistics and warehousing sectors. Rising investments in transport and housing projects, alongside a strong focus on safety and efficiency, are key growth contributors. In addition, technological advancements such as telematics-enabled booms are gaining traction in the U.K. market.

Germany Lattice and Telescopic Boom Market Insight

Germany is anticipated to grow at a significant CAGR, supported by its well-developed industrial base, focus on automation, and growing renewable energy investments. The country’s emphasis on advanced engineering and eco-friendly solutions is accelerating adoption across construction, wind energy, and manufacturing sectors. Integration of digital technologies, including IoT-enabled equipment monitoring, is further enhancing market growth in Germany.

Which Region is the Fastest Growing in the Lattice and Telescopic Boom Market?

Asia-Pacific Lattice and Telescopic Boom market is set to grow at the fastest CAGR of 5.21% during 2025–2032, fueled by rapid urbanization, infrastructure development, and government-backed construction projects in countries such as China, Japan, and India. Rising investments in smart cities, industrial facilities, and renewable energy projects are boosting demand for heavy lifting solutions. In addition, the presence of leading manufacturers in APAC ensures cost-effective equipment availability, expanding adoption across emerging economies.

Japan Lattice and Telescopic Boom Market Insight

Japan’s market is gaining momentum with increasing infrastructure upgrades, renewable energy expansion, and demand for precision-engineered lifting equipment. The country’s strong technological base supports the integration of advanced automation and safety systems in cranes. In addition, rising urban development projects and the growing need for compact, efficient lifting solutions are propelling adoption in both residential and commercial sectors.

China Lattice and Telescopic Boom Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, backed by extensive construction activities, industrial growth, and large-scale infrastructure projects. The country’s push towards smart cities, renewable energy installations, and modernization of transport infrastructure is accelerating demand. Domestic manufacturers play a crucial role in offering competitively priced equipment, making China a global hub for lattice and telescopic boom adoption.

Which are the Top Companies in Lattice and Telescopic Boom Market?

The lattice and telescopic boom industry is primarily led by well-established companies, including:

- Konecranes (Finland)

- Liebherr (Switzerland)

- Tadano Ltd. (Japan)

- The Manitowoc Company, Inc. (U.S.)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- Terex Corporation (U.S.)

- Ingersoll Rand (U.S.)

- PALFINGER AG (Austria)

- Columbus McKinnon Corporation (U.S.)

- KOBE STEEL, LTD. (Japan)

- XCMG Group (China)

- Sumitomo Heavy Industries, Ltd. (Japan)

- ABUS Kransysteme GmbH (Germany)

- Mammoet (Netherlands)

- KATO WORKS CO., LTD. (Japan)

What are the Recent Developments in Global Lattice and Telescopic Boom Market?

- In January 2024, Kobelco Construction Machinery launched the TKE750G, a new telescopic boom crawler crane designed for the European market with a 75-metric-ton lifting capacity. Built on the proven G series lattice boom crawler crane technology, it ensures durability, reliability, and user-friendly operation, reinforcing Kobelco’s commitment to advanced lifting solutions

- In September 2023, Elliott Equipment introduced the D47 digger derrick, developed for distribution applications with a 26,000-lb lifting capacity and a 17- to 26-ft digging radius. Featuring 46 kV insulation, independent boom operation, a transferable pole guide, and a rear-mounted hydraulic tool circuit, the model enhances operational versatility, strengthening Elliott’s position in material handling and lifting equipment

- In August 2023, Amphenol RF added embedded antennas to its product portfolio, offering surface-mounted chip antennas with exceptional electrical performance up to 8.5 GHz. This addition expands Amphenol’s solutions for high-frequency applications, further solidifying its role in advanced connectivity technologies

- In September 2022, PCTEL, Inc. unveiled the MultiFin programmable antenna, targeting fleet management, public safety, and intelligent transportation systems. The product enhances communication reliability and flexibility, showcasing PCTEL’s dedication to innovation in wireless solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lattice And Telescopic Boom Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lattice And Telescopic Boom Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lattice And Telescopic Boom Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.