Global Law Enforcement Software Market

Market Size in USD Billion

CAGR :

%

USD

19.50 Billion

USD

46.15 Billion

2025

2033

USD

19.50 Billion

USD

46.15 Billion

2025

2033

| 2026 –2033 | |

| USD 19.50 Billion | |

| USD 46.15 Billion | |

|

|

|

|

Law Enforcement Software Market Size

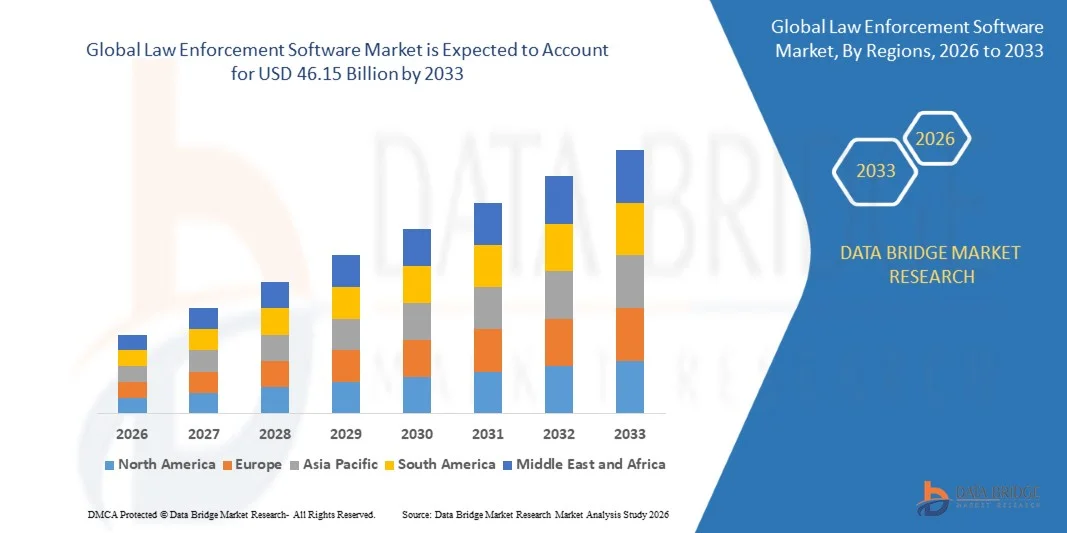

- The Law Enforcement Software Market size was valued at USD 19.50 billion in 2025 and is projected to reach USD 46.15 billion by 2033, growing at a CAGR of 11.37% during the forecast period.

- The market expansion is primarily driven by the increasing adoption of advanced digital policing technologies, such as AI-powered analytics, cloud-based solutions, and real-time data sharing, which enhance efficiency and transparency in law enforcement operations.

- Moreover, the rising need for crime prediction, case management, and public safety solutions is encouraging agencies to invest in integrated software platforms. These advancements are transforming law enforcement processes globally, thereby propelling substantial market growth.

Law Enforcement Software Market Analysis

- Law enforcement software, encompassing digital tools for data management, crime analysis, evidence tracking, and case management, has become an essential component of modern policing infrastructure in both developed and developing regions due to its ability to enhance operational efficiency, transparency, and inter-agency collaboration.

- The accelerating demand for law enforcement software is primarily driven by the increasing prevalence of cybercrime, rising public safety concerns, and the growing emphasis on digital transformation within policing and security agencies worldwide.

- North America dominated the Law Enforcement Software Market with the largest revenue share of 34.9% in 2025, attributed to the region’s advanced law enforcement infrastructure, strong government support for public safety technologies, and widespread adoption of cloud-based and AI-driven solutions, particularly in the U.S., where smart policing initiatives and predictive analytics tools are being rapidly deployed.

- Asia-Pacific is expected to be the fastest-growing region in the Law Enforcement Software Market during the forecast period, fueled by rapid urbanization, increasing government investments in smart city and surveillance projects, and the modernization of police forces across emerging economies.

- The cloud-based segment dominated the market with the largest revenue share of 61.4% in 2025, driven by the growing preference for scalable, cost-effective, and easily deployable solutions that enable real-time data access and inter-agency collaboration.

Report Scope and Law Enforcement Software Market Segmentation

|

Attributes |

Law Enforcement Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Law Enforcement Software Market Trends

“Enhanced Efficiency Through AI and Predictive Analytics Integration”

- A significant and accelerating trend in the Law Enforcement Software Market is the deepening integration of artificial intelligence (AI), machine learning (ML), and predictive analytics technologies into policing and public safety operations. This fusion is revolutionizing how agencies analyze data, predict crime patterns, and optimize resource allocation.

- For instance, AI-driven platforms such as Palantir Gotham and Motorola Solutions’ CommandCentral enable real-time data processing and predictive modeling to identify high-risk areas and potential threats, empowering officers to take proactive measures. Similarly, Axon’s AI-powered video analytics enhances evidence review by automatically detecting and tagging critical events within hours of footage.

- AI integration in law enforcement software facilitates features such as automated report generation, crime trend forecasting, and behavioral analysis, significantly improving decision-making accuracy. For example, IBM i2 Analyst’s Notebook uses AI to visualize complex networks and detect hidden relationships across large data sets, while NICE Investigate employs machine learning to correlate digital evidence efficiently.

- The incorporation of AI and data-driven insights into cloud-based platforms allows for centralized access and real-time collaboration between departments and agencies. Through a unified interface, users can manage case files, video evidence, and communication records, enabling faster investigations and coordinated responses.

- This growing shift toward intelligent, automated, and interconnected law enforcement systems is transforming operational models and raising expectations for data transparency and efficiency. Consequently, companies such as Hexagon AB and CentralSquare Technologies are investing in advanced AI and analytics tools to enhance situational awareness and predictive policing capabilities.

- The demand for AI-integrated law enforcement software is rapidly increasing across both developed and emerging regions, as governments and agencies prioritize smarter, data-driven approaches to ensure public safety and optimize law enforcement outcomes.

Law Enforcement Software Market Dynamics

Driver

“Growing Need Due to Rising Crime Rates and Digital Transformation in Policing”

- The increasing prevalence of criminal activities, cyber threats, and public safety concerns, coupled with the rapid digital transformation of policing operations, is a major driver for the growing demand for law enforcement software worldwide.

- For instance, in March 2025, Motorola Solutions, Inc. introduced an upgraded CommandCentral platform integrating AI-based analytics and real-time crime mapping to enhance situational awareness and operational efficiency. Such advancements and strategic initiatives by leading companies are expected to accelerate market growth in the forecast period.

- As law enforcement agencies face growing challenges in managing vast amounts of digital evidence, case data, and surveillance information, software solutions offering real-time data processing, automated reporting, and predictive insights are becoming essential tools for modern policing.

- Furthermore, the increasing adoption of smart city projects and IoT-enabled surveillance systems is making law enforcement software an integral component of digital public safety infrastructures, enabling interoperability among agencies and faster emergency response coordination.

- The convenience of cloud-based deployment, mobile accessibility for field officers, and seamless integration with analytics and body-worn camera systems are key factors propelling the adoption of law enforcement software across both developed and emerging regions. Additionally, the growing trend toward data-driven decision-making and evidence-based policing further contributes to market expansion.

Restraint/Challenge

“Concerns Regarding Data Privacy, Cybersecurity, and High Implementation Costs”

- Concerns surrounding data privacy breaches, cybersecurity vulnerabilities, and unauthorized access to sensitive law enforcement data pose significant challenges to the widespread adoption of law enforcement software. As these systems rely heavily on interconnected digital networks, they are susceptible to hacking attempts, ransomware attacks, and information leaks.

- For Instance, several high-profile incidents involving data breaches in police databases and digital evidence systems have raised global concerns about data integrity and the security of sensitive criminal records.

- Addressing these issues through robust encryption, multi-layer authentication, secure cloud infrastructure, and regular security audits is critical for building institutional trust. Leading companies such as IBM Corporation and Axon Enterprise, Inc. emphasize their end-to-end encryption protocols and compliance with global cybersecurity standards to reassure clients of their data protection measures.

- Moreover, the high initial cost of deployment, especially for smaller law enforcement agencies or developing nations, remains a barrier to adoption. Expenses related to software integration, officer training, and system upgrades can limit accessibility for budget-constrained organizations.

- Although advancements in cloud-based subscription models and modular deployment options are making solutions more cost-effective, financial constraints and security concerns continue to impede full-scale implementation. Overcoming these challenges through enhanced cybersecurity frameworks, affordable pricing models, and international data governance standards will be crucial for the sustained growth of the Law Enforcement Software Market.

Law Enforcement Software Market Scope

The market is segmented on the basis of Deployment, application, and end user.

• By Deployment

On the basis of deployment, the Law Enforcement Software Market is segmented into cloud-based and on-premise solutions. The cloud-based segment dominated the market with the largest revenue share of 61.4% in 2025, driven by the growing preference for scalable, cost-effective, and easily deployable solutions that enable real-time data access and inter-agency collaboration. Cloud deployment supports seamless integration with AI-driven analytics, video evidence management, and mobile accessibility, making it increasingly popular among law enforcement agencies seeking digital transformation.

the on-premise segment is expected to witness the fastest CAGR from 2026 to 2033, as agencies with strict data confidentiality and regulatory requirements continue to invest in secure, in-house systems. The flexibility of hybrid deployment models combining on-premise control with cloud efficiency is also expected to gain traction, addressing both data security and operational efficiency needs across global policing institutions.

• By Application

On the basis of application, the Law Enforcement Software Market is segmented into case management, incident mapping, dispatch management, and evidence management. The case management segment held the largest market revenue share of 38.9% in 2025, driven by the growing need for centralized systems to manage case records, automate workflows, and streamline investigations. These systems improve efficiency by integrating digital evidence, documentation, and reporting tools.

On the other hand, the evidence management segment is projected to record the fastest CAGR from 2026 to 2033, fueled by the rapid growth of digital evidence such as body-worn camera footage, surveillance videos, and forensic data. The increasing adoption of AI-enabled analytics and cloud storage solutions is enhancing data integrity and chain-of-custody tracking, making evidence management software a critical component in ensuring transparency, accountability, and judicial compliance within law enforcement operations.

• By End User

On the basis of end user, the Law Enforcement Software Market is segmented into government and commercial sectors. The government segment dominated the market with the largest revenue share of 72.3% in 2025, attributed to extensive investments in public safety infrastructure, national security programs, and digital policing initiatives by government bodies across North America, Europe, and Asia-Pacific. Governments are increasingly adopting AI-driven and cloud-based platforms to enhance data-driven decision-making, improve coordination among departments, and ensure community safety.

The commercial segment is anticipated to witness the fastest CAGR from 2026 to 2033, as private security firms, transport networks, and corporate establishments integrate law enforcement software for monitoring, threat analysis, and incident response. Growing collaboration between private entities and law enforcement agencies for security data sharing and crime prevention initiatives is further expected to drive adoption in this segment during the forecast period.

Law Enforcement Software Market Regional Analysis

- North America dominated the Law Enforcement Software Market with the largest revenue share of 34.9% in 2025, driven by increasing investments in digital policing, advanced analytics, and public safety modernization initiatives across the U.S. and Canada.

- Law enforcement agencies in the region are rapidly adopting AI-powered investigation tools, cloud-based data management platforms, and predictive analytics systems to improve operational efficiency and enhance decision-making capabilities.

- This strong market position is further supported by robust government funding, the presence of leading technology providers such as Motorola Solutions, Axon Enterprise, and IBM, and growing inter-agency collaboration efforts. Additionally, North America’s focus on real-time crime monitoring, digital evidence management, and integrated communication systems continues to accelerate the adoption of law enforcement software, positioning the region as a global leader in next-generation policing technologies.

U.S. Law Enforcement Software Market Insight

The U.S. law enforcement software market captured the largest revenue share of 78% in 2025 within North America, driven by rapid adoption of advanced technologies such as AI, cloud computing, and predictive analytics to improve crime prevention and investigation. Federal, state, and local agencies are increasingly prioritizing digital transformation to streamline case management, evidence tracking, and data sharing. The U.S. market is also supported by significant government funding for public safety modernization and collaborations with major technology firms such as Motorola Solutions, Axon Enterprise, and Palantir Technologies. Additionally, the growing emphasis on transparency, accountability, and real-time reporting continues to propel the adoption of integrated law enforcement platforms nationwide.

Europe Law Enforcement Software Market Insight

The Europe law enforcement software market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent data protection regulations and the growing need for secure digital policing solutions. European nations are investing in cloud-based and AI-powered platforms to enhance cross-border information sharing and improve the efficiency of policing networks. The rise in cybercrime and organized criminal activity across urban areas has further accelerated adoption. Law enforcement agencies in Europe are prioritizing evidence management and digital record systems, supported by EU-led smart city and digital security initiatives. The integration of advanced analytics tools is also fostering improved situational awareness and coordinated emergency response.

U.K. Law Enforcement Software Market Insight

The U.K. law enforcement software market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing emphasis on digital intelligence, automation, and data-driven policing. The U.K. Home Office’s ongoing initiatives to modernize police IT infrastructure and enhance inter-agency data collaboration are significant market growth catalysts. Rising concerns over cyber threats, terrorism, and digital evidence management are encouraging greater investment in cloud-based platforms and AI-enabled analysis tools. Additionally, the expansion of predictive policing systems and mobile applications for officers in the field supports the transition to more agile and responsive law enforcement operations.

Germany Law Enforcement Software Market Insight

The Germany law enforcement software market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s focus on digital transformation, cybersecurity, and data privacy compliance. German law enforcement agencies are increasingly deploying secure cloud-based and AI-integrated systems to enhance investigative accuracy and operational efficiency. The nation’s strong emphasis on privacy and compliance with GDPR standards has led to the development of advanced, secure platforms tailored for evidence and case management. Moreover, Germany’s well-established infrastructure and investments in smart city projects are further fostering the adoption of data-centric law enforcement technologies across both federal and regional levels.

Asia-Pacific Law Enforcement Software Market Insight

The Asia-Pacific law enforcement software market is poised to grow at the fastest CAGR of 23.5% during the forecast period from 2026 to 2033, driven by increasing urbanization, rapid digitization, and government-led smart city initiatives across countries such as China, Japan, and India. The growing need for efficient crime management systems, digital surveillance, and real-time incident response is propelling market growth. Furthermore, local governments are increasingly collaborating with technology providers to modernize law enforcement infrastructure. The expansion of affordable, cloud-based platforms is also making advanced policing software more accessible to developing nations in the region.

Japan Law Enforcement Software Market Insight

The Japan law enforcement software market is gaining momentum due to the country’s strong focus on technology-driven policing, automation, and data security. With Japan’s high-tech ecosystem and proactive public safety initiatives, law enforcement agencies are rapidly adopting AI-enabled case management and predictive analytics tools to improve operational efficiency. The integration of law enforcement software with national surveillance systems and digital crime databases is streamlining investigations and boosting response times. Additionally, Japan’s aging population and rising urban density are increasing the demand for efficient, technology-based security management solutions across both public and private sectors.

China Law Enforcement Software Market Insight

The China law enforcement software market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by strong government investments in digital surveillance, smart city development, and AI-based crime analytics. China’s extensive use of big data and facial recognition technologies has positioned it as a leading adopter of advanced policing software. The integration of law enforcement platforms with national security and monitoring systems enables real-time data sharing and crime prediction capabilities. Moreover, the rise of domestic software developers and the government’s focus on smart governance are further strengthening the market. The expansion of AI, cloud, and IoT-based policing solutions continues to shape the evolution of China’s digital law enforcement landscape.

Law Enforcement Software Market Share

The Law Enforcement Software industry is primarily led by well-established companies, including:

- Motorola Solutions, Inc. (U.S.)

- Axon Enterprise, Inc. (U.S.)

- Palantir Technologies Inc. (U.S.)

- Hexagon AB (Sweden)

- IBM Corporation (U.S.)

- Synergis Software, Inc. (U.S.)

- Mark43, Inc. (U.S.)

- CentralSquare Technologies (U.S.)

- Genetec Inc. (Canada)

- CivicSmart (U.S.)

- Verint Systems Inc. (U.S.)

- Niche Technology (U.K.)

- Spillman Technologies (U.S.)

- ESO Solutions, Inc. (U.S.)

- Trakopolis (Canada)

- Tiburon, Inc. (U.S.)

- OpenText Corporation (Canada)

- Fusion Software (U.S.)

- Hexagon Safety & Infrastructure (Sweden)

- Thales Group (France)

What are the Recent Developments in Law Enforcement Software Market?

- In April 2024, Motorola Solutions, Inc., a global leader in public safety and security technology, launched a next-generation CommandCentral platform in the U.S., aimed at enhancing operational visibility and data-driven decision-making for law enforcement agencies. This strategic initiative integrates AI-powered analytics, digital evidence management, and cloud-based collaboration tools to streamline investigations and improve response times. The launch underscores Motorola’s commitment to advancing digital policing through innovation and reinforces its leading position in the rapidly growing Law Enforcement Software Market.

- In March 2024, Axon Enterprise, Inc. unveiled Axon Evidence Pro, an upgraded digital evidence management system designed to improve data security and inter-agency collaboration. The new platform leverages artificial intelligence to automate video tagging and transcription, significantly reducing administrative workloads for officers. Tailored for large-scale law enforcement organizations, this solution enhances transparency and evidentiary integrity, reflecting Axon’s ongoing dedication to empowering modern policing through technology-driven solutions.

- In March 2024, IBM Corporation successfully implemented an AI-driven crime prediction and analysis platform in collaboration with the London Metropolitan Police Service. The initiative utilizes advanced data analytics and machine learning algorithms to identify high-risk areas, helping agencies allocate resources more effectively. This project highlights IBM’s commitment to applying artificial intelligence for public safety optimization and demonstrates the increasing role of predictive analytics in shaping the future of digital law enforcement.

- In February 2024, Hexagon AB, a global provider of digital reality solutions, partnered with the Singapore Police Force to deploy its HxGN OnCall Dispatch and Records platform, enabling real-time coordination, data sharing, and emergency response management. The system enhances communication between departments and improves situational awareness during large-scale incidents. This collaboration marks a significant milestone in Hexagon’s efforts to strengthen global law enforcement operations through integrated, intelligent software systems.

- In January 2024, Palantir Technologies Inc. announced the expansion of its Foundry for Law Enforcement platform across several European agencies to support data integration, intelligence analysis, and interdepartmental collaboration. The platform enables secure sharing of structured and unstructured data, empowering officers with actionable insights for faster case resolution. This initiative reaffirms Palantir’s strategic focus on leveraging advanced analytics and AI technologies to modernize policing infrastructure and support data-driven law enforcement practices worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.