Global Lead Stearate Market

Market Size in USD Million

CAGR :

%

USD

140.41 Million

USD

161.95 Million

2024

2032

USD

140.41 Million

USD

161.95 Million

2024

2032

| 2025 –2032 | |

| USD 140.41 Million | |

| USD 161.95 Million | |

|

|

|

|

What is the Global Lead Stearate Market Size and Growth Rate?

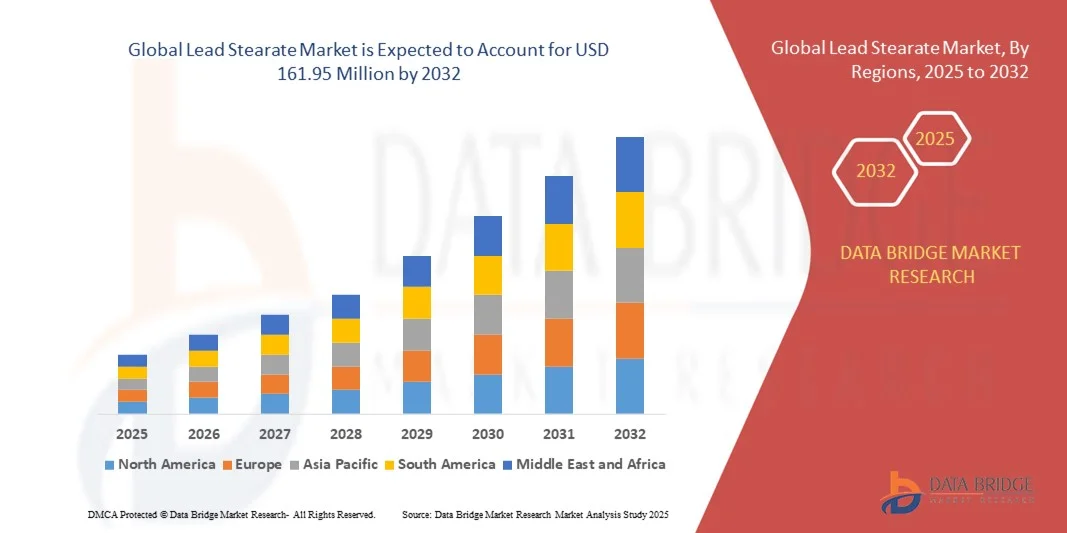

- The global lead stearate market size was valued at USD 140.41 million in 2024 and is expected to reach USD 161.95 million by 2032, at a CAGR of 1.80% during the forecast period

- The increase in demand for lead stearate from the PVC industry due to its use as stabilizers for PVC is one of the major factors driving the lead stearate market growth. PVC industry facilitates a chain of downstream industries including infrastructure, agriculture, housing, sanitation and others

- The growing use of the lead stearate in the electronic industry and the expansion of the industry due to new product innovations, advancements and development of electronic products. Lead compounds are used as predominant stabilizer in wire and cable owning to its excellent electrical insulation properties and cost-effectiveness. The product is also utilized as drier in the oil and paint sector which accelerates its demand

What are the Major Takeaways of Lead Stearate Market?

- Rapid urbanization, growth of various industries consuming lead stearate in their applications and rise in population globally also influences the lead stearate market. Furthermore, the multiple utilization of lead stearate and the emerging markets in the developing countries extend profitable opportunities to the market players

- Concerns with the toxicity of the natural compounds and the stringent government regulations and policies associated with the use of lead stearate are factors expected to obstruct the market growth

- South America dominated the lead stearate market with the largest revenue share of 42.61% in 2024, driven by increasing industrialization, expanding plastics, rubber, and chemical manufacturing sectors, and growing demand for high-performance stabilizers and lubricants

- The Asia-Pacific lead stearate market is poised to grow at the fastest CAGR of 9.35% during the forecast period of 2025 to 2032, driven by rapid industrialization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The Di-basic Lead Stearate segment dominated the market with the largest revenue share of 57% in 2024, driven by its superior thermal stability, multifunctionality, and high demand in PVC stabilization, rubber processing, and lubricant formulations

Report Scope and Lead Stearate Market Segmentation

|

Attributes |

Lead Stearate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Lead Stearate Market?

Growing Demand for Eco-Friendly and Multifunctional Applications

- A significant and accelerating trend in the global Lead Stearate market is the increasing focus on multifunctional and eco-friendly formulations. Manufacturers are innovating to produce lead stearates that serve as lubricants, stabilizers, and release agents in diverse applications, reducing reliance on multiple additives

- For instance, recent developments in PVC stabilizers and rubber processing incorporate lead stearate blends that improve thermal stability while minimizing environmental impact. Such innovations are attracting attention in construction, automotive, and polymer industries

- The push for sustainable formulations has also encouraged companies to develop lead stearates with lower heavy-metal content, meeting stricter regulatory standards while maintaining performance. These formulations enhance product versatility, enabling broader adoption across industrial and consumer applications

- The integration of multifunctional lead stearates into coatings, plastics, and rubber processing systems facilitates improved efficiency and reduced production complexity, providing manufacturers with consolidated additive solutions

- This trend toward eco-conscious, versatile, and high-performance lead stearates is reshaping industry expectations, prompting companies such as Ferro Corporation and Mingtai Chemical to innovate products that meet evolving environmental and performance standards

- The growing emphasis on multifunctional and regulatory-compliant lead stearates is driving demand across global industrial sectors, particularly in regions with stringent environmental regulations

What are the Key Drivers of Lead Stearate Market?

- The rising demand for PVC, rubber, and plastic products across automotive, construction, and packaging industries is a primary driver of lead stearate consumption. Lead stearate functions as a lubricant and stabilizer, improving processing efficiency and end-product durability

- For instance, in March 2024, Ferro Corporation launched a new high-purity lead stearate variant optimized for PVC and rubber applications, which improved thermal stability and reduced processing defects. Such strategic product developments fuel industry growth

- Increasing regulatory compliance requirements for additives in plastics and rubbers are driving manufacturers to adopt high-quality, multifunctional lead stearates to meet safety and performance standards

- The expanding industrial base in emerging economies is boosting demand for lead stearate in coatings, adhesives, and polymers, particularly in India, China, and Southeast Asia, where infrastructure development is rapid

- The growing awareness of the performance advantages of lead stearate, such as enhanced lubrication, thermal stability, and release properties, continues to propel adoption in diverse manufacturing processes

Which Factor is Challenging the Growth of the Lead Stearate Market?

- Environmental concerns and regulations regarding the use of lead-containing compounds pose a significant challenge to market expansion. Lead stearate usage is increasingly scrutinized due to potential health and ecological impacts

- For example, stringent EU and U.S. environmental regulations are compelling manufacturers to explore alternative stabilizers, creating hurdles for traditional lead stearate formulations

- Addressing these challenges requires the development of low-lead or lead-free variants without compromising functional performance. Companies such as Mingtai Chemical and Ferro Corporation are focusing on R&D to produce safer, compliant formulations

- Additionally, fluctuating raw material prices and the relatively higher cost of high-purity lead stearate compared to alternatives can hinder adoption, particularly in cost-sensitive manufacturing sectors

- Overcoming regulatory pressures, advancing environmentally friendly formulations, and educating manufacturers on the performance advantages of lead stearate will be crucial for sustained growth in the market

How is the Lead Stearate Market Segmented?

The market is segmented on the basis of type, form, application, and end users.

- By Type

On the basis of type, the lead stearate market is segmented into Di-basic Lead Stearate (51% Lead) and Normal Lead Stearate (28% Lead). The Di-basic Lead Stearate segment dominated the market with the largest revenue share of 57% in 2024, driven by its superior thermal stability, multifunctionality, and high demand in PVC stabilization, rubber processing, and lubricant formulations. Manufacturers prefer Di-basic Lead Stearate for its better performance in industrial applications, including plastics, coatings, and chemical intermediates. Its higher lead content ensures enhanced durability, improved processing efficiency, and compatibility with multiple additives, making it a preferred choice for premium industrial products.

The Normal Lead Stearate segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by cost-effectiveness and growing adoption in non-critical industrial applications where moderate stabilization and lubrication properties are sufficient. The market is witnessing a balance between high-performance and economical solutions, driving growth across both segments.

- By Form

On the basis of form, the lead stearate market is segmented into Submicron Powder and Nano Powder. The Submicron Powder segment held the largest market revenue share of 62% in 2024, owing to its wide application in plastics, rubber, lubricants, and coatings. Submicron powders offer excellent dispersion, improved thermal stability, and ease of processing, making them suitable for large-scale industrial use.

Nano Powder is anticipated to witness the fastest growth from 2025 to 2032, driven by rising demand in advanced polymer composites, high-performance coatings, and specialty lubricants. The nano form enhances reactivity, surface area, and functional efficiency, allowing manufacturers to develop lighter, more durable, and higher-performing products. The growing emphasis on miniaturized, high-efficiency industrial materials is expected to expand the adoption of nano powder Lead Stearates in emerging and technologically advanced markets.

- By Application

On the basis of application, the lead stearate market is segmented into Lubricants, Driers, Stabilizers, Mold Releasing Agents, and Accelerants. The Stabilizer segment dominated with the largest revenue share of 45% in 2024, primarily driven by extensive use in PVC, rubber, and plastic processing to enhance heat resistance, prevent degradation, and improve product durability. Stabilizers are crucial for both industrial and consumer-grade products, ensuring compliance with thermal and mechanical requirements.

Mold Releasing Agents are expected to witness the fastest CAGR from 2025 to 2032, owing to their increasing use in plastic molding, rubber components, and high-volume production settings. The convenience, efficiency, and reduction in production defects offered by mold releasing agents are encouraging manufacturers to adopt them widely, especially in automotive, electronics, and construction industries. The application-driven segmentation highlights the balance between traditional stabilization needs and emerging high-efficiency processing solutions.

- By End Users

On the basis of end users, the lead stearate market is segmented into Petroleum Industry, Ink, Oil and Paints, Electrical Industry, Plastic Industry, and Rubber Industry. The Plastic Industry segment accounted for the largest revenue share of 42% in 2024, driven by the extensive use of Lead Stearates as stabilizers, lubricants, and mold release agents in PVC, polyethylene, and other polymers. High demand in construction, automotive, and consumer goods sectors continues to support this dominance.

The Rubber Industry segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of lead stearate in high-performance rubber compounds, tire manufacturing, and industrial rubber products. The growth is reinforced by the requirement for superior heat resistance, improved processability, and long-term product durability. The end-user segmentation demonstrates how industrial demand, technological advancements, and regulatory compliance shape market growth across sectors.

Which Region Holds the Largest Share of the Lead Stearate Market?

- South America dominated the lead stearate market with the largest revenue share of 42.61% in 2024, driven by increasing industrialization, expanding plastics, rubber, and chemical manufacturing sectors, and growing demand for high-performance stabilizers and lubricants

- Industries in the region highly value the thermal stability, processability, and multifunctionality offered by Lead Stearates across PVC, rubber, lubricants, and coatings applications

- This widespread adoption is further supported by cost-effective production, robust industrial infrastructure, and a skilled workforce, establishing Lead Stearates as a critical raw material for multiple downstream industries in South America

Brazil Lead Stearate Market Insight

The Brazil lead stearate market captured the largest revenue share of 78% in 2024 within South America, fueled by strong investments in polymer processing, plastics, and chemical manufacturing. Domestic manufacturers are increasingly producing high-quality Lead Stearate, meeting growing industrial demand efficiently, while government initiatives supporting advanced manufacturing further drive market expansion.

Argentina Lead Stearate Market Insight

The Argentina lead stearate market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising demand from the plastics, rubber, and paint industries. Industrial diversification, urbanization, and adoption of modern manufacturing techniques are fostering Lead Stearate consumption across multiple sectors.

Chile Lead Stearate Market Insight

The Chile lead stearate market is expected to grow at a noteworthy CAGR, fueled by increasing industrial applications in automotive, construction, and coatings sectors. Chile’s focus on eco-conscious production and high-quality chemical inputs is further promoting the adoption of Lead Stearates.

Which Region is the Fastest Growing Region in the Lead Stearate Market?

The Asia-Pacific lead stearate market is poised to grow at the fastest CAGR of 9.35% during the forecast period of 2025 to 2032, driven by rapid industrialization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Government initiatives promoting digitalization and modernization of chemical manufacturing are accelerating adoption.

Japan Lead Stearate Market Insight

The Japan lead stearate market is gaining momentum due to advanced industrial applications, high-tech polymer usage, and growing demand from automotive and electronics sectors. The integration of Lead Stearates into modern manufacturing processes is driving growth across both industrial and commercial applications.

China Lead Stearate Market Insight

The China lead stearate market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial expansion, rising polymer production, and strong domestic manufacturing capacity. The push toward high-performance plastics, coatings, and rubber products, along with affordable locally produced Lead Stearate, is a key factor propelling the market.

Which are the Top Companies in Lead Stearate Market?

The lead stearate industry is primarily led by well-established companies, including:

- WSD Chemical Limited (China)

- American Elements (U.S.)

- Triveni Interchem Private Limited (India)

- aivitchem (India)

- Pratham Metchem LLP (India)

- POCL Enterprises Limited (India)

- Beijing Yunbang Biosciences Co. Ltd. (China)

- Shristab Pvt. Ltd. (India)

- Chongqing ChangFeng Chemical Co., Ltd. (China)

- Xiamen Hisunny Chemical Co., LTD (China)

- Qingdao Echemi Technology Co., Ltd. (China)

- Hengshui Taocheng Chemical Auxiliary Co., Ltd. (China)

- Hangzhou Oleochemicals Co., Ltd. (China)

- Hunan Shaoyang Tiantang Auxiliaries Chemical, Co., Ltd. (China)

- Asian Organo Industries (India)

- Sancheti Polymers (India)

- Zauba Technologies Pvt Ltd (India)

- Stabplastchemo (India)

- Nexus Polychem (India)

- Almstab (India)

- Vishal Pharmakem (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lead Stearate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lead Stearate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lead Stearate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.