Global Led Backlight Display Driver Ics Market

Market Size in USD Billion

CAGR :

%

USD

2.48 Billion

USD

3.19 Billion

2024

2032

USD

2.48 Billion

USD

3.19 Billion

2024

2032

| 2025 –2032 | |

| USD 2.48 Billion | |

| USD 3.19 Billion | |

|

|

|

|

LED Backlight Display Driver ICS Market Size

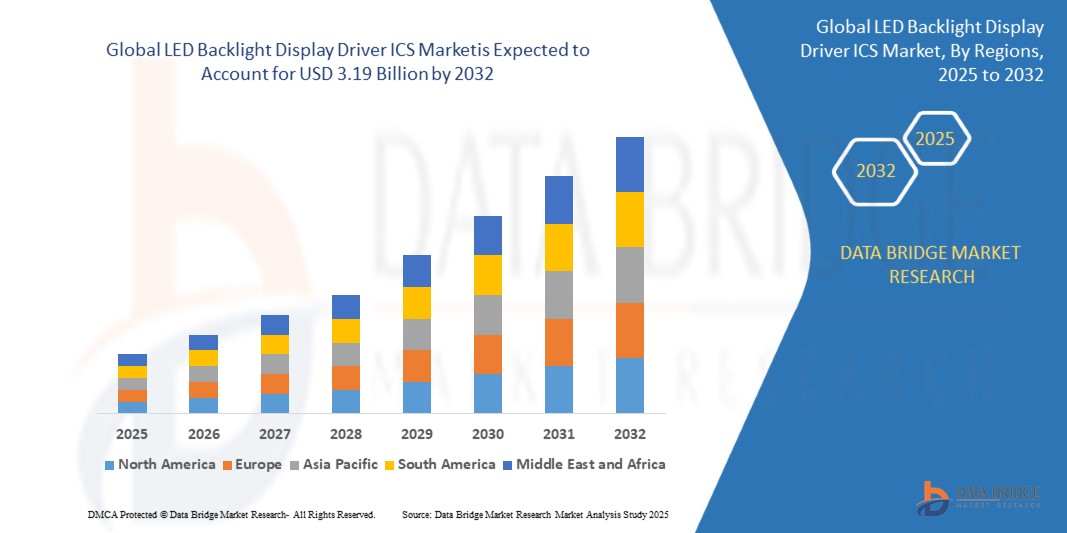

- The global LED backlight display driver ICS market size was valued at USD 2.48 billion in 2024 and is expected to reach USD 3.19 billion by 2032, at a CAGR of 3.20% during the forecast period

- This growth is driven by factors such as the rising demand for energy-efficient display technologies, increasing adoption of LED displays in consumer electronics and automotive applications, and continuous advancements in display panel technologies

LED Backlight Display Driver ICS Market Analysis

- The LED backlight display driver ICs market is experiencing significant growth, driven by the increasing demand for energy-efficient and high-resolution displays across various applications

- Technological advancements, such as the integration of advanced features such as dimming control and temperature compensation, are enhancing the functionality and reliability of LED backlight display driver ICS

- North America is expected to dominate the LED Backlight Display Driver ICs market due to the strong presence of major consumer electronics manufacturers, advanced technological developments, and high demand for energy-efficient display solutions in industries such as automotive and healthcare

- Asia-Pacific is expected to be the fastest growing region in the LED Backlight Display Driver ICs market during the forecast period due to the rapid adoption of LED displays in consumer electronics, automotive applications, and the region's growing manufacturing capabilities, particularly in China, Japan, and South Korea

- The switching LED driver ICs segment is expected to dominate the LED backlight display driver ICS market with the largest share of 40.5% in 2025 due to its superior energy efficiency, high performance, and ability to handle higher power outputs. These ICs are ideal for applications such as televisions, smartphones, and automotive displays that require robust and energy-efficient backlighting solutions.

Report Scope and LED Backlight Display Driver ICS Market Segmentation

|

Attributes |

LED Backlight Display Driver ICS Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

LED Backlight Display Driver ICS Market Trends

“Increasing Adoption of Advanced Dimming Technologies”

- Advanced dimming technologies enable precise control over backlight zones, significantly improving contrast ratios and overall display quality

- For instance, televisions with local dimming offer deeper blacks and enhanced color accuracy compared to standard edge-lit models

- These technologies help reduce power consumption by adjusting brightness based on screen content and ambient lighting

- For instance, smartphones now feature adaptive brightness modes that rely on driver ICs to dynamically manage backlight intensity

- In automotive displays, advanced dimming supports clear visibility in both bright daylight and low-light conditions

- For instance, digital instrument clusters in modern vehicles adjust backlight levels to ensure readability without causing glare

- The push for sustainability is encouraging electronics manufacturers to adopt dimming-enabled components to improve energy efficiency

- As display resolutions increase, so does the need for sophisticated dimming features to maintain performance and power efficiency

LED Backlight Display Driver ICS Market Dynamics

Driver

“Increasing Demand for High-Quality Displays”

- Consumer preference for high-resolution and energy-efficient displays is driving the demand for advanced LED backlight display driver integrated circuits

- For instance, users expect smartphones and smart TVs to deliver vivid visuals with accurate colors and sharp contrast in both bright and dark environments

- These driver ICs are essential for regulating LED current, managing brightness levels, and maintaining thermal efficiency to support modern display performance

- For instance, high-end laptops and monitors utilize driver ICs to balance brightness and reduce overheating during extended usage

- The rise of OLED and Mini-LED technologies in devices has increased the need for sophisticated driver ICs that can support higher luminance and more precise control

- For instance, premium television models with Mini-LED backlighting offer local dimming zones that rely on advanced driver ICs for accurate lighting control

- Advancements in microcontroller-based designs and digital power management are enhancing the capabilities and reliability of driver ICs across applications

- Manufacturers are prioritizing innovation in driver ICs to meet growing expectations for display quality, durability, and energy savings in consumer electronics and automotive systems

Opportunity

“Expansion in Automotive Applications”

- The growing use of advanced digital displays in vehicles is creating strong growth opportunities for the LED backlight display driver integrated circuits market

- For instance, newer vehicle models feature full-digital instrument clusters and center consoles that require precise and efficient backlighting control

- Automotive applications such as dashboards, infotainment systems, and heads-up displays rely on driver ICs to deliver reliable and high-performance visual output

- Major automotive manufacturers are investing in connected car technologies that include sophisticated display systems as a core feature

- For instance, brands such as Mercedes-Benz and Hyundai have introduced models with panoramic display panels that span across the dashboard

- These advanced displays require high-quality LED backlighting, which increases the demand for specialized and efficient driver ICs tailored to automotive standards

- As the automotive sector continues to digitize and prioritize user interface innovation, the need for intelligent display driver solutions is expected to grow rapidly

Restraint/Challenge

“High Development Costs”

- Developing advanced LED backlight display driver integrated circuits involves high costs due to the complexity of modern display technologies

- For instance, creating driver ICs compatible with Mini-LED and MicroLED displays requires specialized engineering and precision manufacturing processes

- As display technology standards rise, driver ICs must deliver greater performance in areas such as color accuracy, brightness control, and power efficiency

- These evolving requirements drive up research and development spending, making it expensive for companies to stay competitive in the market

- Higher production costs affect pricing strategies and reduce profit margins, especially for companies that do not benefit from large-scale economies

- For instance, smaller semiconductor firms often face financial constraints that limit their ability to invest in the next generation of display driver solutions

- Balancing innovation with cost-efficiency remains a major challenge, particularly for players aiming to maintain high product quality while keeping prices competitive

LED Backlight Display Driver ICS Market Scope

The market is segmented on the basis of product type, backlight type, display type, application, and end-user industry.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Backlight Type |

|

|

By Display Type |

|

|

By Application |

|

|

By End-User Industry |

|

In 2025, the switching LED driver ICs is projected to dominate the market with a largest share in product type segment

The switching LED driver ICs segment is expected to dominate the LED backlight display driver ICS market with the largest share of 40.5% in 2025 due to its superior energy efficiency, high performance, and ability to handle higher power outputs. These ICs are ideal for applications such as televisions, smartphones, and automotive displays that require robust and energy-efficient backlighting solutions.

The LCD (liquid crystal display) is expected to account for the largest share during the forecast period in display type market

In 2025, the LCD (liquid crystal display) segment is expected to dominate the market with the largest market share of 50-55% due to its cost-effectiveness, wide adoption, and established manufacturing infrastructure. LCD technology remains the preferred choice for a broad range of applications, including consumer electronics, televisions, and computer monitors.

LED Backlight Display Driver ICS Market Regional Analysis

“North America Holds the Largest Share in the LED Backlight Display Driver ICS Market”

- North America is expected to dominate the LED backlight display driver ICs market by holding a market share of 70%. The demand for high-resolution displays in consumer electronics and automotive sectors, combined with technological advancements in display driver ICs, positions North America as the leader in the market

- The region's established infrastructure for electronics manufacturing and innovation makes it a hub for the development and consumption of advanced LED backlighting solutions

- North America holds the largest market share due to the high demand for ultra-high-definition displays in devices such as televisions, monitors, and smartphones

- The region's adoption of energy-efficient, high-performance display technologies in consumer electronics and automotive systems is a major contributor to its dominance

- The presence of leading companies such as Texas Instruments, Analog Devices, and Microchip Technology strengthens the region’s position in the market

- The growing trend of digitalization in automotive and healthcare sectors further drives the demand for advanced LED backlight solutions in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the LED Backlight Display Driver ICS Market”

- Asia-Pacific is expected to be the fastest-growing region in the LED backlight display driver ICs market

- This growth is primarily driven by the increasing adoption of advanced display technologies and the rapid expansion of electronics manufacturing in countries such as China, South Korea, and Japan

- The region is also witnessing a surge in demand for consumer electronics, automotive displays, and other digital applications that rely on high-performance display solutions

- The region’s rapid growth is attributed to the increasing demand for LED-backlit displays in smartphones, TVs, and automotive systems

- Asia-Pacific’s strong electronics manufacturing base, coupled with the rising adoption of innovative technologies such as OLED and Mini-LED, is a key driver of growth

- The availability of cost-effective production resources and a large consumer market in countries such as China and India further fuel the market’s expansion

- Government initiatives to foster technological innovation in countries such as China also support the adoption of advanced display technologies

LED Backlight Display Driver ICS Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Texas Instruments (U.S.)

- Analog Devices, Inc. (U.S.)

- Microchip Technology (U.S.)

- NXP Semiconductors (Netherlands)

- ON Semiconductor (U.S.)

- STMicroelectronics (Switzerland)

- Infineon Technologies (Germany)

- Maxim Integrated (U.S.)

- Broadcom Inc. (U.S.)

- Qualcomm Incorporated (U.S.)

Latest Developments in Global LED Backlight Display Driver ICS Market

- In March 2023, Panasonic Holdings Corporation (Japan) introduced a compact, IP-enabled live video switcher designed for high-quality streaming and webinars. This development aims to enhance the flexibility and scalability of live video production, catering to the growing demand for remote and hybrid event solutions. The device supports multiple video inputs and outputs, enabling seamless integration with various streaming platforms and video conferencing tools. By incorporating advanced networking capabilities, it facilitates real-time control and monitoring, ensuring reliable and efficient live broadcasts. This innovation is expected to impact the market by providing content creators, educators, and corporate users with a versatile and cost-effective solution for professional-grade live video production

- In May 2023, Analog Devices (U.S.) announced a EUR 630 million investment to establish a state-of-the-art research and development and manufacturing facility in Limerick, Ireland. This initiative aims to accelerate advancements in next-generation signal processing technologies, particularly for applications in digital biology, electric vehicles, and robotics. The new facility is expected to triple the company's European wafer production capacity and create approximately 600 new jobs, significantly enhancing Analog Devices' manufacturing capabilities and supply chain resilience. This strategic expansion underscores the company's commitment to innovation and its pivotal role in the global semiconductor industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.