Global Led Fog Lamp Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

1.62 Billion

2025

2033

USD

1.37 Billion

USD

1.62 Billion

2025

2033

| 2026 –2033 | |

| USD 1.37 Billion | |

| USD 1.62 Billion | |

|

|

|

|

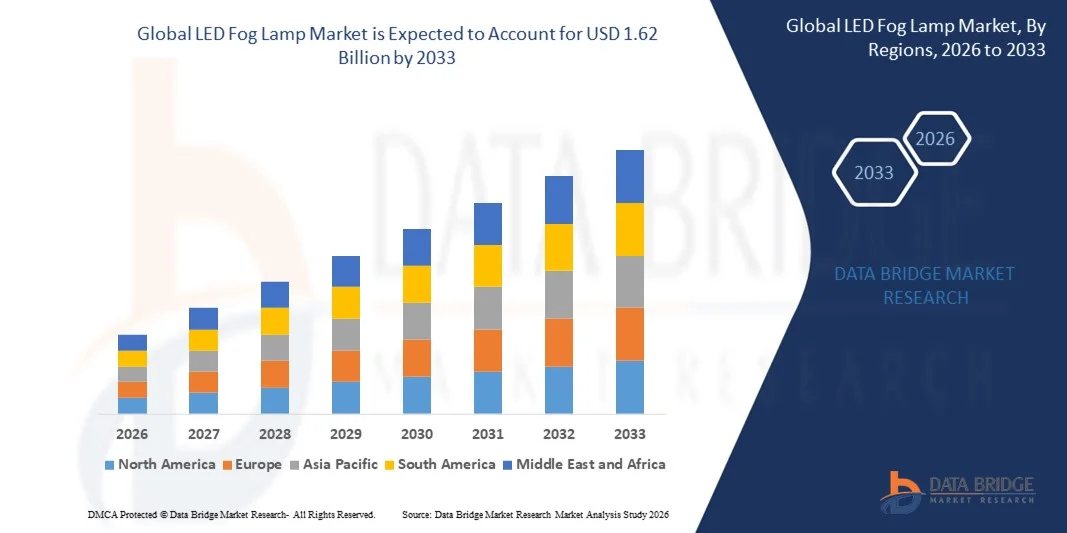

What is the Global LED Fog Lamp Market Size and Growth Rate?

- The global LED fog lamp market size was valued at USD 1.37 billion in 2025 and is expected to reach USD 1.62 billion by 2033, at a CAGR of2.10% during the forecast period

- The rise in the concerns regarding the safety for the drivers acts as one of the major factors driving the growth of LED fog lamp market

- The increase in the adoption of LED as they are known fog penetrating capabilities than other light sources and the implementation of stringent safety regulations accelerates the LED fog lamp market growth

What are the Major Takeaways of LED Fog Lamp Market?

- The growth of automotive aftermarket sector and rise in the consciousness of adaptive fog light clarifications and security actions further influence the LED fog lamp market. In addition, rapid urbanization, high usage in the production of electric cars, high production and sales of vehicles and surge in disposable income positively affect the LED fog lamp market

- Furthermore, developments and incessant progress of fog lights extend profitable opportunities to the LED fog lamp market players

- Asia-Pacific dominated the LED fog lamp market with the largest revenue share of 42.24% in 2025, driven by high vehicle production volumes, strong automotive manufacturing ecosystems, and rapid adoption of LED lighting technologies across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rising adoption of advanced vehicle lighting technologies, increasing sales of SUVs and pickup trucks, and growing penetration of electric and hybrid vehicles across the U.S. and Canada

- The White LED fog lamp segment dominated the market with a 54.6% share in 2025, owing to its superior brightness, modern appearance, and widespread adoption across passenger vehicles and premium automotive models

Report Scope and LED Fog Lamp Market Segmentation

|

Attributes |

LED Fog Lamp Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the LED Fog Lamp Market?

Rising Adoption of Advanced, Energy-Efficient, and Smart LED Fog Lamps

- The LED Fog Lamp market is witnessing a growing shift toward high-luminance, compact, and energy-efficient LED fog lamps that offer superior visibility in foggy, rainy, and low-light conditions

- Manufacturers are increasingly integrating adaptive lighting technologies, advanced optics, and precise beam control to improve road safety and reduce glare for oncoming traffic

- Rising demand for lightweight, durable, and long-life lighting solutions is driving adoption across passenger cars, commercial vehicles, and off-road vehicles

- For instance, leading players such as Valeo, HELLA, KOITO, OSRAM, and Philips are introducing LED fog lamps with enhanced brightness, thermal management, and compliance with global safety standards

- Increasing integration of smart vehicle lighting systems and ADAS-compatible illumination is accelerating demand for technologically advanced LED fog lamps

- As automotive lighting systems evolve toward efficiency, safety, and design aesthetics, LED fog lamps will remain critical components in modern vehicle architectures

What are the Key Drivers of LED Fog Lamp Market?

- Growing demand for improved vehicle safety and enhanced road visibility under adverse weather conditions is a primary driver for LED fog lamp adoption

- For instance, during 2024–2025, several automakers expanded the use of LED fog lamps as standard or optional features in mid-range and premium vehicles to meet safety expectations

- Rising production of passenger vehicles, SUVs, electric vehicles, and commercial vehicles across Asia-Pacific, Europe, and North America is boosting market demand

- Technological advancements in LED efficiency, heat dissipation, optical lens design, and power management have improved performance and lifespan

- Increasing consumer preference for stylish vehicle lighting, customization, and aftermarket upgrades further supports market growth

- Backed by stricter vehicle safety regulations, growing automotive electrification, and continuous lighting innovation, the LED fog lamp market is expected to experience steady long-term expansion

Which Factor is Challenging the Growth of the LED Fog Lamp Market?

- High initial costs associated with advanced LED fog lamps and smart lighting features limit adoption in low-cost and entry-level vehicles

- For instance, fluctuations in raw material prices, semiconductor availability, and LED chip supply during 2024–2025 increased production costs for several manufacturers

- Complexity in thermal management, optical calibration, and compliance with regional automotive lighting regulations raises design and development challenges

- Limited awareness in emerging markets regarding the performance benefits of LED fog lamps compared to conventional halogen solutions slows penetration

- Intense competition from halogen and xenon fog lamps, along with pricing pressure in the aftermarket segment, impacts profitability

- To overcome these challenges, companies are focusing on cost optimization, localized manufacturing, regulatory compliance, and technological differentiation to strengthen global adoption of LED fog lamps

How is the LED Fog Lamp Market Segmented?

The market is segmented on the basis of color, position, sales channel and vehicle type.

- By Color

On the basis of color, the LED Fog Lamp market is segmented into White, Yellow, and Others. The White LED fog lamp segment dominated the market with a 54.6% share in 2025, owing to its superior brightness, modern appearance, and widespread adoption across passenger vehicles and premium automotive models. White LED fog lamps offer higher luminous efficacy, longer lifespan, and seamless integration with advanced vehicle lighting systems, making them the preferred choice for OEMs. Their compatibility with adaptive lighting and aesthetic vehicle designs further strengthens adoption across global markets.

The Yellow LED fog lamp segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by its enhanced performance in dense fog, rain, and snow conditions. Increasing awareness of safety benefits, rising use in commercial vehicles, off-road applications, and growing demand in regions with extreme weather conditions are accelerating adoption of yellow LED fog lamps worldwide.

- By Position

Based on position, the LED Fog Lamp market is segmented into Front and Rear. The Front LED fog lamp segment dominated the market with a 67.2% share in 2025, as front fog lamps play a critical role in improving driver visibility during adverse weather conditions such as fog, heavy rain, and dust. Automakers increasingly install front LED fog lamps as standard or optional features in passenger cars, SUVs, and commercial vehicles to meet safety regulations and enhance driving comfort. Advanced beam control, low glare, and high durability further support strong demand.

The Rear LED fog lamp segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing focus on rear-end collision prevention and regulatory mandates in Europe and Asia-Pacific. Rising adoption in commercial vehicles and premium passenger cars is further supporting growth.

- By Vehicle Type

On the basis of vehicle type, the LED Fog Lamp market is segmented into Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The Passenger Car segment dominated the market with a 58.9% share in 2025, supported by high global vehicle production, increasing consumer preference for advanced lighting systems, and rising adoption of LED technologies in mid-range and premium cars. LED fog lamps enhance safety, aesthetics, and energy efficiency, making them a standard offering across many passenger vehicle models.

The Heavy Commercial Vehicle segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing deployment in mining trucks, construction vehicles, long-haul trucks, and defense vehicles. Harsh operating environments, stringent safety requirements, and demand for high-visibility lighting systems are accelerating LED fog lamp adoption in the commercial vehicle sector.

- By Sales Channel

Based on sales channel, the LED Fog Lamp market is segmented into OEM and Aftermarket. The OEM segment dominated the market with a 61.4% share in 2025, driven by increasing integration of LED fog lamps during vehicle manufacturing. Automakers are focusing on factory-installed LED lighting systems to ensure regulatory compliance, performance reliability, and design consistency. Strong partnerships between lighting manufacturers and automotive OEMs further strengthen this segment.

The Aftermarket segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising vehicle customization trends, replacement demand, and increasing availability of cost-effective LED fog lamp kits. Growing awareness of safety benefits and expanding e-commerce platforms are further accelerating aftermarket sales globally.

Which Region Holds the Largest Share of the LED Fog Lamp Market?

- Asia-Pacific dominated the LED fog lamp market with the largest revenue share of 42.24% in 2025, driven by high vehicle production volumes, strong automotive manufacturing ecosystems, and rapid adoption of LED lighting technologies across China, Japan, India, South Korea, and Southeast Asia. Rising demand for passenger vehicles, increasing penetration of electric vehicles, and growing emphasis on vehicle safety and visibility have significantly boosted LED fog lamp adoption

- Major automotive OEMs and component manufacturers in the region are increasingly integrating LED fog lamps as standard features to meet safety regulations and enhance vehicle aesthetics. Expanding investments in automotive electronics, smart lighting systems, and EV infrastructure further strengthen Asia-Pacific’s leadership

- Strong supply chains, cost-effective manufacturing, and high aftermarket demand reinforce the region’s dominant position in the global LED fog lamp market

China LED Fog Lamp Market Insight

China is the largest contributor in Asia-Pacific, supported by massive automotive production capacity, rapid EV adoption, and strong government focus on vehicle electrification and safety standards. Growing domestic OEM demand and export-oriented manufacturing drive sustained market growth.

Japan LED Fog Lamp Market Insight

Japan shows steady growth due to advanced automotive engineering, focus on high-quality lighting systems, and continuous innovation in vehicle safety technologies.

India LED Fog Lamp Market Insight

India is emerging rapidly, driven by expanding vehicle production, rising consumer preference for LED lighting upgrades, and government safety regulations.

North America LED Fog Lamp Market

North America is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rising adoption of advanced vehicle lighting technologies, increasing sales of SUVs and pickup trucks, and growing penetration of electric and hybrid vehicles across the U.S. and Canada. Automakers in the region are focusing on high-performance LED fog lamps with improved beam control, durability, and energy efficiency to enhance safety under adverse weather conditions. Strong regulatory emphasis on road safety, high consumer purchasing power, and growing aftermarket upgrades are accelerating market expansion.

U.S. LED Fog Lamp Market Insight

The U.S. leads regional growth due to high vehicle ownership, strong OEM integration, and increasing demand for premium and customized lighting solutions.

Canada LED Fog Lamp Market Insight

Canada contributes steadily, supported by demand for enhanced visibility lighting in extreme weather conditions and growing adoption across passenger and commercial vehicles.

Which are the Top Companies in LED Fog Lamp Market?

The LED fog lamp industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- OSRAM GmbH (Germany)

- HELLA GmbH & Co. KGaA (Germany)

- Valeo (France)

- Koninklijke Philips N.V. (Netherlands)

- Marelli Holdings Co., Ltd. (Japan)

- Robert Bosch GmbH (Germany)

- IPFS Corporation (U.S.)

- SL Corporation (South Korea)

- KOITO MANUFACTURING CO., LTD. (Japan)

- JDM ASTAR (China)

- LEDO Auto (China)

- MOBIS INDIA LIMITED (India)

- ZKW (Austria)

- Hopkins Manufacturing Corporation (U.S.)

- Sammoon Lighting Co., Ltd. (China)

- Nokya (Japan)

- PIAA Corporation (Japan)

What are the Recent Developments in Global LED Fog Lamp Market?

- In November 2024, OSRAM introduced the NIGHT BREAKER LED SMART retrofit front fog lamps, available in H8, H10, H16, and HB4 variants, enabling vehicle owners to upgrade easily to advanced LED technology with white light output of up to 6000 Kelvin and a wide beam pattern, improving visibility and safety in foggy conditions while supporting cost-effective aftermarket upgrades

- In February 2024, Philips Automotive unveiled a new LED fog lamp designed to deliver enhanced visibility in low-visibility and foggy driving conditions, reinforcing the company’s focus on advanced lighting technologies to improve vehicle safety and strengthen its position in the premium automotive lighting segment

- In January 2024, Lumax Auto Technologies Limited launched a new range of LED fog lamps in India, offering compatibility with nearly 90% of vehicles and backed by a 12-month warranty, significantly expanding aftermarket accessibility and accelerating LED fog lamp adoption across the domestic automotive market

- In September 2021, Osram Sylvania announced the launch of its SYLVANIA LED Fog and Powersports bulbs capable of emitting 6000K white light, enhancing road visibility and performance for both on-road and off-road applications while supporting the shift toward high-performance LED lighting solutions

- In March 2021, BMW introduced its 220i Sport model in India, equipped with LED headlights and LED fog lamps as standard features, highlighting the growing integration of advanced LED lighting systems in premium vehicles and driving long-term OEM demand for LED fog lamps

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.