Global Legal Unified Communication Market

Market Size in USD Billion

CAGR :

%

USD

126.12 Billion

USD

439.85 Billion

2024

2032

USD

126.12 Billion

USD

439.85 Billion

2024

2032

| 2025 –2032 | |

| USD 126.12 Billion | |

| USD 439.85 Billion | |

|

|

|

|

What is the Global Legal Unified Communication Market Size and Growth Rate?

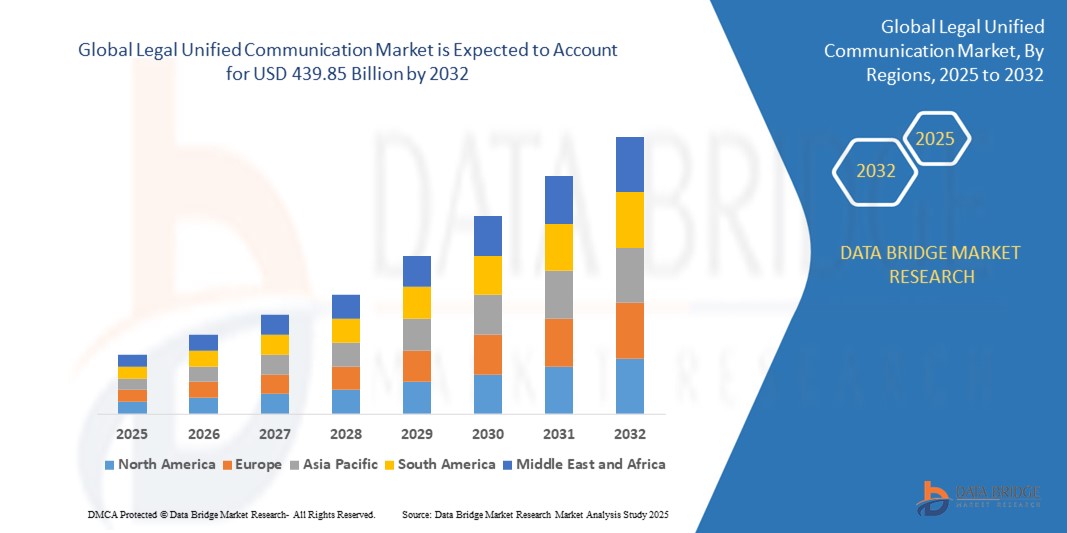

- The global legal unified communication market size was valued at USD 126.12 billion in 2024 and is expected to reach USD 439.85 billion by 2032, at a CAGR of 15.20% during the forecast period

- The legal unified communication market is witnessing significant advancements in methods and technology, driving its growth. The latest technologies, such as cloud-based platforms and AI-driven communication tools, are being increasingly adopted for their ability to streamline communication and collaboration in legal environments

- Cloud-based solutions offer secure, scalable communication channels, enabling law firms to manage client interactions, case files, and internal communication efficiently. AI tools, such as natural language processing (NLP) and machine learning, are being integrated to automate routine tasks, such as document management, legal research, and client communication, enhancing productivity

What are the Major Takeaways of Legal Unified Communication Market?

- The integration of unified communication systems with existing legal software and CRM platforms is also contributing to market growth. As the legal industry continues to embrace digital transformation, the demand for advanced communication solutions is expected to rise, driving further innovation and market expansion

- North America dominated the global legal unified communication market, accounting for the largest revenue share of 34.2% in 2024, driven by widespread digital transformation, advanced cloud infrastructure, and the growing need for secure, compliant communication within the legal sector

- Asia-Pacific legal unified communication market is projected to grow at the fastest CAGR of 18.5% from 2025 to 2032, driven by rapid digital transformation, accelerated cloud adoption, and government-led initiatives to enhance cybersecurity and legal technology infrastructure across countries such as China, India, Japan, and Southeast Asia

- The Large Enterprises segment dominated the market with the largest revenue share of 69.8% in 2024, driven by their complex operational requirements, expansive global presence, and the need for advanced, scalable communication platforms

Report Scope and Legal Unified Communication Market Segmentation

|

Attributes |

Legal Unified Communication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Legal Unified Communication Market?

“AI-Driven Automation and Visibility Transforming Legal Communication Ecosystems”

- A prominent and evolving trend in the global legal unified communication market is the adoption of AI-powered automation and intelligent analytics to enhance visibility, security, and collaboration across legal teams operating in complex digital environments

- Law firms and corporate legal departments are increasingly integrating AI-driven Unified Communication platforms to streamline case management, automate routine interactions, and ensure secure, real-time collaboration across hybrid and remote work setups

- For instance, major players such as Microsoft and Cisco Systems have introduced AI-enhanced features in their communication suites, enabling functionalities such as smart transcription, automated meeting summaries, and AI-based compliance monitoring to support legal teams

- AI is also transforming e-discovery and information governance within Legal Unified Communication tools, allowing legal teams to efficiently locate, analyze, and share case-related data while ensuring adherence to strict confidentiality protocols

- Integration with advanced compliance management and legal workflow automation platforms enables organizations to reduce manual processes, mitigate human error, and enhance operational efficiency across multi-jurisdictional legal operations

- As legal practices become more globalized and digitally connected, AI-enabled Unified Communication solutions are emerging as critical infrastructure for ensuring secure collaboration, regulatory compliance, and operational resilience in the legal sector

- This shift toward intelligent, automated communication is reshaping how legal teams manage sensitive information, driving increased adoption of legal unified communication platforms worldwide

What are the Key Drivers of Legal Unified Communication Market?

- The rising demand for secure, real-time collaboration among geographically dispersed legal teams is a significant driver accelerating the adoption of legal unified communication solutions. Remote and hybrid work models have heightened the need for integrated, compliant communication platforms

- For instance, in February 2024, RingCentral launched AI-powered collaboration tools specifically designed for legal teams, featuring secure messaging, automated compliance archiving, and AI-driven transcription services to support remote legal workflows

- Stringent data privacy regulations, including GDPR, CCPA, and emerging regional compliance mandates, are prompting legal organizations to adopt Unified Communication platforms with built-in security, encryption, and compliance monitoring features

- The increasing complexity of multi-party legal cases, cross-border transactions, and regulatory investigations necessitates seamless, secure communication tools that ensure confidentiality and traceability

- Legal Unified Communication solutions also support cost optimization, enabling legal teams to reduce travel, streamline workflows, and improve case management efficiency, particularly for large firms managing global operations

- As legal organizations prioritize digital transformation and operational efficiency, the demand for AI-integrated, secure unified communication platforms is expected to grow, fueling market expansion globally

Which Factor is challenging the Growth of the Legal Unified Communication Market?

- The fragmentation of communication platforms, lack of interoperability with existing legal technology ecosystems, and concerns over data security present key barriers to the widespread adoption of legal unified communication solutions

- For instance, legal firms using a mix of third-party collaboration tools often face integration challenges, leading to fragmented workflows and increased risk of data breaches or compliance lapses

- Data privacy concerns are heightened in the legal sector, where unauthorized access to confidential case data can result in regulatory penalties, reputational damage, and legal liabilities

- In addition, the shortage of legal IT professionals with expertise in deploying and managing AI-enabled communication tools constrains adoption, especially among small and mid-sized legal practices with limited technical resources

- High implementation and subscription costs for advanced, AI-integrated Unified Communication platforms deter smaller firms from adopting these solutions, widening the technological gap between large and small legal organizations

- Overcoming these challenges requires standardization, enhanced platform interoperability, investment in workforce training, and development of scalable, affordable legal unified communication solutions tailored to the specific needs of the legal industry

How is the Legal Unified Communication Market Segmented?

The market is segmented on the basis of organization size, deployment, and solutions.

- By Organization Size

On the basis of organization size, the legal unified communication market is segmented into Large Enterprises and Small and Medium-Sized Enterprises (SMEs). The Large Enterprises segment dominated the market with the largest revenue share of 69.8% in 2024, driven by their complex operational requirements, expansive global presence, and the need for advanced, scalable communication platforms that ensure data security, regulatory compliance, and seamless collaboration across distributed teams. Large organizations continue to invest significantly in comprehensive Legal Unified Communication solutions to manage hybrid workforces and safeguard sensitive information.

The Small and Medium-Sized Enterprises (SMEs) segment is projected to witness the fastest CAGR during the forecast period, supported by increasing access to affordable, cloud-based communication tools and growing awareness of the security risks associated with shadow IT. SMEs are adopting simplified, scalable Legal Unified Communication platforms to enhance collaboration, improve security posture, and manage costs effectively without the need for large in-house IT teams.

- By Deployment

On the basis of deployment, the legal unified communication market is segmented into Public Cloud and Private Cloud. The Public Cloud segment dominated the market with the largest revenue share of 63.5% in 2024, attributed to the rapid adoption of flexible, cost-effective cloud services that offer scalability and global accessibility. Organizations are leveraging Public Cloud-based Legal Unified Communication platforms to enable remote collaboration, ensure compliance, and manage operational efficiency without significant capital investment in IT infrastructure.

The Private Cloud segment is anticipated to register the fastest CAGR during the forecast period, driven by the demand for enhanced security, data sovereignty, and regulatory compliance, particularly among industries handling sensitive information such as legal, healthcare, and finance. Enterprises with strict governance requirements are increasingly adopting Private Cloud-based Legal Unified Communication solutions to maintain control over data while benefiting from the flexibility of cloud infrastructure.

- By Solutions

On the basis of solutions, the legal unified communication market is segmented into Instant and Unified Messaging, Audio and Video Conferencing, IP Telephony, and Others. The Audio and Video Conferencing segment dominated the market with the largest revenue share of 42.1% in 2024, fueled by the surge in hybrid work models, virtual court proceedings, and the growing need for real-time, secure communication within legal teams and client interactions. Organizations are prioritizing reliable conferencing tools integrated with security features to facilitate efficient remote collaboration.

The Instant and Unified Messaging segment is projected to witness the fastest CAGR during the forecast period, driven by the growing emphasis on secure, real-time messaging platforms that streamline legal workflows, enhance productivity, and reduce dependency on unsecured third-party applications. Legal teams are adopting integrated messaging solutions to ensure compliance, maintain confidentiality, and enable seamless communication across devices and locations.

Which Region Holds the Largest Share of the Legal Unified Communication Market?

- North America dominated the global legal unified communication market, accounting for the largest revenue share of 34.2% in 2024, driven by widespread digital transformation, advanced cloud infrastructure, and the growing need for secure, compliant communication within the legal sector

- Enterprises in North America are heavily investing in AI-powered Legal Unified Communication platforms to address rising data privacy concerns, shadow IT risks, and multi-cloud complexity, supported by a mature IT ecosystem and strict regulatory frameworks

- The region's leadership is further reinforced by high cloud adoption rates, strong cybersecurity focus, and the presence of major unified communication providers, positioning North America as a key hub for market innovation and growth

U.S. Legal Unified Communication Market Insight

U.S. held the largest revenue share within North America in 2024, driven by rapid hybrid cloud adoption, increasing security risks, and strict regulatory requirements across sectors such as finance, healthcare, and government. Organizations are prioritizing secure, compliant legal unified communication platforms to enhance collaboration, manage operational complexity, and address growing shadow IT challenges. The U.S. market benefits from technological innovation, large enterprise presence, and evolving data protection laws that fuel demand for AI-enabled communication solutions.

Europe Legal Unified Communication Market Insight

The Europe legal unified communication market is poised for steady growth, fueled by stringent data protection regulations such as GDPR, increasing cloud adoption, and rising emphasis on digital sovereignty. Enterprises across finance, legal, public sector, and healthcare industries are adopting scalable, secure communication platforms to enhance governance, reduce operational risks, and ensure regulatory compliance. The region's strong cybersecurity focus and investment in legal technology infrastructure support market expansion.

U.K. Legal Unified Communication Market Insight

The U.K. legal unified communication market is expected to grow at a healthy pace, driven by increased hybrid and multi-cloud deployments, evolving data protection standards, and the country’s role as a global financial hub. Enterprises are leveraging legal unified communication solutions to enhance collaboration, manage regulatory compliance, and control shadow IT risks. The market is further supported by the U.K.'s emphasis on secure digital transformation and operational efficiency in legal and financial sectors.

Germany Legal Unified Communication Market Insight

The Germany legal unified communication market is witnessing steady growth, supported by a strong national focus on data privacy, cloud governance, and technological innovation. German enterprises, especially in finance, manufacturing, and public sectors, are adopting legal unified communication tools to enhance asset visibility, prevent data leakage, and comply with both EU and national regulatory frameworks. Increasing digitalization and emphasis on secure collaboration are driving market demand.

Which Region is the Fastest Growing Region in the Legal Unified Communication Market?

Asia-Pacific legal unified communication market is projected to grow at the fastest CAGR of 18.5% from 2025 to 2032, driven by rapid digital transformation, accelerated cloud adoption, and government-led initiatives to enhance cybersecurity and legal technology infrastructure across countries such as China, India, Japan, and Southeast Asia. Enterprises are investing in unified communication platforms to manage rising operational complexity, ensure regulatory compliance, and support secure collaboration in the expanding digital economy.

Japan Legal Unified Communication Market Insight

The Japan legal unified communication market is expanding steadily, fueled by the country’s advanced technology ecosystem, growing data security concerns, and widespread enterprise cloud adoption. Organizations in critical sectors such as healthcare, manufacturing, and finance are deploying legal unified communication solutions to gain real-time visibility, control shadow IT, and comply with evolving national data protection laws. The market benefits from strong government support for digital innovation.

China Legal Unified Communication Market Insight

The China legal unified communication market captured the largest revenue share within Asia-Pacific in 2024, driven by rapid digitalization, high enterprise cloud adoption rates, and stringent government policies promoting cybersecurity and cloud governance. Chinese organizations across industries are leveraging AI-enabled legal unified communication platforms to manage operational risks, enhance asset visibility, and comply with evolving national data privacy laws, supporting strong market growth.

Which are the Top Companies in Legal Unified Communication Market?

The legal unified communication industry is primarily led by well-established companies, including:

- RingCentral, Inc. (U.S.)

- BT (U.K.)

- Verizon (U.S.)

- Orange Business Services (France)

- 8x8, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Google (U.S.)

- Microsoft (U.S.)

- Sangoma (Canada)

- LogMeIn, Inc. (U.S.)

- Mitel Networks Corp. (Canada)

- DIALPAD, INC. (U.S.)

- Fuze, Inc. (U.S.)

- Star2Star Communications (U.S.)

- Windstream Services, LLC (U.S.)

- NTT Communications Corporation (Japan)

- Vonage (U.S.)

- Intrado (U.S.)

- Masergy Communications, Inc. (U.S.)

- Revation Systems, Inc. (U.S.)

What are the Recent Developments in Global Legal Unified Communication Market?

- In August 2023, Avaya Inc. entered into a cooperative purchasing agreement with Sourcewell, a prominent Government Cooperative Purchasing Organization in North America. This contract allows U.S. and Canadian customers to acquire Avaya’s solutions and services directly or through an authorized partner via the cooperative contract, streamlining the procurement process

- In August 2023, Mitel Network Corporation released an upgraded version of MiCollab, its collaboration tool. The new version integrates messaging, voice, and meeting functions on a single platform. It now allows users to choose from multiple meeting providers, enhancing customization and ease of use for a more tailored collaboration experience

- In May 2023, NEC Corporation unveiled UNIVERGE BLUE ARCHIVE, a cutting-edge data retention solution for its UNIVERGE BLUE CONNECT unified communications application. This new tool is designed to safeguard and facilitate the search and retrieval of crucial business communications, including chat, phone call recordings, SMS, and voicemail, ensuring comprehensive data protection

- In January 2023, Verizon Communications Inc. and Microsoft Corporation launched Teams Phone Mobile, integrating Public Switched Telephone Network (PSTN) connectivity with Microsoft Teams and Phone System. This partnership introduced Verizon Mobile for Microsoft Teams, a service that combines mobile devices with Teams, streamlining collaboration and enhancing calling capabilities for users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.