Global Leukemia Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

20.70 Billion

USD

35.56 Billion

2025

2033

USD

20.70 Billion

USD

35.56 Billion

2025

2033

| 2026 –2033 | |

| USD 20.70 Billion | |

| USD 35.56 Billion | |

|

|

|

|

Leukemia Therapeutics Market Size

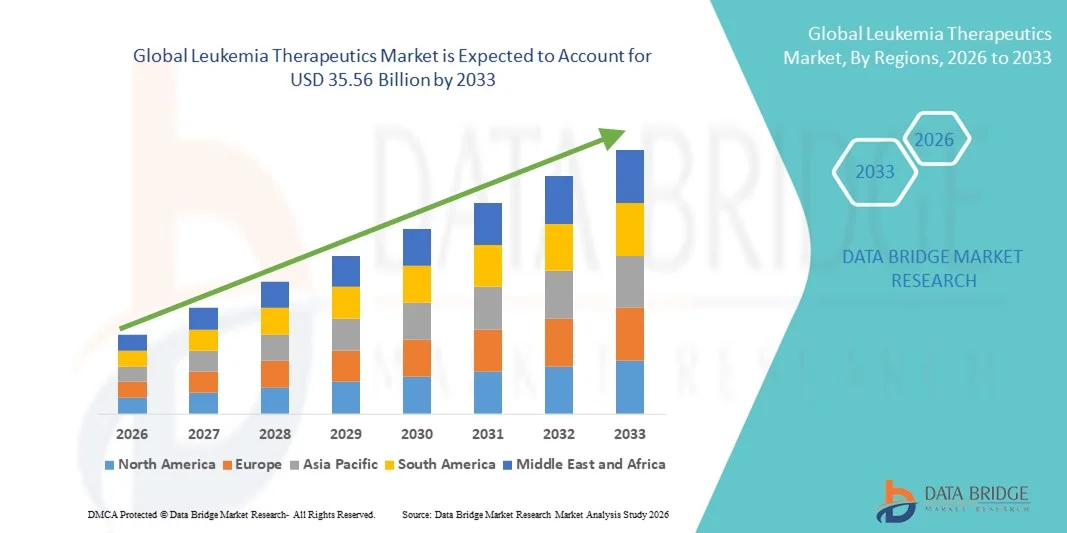

- The global leukemia therapeutics market size was valued at USD 20.7 billion in 2025 and is expected to reach USD 35.56 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by the rising incidence of leukemia across both pediatric and adult populations, increasing advancements in targeted therapies and immunotherapies, and expanding research and development activities in hematologic oncology. Continuous progress in precision medicine, CAR-T cell therapy, monoclonal antibodies, and tyrosine kinase inhibitors (TKIs) is significantly enhancing treatment outcomes and driving adoption across hospitals and specialty cancer centers

- Furthermore, growing awareness regarding early diagnosis, improving access to advanced cancer care, and increasing regulatory approvals for novel leukemia therapies are establishing leukemia therapeutics as a critical component of modern oncology treatment. These converging factors are accelerating the uptake of Leukemia Therapeutics solutions, thereby significantly boosting overall market growth

Leukemia Therapeutics Market Analysis

- Leukemia therapeutics, including targeted therapies, chemotherapy, immunotherapy, monoclonal antibodies, and CAR-T cell therapies, are increasingly vital components of modern oncology treatment due to their ability to improve survival rates, enhance treatment precision, and reduce relapse risk across acute and chronic leukemia types in hospitals and specialized cancer centers

- The escalating demand for leukemia therapeutics is primarily fueled by the rising global incidence of acute lymphocytic leukemia (ALL), acute myeloid leukemia (AML), chronic lymphocytic leukemia (CLL), and chronic myeloid leukemia (CML), along with continuous advancements in precision medicine, increasing clinical trials, and growing regulatory approvals for novel biologics and targeted agent

- North America dominated the leukemia therapeutics market with the largest revenue share of 41.3% in 2025, characterized by advanced oncology infrastructure, strong presence of leading pharmaceutical companies, high healthcare expenditure, favorable reimbursement frameworks, and rapid adoption of innovative therapies such as CAR-T and next-generation kinase inhibitors, with the U.S. accounting for the majority of regional revenue

- Asia-Pacific is expected to be the fastest growing region in the leukemia therapeutics market during the forecast period, driven by increasing cancer incidence, expanding access to advanced treatment options, rising healthcare investments, and growing clinical research activities in countries such as China, Japan, South Korea, and India

- The Small Molecules segment dominated with a 56.2% revenue share in 2025, driven by widespread use of tyrosine kinase inhibitors and oral targeted therapies

Report Scope and Leukemia Therapeutics Market Segmentation

|

Attributes |

Leukemia Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Leukemia Therapeutics Market Trends

Advancements in Targeted Therapies and Immunotherapy

- A significant and accelerating trend in the global leukemia therapeutics market is the rapid advancement of targeted therapies and immunotherapy-based treatment approaches. Unlike conventional chemotherapy, these innovative therapies are designed to specifically target cancer cells while minimizing damage to healthy tissues, thereby improving treatment outcomes and reducing adverse effects

- For instance, the development and increasing adoption of tyrosine kinase inhibitors (TKIs) for chronic myeloid leukemia (CML) and monoclonal antibody therapies for acute lymphoblastic leukemia (ALL) have significantly transformed the treatment landscape. In addition, chimeric antigen receptor T-cell (CAR-T) therapy has emerged as a breakthrough treatment option for relapsed or refractory leukemia patients, demonstrating promising remission rates

- The growing focus on precision medicine is enabling personalized treatment strategies based on genetic profiling and molecular diagnostics. Biomarker-driven therapies allow clinicians to tailor drug regimens according to specific mutations such as FLT3, BCR-ABL, or IDH1/2, thereby enhancing therapeutic efficacy

- Furthermore, continuous investments in oncology research, increasing clinical trials for novel drug combinations, and regulatory approvals for next-generation leukemia drugs are accelerating innovation in the market. Pharmaceutical companies are expanding their oncology pipelines to develop safer and more effective targeted treatment options

- This trend toward personalized, mechanism-specific therapies is fundamentally reshaping leukemia management, improving survival rates, and enhancing quality of life for patients

- The demand for advanced leukemia therapeutics, particularly targeted agents and immunotherapies, is growing across hospitals, cancer research centers, and specialty oncology clinics worldwide as healthcare providers prioritize precision-driven treatment approaches

Leukemia Therapeutics Market Dynamics

Driver

Rising Prevalence of Leukemia and Increasing Awareness for Early Diagnosis

- The increasing global incidence of leukemia is a major driver propelling the growth of the leukemia therapeutics market. Factors such as aging populations, genetic predisposition, environmental exposure, and lifestyle-related risks are contributing to the rising number of diagnosed cases worldwide

- For instance, acute myeloid leukemia (AML) and chronic lymphocytic leukemia (CLL) cases are steadily increasing among elderly populations, thereby driving demand for advanced treatment options including targeted drugs and immunotherapies. Early screening programs and improved diagnostic capabilities are leading to timely detection and higher treatment initiation rates

- In addition, growing awareness campaigns, government initiatives for cancer control, and improvements in healthcare infrastructure are encouraging patients to seek early diagnosis and specialized treatment. Expanding access to oncology centers and improved reimbursement policies in developed countries further support market expansion

- Increasing investments in research and development by pharmaceutical companies and biotechnology firms are also contributing to the introduction of novel therapies and combination treatment regimens, strengthening overall market growth

- The rising demand for effective and long-term leukemia treatment solutions across both developed and emerging economies continues to drive the adoption of innovative therapeutics

Restraint/Challenge

High Treatment Costs and Adverse Side Effects

- The high cost associated with advanced leukemia therapies, particularly targeted therapies and CAR-T cell treatments, presents a significant barrier to widespread adoption. These treatments often involve complex manufacturing processes, prolonged hospital stays, and intensive monitoring, leading to substantial financial burden for patients and healthcare systems

- For instance, CAR-T therapy and certain novel biologic drugs can cost hundreds of thousands of dollars per treatment cycle, limiting accessibility in low- and middle-income countries where reimbursement coverage may be inadequate

- Furthermore, despite therapeutic advancements, leukemia treatments are often associated with severe side effects such as immunosuppression, infections, anemia, and organ toxicity. These adverse events can impact patient compliance and overall treatment outcomes

- Regulatory challenges and lengthy clinical trial timelines also delay the introduction of new therapies into the market, increasing development costs for pharmaceutical companies

- Addressing these challenges through cost-effective manufacturing strategies, expanded reimbursement support, patient assistance programs, and the development of safer treatment modalities will be critical for ensuring sustained growth in the leukemia therapeutics market

Leukemia Therapeutics Market Scope

The market is segmented on the basis of treatment, leukemia type, molecule type, gender, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Global Leukemia Therapeutics Market is segmented into Chemotherapy, Targeted Therapy, and Others. The Targeted Therapy segment dominated the largest market revenue share of 48.7% in 2025, driven by the growing shift toward precision medicine and improved safety profiles compared to conventional chemotherapy. Targeted drugs specifically inhibit molecular pathways responsible for leukemia progression, improving treatment outcomes. Increasing approvals of tyrosine kinase inhibitors and monoclonal antibodies strengthen adoption. Rising prevalence of chronic leukemias further supports demand. Physicians increasingly prefer targeted regimens due to reduced systemic toxicity. Strong clinical trial pipelines accelerate innovation. Favorable reimbursement for novel oncology drugs in developed markets enhances accessibility. Growing awareness regarding personalized cancer therapy sustains growth. Expansion of companion diagnostics improves patient selection accuracy. Increasing healthcare expenditure in emerging economies strengthens uptake. Continuous R&D investments by pharmaceutical companies further reinforce dominance. These combined factors enabled targeted therapy to lead in 2025.

The Chemotherapy segment is anticipated to witness the fastest growth at a CAGR of 9.6% from 2026 to 2033, driven by its continued role as a backbone therapy in acute leukemia treatment. Combination regimens integrating chemotherapy with immunotherapy support expansion. Increasing diagnosis rates of acute lymphocytic and acute myeloid leukemia accelerate utilization. Cost-effectiveness compared to newer biologics sustains adoption in developing regions. Expanding oncology infrastructure globally enhances treatment access. Growing government cancer treatment programs support affordability. Advancements in supportive care reduce side effects, improving compliance. Rising pediatric leukemia cases strengthen chemotherapy demand. Clinical guidelines continue to recommend chemotherapy as first-line therapy in several indications. Expansion of hospital oncology units further boosts procurement. Increasing generic drug availability supports market penetration. These factors collectively position chemotherapy as a steadily growing segment during the forecast period.

- By Leukemia

On the basis of leukemia type, the market is segmented into Acute Lymphocytic Leukemia (ALL), Acute Myeloid Leukemia (AML), Chronic Lymphocytic Leukemia (CLL), Chronic Myeloid Leukemia (CML), and Others. The Chronic Lymphocytic Leukemia (CLL) segment held the largest revenue share of 29.8% in 2025, owing to its high prevalence among the aging population. Increasing life expectancy significantly contributes to rising CLL cases. Availability of multiple targeted therapies improves long-term disease management. Favorable reimbursement policies strengthen patient access. Growing awareness and early diagnosis support higher treatment rates. Strong clinical pipeline activity sustains innovation. Combination regimens enhance therapeutic efficacy. Expansion of oncology specialty centers further supports demand. Increasing patient survival rates extend therapy duration. Rising adoption of oral targeted agents improves compliance. Continuous monitoring and maintenance therapy contribute to recurring revenue streams. These factors enabled CLL to dominate in 2025.

The Acute Myeloid Leukemia (AML) segment is projected to witness the fastest growth at a CAGR of 10.4% from 2026 to 2033, driven by increasing research in novel targeted and immunotherapeutic agents. Rising incidence rates among elderly patients accelerate treatment demand. Advancements in genetic profiling improve risk stratification and therapy selection. Growing number of FDA and EMA approvals for AML-specific drugs strengthen the pipeline. Expansion of bone marrow transplant programs supports overall therapeutic growth. Increasing government funding for rare and aggressive cancers boosts research activity. Improved supportive care enhances patient survival rates. Rising awareness regarding early intervention accelerates diagnosis. Strong collaboration between biotech firms and research institutes supports innovation. Increased participation in clinical trials further expands treatment options. These combined drivers position AML as the fastest-growing leukemia segment.

- By Molecule Type

On the basis of molecule type, the market is segmented into Small Molecules and Biologics. The Small Molecules segment dominated with a 56.2% revenue share in 2025, driven by widespread use of tyrosine kinase inhibitors and oral targeted therapies. These drugs offer ease of administration and high patient compliance. Strong generic competition improves affordability and accessibility. Established clinical efficacy supports continued physician preference. Long-term maintenance therapy requirements ensure stable revenue. Rapid absorption and systemic activity enhance therapeutic outcomes. Expansion of oral oncology treatment models strengthens uptake. Increasing production capacity supports supply stability. Broad indications across leukemia types further enhance market penetration. Ongoing innovation in next-generation inhibitors sustains growth. Favorable regulatory approvals further reinforce dominance. These factors collectively secured leadership in 2025.

The Biologics segment is expected to witness the fastest growth at a CAGR of 11.2% from 2026 to 2033, fueled by increasing adoption of monoclonal antibodies and CAR-T cell therapies. Rising focus on immunotherapy strengthens market expansion. Improved specificity and enhanced survival outcomes accelerate uptake. Expansion of advanced cell therapy manufacturing facilities supports supply. Increasing regulatory approvals for innovative biologics boost commercialization. Growing physician confidence in biologic-based regimens enhances utilization. Rising investment in oncology biologics research strengthens pipeline development. Expansion of combination therapies integrating biologics supports demand. Higher remission rates improve treatment adoption. Increased healthcare spending globally further drives growth. These drivers collectively position biologics as the fastest-growing molecule segment.

- By Gender

On the basis of gender, the market is segmented into Male and Female. The Male segment accounted for the largest market revenue share of 54.1% in 2025, attributed to higher leukemia incidence rates among men globally. Epidemiological data indicates greater prevalence of certain leukemia types in males. Increased awareness campaigns promote early detection in high-risk populations. Strong clinical management infrastructure supports treatment access. Expansion of oncology services improves patient outcomes. Rising health insurance coverage enhances therapy affordability. Growing adoption of targeted and immunotherapies strengthens segment contribution. Continuous screening initiatives support early diagnosis. Increasing survival rates extend treatment duration. Expansion of specialized cancer centers reinforces therapy uptake. These factors collectively contributed to male segment dominance in 2025.

The Female segment is anticipated to witness the fastest growth at a CAGR of 9.1% from 2026 to 2033, driven by improving diagnostic rates and access to oncology care. Rising awareness about hematologic malignancies accelerates screening participation. Increasing healthcare infrastructure in emerging markets supports access for women. Government-led cancer awareness programs strengthen early detection. Growing insurance coverage enhances affordability. Expansion of telemedicine oncology consultations improves reach. Improved survival outcomes increase long-term treatment adherence. Rising clinical trial participation among female patients further supports innovation. These factors position the female segment for steady growth during the forecast period.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Parenteral, and Others. The Oral segment dominated with a 51.6% share in 2025, driven by the increasing adoption of oral targeted therapies and improved patient convenience. Oral treatments reduce hospital visits, improving cost-effectiveness and patient compliance. Home-based administration models support therapy adherence and reduce healthcare burden. The strong pipeline of oral kinase inhibitors expands available treatment options. Oral formulations are favored for chronic leukemia management due to ease of long-term use. Specialty pharmacies enhance distribution efficiency and patient access. Robust clinical evidence supporting oral regimens strengthens physician confidence. Reimbursement policies increasingly cover oral oncology therapies. Patient preference for non-invasive treatments accelerates adoption. Increased awareness programs encourage early initiation of oral therapy. Continuous innovation in oral drug development further consolidates market leadership. Digital adherence tools and mobile health apps support therapy management. These combined factors ensured dominance of oral administration in 2025.

The Parenteral segment is projected to witness the fastest growth at a CAGR of 10.7% from 2026 to 2033, driven by the rising adoption of injectable biologics and CAR-T therapies. Parenteral administration is preferred for high-potency and targeted immunotherapies requiring hospital-based supervision. Expansion of oncology infusion centers ensures greater access to these therapies. Increasing approvals of monoclonal antibodies and biologics accelerate market uptake. Advanced infusion devices enhance treatment safety and precision. Growth in supportive care programs improves patient tolerance and therapy adherence. Hospitals and specialty clinics are investing in parenteral therapy infrastructure. Combination regimens integrating parenteral agents further drive demand. Expansion of clinical trials for injectable therapies supports innovation. Patient outcomes and remission rates improve with optimized parenteral administration. Telemedicine integration allows monitoring of infusion-based therapies. Growing awareness among oncologists strengthens therapy preference. These drivers collectively propel parenteral administration as the fastest-growing segment.

- By End-Users

On the basis of end-users, the market is segmented into Hospitals, Homecare, Specialty Clinics, and Others. The Hospitals segment dominated with a 47.3% revenue share in 2025, owing to the availability of comprehensive oncology infrastructure and specialized hematology departments. High patient admissions for acute and chronic leukemia contribute to consistent therapy demand. Hospitals possess advanced diagnostic and transplantation facilities supporting complex treatments. Favorable reimbursement structures facilitate procurement of high-cost therapies. Skilled healthcare professionals ensure safe administration of chemotherapy, targeted therapy, and biologics. Hospitals maintain long-term therapy adherence programs. Large-scale treatment volumes enhance revenue generation. Advanced electronic medical record systems improve therapy tracking. Hospitals act as primary sites for clinical trials and early access programs. Strategic collaborations with pharmaceutical companies strengthen drug availability. Continuous investment in oncology departments supports capacity expansion. These factors collectively secured hospitals as the dominant end-user segment in 2025.

The Specialty Clinics segment is expected to witness the fastest growth at a CAGR of 9.9% from 2026 to 2033, driven by rising demand for focused oncology care centers offering personalized treatment approaches. Clinics provide specialized outpatient chemotherapy, immunotherapy, and CAR-T treatments. Expansion of private oncology networks supports patient access to advanced therapies. Personalized medicine programs improve treatment outcomes. Rising awareness of hematologic malignancies encourages early clinic visits. Integration of telemedicine enables remote monitoring of therapy response. Growth in home-based infusion support further strengthens specialty clinic adoption. Increasing investment in clinic infrastructure ensures high-quality care delivery. Clinics offer shorter waiting times and patient-centric services, boosting preference. Partnerships with diagnostic labs enhance treatment planning. These combined drivers position specialty clinics as a rapidly growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy. The Hospital Pharmacy segment accounted for the largest revenue share of 52.4% in 2025, supported by high inpatient volumes for leukemia treatments and stringent regulatory control over oncology drug dispensing. Bulk procurement agreements reduce costs and ensure consistent supply. Hospital pharmacies provide cold-chain management and adherence support for biologics and CAR-T therapies. Centralized distribution ensures timely availability of high-cost targeted therapies. Integration with hospital IT systems enhances inventory tracking and patient management. Long-term partnerships with pharmaceutical companies improve supply stability. Experienced pharmacy staff support safe drug preparation and administration. Hospital pharmacies remain the primary access point for complex and high-risk leukemia therapeutics. Education programs for patients enhance therapy adherence. Strong reimbursement coverage for inpatient therapies supports hospital pharmacy dominance. Clinical trial participation further drives drug availability in hospitals. These factors collectively reinforce hospital pharmacies as the leading distribution channel in 2025.

The Online Pharmacy segment is projected to witness the fastest growth at a CAGR of 10.3% from 2026 to 2033, fueled by rising digital healthcare adoption and growing patient preference for home delivery of specialty medications. Online platforms provide convenience, especially for chronic leukemia patients requiring ongoing therapy. Telepharmacy services enable remote consultation and guidance. Increased internet penetration and e-commerce adoption expand reach to urban and semi-urban areas. Home delivery reduces hospital visits, improving patient convenience. Integration with mobile applications enhances prescription management and adherence tracking. Online pharmacies facilitate access to oral and parenteral therapies. Partnerships with logistics providers ensure secure cold-chain delivery. Patient awareness campaigns boost confidence in online drug purchases. Rising insurance coverage for online orders accelerates adoption. Expansion of subscription-based delivery models strengthens retention. These drivers collectively position online pharmacies as the fastest-growing distribution channel.

Leukemia Therapeutics Market Regional Analysis

- North America dominated the leukemia therapeutics market with the largest revenue share of 41.3% in 2025

- Characterized by advanced oncology infrastructure, strong presence of leading pharmaceutical companies, high healthcare expenditure, favorable reimbursement frameworks

- Rapid adoption of innovative therapies such as CAR-T and next-generation kinase inhibitors

U.S. Leukemia Therapeutics Market Insight

The U.S. leukemia therapeutics market captured the majority of North America’s revenue in 2025, driven by the high prevalence of leukemia, increasing patient awareness, and strong healthcare funding. The rapid adoption of CAR-T therapies, tyrosine kinase inhibitors, and other targeted treatments is significantly contributing to market expansion. Additionally, robust R&D pipelines, active clinical trials, and favorable insurance coverage are enabling faster access to advanced therapies across hospitals, specialty oncology centers, and research institutions.

Europe Leukemia Therapeutics Market Insight

The Europe leukemia therapeutics market is projected to expand at a substantial CAGR during the forecast period, driven by increasing incidence of leukemia, government support for oncology research, and rising adoption of precision therapies. Countries such as Germany, France, and Italy are witnessing significant growth due to advanced healthcare systems, growing clinical trial activities, and well-established pharmaceutical infrastructure that supports the introduction of novel leukemia drugs.

U.K. Leukemia Therapeutics Market Insight

The U.K. leukemia therapeutics market is expected to grow at a noteworthy CAGR, fueled by the adoption of next-generation therapies, increasing public and private healthcare investments, and the country’s robust clinical research network. The rising demand for personalized treatment approaches and improved access to targeted therapies is expected to sustain growth in both public hospitals and private oncology centers.

Germany Leukemia Therapeutics Market Insight

Germany’s leukemia therapeutics market is expected to expand at a considerable CAGR due to well-developed healthcare infrastructure, strong government support for oncology innovation, and increasing patient awareness. The presence of leading pharmaceutical companies and active participation in clinical trials for CAR-T therapies and kinase inhibitors further accelerates market development in the country.

Asia-Pacific Leukemia Therapeutics Market Insight

The Asia-Pacific leukemia therapeutics market region is anticipated to be the fastest-growing market for leukemia therapeutics during the forecast period, with a CAGR Growth is driven by rising leukemia incidence, expanding healthcare infrastructure, growing healthcare expenditure, and increased access to innovative therapies in countries such as China, Japan, India, and South Korea. The region’s emerging biopharma and contract research sectors are also supporting rapid introduction of novel treatment options.

Japan Leukemia Therapeutics Market Insight

Japan’s leukemia therapeutics market is gaining momentum due to high healthcare standards, advanced medical research facilities, and a strong focus on precision medicine. The increasing adoption of CAR-T therapies and targeted drugs, coupled with government initiatives to improve oncology care, is driving growth across hospitals and specialty clinics.

China Leukemia Therapeutics Market Insight

China leukemia therapeutics market accounted for the largest revenue share in Asia-Pacific in 2025, fueled by expanding oncology infrastructure, high patient population, increasing incidence of leukemia, and strong government support for innovative therapies. Rising clinical research activities, growing adoption of targeted therapies, and improved healthcare accessibility are key factors propelling the market in China.

Leukemia Therapeutics Market Share

The Leukemia Therapeutics industry is primarily led by well-established companies, including:

- Novartis (Switzerland)

- Bristol-Myers Squibb (U.S.)

- AbbVie (U.S.)

- Johnson & Johnson (U.S.)

- Gilead Sciences (U.S.)

- Pfizer (U.S.)

- Roche (Switzerland)

- Amgen (U.S.)

- Takeda Pharmaceutical (Japan)

- AstraZeneca (U.K.)

- Sanofi (France)

- Bayer (Germany)

- Jazz Pharmaceuticals (Ireland)

- BeiGene (China)

- Sun Pharmaceutical (India)

- Otsuka Pharmaceutical (Japan)

- Daiichi Sankyo (Japan)

- Incyte Corporation (U.S.)

- Astellas Pharma (Japan)

- Merck & Co. (U.S.)

Latest Developments in Global Leukemia Therapeutics Market

- In August 2023, the FDA granted Phase 3 clinical trial clearance for lisaftoclax, a selective BCL-2 inhibitor, for relapsed or refractory chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL), signaling progress in oral targeted therapies for B-cell malignancies

- In May 2023, the targeted leukemia drug ivosidenib (brand name Tibsovo) received approval in the European Union for certain acute myeloid leukemia (AML) patients with IDH1 mutation, providing a precision therapy option for mutation-specific leukemia cases

- In November 2024, the U.S. FDA approved obecabtagene autoleucel (Aucatzyl), a CD19-directed CAR-T cell immunotherapy for adults with relapsed or refractory B-cell precursor acute lymphoblastic leukemia (r/r ALL), representing a major advancement in personalized cellular therapies for aggressive leukemia

- In April 2025, the UK Medicines and Healthcare products Regulatory Agency (MHRA) granted conditional marketing authorization for obecabtagene autoleucel (Aucatzyl) for treating adult patients with relapsed or refractory B-ALL, paving the way for broader clinical adoption in Europe

- In July 2025, the European Commission approved obecabtagene autoleucel (Aucatzyl) for adult patients aged 26 years and older with relapsed or refractory B-cell precursor acute lymphoblastic leukemia across the EU, marking one of the first CAR-T cell therapies authorized for adult ALL in Europe

- In November 2025, the U.S. FDA approved Komzifti (ziftomenib), a once-daily oral menin inhibitor for adults with relapsed or refractory AML with NPM1 mutation, expanding oral targeted therapy options for challenging AML subtypes

- In January 2025, LYT-200, an investigational leukemia drug targeting acute myeloid leukemia, received Fast Track designation from the U.S. FDA, aimed at accelerating development and review due to high unmet need in AML treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.