Global Liability Insurance Market

Market Size in USD Billion

CAGR :

%

USD

290.45 Billion

USD

462.93 Billion

2024

2032

USD

290.45 Billion

USD

462.93 Billion

2024

2032

| 2025 –2032 | |

| USD 290.45 Billion | |

| USD 462.93 Billion | |

|

|

|

|

Liability Insurance Market Size

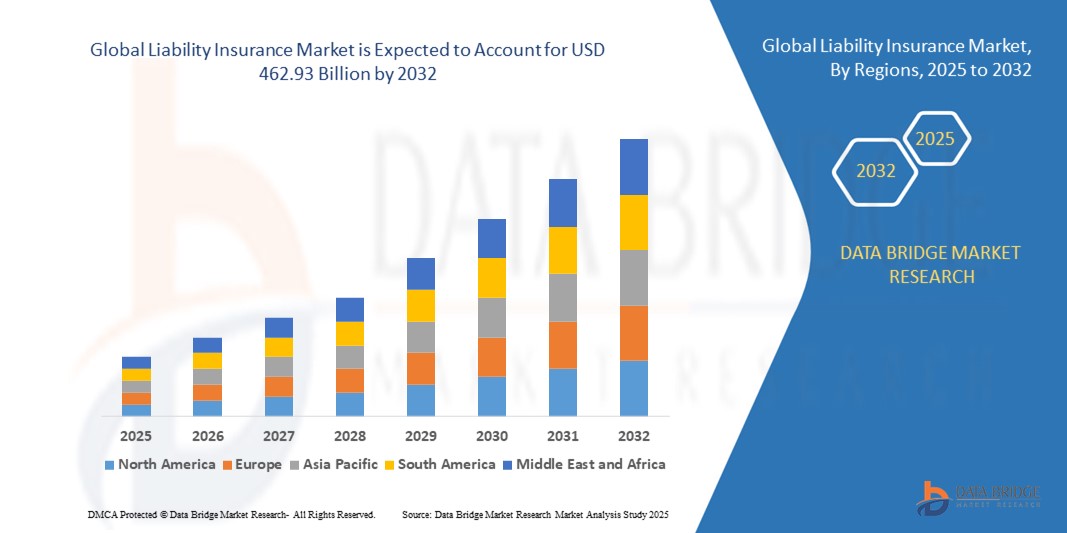

- The global liability insurance market size was valued at USD 290.45 billion in 2024 and is expected to reach USD 462.93 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the rising awareness of financial protection against legal claims, increasing business risks due to globalization, and the surge in litigation cases across industries

- Growing regulatory requirements mandating liability insurance in several sectors are also supporting market expansion

Liability Insurance Market Analysis

- The liability insurance market is witnessing robust growth due to heightened corporate accountability, increasing professional errors and omissions, and the rising frequency of cyberattacks that require coverage

- Small and medium-sized enterprises (SMEs) are emerging as a key growth segment, as they increasingly recognize the importance of liability insurance to safeguard against unforeseen risks

- North America dominated the liability insurance market with the largest revenue share of 38.5% in 2024, driven by high litigation costs, strict regulatory mandates, and strong awareness among corporations regarding risk management

- Asia-Pacific region is expected to witness the highest growth rate in the global liability insurance market, driven by expanding economies, rising demand for professional and cyber liability coverage, and the growing integration of digital insurance platforms

- The General Liability Insurance segment held the largest market revenue share in 2024, supported by its broad coverage of bodily injury, property damage, and personal injury claims. Its wide applicability across industries makes it the foundation of commercial liability protection

Report Scope and Liability Insurance Market Segmentation

|

Attributes |

Liability Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand For Cyber Liability Insurance |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Liability Insurance Market Trends

Growing Adoption Of Digital Platforms And InsurTech Solutions

• The increasing integration of digital technologies in the insurance industry is reshaping liability insurance offerings by enabling faster policy issuance, risk evaluation, and claims processing. Digital-first approaches reduce paperwork and improve customer experience, driving greater adoption

• The surge in InsurTech startups and AI-powered underwriting is helping insurers customize liability coverage based on industry-specific risk profiles. Automation in fraud detection and predictive analytics is further supporting operational efficiency and better risk management

• Cloud-based platforms and mobile applications are making liability insurance more accessible to SMEs and individuals, reducing barriers to entry. This digital reach ensures wider penetration of policies across emerging markets where traditional distribution channels were limited

• For instance, in 2023, multiple insurers in the U.S. and Europe partnered with InsurTech firms to introduce AI-driven liability policies, which helped reduce claim settlement times by nearly 30%. This significantly improved client satisfaction and operational scalability

• While digitization is accelerating innovation in liability insurance, long-term growth depends on maintaining cybersecurity, ensuring regulatory compliance, and enhancing customer trust in digital platforms. Insurers must continue investing in secure and scalable solutions to leverage this opportunity fully.

Liability Insurance Market Dynamics

Driver

Rising Business Risks And Regulatory Mandates Fueling Insurance Uptake

• The global increase in business risks, including lawsuits, cyberattacks, and professional errors, is making liability insurance essential for both corporations and SMEs. Regulatory frameworks in several countries mandate coverage for certain industries, boosting adoption

• Growing awareness among businesses about financial exposure due to litigation and third-party claims is driving steady demand. Firms are realizing that liability coverage is not only about compliance but also about safeguarding profitability and reputation

• Public and private sector initiatives are supporting the expansion of liability insurance through subsidies, awareness programs, and policy incentives. This has strengthened adoption across both developed and developing economies

• For instance, in 2022, the European Union expanded compliance requirements for professional indemnity insurance in financial services, which increased demand for liability policies across multiple member states

• While regulatory support and rising risks drive market expansion, insurers must also ensure affordability, innovative policy designs, and better risk assessment tools to maintain long-term growth momentum

Restraint/Challenge

High Premium Costs And Limited Awareness In Emerging Markets

• The relatively high cost of liability insurance premiums remains a significant barrier, particularly for small enterprises and startups with limited budgets. Many firms in developing economies still consider liability insurance as an added expense rather than a necessity

• Lack of awareness among businesses in rural and semi-urban areas about the importance of liability coverage further limits penetration. This knowledge gap often leads to underinsurance, leaving businesses vulnerable to financial losses

• Infrastructure and distribution challenges in emerging markets also restrict access. Limited presence of specialized insurers and agents in these regions slows down market growth, as businesses rely on traditional insurance products that may not cover liability risks adequately

• For instance, in 2023, reports from Southeast Asia indicated that over 60% of SMEs had little or no liability coverage due to high premium costs and lack of tailored products suitable for their scale of operations

• While product innovation and digital platforms are gradually addressing these challenges, ensuring affordability, targeted awareness campaigns, and localized distribution models remain critical to unlocking the untapped potential in emerging markets

Liability Insurance Market Scope

The market is segmented on the basis of type, application, end-user sector, distribution channel, and policy term.

- By Type

On the basis of type, the liability insurance market is segmented into General Liability Insurance, Professional Liability Insurance, Product Liability Insurance, and Cyber Liability Insurance. The General Liability Insurance segment held the largest market revenue share in 2024, supported by its broad coverage of bodily injury, property damage, and personal injury claims. Its wide applicability across industries makes it the foundation of commercial liability protection.

The Cyber Liability Insurance segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the surge in cyberattacks, data breaches, and growing regulatory compliance requirements for digital security. Increasing digital transformation across businesses is fueling demand for cyber liability policies that provide protection against financial losses arising from cyber risks.

- By Application

On the basis of application, the market is segmented into Commercial, Industrial, and Residential. The Commercial segment dominated the market in 2024, as businesses face continuous exposure to third-party claims and lawsuits, making liability coverage a critical operational requirement.

The Residential segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising homeowner awareness of personal liability coverage and increasing adoption of umbrella liability policies to protect against unexpected legal claims.

- By End-User Sector

On the basis of end-user sector, the market is categorized into Corporate, Small and Medium Enterprises, Self-Employed, Non-Profit Organizations, and Government Entities. The Corporate segment accounted for the largest market share in 2024, due to high-risk exposure in large enterprises and mandatory liability insurance requirements across several regulated industries.

The Small and Medium Enterprises (SMEs) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing awareness of financial risks, increasing litigation cases, and tailored insurance offerings designed specifically for SMEs with cost-effective premium structures.

- By Distribution Channel

On the basis of distribution channel, the liability insurance market is segmented into Direct Sales, Broker, Online Platform, Insurance Agents, and Bancassurance. The Broker segment held the largest market revenue share in 2024, as brokers remain a preferred channel for customized liability solutions and expert guidance in complex risk environments.

The Online Platform segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising adoption of digital insurance platforms, instant policy issuance, and increasing penetration of InsurTech solutions that enhance accessibility and convenience.

- By Policy Term

On the basis of policy term, the market is segmented into Short-term, Medium-term, and Long-term. The Medium-term segment captured the largest market share in 2024, as it balances affordability and adequate coverage, making it the most widely adopted option among businesses of varying scales.

The Long-term segment is expected to witness the fastest growth rate from 2025 to 2032, as enterprises increasingly seek long-term stability in coverage to mitigate recurring risks and secure premium cost advantages over extended durations.

Liability Insurance Market Regional Analysis

• North America dominated the liability insurance market with the largest revenue share of 38.5% in 2024, driven by high litigation costs, strict regulatory mandates, and strong awareness among corporations regarding risk management.

• Businesses in the region rely heavily on liability insurance to mitigate financial exposure arising from lawsuits, product recalls, and professional negligence claims.

• This widespread adoption is further supported by the presence of leading global insurers, advanced digital distribution channels, and a robust legal framework, positioning North America as a mature and highly regulated liability insurance market.

U.S. Liability Insurance Market Insight

The U.S. liability insurance market captured the largest revenue share in 2024 within North America, fueled by the increasing frequency of litigation and the growing complexity of corporate risks. Rising demand for cyber liability coverage, coupled with heightened regulatory scrutiny in financial services, healthcare, and manufacturing sectors, is driving adoption. In addition, the strong presence of InsurTech companies offering AI-driven underwriting and digital claims processing is further enhancing market growth.

Europe Liability Insurance Market Insight

The Europe liability insurance market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stricter compliance standards, the implementation of EU-wide liability regulations, and growing risk awareness among SMEs. The region is witnessing a surge in demand for professional indemnity and product liability insurance, particularly in industries such as pharmaceuticals, automotive, and financial services. Liability coverage is increasingly being integrated into business continuity planning, strengthening its role across commercial sectors.

U.K. Liability Insurance Market Insight

The U.K. liability insurance market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising trend of corporate risk management and the legal environment’s strong emphasis on accountability. Concerns over professional negligence, cyber risks, and workplace safety are encouraging both small businesses and large enterprises to adopt liability policies. Moreover, London’s position as a global insurance hub further supports growth through access to specialized underwriting expertise and diverse liability insurance products.

Germany Liability Insurance Market Insight

The Germany liability insurance market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s well-established industrial base, focus on innovation, and stringent quality and safety standards. The demand for product liability insurance is particularly high among manufacturers, while SMEs are increasingly opting for professional indemnity and cyber liability coverage. Germany’s structured regulatory environment and preference for comprehensive protection continue to accelerate the adoption of liability insurance across corporate and industrial sectors.

Asia-Pacific Liability Insurance Market Insight

The Asia-Pacific liability insurance market is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid industrialization, urbanization, and the expansion of SMEs across the region. Rising awareness of business risks, combined with government initiatives promoting insurance adoption, is fostering growth. Countries such as China, Japan, and India are driving demand for cyber liability and professional indemnity insurance, as digital transformation and cross-border trade expose firms to new risks.

Japan Liability Insurance Market Insight

The Japan liability insurance market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s highly developed corporate sector, increasing digital adoption, and strong emphasis on regulatory compliance. Demand for cyber liability insurance is expanding rapidly as businesses integrate advanced IT systems and IoT-enabled processes. In addition, Japan’s aging population and the need for healthcare-related liability coverage are expected to further drive growth, particularly in medical malpractice and professional indemnity policies.

China Liability Insurance Market Insight

The China liability insurance market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid industrial expansion, a rising middle class, and growing regulatory focus on corporate accountability. Demand is particularly strong in product liability insurance, as China strengthens consumer protection laws and expands its export markets. The government’s push towards financial risk mitigation, coupled with the rise of domestic insurers and InsurTech platforms, is making liability insurance more accessible and affordable to businesses of all sizes.

Liability Insurance Market Share

The Liability Insurance industry is primarily led by well-established companies, including:

- Allianz (Germany)

- AXA SA (France)

- Zurich Insurance Group (Switzerland)

- Chubb Limited (Switzerland)

- American International Group, Inc. (U.S.)

- Berkshire Hathaway Inc. (U.S.)

- Liberty Mutual Insurance Group (U.S.)

- The Travelers Indemnity Company (U.S.)

- Tokio Marine Holdings, Inc. (Japan)

- Munich Re Group (Germany)

Latest Developments in Global Liability Insurance Market

- In January 2024, Zurich Insurance Group launched a new liability insurance product specifically designed for small and medium-sized enterprises (SMEs). This development provides comprehensive coverage across general liability, professional liability, and product liability, enabling SMEs to better safeguard against diverse risk exposures. By addressing the unique needs of smaller businesses, the product enhances financial protection, builds resilience, and is expected to strengthen Zurich’s positioning in the SME insurance segment while driving greater adoption of liability coverage in this market

- In February 2024, Allianz SE introduced a directors and officers (D&O) liability insurance solution aimed at protecting corporate leaders from legal liabilities tied to their managerial responsibilities. The product offers coverage for defense costs, settlements, and judgments in cases involving wrongful acts or fiduciary breaches. This launch not only supports corporate governance and risk management but also expands Allianz’s product portfolio, reinforcing its role as a key player in meeting the evolving liability insurance needs of enterprises globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.