Global Lidar Simulation Market

Market Size in USD Million

CAGR :

%

USD

810.00 Million

USD

4,218.74 Million

2024

2032

USD

810.00 Million

USD

4,218.74 Million

2024

2032

| 2025 –2032 | |

| USD 810.00 Million | |

| USD 4,218.74 Million | |

|

|

|

|

LiDAR Simulation Market Size

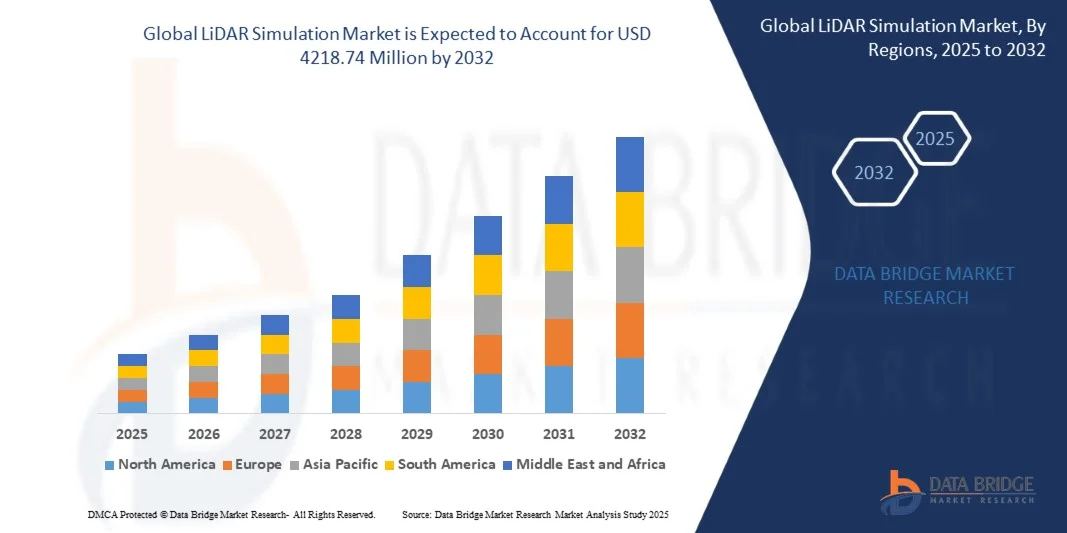

- The global LiDAR simulation market size was valued at USD 810 million in 2024 and is expected to reach USD 4218.74 million by 2032, at a CAGR of 22.91% during the forecast period

- The market growth is largely driven by the increasing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS), which require precise environmental modeling and simulation for safe and efficient navigation

- Furthermore, rising investments in automotive, robotics, and drone applications for testing and validating LiDAR systems are accelerating the demand for LiDAR simulation solutions, significantly boosting market growth

LiDAR Simulation Market Analysis

- LiDAR simulation involves virtual testing and validation of LiDAR sensors using digital environments, enabling manufacturers to assess performance, accuracy, and reliability without extensive physical trials

- The growing need for cost-effective and scalable testing solutions, combined with regulatory requirements for autonomous systems, is fueling the adoption of LiDAR simulation across automotive, robotics, and aerospace sectors

- Europe dominated the LiDAR simulation market in 2024, due to strong investments in autonomous vehicle development, advanced automotive manufacturing, and strict safety regulations requiring rigorous sensor testing

- Asia-Pacific is expected to be the fastest growing region in the LiDAR simulation market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing government support for autonomous and connected vehicle development

- Passenger cars segment dominated the market with a market share of over 90% in 2024, due to widespread integration of LiDAR-based ADAS and autonomous driving technologies in electric and luxury vehicles. Growing consumer preference for safer driving experiences and the rising adoption of semi-autonomous features in mid-range models strengthen this segment’s leadership

Report Scope and LiDAR Simulation Market Segmentation

|

Attributes |

LiDAR Simulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

LiDAR Simulation Market Trends

“Growing Use of LiDAR Simulation in Autonomous Vehicles”

- The LiDAR simulation market is witnessing rapid adoption fueled by the growing use of simulation technologies to support the development and testing of autonomous vehicles. LiDAR simulation helps automakers and technology firms virtually validate sensors and perception systems, reducing time and costs associated with physical testing

- For instance, companies such as dSPACE and Cognata are offering advanced LiDAR simulation platforms for OEMs and autonomous technology developers. Their solutions enable vehicle manufacturers to test different road conditions, lighting scenarios, and obstacle movements virtually, ensuring system accuracy and safety before real-world deployment

- The demand for LiDAR simulation is expanding as autonomous vehicle testing requires billions of driving miles to validate safety and reliability. Simulation environments allow engineers to replicate large-scale driving data and extreme conditions that are difficult or expensive to replicate physically, making virtual testing indispensable

- Integration of LiDAR simulation with artificial intelligence and digital twin platforms is enhancing the precision of autonomous systems, allowing cars to predict, adapt, and make decisions based on real-time environmental complexities. This strengthens the robustness of ADAS and fully autonomous applications

- LiDAR simulation also extends its utility to the design and optimization of LiDAR sensors themselves. Manufacturers can evaluate different sensor placements, scanning angles, and environmental responses virtually, improving performance benchmarks while reducing design iterations

- The growing use of LiDAR simulation in autonomous vehicle development is transforming the market into a core enabler of next-generation transportation. It ensures safety, scalability, and cost efficiency in system testing, positioning simulation as a key pillar of the autonomous mobility ecosystem globally

LiDAR Simulation Market Dynamics

Driver

“Adoption of ADAS and Autonomous Technologies”

- The rising adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies is a primary driver for LiDAR simulation. As vehicles increasingly integrate sensors for collision avoidance, lane guidance, and automated navigation, simulation platforms are becoming central to validating performance and reliability

- For instance, IPG Automotive provides Virtual Test Drive (VTD) software that integrates LiDAR simulation for testing ADAS features in realistic traffic scenarios. Collaborations with automotive OEMs underline how simulation is helping reduce dependence on costly and time-consuming real-world testing

- Developments in semi-autonomous and fully autonomous vehicles require sophisticated perception and situational awareness capabilities. LiDAR simulation allows comprehensive testing of object detection, classification, and tracking models under thousands of virtual scenarios, ensuring accuracy and safety standards are met

- Simulation platforms also enable performance validation under diverse geographic and weather conditions such as fog, heavy rain, or night driving. By replicating these situations, developers can refine sensor algorithms without exposing physical vehicles to unsafe environments

- The global momentum toward connected, automated, and intelligent mobility ensures that LiDAR simulation will remain a critical tool in the design, testing, and validation of next-generation ADAS and autonomous driving systems, reinforcing its role in automotive innovation

Restraint/Challenge

“High Cost and Complexity of Simulation Models”

- A significant challenge in the LiDAR simulation market lies in the high cost and complexity associated with developing and maintaining advanced simulation models. Creating realistic virtual environments requires significant computational power, extensive datasets, and specialized expertise, which increases adoption barriers

- For instance, smaller autonomous technology start-ups often face high licensing and infrastructure costs when adopting simulation platforms from providers such as Cognata or dSPACE. These financial pressures limit accessibility for smaller firms compared to large automotive OEMs with greater resources

- The technical complexity of accurately replicating diverse real-world environments, dynamic traffic behaviors, and sensor-material interactions makes simulation development resource-intensive. Any inaccuracies in simulation models can compromise system validation and delay commercialization of autonomous vehicles

- Integration challenges also arise when expanding simulation across different testing platforms, requiring compatibility with varied hardware and software ecosystems. This adds complexity to deployment and increases costs for developers working on multi-sensor autonomous platforms

- To overcome these hurdles, vendors are investing in scalable, cloud-based simulation solutions and modular model libraries that reduce time and cost burdens. Simplifying simulation access and lowering costs will be vital for enabling broader participation and faster innovation cycles in the LiDAR simulation market

LiDAR Simulation Market Scope

The market is segmented on the basis of level of autonomy, laser wavelength, LiDAR type, method, application, and vehicle type.

- By Level of Autonomy

On the basis of level of autonomy, the LiDAR simulation market is segmented into Level 2/2.5, Level 3, and Level 4/5. The Level 2/2.5 segment dominated the largest market revenue share in 2024, supported by the widespread implementation of advanced driver-assistance systems (ADAS) in mid-range vehicles. Automakers increasingly deploy Level 2/2.5 systems for features such as adaptive cruise control, lane-keeping assistance, and automated braking, which require precise LiDAR simulation for validation and testing. Growing demand for safer semi-autonomous driving and the relatively lower cost of integrating these technologies compared to higher autonomy levels strengthen this segment’s leadership.

The Level 4/5 segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by accelerating development of fully autonomous vehicles and robotaxis. Automakers and technology companies are heavily investing in high-fidelity LiDAR simulation to accurately replicate complex driving environments, reduce road-testing costs, and meet regulatory safety standards. Rising pilot programs for driverless mobility services and expanding partnerships between LiDAR vendors and autonomous vehicle developers further boost the adoption of LiDAR simulation in this category.

- By Laser Wavelength

On the basis of laser wavelength, the LiDAR simulation market is segmented into Short Wave Infrared (SWIR) and Long Wave Infrared (LWIR). The SWIR segment accounted for the largest revenue share in 2024 due to its superior ability to penetrate fog, dust, and low-light conditions, enabling highly accurate detection of distant objects. Automotive OEMs prefer SWIR LiDAR simulations to optimize performance in adverse weather, improve detection accuracy, and enhance safety in semi-autonomous systems. Its compatibility with advanced 3D mapping and cost-effective sensor integration also strengthens its market leadership.

The LWIR segment is expected to witness the fastest growth from 2025 to 2032, supported by rising interest in thermal imaging capabilities that improve obstacle detection in extreme environmental conditions. LWIR-based LiDAR simulation is increasingly used for night vision and pedestrian identification, particularly in next-generation autonomous driving systems. Continuous technological advancements to improve wavelength sensitivity and reduce production costs further drive the segment’s adoption.

- By LiDAR Type

On the basis of LiDAR type, the market is segmented into Mechanical LiDAR and Solid-State LiDAR. The Mechanical LiDAR segment dominated the market in 2024 owing to its established use in high-resolution mapping and reliable 360-degree coverage for autonomous vehicle testing. Mechanical LiDAR simulation provides superior accuracy for long-range detection and object classification, making it indispensable for R&D and validation in early-stage autonomous driving projects. Strong demand from automotive and robotics sectors reinforces its market position despite its relatively higher cost and complexity.

The Solid-State LiDAR segment is projected to register the fastest growth during 2025–2032, fueled by its compact design, improved durability, and lower production costs. Solid-state LiDAR simulation is gaining traction for scalable deployment in consumer vehicles, where mass production and cost efficiency are critical. The technology’s compatibility with next-generation autonomous platforms and its potential for seamless integration into vehicle architecture drive rapid adoption.

- By Method

On the basis of method, the LiDAR simulation market is segmented into Testing Methods and Simulation Methods. The Simulation Methods segment held the largest market revenue share in 2024, driven by the growing need to reduce the time and expense associated with physical road testing. Automakers and technology developers increasingly rely on virtual simulation to model diverse driving environments, accelerate product validation, and comply with regulatory requirements. The ability to replicate complex traffic scenarios and weather conditions further strengthens this segment’s dominance.

The Testing Methods segment is forecast to grow at the fastest rate from 2025 to 2032, supported by rising demand for real-world validation to complement virtual simulations. Automotive companies continue to invest in physical testing to ensure safety compliance and performance reliability in advanced autonomous systems. Increasing hybrid testing approaches, combining simulation with live road trials, will further boost growth in this category.

- By Application

On the basis of application, the LiDAR simulation market is segmented into Intelligent Parking Assist, Night Vision, Traffic Jam Assist, and Road Mapping and Localization. The Road Mapping and Localization segment accounted for the largest revenue share in 2024, driven by its critical role in enabling accurate 3D mapping and real-time navigation for autonomous vehicles. LiDAR simulation for mapping applications helps developers validate sensor performance in diverse terrains and complex traffic conditions, ensuring high-precision localization. Expanding investments in smart city infrastructure and autonomous fleet deployment support the segment’s growth.

The Night Vision segment is anticipated to witness the fastest growth from 2025 to 2032, propelled by rising demand for enhanced safety during low-light driving conditions. LiDAR simulation enables effective modeling of pedestrian detection and object recognition at night, improving autonomous system performance. Growing adoption of night vision solutions by premium automakers and advancements in low-light LiDAR sensors further fuel this segment’s expansion.

- By Vehicle Type

On the basis of vehicle type, the LiDAR simulation market is segmented into Passenger Cars and Commercial Vehicles. The Passenger Cars segment dominated the largest market revenue share of over 90% in 2024 due to widespread integration of LiDAR-based ADAS and autonomous driving technologies in electric and luxury vehicles. Growing consumer preference for safer driving experiences and the rising adoption of semi-autonomous features in mid-range models strengthen this segment’s leadership.

The Commercial Vehicles segment is projected to grow at the fastest rate during 2025–2032, driven by increasing use of autonomous trucks, delivery vehicles, and robotaxis. LiDAR simulation for commercial fleets enables efficient testing of advanced navigation systems, improved route optimization, and enhanced operational safety. The rapid expansion of e-commerce and logistics industries further accelerates demand for LiDAR simulation in this category.

LiDAR Simulation Market Regional Analysis

- Europe dominated the LiDAR simulation market with the largest revenue share in 2024, driven by strong investments in autonomous vehicle development, advanced automotive manufacturing, and strict safety regulations requiring rigorous sensor testing

- The region’s leadership is reinforced by well-established automotive giants, robust R&D infrastructure, and government initiatives promoting sustainable transportation and next-generation mobility technologies

- Increasing collaborations between automakers, LiDAR suppliers, and simulation software developers, along with a growing emphasis on reducing road-testing costs through virtual validation, further strengthen Europe’s market position

Germany LiDAR Simulation Market Insight

The Germany LiDAR simulation market captured a dominant share within Europe in 2024, supported by the country’s robust automotive sector and its emphasis on technological innovation. Leading German carmakers and research institutions are heavily investing in high-fidelity simulation platforms to reduce the cost and time associated with physical road testing. Germany’s engineering expertise, commitment to precision, and strong regulatory framework aimed at ensuring safety and quality continue to drive widespread adoption of LiDAR simulation for autonomous and semi-autonomous vehicle development.

U.K. LiDAR Simulation Market Insight

The U.K. LiDAR simulation market is projected to grow at a notable CAGR during the forecast period, fueled by extensive government-backed autonomous vehicle trials and rising interest in connected mobility solutions. The country’s thriving technology ecosystem, combined with its proactive approach to developing smart transportation infrastructure, has created a favorable environment for partnerships between simulation providers, automotive manufacturers, and software developers. The focus on cost-efficient virtual testing to support early commercialization of self-driving technologies further accelerates market growth in the U.K.

North America LiDAR Simulation Market Insight

North America held a significant revenue share in the LiDAR simulation market in 2024, driven by early adoption of autonomous driving technologies, strong R&D investments, and the presence of leading simulation and sensor technology companies. Automakers and technology firms in the region are increasingly leveraging LiDAR simulation to validate complex driving scenarios, reduce reliance on expensive real-world testing, and meet evolving regulatory safety standards. Continuous advancements in AI-driven modeling and government initiatives supporting intelligent transportation systems further bolster regional growth.

U.S. LiDAR Simulation Market Insight

The U.S. LiDAR simulation market captured the largest share in North America in 2024, supported by a high concentration of autonomous vehicle programs, strong venture capital investments, and the rapid adoption of next-generation testing tools. Major automotive companies and startups are increasingly utilizing LiDAR simulation to enhance the safety, reliability, and scalability of autonomous driving platforms. The country’s supportive regulatory landscape, combined with its strong culture of technological innovation, ensures sustained market expansion over the coming years.

Asia-Pacific LiDAR Simulation Market Insight

The Asia-Pacific LiDAR simulation market is anticipated to grow at the fastest CAGR during the forecast period, fueled by rapid urbanization, rising disposable incomes, and increasing government support for autonomous and connected vehicle development. Countries such as China, Japan, and South Korea are investing heavily in smart transportation initiatives, advanced LiDAR sensor technologies, and simulation platforms to reduce development cycles and accelerate commercialization of self-driving vehicles. Expanding smart city projects and the availability of cost-effective simulation solutions further stimulate market demand across the region.

China LiDAR Simulation Market Insight

The China LiDAR simulation market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s extensive autonomous vehicle programs, strong manufacturing capabilities, and rapid adoption of advanced mobility solutions. Domestic automotive companies are partnering with global simulation providers to create highly accurate virtual testing environments, reducing dependence on time-consuming physical trials. Government-backed smart city initiatives and significant investments in AI-based modeling technologies further drive market growth.

Japan LiDAR Simulation Market Insight

The Japan LiDAR simulation market is witnessing steady growth as the country focuses on integrating advanced sensor technologies into next-generation mobility platforms. Japan’s strong emphasis on safety, precision engineering, and high-tech innovation supports the increasing adoption of simulation tools for validating autonomous driving systems. Growing collaborations between automotive OEMs, research institutes, and software developers, coupled with government support for intelligent transportation infrastructure, continue to enhance the market outlook.

LiDAR Simulation Market Share

The LiDAR simulation industry is primarily led by well-established companies, including:

- Dekra (Germany)

- AVL (Austria)

- Valeo (France)

- RoboSense (China)

- Luminar Technologies (U.S.)

- Vector Informak GmbH (Germany)

- Applied Intuition (U.S.)

- Cognata (Israel)

- dSpace GmbH (Germany)

- IPG Automotive GmbH (Germany)

- Hesai Technology (China)

- XenomatiX (Belgium)

- Cepton, Inc. (U.S.)

- Innoviz Technologies (Israel)

- Quanergy Solution, Inc. (U.S.)

Latest Developments in LiDAR Simulation Market

- In May 2025, DEKRA expanded its global testing infrastructure by opening a state-of-the-art Automotive Testing Centre in Michigan, U.S., significantly enhancing the market’s capacity for advanced validation of autonomous driving technologies. This facility strengthens industry confidence in LiDAR simulation by offering comprehensive capabilities for testing, certifying, and validating LiDAR and other critical sensor systems, helping automakers accelerate the deployment of future mobility solutions while ensuring compliance with evolving safety standards

- In March 2025, AVL launched its upgraded simulation software, AVL SiL Suite, introducing advanced features and improvements based on customer feedback to address evolving testing challenges. By supporting software-in-the-loop (SiL), hardware-in-the-loop (HiL), and virtual testing environments, the new suite elevates LiDAR simulation efficiency, enabling OEMs and technology developers to achieve faster, more accurate validation of sensors and perception systems, thereby driving broader adoption of simulation-based development

- In July 2024, AVL acquired a 70% stake in FIFTY2 Technology, the developer of the particle-based flow simulation tool PreonLab, reinforcing its simulation ecosystem. This acquisition empowers AVL to offer more sophisticated and cost-effective virtual testing capabilities, including complex environmental modeling critical for LiDAR system validation, thus expanding the market’s potential for high-fidelity sensor testing across diverse automotive applications

- In May 2024, Valeo and Applied Intuition partnered to co-develop a digital twin simulation platform centered on Valeo’s SCALA 3 LiDAR and related sensor technologies, strengthening the integration of AI-driven simulation in autonomous driving. The platform enables highly accurate sensor and environment modeling for ADAS applications and supports both SiL and HiL testing, allowing OEMs to validate perception algorithms under diverse real-world and virtual scenarios, accelerating innovation in LiDAR-based mobility solutions

- In February 2024, dSPACE introduced a next-generation sensor simulation platform specifically tailored for LiDAR testing, providing enhanced real-time data processing and high-resolution environmental modeling. This launch expands the market by enabling automakers and technology firms to conduct more precise and scalable virtual validation of LiDAR systems, reducing the time and cost associated with physical testing while supporting the development of safer autonomous vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.