Global Life Sciences Business Processing Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

463.50 Billion

USD

831.57 Billion

2025

2033

USD

463.50 Billion

USD

831.57 Billion

2025

2033

| 2026 –2033 | |

| USD 463.50 Billion | |

| USD 831.57 Billion | |

|

|

|

|

Life Sciences Business Processing Outsourcing Market Size

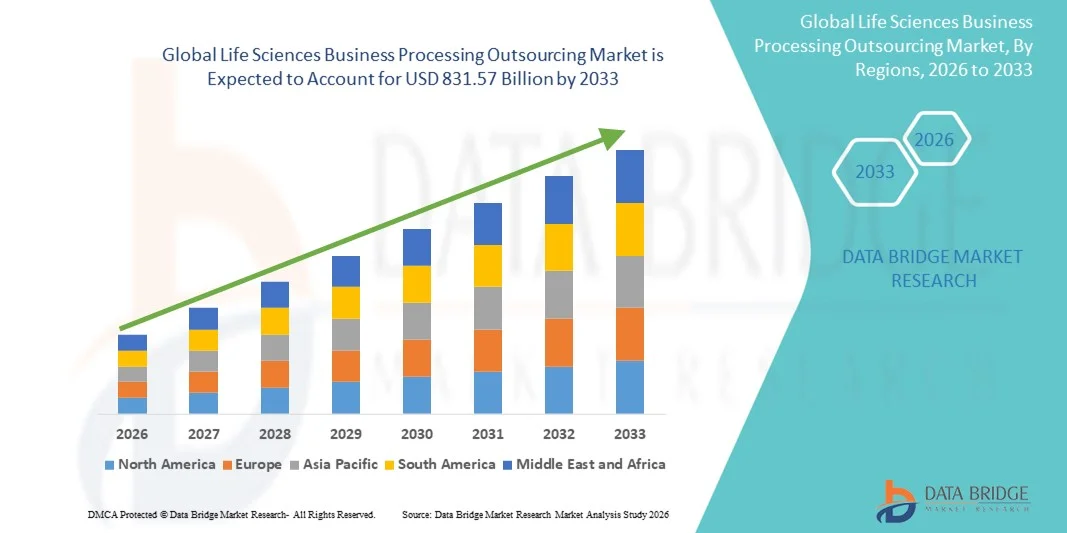

- The global life sciences business processing outsourcing market size was valued at USD 463.5 billion in 2025 and is expected to reach USD 831.57 billion by 2033, at a CAGR of 7.58% during the forecast period

- The market growth is largely fueled by the increasing outsourcing of critical business processes within the life sciences sector, driven by the need to optimize operational efficiency, reduce costs, and enhance focus on core research and development activities

- Furthermore, rising demand for specialized expertise, regulatory compliance support, and digital transformation in pharmaceutical, biotechnology, and medical device companies is accelerating the uptake of Life Sciences Business Processing Outsourcing solutions, thereby significantly boosting the industry's growth

Life Sciences Business Processing Outsourcing Market Analysis

- Life Sciences Business Processing Outsourcing services, encompassing functions such as regulatory affairs, pharmacovigilance, clinical data management, and medical writing, are increasingly vital components for pharmaceutical, biotechnology, and medical device companies due to their ability to enhance operational efficiency, ensure regulatory compliance, and accelerate time-to-market

- The escalating demand for these outsourcing services is primarily fueled by the growing complexity of life sciences regulations, rising R&D expenditures, and a need for cost-effective and specialized expertise

- North America dominated the life sciences business processing outsourcing market with the largest revenue share of 42.5% in 2025, driven by the presence of major pharmaceutical companies, advanced healthcare infrastructure, and a high adoption of outsourcing solutions for regulatory and clinical operations

- Asia-Pacific is expected to be the fastest growing region in the Life Sciences Business Processing Outsourcing market during the forecast period, with a projected CAGR of 12.8%, due to increasing investments in biotechnology, expansion of clinical trials, and a growing focus on cost optimization in emerging economies such as India and China

- The Clinical Trials segment accounted for the largest market revenue share of 48.3% in 2025, driven by the growing volume of outsourced Phase I–IV trials and increasing drug development pipelines globally

Report Scope and Life Sciences Business Processing Outsourcing Market Segmentation

|

Attributes |

Life Sciences Business Processing Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• IQVIA (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Life Sciences Business Processing Outsourcing Market Trends

Rising Demand for Cost-Efficient and Specialized Outsourcing Services

- A significant and accelerating trend in the global Life Sciences Business Processing Outsourcing market is the increasing demand for specialized, cost-efficient services that streamline clinical, regulatory, and administrative workflows for pharmaceutical, biotechnology, and medical device companies

- For instance, in 2024, leading CROs and BPO providers expanded services in regulatory document management and pharmacovigilance support to cater to growing clinical trial complexities and compliance requirements. This demonstrates the rising preference for outsourcing non-core yet critical business processes to reduce operational burden

- Organizations are increasingly adopting multi-functional outsourcing solutions covering clinical data management, regulatory submissions, medical writing, and drug safety monitoring to enhance operational efficiency and scalability

- The trend toward digital transformation in life sciences, including automation of routine tasks and integration of cloud-based platforms, is further driving the adoption of BPO services

- Pharmaceutical companies, especially mid-size and emerging biotech firms, are outsourcing complex processes to reduce overhead costs, meet stringent regulatory standards, and focus on core R&D activities

- The rising prevalence of global clinical trials, expansion of specialty therapeutics, and increasing regulatory compliance requirements are reinforcing the need for reliable and flexible BPO solutions

Life Sciences Business Processing Outsourcing Market Dynamics

Driver

Increasing R&D Complexity and Cost Pressures

- The growing complexity of clinical trials and the high cost of in-house processing are major drivers of the Life Sciences BPO market. Outsourcing enables companies to access specialized expertise while optimizing operational costs

- For instance, in March 2025, a major pharmaceutical company outsourced pharmacovigilance and clinical data management functions to a leading BPO provider, significantly reducing operational expenditures and improving trial turnaround time

- Life sciences companies benefit from scalable and flexible outsourcing solutions that adapt to fluctuating workloads and trial demands

- The rise in global trials, expansion into emerging markets, and increased focus on regulatory compliance have further accelerated the adoption of BPO services

- Outsourcing helps firms access global talent, maintain data quality, and ensure adherence to local and international regulatory requirements, improving efficiency and productivity

Restraint/Challenge

Data Security Concerns and Regulatory Complexity

- Despite strong growth prospects, the Life Sciences BPO market faces challenges related to data confidentiality, intellectual property protection, and compliance with complex global regulation

- For instance, in 2024, several mid-size biotech companies reported concerns over outsourcing sensitive clinical data to third-party providers due to potential breaches or non-compliance risks

- Regulatory variations across regions, especially in Europe, the U.S., and emerging markets, make compliance management a critical concern for outsourcing partnerships

- High initial costs for implementing secure IT infrastructure, training, and quality control mechanisms can also hinder adoption among smaller firms

- In addition, inconsistent service quality or delays from outsourcing partners may impact trial timelines and regulatory submissions, potentially affecting overall productivity

- Addressing these challenges through robust data protection measures, transparent contractual agreements, and adherence to international regulatory standards is essential for sustained market growth in the Life Sciences BPO sector

Life Sciences Business Processing Outsourcing Market Scope

The market is segmented on the basis of service type, application, and technology.

- By Service Type

On the basis of service type, the Global Life Sciences BPO market is segmented into Contract Manufacturing Organizations (CMOs), Contract Research Organizations (CROs), Contract Sales and Marketing Organizations (CSMOs), and Others. The Contract Research Organizations (CROs) segment dominated the largest market revenue share of 44.7% in 2025, driven by the increasing outsourcing of clinical trials, preclinical studies, and regulatory compliance services by pharmaceutical and biotechnology companies. CROs offer specialized expertise, infrastructure, and global reach, reducing costs and accelerating time-to-market for drugs and therapies. The segment benefits from strong demand across developed markets, where regulatory requirements are stringent. Increasing prevalence of complex therapies, biologics, and specialty drugs further fuels CRO adoption. Their ability to handle multi-site trials, data management, and patient recruitment efficiently makes them indispensable for pharmaceutical development. Strategic collaborations and mergers strengthen market presence. The combination of cost efficiency, speed, and quality ensures CROs remain the dominant service type globally.

The Contract Manufacturing Organizations (CMOs) segment is expected to witness the fastest CAGR of 8.6% from 2026 to 2033, driven by rising demand for outsourced drug manufacturing, including sterile injectables, biologics, and small molecules. Pharmaceutical companies are increasingly focusing on core competencies while outsourcing production. CMOs offer flexible production capacity, regulatory compliance support, and cost efficiency. Expanding contract manufacturing in emerging markets further accelerates growth. Increasing demand for personalized medicine and complex formulations fuels CMO adoption. Technological advancements in high-throughput and automated manufacturing enhance productivity. These factors are expected to drive robust expansion of the CMO segment globally.

- By Application

On the basis of application, the Global Life Sciences BPO market is segmented into Clinical Trials, Patient-Centric Services, R&D Activities, and Digital Era Services. The Clinical Trials segment accounted for the largest market revenue share of 48.3% in 2025, driven by the growing volume of outsourced Phase I–IV trials and increasing drug development pipelines globally. Life sciences companies rely on BPO providers for trial design, patient recruitment, monitoring, and data management. Rising prevalence of chronic diseases and specialty therapies contributes to higher outsourcing. Stringent regulatory requirements and need for multi-country trial management further increase reliance on BPO providers. Cost efficiency, faster study completion, and access to global patient pools enhance CRO engagement. Strategic partnerships and advanced trial management software strengthen capabilities. These factors position clinical trials as the leading application segment.

The Patient-Centric Services segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by rising demand for personalized patient support programs, telemedicine, remote monitoring, and patient engagement solutions. Digital patient services improve adherence, outcomes, and data collection. Pharma and biotech companies increasingly outsource patient-centric services to enhance experience and reduce operational burden. Integration of AI-powered analytics and mobile platforms strengthens service effectiveness. Increasing regulatory encouragement for patient-centric approaches accelerates adoption. Growing awareness among patients and healthcare providers further boosts demand. These factors make patient-centric services the fastest-growing application segment globally.

- By Technology

On the basis of technology, the Global Life Sciences BPO market is segmented into Artificial Intelligence (AI) and Machine Learning (ML), and Others. The AI and Machine Learning segment dominated the largest market revenue share of 39.5% in 2025, driven by the adoption of advanced data analytics, predictive modeling, and process automation across outsourced BPO services. AI/ML tools are increasingly used for clinical trial data analysis, patient recruitment, adverse event prediction, and regulatory submissions. The ability to process large datasets efficiently reduces costs and accelerates decision-making. Pharma companies prefer BPO providers with AI/ML capabilities for enhanced quality and productivity. Regulatory compliance and real-world evidence generation further fuel adoption. Integration with cloud platforms and digital tools strengthens operational efficiency. As a result, AI/ML leads technology adoption in the market.

The Others segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, driven by emerging technologies such as robotic process automation, blockchain, and cloud-based platforms. These technologies streamline workflow, improve data integrity, and enhance collaboration across global BPO operations. Increased digital transformation initiatives by life sciences companies support adoption. Startups and niche BPO providers are leveraging these technologies for competitive advantage. Growing demand for secure, efficient, and scalable outsourcing solutions accelerates deployment. Continuous innovation and reduced operational costs further boost market penetration. These factors are expected to drive rapid growth of the Others segment globally.

Life Sciences Business Processing Outsourcing Market Regional Analysis

- The North America Life Sciences business processing outsourcing market dominated with the largest revenue share of 42.5% in 2025

- Driven by the presence of major pharmaceutical companies, advanced healthcare infrastructure, and a high adoption of outsourcing solutions for regulatory, clinical, and pharmacovigilance operations

- The market, in particular, accounted for the majority of regional demand due to increasing outsourcing of clinical trials, regulatory affairs, and medical writing services by global pharmaceutical and biotech firms

U.S. Life Sciences Business Processing Outsourcing Market Insight

The U.S. business processing outsourcing market captured the largest revenue share within North America in 2025, fueled by well-established clinical research organizations (CROs), increasing regulatory complexities, and the growing need for cost optimization in clinical development and drug lifecycle management. In addition, rising adoption of digital BPO solutions, advanced analytics, and AI-enabled platforms is further propelling the market’s expansion.

Europe Life Sciences Business Processing Outsourcing Market Insight

The Europe business processing outsourcing market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing adoption of outsourcing services by pharmaceutical and biotechnology companies for clinical, regulatory, and pharmacovigilance operations. Germany, the U.K., and France are leading contributors due to their mature healthcare infrastructure, strong pharmaceutical sector, and the presence of key service providers offering specialized outsourcing solutions.

U.K. Life Sciences Business Processing Outsourcing Market Insight

The U.K. business processing outsourcing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing clinical trial outsourcing, regulatory compliance requirements, and growing investments in biotech and life sciences research. In addition, the country’s robust CRO and clinical data management ecosystem supports the growth of BPO services.

Germany Life Sciences Business Processing Outsourcing Market Insight

Germany’s business processing outsourcing market is expected to expand at a considerable CAGR during the forecast period, supported by increasing adoption of outsourcing in clinical trials, regulatory operations, and medical writing. The country’s focus on innovation, strong pharmaceutical sector, and stringent regulatory frameworks are driving demand for specialized BPO services.

Asia-Pacific Life Sciences Business Processing Outsourcing Market Insight

The Asia-Pacific business processing outsourcing market is poised to grow at the fastest CAGR of 12.8% during the forecast period, driven by increasing investments in biotechnology, expanding clinical trial activities, and a growing focus on cost optimization in emerging economies such as India and China. Rising demand for contract research, regulatory, and data management services, along with government initiatives supporting life sciences outsourcing, is significantly contributing to market growth.

Japan Life Sciences Business Processing Outsourcing Market Insight

Japan’s business processing outsourcing market is gaining momentum due to a strong pharmaceutical and biotechnology industry, increasing adoption of outsourced clinical trial and regulatory services, and growing emphasis on efficiency and compliance in drug development processes. The integration of digital platforms for clinical data management is further supporting market expansion.

China Life Sciences Business Processing Outsourcing Market Insight

China business processing outsourcing market accounted for the largest revenue share in the Asia-Pacific region in 2025, attributed to rapid growth in clinical research, biotech investments, and high adoption of outsourcing services by domestic and international pharmaceutical companies. The increasing number of CROs, regulatory reforms, and cost-efficient BPO solutions are key factors propelling market growth in the country.

Life Sciences Business Processing Outsourcing Market Share

The Life Sciences Business Processing Outsourcing industry is primarily led by well-established companies, including:

• IQVIA (U.S.)

• Parexel International (U.S.)

• Syneos Health (U.S.)

• ICON plc (Ireland)

• Labcorp Drug Development (U.S.)

• PPD, Inc. (U.S.)

• Charles River Laboratories (U.S.)

• WuXi AppTec (China)

• Covance Inc. (U.S.)

• Medpace Holdings (U.S.)

• Pharmaron (China)

• Thermo Fisher Scientific (U.S.)

• Accenture Life Sciences (Ireland)

• Genpact Life Sciences (U.S.)

• Infosys Life Sciences Services (India)

• Cognizant Life Sciences (U.S.)

Latest Developments in Global Life Sciences Business Processing Outsourcing Market

- In December 2021, IQVIA, a leading provider of clinical research and life sciences BPO services, was recognized by IDC as a leader in worldwide life sciences sales and marketing outsourcing. This recognition highlighted IQVIA’s strong capabilities in commercial operations outsourcing, advanced analytics, and regulatory support services for pharmaceutical and biotechnology companies

- In March 2022, Accenture plc expanded its life sciences BPO capabilities by strengthening its intelligent operations portfolio, integrating cloud, automation, and analytics to support pharmaceutical clients across regulatory affairs, clinical operations, and supply chain management. This development reflected the growing shift toward digitally enabled outsourcing models

- In June 2023, Cognizant Technology Solutions announced the expansion of its life sciences business process outsourcing services with enhanced digital solutions focused on clinical trial management, pharmacovigilance, and regulatory submissions. The initiative aimed to help life sciences companies accelerate drug development timelines and improve compliance efficiency

- In September 2023, Wipro Limited launched upgraded life sciences BPO offerings incorporating AI-driven data management and automation tools to support R&D operations, medical writing, and regulatory documentation. This launch underscored the industry’s increasing reliance on advanced technologies within outsourced life sciences workflows

- In May 2024, Accenture introduced an AI-powered life sciences BPO platform designed to optimize clinical operations, regulatory compliance, and patient data management. The platform leveraged generative AI and cloud-based analytics to enhance productivity and reduce operational costs for pharmaceutical and biotechnology clients

- In October 2024, Cognizant entered into a strategic partnership with a global pharmaceutical company to deliver end-to-end digital life sciences BPO services, focusing on R&D productivity, real-world evidence generation, and regulatory process optimization. This partnership highlighted the rising demand for integrated, technology-driven outsourcing solutions

- In January 2025, Indian life sciences BPO providers reported a significant increase in outsourcing contracts from global pharmaceutical companies, driven by cost efficiency, skilled talent availability, and expanding clinical trial activity. This development reinforced Asia-Pacific’s growing role as a key outsourcing hub for life sciences operation

- In April 2025, a leading global contract research organization (CRO) launched a digital regulatory submission and lifecycle management platform covering multiple international markets. The platform enabled faster regulatory filings and improved compliance tracking, reflecting the continued evolution of high-value, technology-enabled life sciences BPO services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.