Global Light Attack And Reconnaissance Aircraft Market

Market Size in USD Billion

CAGR :

%

USD

1.62 Billion

USD

2.21 Billion

2024

2032

USD

1.62 Billion

USD

2.21 Billion

2024

2032

| 2025 –2032 | |

| USD 1.62 Billion | |

| USD 2.21 Billion | |

|

|

|

|

Light Attack and Reconnaissance Aircraft Market Size

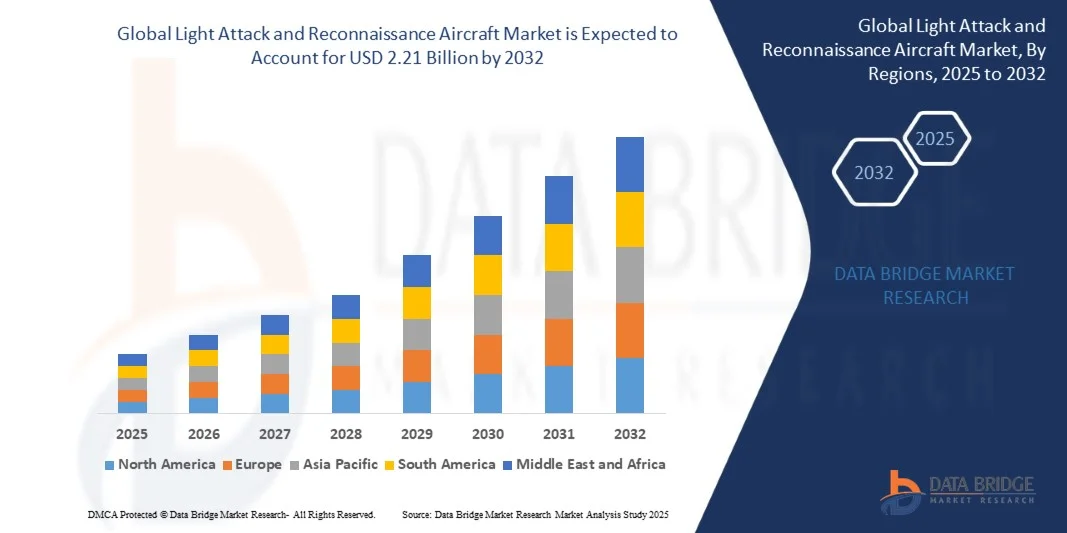

- The global light attack and reconnaissance aircraft market size was valued at USD 1.62 billion in 2024 and is expected to reach USD 2.21 billion by 2032, at a CAGR of 3.99% during the forecast period

- The market growth is largely fueled by increasing defense budgets, modernization of air fleets, and the rising need for advanced surveillance and tactical strike capabilities in both national defense and conflict scenarios

- Furthermore, growing demand for multi-role, cost-effective, and versatile aircraft capable of reconnaissance, light attack, and rapid deployment is driving procurement. These converging factors are accelerating the adoption of light attack and reconnaissance aircraft, thereby significantly boosting the industry’s growth

Light Attack and Reconnaissance Aircraft Market Analysis

- Light attack and reconnaissance aircraft are specialized platforms designed for intelligence gathering, border surveillance, and precision strike missions. They include both fixed-wing and rotary-wing configurations, often integrated with advanced avionics, sensors, and light armaments to support multi-role operations in diverse terrains and combat environments

- The escalating demand for these aircraft is primarily fueled by rising geopolitical tensions, the need for agile and flexible aerial assets, modernization programs across global defense forces, and a preference for cost-efficient alternatives to high-end fighter jets for tactical missions

- North America dominated the light attack and reconnaissance aircraft market with a share of over 40% in 2024, due to increasing defense budgets, modernization of air fleets, and the strategic emphasis on advanced surveillance and tactical strike capabilities

- Asia-Pacific is expected to be the fastest growing region in the light attack and reconnaissance aircraft market during the forecast period due to increasing defense budgets, regional security concerns, and rapid modernization of air forces in countries such as India, Japan, and South Korea

- National defense segment dominated the market with a market share of 68.8% in 2024, due to continuous investments in strengthening military surveillance, border patrol, and tactical defense capabilities. Defense forces globally prioritize aircraft equipped with advanced sensors, reconnaissance systems, and light attack capabilities to maintain operational readiness and strategic advantage. Increasing geopolitical tensions and the need for rapid intelligence gathering further drive procurement in this segment. Integration with modern command-and-control systems enhances the operational efficiency of these aircraft in national defense missions. The consistent modernization of air fleets ensures sustained demand for both fixed-wing and rotary-wing platforms

Report Scope and Light Attack and Reconnaissance Aircraft Market Segmentation

|

Attributes |

Light Attack and Reconnaissance Aircraft Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Light Attack and Reconnaissance Aircraft Market Trends

Growing Use of Unmanned Light Attack and Reconnaissance Aircraft

- The light attack and reconnaissance aircraft market is increasingly shaped by the growing use of unmanned aerial platforms that combine intelligence, surveillance, and precision strike capabilities. These aircraft offer lower operational risk, cost efficiency, and longer endurance compared to traditional manned platforms, making them a strategic fit for modern defense forces

- For instance, General Atomics Aeronautical Systems has developed the MQ-9 Reaper and Avenger UAVs, which can perform both reconnaissance and light attack missions. These platforms highlight how unmanned aircraft are becoming integral to global defense strategies, offering flexibility in both counterinsurgency and border patrol missions

- The adoption of unmanned light attack and reconnaissance aircraft is gaining traction for asymmetric warfare and counterterrorism operations where lower-cost, high-endurance platforms can effectively support ground troops with real-time intelligence and precision firepower. This makes them an alternative to high-maintenance fighter jets

- Integration of artificial intelligence and advanced sensors in UAVs is enhancing situational awareness, autonomous mission planning, and targeting precision. These capabilities are allowing defense forces to act faster while reducing the risk to pilots in contested environments

- Unmanned platforms are also being used in missions beyond combat, including disaster response, maritime surveillance, and border monitoring. Their adaptability and relatively lower life-cycle costs compared to advanced fighter jets make them increasingly essential to multi-role operations

- The growing reliance on unmanned light attack and reconnaissance aircraft is aligning with a long-term shift in defense procurement, emphasizing cost-effective, versatile, and survivable solutions. This trend is set to redefine force structures and mission planning for armed services across multiple regions

Light Attack and Reconnaissance Aircraft Market Dynamics

Driver

“Rising Global Defense Budgets and Fleet Modernization”

- Rising global defense budgets, alongside modernization programs, are driving demand for light attack and reconnaissance aircraft as nations seek to enhance ISR (intelligence, surveillance, reconnaissance) and counter-insurgency capabilities. These aircraft serve as cost-effective solutions for multiple mission profiles compared to heavier combat aircraft

- For instance, Embraer’s A-29 Super Tucano has been widely adopted by countries such as Brazil, Afghanistan, and Nigeria for light attack and reconnaissance missions. Backed by foreign military sales, this aircraft demonstrates how developing nations are modernizing fleets through efficient and versatile platforms

- Light attack aircraft provide affordability in acquisition and operating costs, making them attractive to countries with limited budgets. Their ability to operate in rugged terrains and austere airfields further reinforces their suitability for counterinsurgency and peacekeeping operations worldwide

- Modernization programs across Asia, the Middle East, and Africa focus on adding aircraft that deliver multi-role capabilities while maintaining operational simplicity. Light reconnaissance aircraft are being used to fill capability gaps between high-cost fighters and UAVs, creating a vital balance in fleet compositions

- As defense forces seek to achieve more with constrained budgets, the procurement of reliable, cost-effective light attack and reconnaissance platforms has become a cornerstone of military spending strategies globally. This ensures sustained demand in both established and emerging defense markets

Restraint/Challenge

“High Procurement and Maintenance Costs”

- A major challenge for the light attack and reconnaissance aircraft market lies in the high procurement and long-term maintenance costs associated with these platforms, which can strain budgets of smaller defense forces. While cheaper than advanced fighters, they still require significant investment in spare parts, logistics, and support infrastructure

- For instance, maintaining platforms such as the A-29 Super Tucano or Textron’s AT-6 Wolverine requires investments in skilled personnel, maintenance facilities, and pilot training programs. Countries with limited defense infrastructure face challenges in sustaining long-term operational readiness of such fleets

- Procurement costs are further amplified when tailored avionics, advanced weapon systems, and electronic warfare packages are included. This customization often increases overall costs, making affordability a barrier for developing nations looking to modernize airpower capabilities

- Sustainment challenges also include the need for reliable supply chains and availability of high-precision components, which can be disrupted by geopolitical tensions or economic instability. These constraints delay maintenance cycles and undermine fleet availability for critical missions

- Addressing these challenges requires international cooperation, cost-sharing agreements, and modular maintenance solutions that can reduce financial strain. Greater emphasis on life-cycle cost optimization will be critical for enabling broader adoption of light attack and reconnaissance aircraft across global defense markets

Light Attack and Reconnaissance Aircraft Market Scope

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the light attack and reconnaissance aircraft market is segmented into fixed-wing light attack and reconnaissance aircraft and rotary-wing light attack and reconnaissance aircraft. The fixed-wing segment dominated the largest market revenue share of 63% in 2024, driven by its long-range capabilities, higher speed, and efficiency in extended surveillance and strike missions. Fixed-wing aircraft are preferred by national defense forces for their ability to cover vast operational areas and carry advanced reconnaissance payloads. Their relatively lower operational cost per flight hour and compatibility with precision-guided munitions make them a strategic choice for tactical attack and intelligence-gathering missions. The robust performance in both combat and monitoring roles strengthens demand in defense procurement programs. The segment’s proven track record and integration with modern avionics systems further enhance its adoption across multiple regions.

The rotary-wing segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for versatile aircraft capable of vertical takeoff and landing, hovering, and operating in confined areas. Rotary-wing aircraft offer tactical advantages in close-support operations, urban combat, and rapid insertion or extraction missions. Their adaptability to various terrains and integration with lightweight armaments and surveillance systems make them particularly attractive for modern asymmetric warfare. Growing procurement by countries focusing on flexible and agile defense solutions contributes to the rapid expansion of this segment.

• By Application

On the basis of application, the market is segmented into national defense and war. The national defense segment dominated the largest market revenue share of 68.8% in 2024, supported by continuous investments in strengthening military surveillance, border patrol, and tactical defense capabilities. Defense forces globally prioritize aircraft equipped with advanced sensors, reconnaissance systems, and light attack capabilities to maintain operational readiness and strategic advantage. Increasing geopolitical tensions and the need for rapid intelligence gathering further drive procurement in this segment. Integration with modern command-and-control systems enhances the operational efficiency of these aircraft in national defense missions. The consistent modernization of air fleets ensures sustained demand for both fixed-wing and rotary-wing platforms.

The war segment is expected to witness the fastest growth from 2025 to 2032, driven by rising conflicts and the demand for agile, precision-strike aircraft capable of rapid deployment in combat zones. Light attack and reconnaissance aircraft provide cost-effective alternatives to high-end fighter jets, making them suitable for tactical engagements and low-intensity conflicts. Advanced targeting systems, real-time surveillance, and multi-role flexibility make them highly valued in modern warfare scenarios. Escalating defense budgets and procurement strategies in regions facing security threats accelerate growth in this segment.

Light Attack and Reconnaissance Aircraft Market Regional Analysis

- North America dominated the light attack and reconnaissance aircraft market with the largest revenue share of over 40% in 2024, driven by increasing defense budgets, modernization of air fleets, and the strategic emphasis on advanced surveillance and tactical strike capabilities

- Defense forces in the region prioritize aircraft equipped with high-end sensors, precision targeting systems, and multi-role capabilities to enhance national security and rapid response operations

- This widespread adoption is further supported by strong government investments, well-established aerospace manufacturing infrastructure, and continuous research and development in unmanned and manned aircraft platforms, establishing North America as a key hub for both production and procurement

U.S. Light Attack and Reconnaissance Aircraft Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by high military spending, modernization of tactical fleets, and rising demand for multi-role aircraft for border surveillance, reconnaissance, and counter-insurgency missions. The integration of advanced avionics, lightweight armaments, and unmanned capabilities enhances operational efficiency. In addition, collaborations between defense contractors and government agencies, along with investment in training and maintenance infrastructure, further propel market growth.

Europe Light Attack and Reconnaissance Aircraft Market Insight

The Europe market is projected to grow at a significant CAGR during the forecast period, driven by rising defense modernization programs and the need for enhanced aerial reconnaissance and light attack capabilities. Countries are increasingly investing in both fixed-wing and rotary-wing aircraft to strengthen rapid deployment and tactical intelligence operations. The growth is also supported by cross-border collaborations, aerospace R&D initiatives, and the replacement of aging aircraft fleets.

U.K. Light Attack and Reconnaissance Aircraft Market Insight

The U.K. market is expected to expand at a noteworthy CAGR, fueled by rising defense expenditure and the demand for flexible, cost-effective, and technologically advanced aircraft. Focus on national security, rapid response capabilities, and integration with modern command-and-control systems is driving procurement. The presence of strong aerospace manufacturers and adoption of unmanned aerial systems in reconnaissance roles further support market growth.

Germany Light Attack and Reconnaissance Aircraft Market Insight

Germany’s market is projected to grow at a considerable CAGR during the forecast period, driven by modernization programs, technological advancements in avionics, and investments in both manned and unmanned aircraft for national defense and surveillance operations. The country’s focus on precision targeting, eco-conscious propulsion technologies, and integration with NATO operations enhances adoption in both national and collaborative missions.

Asia-Pacific Light Attack and Reconnaissance Aircraft Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing defense budgets, regional security concerns, and rapid modernization of air forces in countries such as India, Japan, and South Korea. Growing procurement of cost-effective fixed-wing and rotary-wing aircraft for reconnaissance, border security, and counter-insurgency missions is fueling demand. Furthermore, the emergence of domestic aerospace manufacturing capabilities and government initiatives to enhance indigenous production are expanding market penetration.

Japan Light Attack and Reconnaissance Aircraft Market Insight

Japan’s market is gaining momentum due to increasing investments in national defense, the need for maritime and border surveillance, and the modernization of its air fleet. Focus on integrating advanced reconnaissance sensors, multi-role capabilities, and unmanned platforms is driving growth. Japan’s strategic partnerships with domestic and international aerospace firms further enhance capabilities and market expansion.

China Light Attack and Reconnaissance Aircraft Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid expansion of its air force capabilities, increasing focus on border and maritime surveillance, and indigenous aircraft production. Investment in advanced avionics, tactical reconnaissance systems, and rotary-wing platforms is accelerating deployment. Government initiatives supporting defense modernization and domestic aerospace innovation are key factors propelling the market.

Light Attack and Reconnaissance Aircraft Market Share

The light attack and reconnaissance aircraft industry is primarily led by well-established companies, including:

- Air Tractor Inc. (U.S.)

- EmbraerX (Brazil)

- IOMAX USA Inc (U.S.)

- Textron Inc. (U.S.)

- AHRLAC Holdings (South Africa)

- Hindustan Aeronautics Limited (HAL) (India)

- AVIC Jiangxi Hongdu Aviation Industry Group Corporation Limited (China)

- BAE Systems (U.K.)

- Paramount Group (U.A.E.)

- Lockheed Martin Corporation (U.S.)

Latest Developments in Global Light Attack and Reconnaissance Aircraft Market

- In March 2025, India signed a $7.3 billion contract to procure 156 combat helicopters for its Air Force and Army, marking one of the largest defense acquisitions in the country’s history. This procurement is set to significantly enhance India’s aerial strike and reconnaissance capabilities, providing advanced multi-role helicopters for both offensive and defensive missions. The contract also emphasizes the country’s push for indigenous defense manufacturing, with a large portion of the helicopters to be produced domestically, strengthening the local aerospace industry and reducing reliance on foreign suppliers

- In February 2025, Russia introduced a new engine variant for the Kamov Ka-226 light military helicopter, aiming to re-enter the Indian market. This upgrade is expected to meet India’s growing demand for light military helicopters, complementing the indigenous Light Utility Helicopter program. The new variant improves performance, operational efficiency, and payload capacity, reinforcing Russia’s position as a supplier for versatile reconnaissance and light attack platforms

- In June 2024, the Indian Ministry of Defence awarded a ₹50,000 crore contract to Hindustan Aeronautics Limited (HAL) for the procurement of Light Combat Helicopters (LCH). This initiative enhances India’s indigenous defense production capabilities while providing specialized helicopters designed for counter-insurgency, border patrol, and tactical reconnaissance. The program ensures operational readiness for diverse missions and contributes to the modernization of India’s light attack helicopter fleet

- In September 2022, the Indian Navy received two MH-60R multi-role helicopters from the U.S. under foreign military sales, as part of a larger 24-helicopter order. These helicopters strengthen naval reconnaissance, anti-submarine warfare, and maritime patrol capabilities, providing the Navy with advanced sensor suites, multi-role combat functionality, and improved mission readiness. The induction of these aircraft marks a significant upgrade in India’s maritime defense and surveillance infrastructure

- In August 2021, Bangladesh received two Mi-171A2 heavy multirole helicopters from the Russian Helicopters Group. This delivery expanded Bangladesh’s operational capabilities for both reconnaissance and light attack missions, enhancing the country’s ability to conduct border surveillance, search and rescue, and rapid troop deployment. The acquisition also demonstrates Bangladesh’s strategy to modernize its rotary-wing fleet and strengthen its aerial defense infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.