Global Light Emitting Diode Led Probing And Testing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.54 Billion

2025

2033

USD

1.16 Billion

USD

1.54 Billion

2025

2033

| 2026 –2033 | |

| USD 1.16 Billion | |

| USD 1.54 Billion | |

|

|

|

|

Light-Emitting Diode (LED) Probing and Testing Equipment Market Size

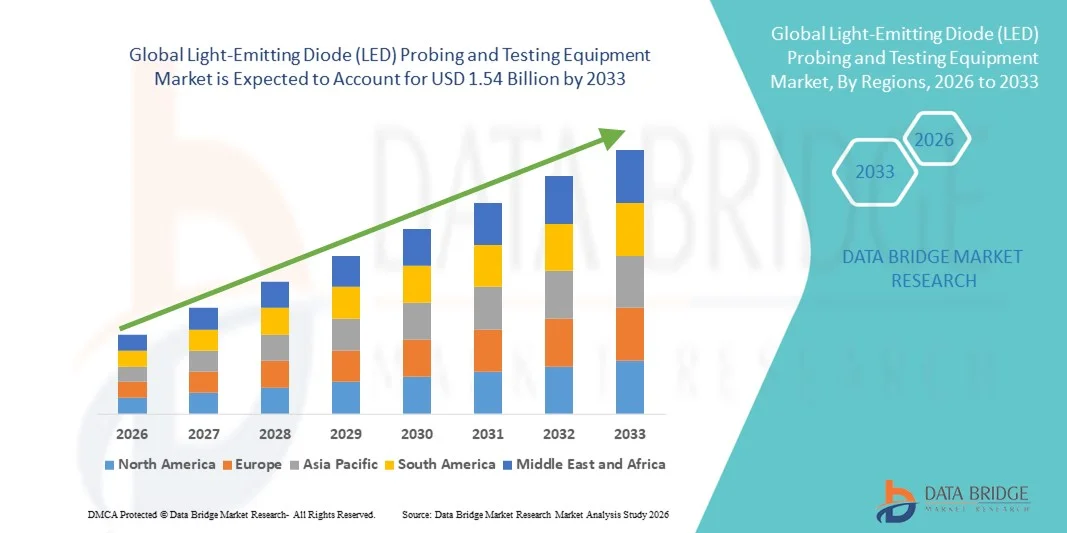

- The global light-emitting diode (LED) probing and testing equipment market size was valued at USD 1.16 billion in 2025 and is expected to reach USD 1.54 billion by 2033, at a CAGR of 3.68% during the forecast period

- The market growth is largely driven by rapid advancements in LED manufacturing technologies and the increasing adoption of high-brightness and mini/micro-LEDs across applications such as displays, automotive lighting, and general illumination, leading to higher demand for precise, automated probing and testing equipment throughout the production lifecycle

- Furthermore, growing emphasis on quality control, yield optimization, and compliance with stringent performance and reliability standards is pushing manufacturers to adopt advanced, user-friendly, and high-accuracy LED probing and testing solutions. These converging factors are accelerating the uptake of Light-Emitting Diode (LED) Probing and Testing Equipment, thereby significantly boosting the overall market growth

Light-Emitting Diode (LED) Probing and Testing Equipment Market Analysis

- Light-Emitting Diode (LED) Probing and Testing Equipment, which enables electrical, optical, and thermal performance evaluation of LED chips and wafers, has become a critical part of LED manufacturing due to the rising complexity of LED architectures and the need for high precision, speed, and reliability across production lines

- The increasing demand for LED probing and testing equipment is primarily driven by the rapid expansion of LED applications in displays, automotive lighting, mini-LED and micro-LED technologies, and general illumination, along with manufacturers’ growing focus on yield improvement, defect reduction, and cost efficiency

- North America dominated the Light-Emitting Diode (LED) Probing and Testing Equipment market with an estimated revenue share of around 34.5% in 2025, supported by strong R&D investments, early adoption of advanced semiconductor testing technologies, and the presence of leading LED and equipment manufacturers, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the Light-Emitting Diode (LED) Probing and Testing Equipment market during the forecast period, driven by rapid expansion of LED manufacturing capacities in China, South Korea, and Taiwan, increasing demand for consumer electronics, and government support for semiconductor and display industries

- The LED performance test segment held the largest market revenue share of 41.2% in 2025, owing to its role in evaluating luminous flux, power efficiency, electrical characteristics, and thermal performance

Report Scope and Light-Emitting Diode (LED) Probing and Testing Equipment Market Segmentation

|

Attributes |

Light-Emitting Diode (LED) Probing and Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Light-Emitting Diode (LED) Probing and Testing Equipment Market Trends

Advancements and Automation in LED Probing and Testing Equipment

- A significant and accelerating trend in the global light-emitting diode (LED) probing and testing equipment market is the increasing adoption of automated and high-precision testing systems to meet the growing quality and performance requirements of LED manufacturers across lighting, automotive, and display applications

- For instance, companies such as Chroma ATE and Advantest provide automated LED probing and testing solutions capable of simultaneously measuring electrical, optical, and thermal characteristics, helping manufacturers reduce testing time while improving yield and consistency

- Another key trend is the rising demand for Mini-LED and Micro-LED testing equipment, driven by their expanding use in advanced displays such as televisions, smartphones, and wearable devices. These technologies require highly accurate probing due to smaller chip sizes and higher pixel densities. For example, FormFactor has developed advanced probe card solutions specifically designed for wafer-level testing of Micro-LEDs used in high-resolution display applications

- The growing implementation of wafer-level and inline testing solutions is also shaping the market, as manufacturers aim to detect defects early in the production process and reduce material wastage. For instance, KLA Corporation offers inline optical and electrical inspection systems that enable real-time quality monitoring during LED fabrication

- The increasing emphasis on product reliability, longer LED lifespan, and compliance with stringent quality standards is further encouraging manufacturers to invest in advanced probing and testing equipment, particularly for automotive and industrial lighting applications

- Overall, these trends reflect a strong shift toward precision, efficiency, and scalability in LED manufacturing, reinforcing the importance of advanced probing and testing equipment across the value chain

Light-Emitting Diode (LED) Probing and Testing Equipment Market Dynamics

Driver

Growing Demand for LEDs Across Multiple End-Use Industries

- The rapid expansion of LEDs in general lighting, automotive, display panels, and consumer electronics is fueling a strong and sustained demand for advanced probing and testing equipment. As manufacturers aim to meet stringent quality, efficiency, and reliability standards, high-precision testing solutions have become an indispensable part of the LED production process

- For instance, the increasing adoption of LED headlights and interior lighting in electric and hybrid vehicles has prompted companies such as OSRAM and Nichia to invest in advanced probing and testing equipment capable of verifying brightness uniformity, color consistency, thermal stability, and long-term reliability. This ensures compliance with automotive standards and enhances product lifespan, supporting market growth

- The rise of Mini-LED and Micro-LED technologies, particularly for high-resolution TVs, smartphones, and wearable devices, has intensified the need for wafer-level testing solutions. Manufacturers are prioritizing precise defect detection and performance optimization at early production stages, driving the adoption of sophisticated LED testing equipment globally

- The demand for high-efficiency and low-power LEDs in sustainable lighting applications is also contributing to growth. As governments and organizations emphasize energy-saving initiatives, manufacturers are required to ensure LEDs meet strict lumen-per-watt and thermal performance benchmarks, increasing reliance on high-accuracy probing and testing systems

- Integration with automated production lines is another key driver. Modern LED manufacturers increasingly adopt automated wafer probing, sorting, and inline testing to improve production throughput and reduce human error. Equipment capable of interfacing with AI-based data analytics or robotics enhances yield and accelerates mass production, creating strong market pull

- The expanding global LED market, projected to grow significantly in residential, commercial, and industrial segments, indirectly boosts the LED testing equipment market. As end-use demand increases, manufacturers invest heavily in testing to maintain quality and reduce failure rates, especially for high-value applications like automotive and medical lighting

Restraint/Challenge

High Capital Costs and Technical Complexity of Advanced Testing Systems

- Despite strong market growth, the substantial capital investment required for advanced LED probing and testing systems acts as a major barrier, especially for small- and medium-sized manufacturers. Equipment such as wafer-level optical testers, automated probe stations, and inline inspection systems can cost hundreds of thousands of dollars, making initial adoption financially challenging

- For instance, implementing Micro-LED wafer-level testing solutions by companies like FormFactor or KLA Corporation requires not only significant equipment expenditure but also highly skilled personnel for operation and maintenance. This can increase operational costs and limit the scalability of testing solutions for smaller manufacturers

- In addition, the technical complexity of testing emerging LED technologies, including Mini-LEDs and Micro-LEDs, involves precise alignment, measurement of ultra-small chip dimensions, and handling high-density arrays. Such intricate processes may deter some manufacturers from upgrading their testing infrastructure, slowing the widespread adoption of advanced equipment despite its long-term benefits in yield optimization and product reliability

- The rapid evolution of LED technologies poses another challenge. As manufacturers develop higher-density displays or new color technologies, testing equipment quickly becomes obsolete unless updated continuously. This necessitates recurrent investment and upgrades, which can strain budgets and slow adoption for smaller player

- Stringent compliance and certification requirements in automotive, aerospace, and medical applications further increase costs and operational complexity. Testing equipment must meet high industry standards, including safety certifications and traceability, adding to the overall expense and technical burden

- Supply chain and raw material constraints may also affect the adoption of advanced LED testing systems. Shortages in critical components, like optical sensors or precision probes, can delay installation and increase costs, particularly in emerging markets where manufacturing infrastructure is still developing

Light-Emitting Diode (LED) Probing and Testing Equipment Market Scope

The market is segmented on the basis of type, testing parameters, application, end-user, and distribution channel.

- By Type

On the basis of type, the Light-Emitting Diode (LED) Probing and Testing Equipment market is segmented into Goniophotometer, Spectroradiometer, Optical Radiation Safety Test, Optical Aging Test, and LED Power Driver Tester. The spectroradiometer segment dominated the largest market revenue share of 34.6% in 2025, driven by its capability to accurately measure spectral power distribution, color rendering index (CRI), luminous intensity, and chromaticity of LEDs. Its widespread adoption in LED manufacturing, laboratory testing, and quality assurance contributes to its dominance. Regulatory standards for color consistency and luminous efficacy across global markets also support its use. Rapid innovation in LED technology and miniaturization requires high-precision spectral analysis. Spectroradiometers are crucial for displays, automotive lighting, and architectural illumination. Integration with automated production lines improves throughput and reduces human error. The segment benefits from high adoption in Asia-Pacific and North America due to large-scale LED production facilities. Demand from research and development activities further reinforces its dominant position.

The optical aging test segment is anticipated to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by growing demand for long-term reliability testing of LEDs in critical applications. Increasing adoption of LED lighting in automotive, medical devices, outdoor, and industrial sectors requires accelerated aging analysis to validate product lifetime and performance. Regulatory compliance for warranties and quality control further fuels the segment’s growth. Manufacturers increasingly invest in automated optical aging systems for faster data acquisition and higher throughput. Expansion of smart lighting and connected LED systems also drives demand. Continuous R&D in LED durability, efficiency, and thermal stability contributes to growth. Emerging markets with expanding industrial infrastructure adopt aging tests to ensure reliability. Stringent quality expectations for high-end applications further support this trend.

- By Testing Parameters

On the basis of testing parameters, the market is segmented into LED performance test, determination of color of LED light, and measurement of color temperature. The LED performance test segment held the largest market revenue share of 41.2% in 2025, owing to its role in evaluating luminous flux, power efficiency, electrical characteristics, and thermal performance. Performance testing is mandatory in production lines, research labs, and quality control departments. Rising global adoption of energy-efficient lighting and stringent regulations on LED efficiency increase the need for performance testing. Automation in performance testing improves accuracy and reduces operational costs. High-volume LED production, especially in Asia-Pacific, drives repeatable and reliable testing. Growing use of LEDs in smart home devices, display panels, and automotive interiors further boosts the segment. Continuous innovations in LED chip technology necessitate advanced performance evaluation. The segment’s universal applicability across residential, commercial, and industrial applications ensures its dominant position.

The measurement of color temperature segment is expected to witness the fastest CAGR of 10.3% from 2026 to 2033, driven by rising demand for human-centric lighting, tunable white LED systems, and advanced display technologies. Accurate color temperature measurement is critical for automotive interiors, healthcare lighting, smart buildings, and premium displays. Increasing adoption of OLED, micro-LED, and mini-LED technologies also supports growth. Color temperature testing ensures compliance with international standards and quality specifications. Development of advanced optical sensors and faster data acquisition tools accelerates adoption. Display manufacturers and lighting solution providers prioritize precise measurement for better user experience. Expansion in emerging markets further fuels segment growth.

- By Application

On the basis of application, the market is segmented into displays, lighting, advertisements, laboratory testing, production testing, and others. The lighting segment accounted for the largest market revenue share of 38.9% in 2025, driven by global adoption of LED-based general illumination. Street lighting, commercial, and residential lighting projects are major contributors. Governments promote energy-efficient lighting and subsidies for LED adoption. LED-based infrastructure in smart cities requires extensive testing. High production volume in lighting manufacturing lines demands consistent probing and testing. The segment benefits from both indoor and outdoor lighting applications. Automotive and architectural lighting applications further strengthen dominance. R&D efforts to improve LED luminous efficacy and lifetime drive demand. Quality compliance with energy efficiency standards is essential. Expanding construction and renovation projects support growth. Laboratory and production testing needs contribute to revenue. Adoption of smart lighting solutions boosts segment dominance.

The display segment is projected to witness the fastest CAGR of 11.1% from 2026 to 2033, fueled by rapid adoption of micro-LED, mini-LED, and OLED display technologies. High-resolution TVs, smartphones, AR/VR devices, and automotive displays require advanced optical testing. Manufacturers demand precise panel-level measurements for uniformity and color accuracy. Investments in display fabs and emerging high-tech regions support growth. LED backlighting and display integration in electronics accelerate adoption. Shorter product life cycles in consumer electronics drive recurring demand. Technological innovations in displays create demand for testing and calibration equipment. Automated testing solutions improve efficiency. Regulatory compliance ensures display quality. Market expansion in Asia-Pacific and North America drives growth. Increasing smart device penetration further supports the segment.

- By End-User

On the basis of end-user, the market is segmented into automobile, electronics, laboratories, hospitals, and others. The electronics segment dominated the market with a revenue share of 36.4% in 2025, due to high LED usage in consumer electronics such as smartphones, televisions, laptops, and wearables. Electronics manufacturers rely on automated LED probing for high-throughput production. Continuous product launches and shorter device life cycles drive recurring demand. Miniaturization of LED components increases testing precision requirements. Asia-Pacific electronics manufacturing hubs support segment dominance. Quality compliance and reliability testing are critical in this sector. Laboratories and production lines adopt LED testing for consistency. High demand from smart devices contributes to revenue. R&D activities further boost adoption. Advanced production lines and regulatory standards reinforce the electronics segment’s leading position.

The automobile segment is expected to witness the fastest CAGR of 10.6% from 2026 to 2033, supported by increasing LED integration in headlights, tail lights, dashboards, interior lighting, and ADAS indicators. Automotive LEDs require strict reliability, thermal, and optical testing. Expansion of electric vehicle production boosts LED testing demand. Regulatory safety standards in automotive lighting mandate high-quality performance testing. Premium automotive segments demand precision optical analysis. OEMs and Tier-1 suppliers adopt advanced testing for long-term durability. Growing automotive production in emerging markets drives adoption. Technological innovations in automotive LEDs contribute to segment growth. Laboratory and production testing needs further support the expansion. Rising EV and smart car adoption accelerate growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The offline segment dominated the market with a revenue share of 62.8% in 2025, driven by the high-value, complex nature of testing equipment. Buyers prefer offline channels for direct consultation, customization, installation, and after-sales support. Industrial and laboratory clients rely on distributors and manufacturer representatives. Technical demonstrations and training reinforce offline purchasing preference. Large industrial buyers typically have long-term supplier relationships. Installation, calibration, and support services further promote offline dominance. Bulk procurement for production testing contributes to revenue. Localized support ensures compliance with regulatory standards. OEMs and laboratories depend on offline service networks. Warranty and maintenance agreements favor offline channels. Existing supply chains strengthen dominance.

The online segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, supported by growing digitalization in procurement processes. Small laboratories, research centers, and emerging manufacturers increasingly use online platforms for standardized testing solutions. Online distribution provides wider product accessibility, transparent pricing, and faster logistics. B2B e-commerce platforms are expanding for industrial equipment. Improved digital catalogs, technical support, and remote ordering facilitate growth. Start-ups and SMEs benefit from online procurement. Global e-commerce adoption accelerates segment growth. Standardized equipment such as spectrometers and power drivers is increasingly available online. Faster delivery and easier comparison enhance adoption. Emerging markets show rising online sales. Online platforms contribute to expanding reach and faster adoption.

Light-Emitting Diode (LED) Probing and Testing Equipment Market Regional Analysis

- North America dominated the light-emitting diode (LED) probing and testing equipment market with an estimated revenue share of around 34.5% in 2025, supported by strong R&D investments, early adoption of advanced semiconductor testing technologies, and the presence of leading LED and equipment manufacturers, particularly in the U.S.

- Consumers in the region highly value the precision, reliability, and efficiency offered by advanced LED probing and testing equipment, which ensures high-quality LED performance across applications in consumer electronics, automotive lighting, and display panels

- This widespread adoption is further supported by well-established semiconductor infrastructure, technological expertise, and the growing emphasis on high-performance LEDs for automotive, display, and industrial applications, driving continued investment in state-of-the-art testing systems

U.S. Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The U.S. light-emitting diode (LED) probing and testing equipment market captured the largest revenue share of 82% in 2025 within North America, fueled by the rapid expansion of LED manufacturing for consumer electronics, automotive, and general lighting applications. Manufacturers are increasingly prioritizing high-precision testing to ensure product efficiency, reliability, and compliance with international quality standards. The country’s robust R&D ecosystem, combined with early adoption of automated and wafer-level testing solutions, further propels the market growth. Moreover, integration with advanced data analytics and AI-driven testing solutions is increasingly being implemented to optimize production yield and reduce defect rates.

Europe Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The Europe light-emitting diode (LED) probing and testing equipment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the growth of LED applications in automotive, consumer electronics, and industrial sectors. The presence of well-established semiconductor manufacturers in Germany, France, and the Netherlands, coupled with supportive government policies for energy-efficient lighting, is boosting the adoption of high-performance testing equipment. Expansion is particularly observed in automotive lighting testing, wafer-level LED testing, and display panel inspection, enhancing the overall demand for LED probing solutions.

U.K. Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The U.K. light-emitting diode (LED) probing and testing equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s focus on precision manufacturing, automotive lighting, and industrial LED applications. Increased adoption of advanced testing solutions for quality assurance, energy efficiency compliance, and high-performance LED production is propelling growth. In addition, collaborations between local semiconductor equipment providers and LED manufacturers are further supporting technological advancements in the sector.

Germany Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The Germany light-emitting diode (LED) probing and testing equipment market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong semiconductor and automotive industries. Germany’s emphasis on precision engineering, quality standards, and technological innovation promotes the adoption of advanced LED testing solutions. Integration with automated production lines and in-line inspection systems is increasingly prevalent, particularly in automotive and industrial LED applications, ensuring high reliability and performance of LED products.

Asia-Pacific Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The Asia-Pacific light-emitting diode (LED) probing and testing equipment market is poised to grow at the fastest CAGR during the forecast period, driven by the rapid expansion of LED manufacturing capacities in China, South Korea, and Taiwan. Increasing demand for consumer electronics, display panels, and automotive LEDs, along with strong government support for semiconductor and display industries, is fueling market growth. Furthermore, the adoption of wafer-level testing and automated probing systems is enabling manufacturers to maintain quality standards while scaling up production, particularly in emerging LED hubs in the region.

Japan Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The Japan light-emitting diode (LED) probing and testing equipment market is gaining momentum due to the country’s high-tech manufacturing ecosystem, focus on automotive and industrial LEDs, and adoption of precision inspection systems. Japanese manufacturers are increasingly leveraging automated testing solutions to enhance product yield, ensure consistent performance, and meet stringent quality requirements in both domestic and export markets.

China Light-Emitting Diode (LED) Probing and Testing Equipment Market Insight

The China light-emitting diode (LED) probing and testing equipment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the rapid expansion of domestic LED manufacturing, increasing demand for consumer electronics and automotive applications, and government initiatives supporting semiconductor and display technology. The country’s manufacturers are increasingly investing in wafer-level testing, high-throughput probing systems, and automated inspection solutions to maintain high quality standards, driving the overall market growth.

Light-Emitting Diode (LED) Probing and Testing Equipment Market Share

The Light-Emitting Diode (LED) Probing and Testing Equipment industry is primarily led by well-established companies, including:

- Labsphere, Inc. (U.S.)

- Instrument Systems GmbH (Germany)

- Everfine Photo-E-Physics Co., Ltd. (China)

- Sekonic Corporation (Japan)

- Konica Minolta, Inc. (Japan)

- Photo Research, Inc. (U.S.)

- Osram Opto Semiconductors GmbH (Germany)

- Everfine Photonics (China)

- Topcon Corporation (Japan)

- X-Rite, Inc. (U.S.)

- StellarNet, Inc. (U.S.)

- AvaSpec (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- Tektronix, Inc. (U.S.)

- Thorlabs, Inc. (U.S.)

- Everlight Electronics Co., Ltd. (Taiwan)

- Lutron Electronics Co., Inc. (U.S.)

- Beijing Normal University Optoelectronics Lab (China)

- ILX Lightwave (U.S.)

Latest Developments in Global Light-Emitting Diode (LED) Probing and Testing Equipment Market

- In June 2025, ficonTEC introduced the industry’s first ATE‑agnostic top‑sided electro‑optical wafer‑level tester, a novel LED probing and testing platform designed to provide precise optical I/O active alignment and electrical probing from the same top side of the wafer. The system supports DC and high‑speed signal testing, thermal control, advanced wafer mapping, and automated wafer handling, enabling LED and photonic device manufacturers to scale wafer‑level testing more cost‑effectively and integrate with major automated test equipment ecosystems

- In June 2025, researchers from Tianjin University reported a breakthrough in non‑destructive micro‑LED wafer testing by developing a flexible three‑dimensional probe array that applies ultra‑low contact pressure, preserving wafer surfaces while enabling high‑throughput electrical testing without damage — a long‑standing challenge in micro‑LED production and an advance expected to accelerate commercialization of large‑area and flexible LED displays

- In March 2025, Advantest announced a strategic partnership with Keysight Technologies to develop integrated wafer prober‑based test workflows, combining high‑throughput probe stations with advanced measurement and analysis software. This collaboration aims to improve test yields and reduce cycle times for advanced LED and photonic semiconductor devices

- In September 2024, FormFactor launched the CryoProbe X, a new cryogenic test probe station designed to support deep low‑temperature testing of LEDs and other emerging semiconductor devices, expanding testing capability into research and production environments where extreme condition performance and new material characterizations are critical

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.