Global Lignin Based Resins Market

Market Size in USD Million

CAGR :

%

USD

482.10 Million

USD

723.20 Million

2024

2032

USD

482.10 Million

USD

723.20 Million

2024

2032

| 2025 –2032 | |

| USD 482.10 Million | |

| USD 723.20 Million | |

|

|

|

|

Lignin-Based Resins Market Size

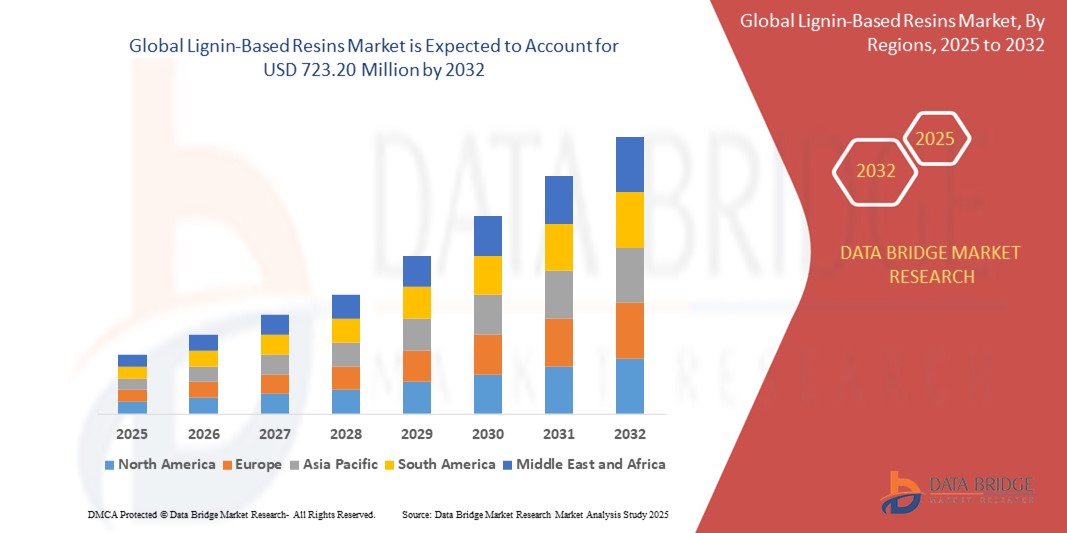

- The global lignin-based resins market size was valued at USD 482.1 million in 2024 and is expected to reach USD 723.20 million by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by the rising demand for sustainable and bio-based resin alternatives, as industries shift away from petroleum-derived chemicals toward environmentally friendly solutions in adhesives, coatings, and composites

- Furthermore, technological advancements in lignin extraction, purification, and functionalization are enhancing the performance and commercial viability of lignin-based resins. These converging factors are accelerating adoption across construction, automotive, and packaging sectors, thereby significantly boosting the industry's growth

Lignin-Based Resins Market Analysis

- Lignin-based resins, derived from renewable lignin extracted primarily as a by-product of the pulp and paper industry, are emerging as sustainable alternatives to petroleum-based resins in applications such as adhesives, coatings, and composites across multiple industrial sectors

- The escalating demand for lignin-based resins is primarily fueled by increasing environmental regulations, rising preference for low-emission and bio-based materials, and advancements in lignin valorization technologies that enhance performance and compatibility with conventional resin systems

- Asia-Pacific dominated the lignin-based resins market with a share of 40.24% in 2024, due to rapid industrialization, growing demand for sustainable construction materials, and increased adoption of bio-based resins

- North America is expected to be the fastest growing region in the lignin-based resins market during the forecast period due to increasing investment in bio-refineries, heightened focus on green building materials, and regulatory encouragement for low-VOC resins

- Lignosulfonates segment dominated the market with a market share of 77.35% in 2024, due to its high solubility in water, ease of processing, and widespread industrial applications. Derived as a by-product from the sulfite pulping process, lignosulfonates are readily available at scale and are cost-effective, making them suitable for bulk use across industries such as construction, agriculture, and animal feed. Their excellent dispersing, binding, and chelating properties enable their use in concrete admixtures, dust control, and fertilizers, further supporting their dominant market position

Report Scope and Lignin-Based Resins Market Segmentation

|

Attributes |

Lignin-Based Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lignin-Based Resins Market Trends

“Increasing Demand for Sustainable Materials”

- A major and accelerating trend in the global lignin-based resins market is the rising demand for bio-based, renewable alternatives to petroleum-derived resins across industries such as construction, automotive, and packaging

- For instance, companies such as Borregaard and UPM Biochemicals are expanding production capacity for lignin-based resins to meet growing market requirements for sustainable and low-carbon materials

- The shift towards greener manufacturing practices and the growing emphasis on reducing VOC emissions and formaldehyde content are making lignin-based resins increasingly attractive to end-users and regulators alike

- Industry players are introducing bio-resins specifically designed to meet both performance and environmental standards, such as Renol by Lignin Industries, which targets applications in thermoplastics with reduced carbon footprints

- Governments across Europe and North America are offering policy support, subsidies, and research incentives for the development and commercialization of sustainable materials, further propelling the market

- The preference for circular economy models and carbon-neutral supply chains is encouraging companies to adopt lignin-based resins as a strategic move towards achieving ESG goals and long-term competitiveness

Lignin-Based Resins Market Dynamics

Driver

“Advancements in Lignin Extraction and Modification Technologies”

- Ongoing innovations in lignin valorization processes, including organosolv extraction, catalytic depolymerization, and chemical modification, are significantly enhancing the usability and commercial appeal of lignin-based resins

- For instance, Finland-based MetGen has developed enzymatic technologies that improve lignin compatibility with high-performance polymer systems, expanding its application scope in durable goods and industrial adhesives

- The improved consistency, purity, and functionalization of lignin feedstocks are enabling better integration into phenolic, epoxy, and polyurethane resin formulations, driving wider acceptance in end-use industries

- Strategic investments by bio-refineries and chemical companies are accelerating the commercialization of advanced lignin-based products, while public-private research collaborations continue to support breakthroughs

- These technological advances are improving the performance of lignin-based resins and also making them more cost-competitive, which is crucial for broader industrial adoption

Restraint/Challenge

“Variability in Lignin's Chemical Structure”

- One of the most significant challenges facing the lignin-based resins market is the inherent variability in lignin's chemical composition depending on its botanical origin and extraction method

- For instance, lignin derived from Kraft pulping differs significantly from that obtained through organosolv or soda processes, leading to inconsistencies in performance when applied in industrial resin systems

- This variability affects molecular weight, reactivity, and functional group distribution, making standardization difficult and complicating formulation consistency for large-scale manufacturers

- As a result, resin producers often need to invest in additional processing or blending steps to achieve desired performance, which can increase production costs and limit scalability. Companies such as Ingevity and Lignolix are working on developing more standardized lignin grades and pre-treatment methods to address this issue, but the challenge remains a key hurdle for mass-market deployment

- Overcoming this barrier will require continued innovation in lignin purification, real-time quality monitoring, and collaborative industry standards that can enable uniformity across feedstocks and end applications

Lignin-Based Resins Market Scope

The market is segmented on the basis of raw material, product type, and application.

• By Raw Material

On the basis of raw material, the lignin-based resins market is segmented into Kraft Lignin, Lignosulfonates, Organosolv Lignin, and Other Materials. The lignosulfonates segment accounted for the largest market share of 77.35% in 2024 due to its high solubility in water, ease of processing, and widespread industrial applications. Derived as a by-product from the sulfite pulping process, lignosulfonates are readily available at scale and are cost-effective, making them suitable for bulk use across industries such as construction, agriculture, and animal feed. Their excellent dispersing, binding, and chelating properties enable their use in concrete admixtures, dust control, and fertilizers, further supporting their dominant market position.

The Organosolv Lignin segment is projected to experience the fastest growth from 2025 to 2032, supported by its low sulfur content, high reactivity, and superior compatibility with advanced polymer systems. Organosolv lignin is gaining traction in high-end applications such as coatings and specialty adhesives where purity and performance are critical. As sustainability regulations tighten and demand for high-performance green materials rises, Organosolv lignin is increasingly preferred for its enhanced processability and environmental profile.

• By Product Type

On the basis of product type, the market is divided into Phenolic Resins, Epoxy Resins, Polyurethane Resins, and Other Products. Phenolic Resins dominated the market with a share of 58.08% in 2024, driven by their well-established role in wood adhesives, insulation materials, and molded products. Lignin-based phenolic resins are increasingly used as a substitute for petroleum-based phenols due to their cost-effectiveness, flame resistance, and structural integrity. The segment’s growth is further supported by increasing demand for formaldehyde-free resin systems and regulatory pressure to minimize volatile organic compounds (VOCs).

Polyurethane Resins are expected to register the highest growth rate over the forecast period, attributed to their diverse applications in foams, coatings, and sealants, and the rising interest in replacing polyols with lignin derivatives. Lignin’s polyfunctional structure makes it suitable for PU formulations, especially in the automotive, construction, and furniture sectors where sustainability and performance need to align. Technological advancements in lignin modification and dispersion are also enhancing its adoption in this segment.

• By Application

On the basis of application, the market is segmented into Adhesives & Binders, Coatings, Composites, and Other Applications. The Adhesives & Binders segment held the largest revenue share of 47.85% in 2024, owing to the expanding use of lignin-based resins in wood panels, plywood, and fiberboard manufacturing. Lignin’s excellent binding properties, thermal stability, and natural origin make it a compelling alternative to synthetic adhesives, especially in construction and furniture sectors where eco-label compliance is important.

The Composites segment is projected to grow at the fastest CAGR during the forecast period, fueled by the demand for lightweight, bio-based materials in automotive, aerospace, and consumer goods. Lignin enhances the mechanical strength, UV resistance, and biodegradability of composite materials, making it attractive for sustainable product development. Ongoing R&D and partnerships between bio-refineries and composite manufacturers are expected to drive significant innovations in this space.

Lignin-Based Resins Market Regional Analysis

- Asia-Pacific dominated the lignin-based resins market with the largest revenue share of 40.24% in 2024, driven by rapid industrialization, growing demand for sustainable construction materials, and increased adoption of bio-based resins

- The region benefits from abundant availability of lignin-rich raw materials, expanding manufacturing capacity, and supportive initiatives promoting low-carbon, renewable alternatives in the chemical and building sectors

- Rising environmental awareness, coupled with strong investment in green chemistry and public-private partnerships focused on biomass valorization, is accelerating the deployment of lignin-based resins across adhesives, composites, and coatings applications

China Lignin-Based Resins Market Insight

China held the largest market share in Asia-Pacific in 2024, supported by its vast pulp and paper industry and aggressive push toward circular economy goals. Domestic manufacturers are leveraging lignin as a value-added by-product, especially in the production of bio-based adhesives and phenolic resins. Government policies promoting low-emission technologies and increased funding for biomass utilization are further boosting market expansion.

India Lignin-Based Resins Market Insight

India is projected to witness the fastest growth in the region, fueled by its growing construction and automotive industries and increasing demand for cost-effective, eco-friendly resins. The country’s emphasis on reducing import dependence for chemicals and increasing bioeconomy investments is encouraging local lignin processing. Rising consumer awareness about sustainability is also enhancing the appeal of lignin-derived resins in paints, binders, and composite panels.

Europe Lignin-Based Resins Market Insight

The Europe lignin-based resins market is poised for significant growth, underpinned by stringent environmental regulations, strong industrial focus on circular materials, and high R&D activity in bio-refining. Countries across Western and Northern Europe are actively replacing fossil-based resins with lignin alternatives in wood adhesives, insulation, and structural composites. EU-funded innovation programs and a mature recycling infrastructure are further supporting widespread adoption.

Germany Lignin-Based Resins Market Insight

Germany is a key contributor to Europe’s market, driven by its advanced bioeconomy strategy and strong industrial base. German companies are at the forefront of developing high-performance lignin derivatives for polyurethane and epoxy applications. Sustainability mandates in the construction and automotive sectors, coupled with growing demand for carbon-neutral materials, are accelerating the commercialization of lignin-based resin technologies.

North America Lignin-Based Resins Market Insight

North America is expected to register the fastest CAGR from 2025 to 2032, driven by increasing investment in bio-refineries, heightened focus on green building materials, and regulatory encouragement for low-VOC resins. Demand for renewable and recyclable materials in the automotive, packaging, and construction sectors is growing steadily, with lignin-based products viewed as strategic substitutes for petroleum-derived resins.

U.S. Lignin-Based Resins Market Insight

The U.S. captured the largest share in North America in 2024, supported by extensive lignin recovery infrastructure and growing use of lignin-derived phenolic resins in insulation and engineered wood products. Federal initiatives promoting sustainable chemistry and bio-based innovation are fostering partnerships between universities, start-ups, and industry players. The market is also benefiting from increasing corporate commitments to net-zero targets and sustainable sourcing.

Lignin-Based Resins Market Share

The lignin-based resins industry is primarily led by well-established companies, including:

- Borregaard (Norway)

- Stora Enso (Finland)

- UPM Biochemicals (Finland)

- MetGen (Finland)

- Ingevity (U.S.)

- Lignolix (U.S.)

- West Fraser (Canada)

- Domtar Corporation (U.S.)

- Domsjö Fabriker (Sweden)

- The Nippon Paper Group (Japan)

- GreenValue Enterprises LLC (U.S.)

- FPInnovations (Canada)

- LigniOx (Finland)

- Metsa Group (Finland)

- GranBio (Brazil)

Latest Developments in Global Lignin-Based Resins Market

- In May 2025, Swedish greentech firm Lignin Industries secured approximately USD 4.2 million (EUR 3.9 million) to scale up commercialization of its lignin-based thermoplastic, Renol. This funding is expected to significantly boost innovation and production capacity in the European market, reinforcing the role of lignin as a sustainable alternative to fossil-based plastics and supporting broader market adoption across packaging and automotive sectors

- In August 2024, Brazil’s Raízen partnered with Dutch biorefinery Vertoro to develop high-value applications for lignin derived from second-generation ethanol production. This collaboration is anticipated to enhance lignin valorization in Latin America, expanding its utility in advanced biofuels, specialty chemicals, and sustainable materials, thereby driving lignin-based resin development and commercialization in emerging markets

- In April 2023, Ahlstrom launched Ahlstrom ECO, a new line of renewable filtration solutions for the automotive industry. By integrating lignin-based technologies, this initiative addresses growing global demand for eco-friendly transport solutions and is expected to stimulate further use of lignin-derived materials in performance-critical automotive components, strengthening the resin market’s presence in mobility applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lignin Based Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lignin Based Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lignin Based Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.