Global Limestone Calcined Clay Cement Market

Market Size in USD Million

CAGR :

%

USD

767.19 Million

USD

1,241.00 Million

2024

2032

USD

767.19 Million

USD

1,241.00 Million

2024

2032

| 2025 –2032 | |

| USD 767.19 Million | |

| USD 1,241.00 Million | |

|

|

|

|

Limestone Calcined Clay Cement Market Size

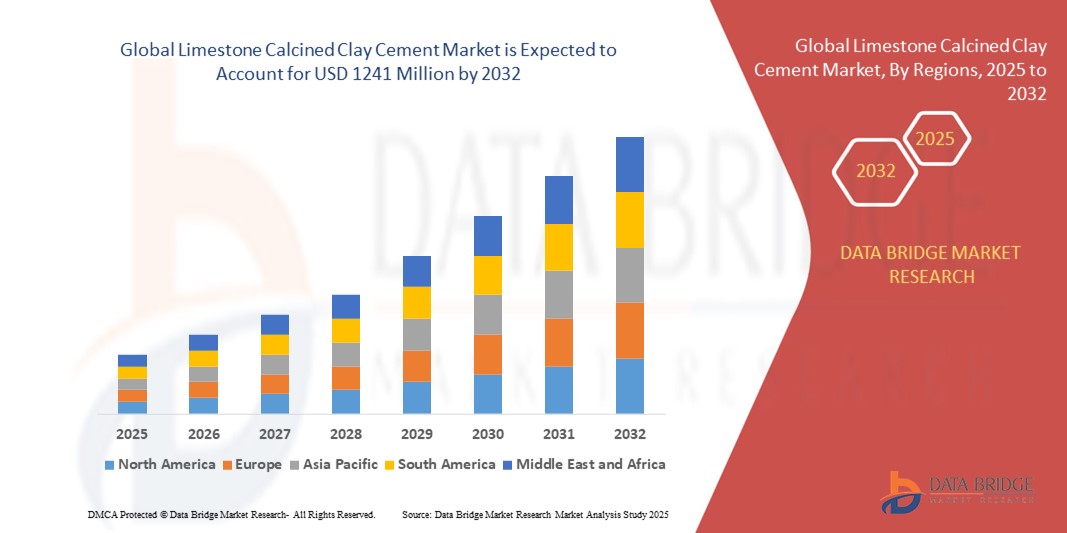

- The global limestone calcined clay cement market size was valued at USD 767.19 million in 2024 and is expected to reach USD 1241 million by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is primarily driven by increasing demand for sustainable and low-carbon cement alternatives, growing construction activities, and rising awareness of environmental benefits such as reduced CO2 emissions

- Rising adoption of eco-friendly construction materials and government initiatives promoting green building practices are further propelling the demand for LC3 across both residential and commercial applications

Limestone Calcined Clay Cement Market Analysis

- The limestone calcined clay cement market is experiencing robust growth due to the global push for sustainable construction materials and the need to reduce the carbon footprint of cement production

- The growing demand from residential, commercial, and infrastructure projects is encouraging manufacturers to innovate with high-performance LC3 solutions that offer durability, cost-effectiveness, and environmental benefits

- Europe dominates the limestone calcined clay cement market with the largest revenue share of 44.9% in 2024, driven by stringent environmental regulations, advanced construction practices, and widespread adoption of sustainable materials

- North America is expected to be the fastest-growing region during the forecast period, fueled by increasing investments in infrastructure, growing awareness of low-carbon cement solutions, and supportive government policies, particularly in the U.S. and Canada

- The LC3 Blended Cements segment dominated the largest market revenue share of 60.2% in 2024, driven by its widespread adoption in construction due to its ability to incorporate limestone and calcined clay with clinker, offering a lower carbon footprint while maintaining performance

Report Scope and Limestone Calcined Clay Cement Market Segmentation

|

Attributes |

Limestone Calcined Clay Cement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Limestone Calcined Clay Cement Market Trends

Increasing Adoption of Sustainable Construction Materials

- The Global Limestone Calcined Clay Cement (LC3) Market is experiencing a significant trend towards the adoption of sustainable construction materials driven by global environmental concerns

- LC3, a blend of clinker, calcined clay, limestone, and gypsum, reduces CO2 emissions by up to 40% compared to traditional Portland cement, making it a preferred choice for eco-conscious construction projects

- Advanced research and development are enhancing LC3 formulations, improving mechanical properties such as compressive strength and durability, which supports its use in diverse applications such as residential, commercial, and industrial construction

- For instances, companies such as JK Cement in India have launched LC3 production, leveraging its eco-friendly profile to target major infrastructure projects

- The integration of LC3 into building codes, such as India’s IS 18189:2023, is boosting its credibility and encouraging wider adoption across global markets

- This trend is increasing the appeal of LC3 for construction firms and governments aiming to meet sustainability goals, particularly in regions such as Europe, which dominates the market due to stringent environmental regulations

Limestone Calcined Clay Cement Market Dynamics

Driver

Growing Demand for Low-Carbon Construction Solutions

- Rising global awareness of climate change and the need to reduce carbon footprints is a major driver for the LC3 market, as it offers a significant reduction in CO2 emissions compared to traditional cement

- LC3’s lower clinker content, typically 50% or less, supports sustainability without compromising performance, making it suitable for residential, commercial, and infrastructure applications

- Government policies and initiatives, particularly in Europe, such as the European Green Deal, mandate the use of low-carbon materials, driving LC3 adoption in construction projects

- The proliferation of green building certifications and incentives in regions such as North America, the fastest-growing market, is further accelerating demand for LC3 in infrastructure and construction sectors

- Major cement manufacturers, such as LafargeHolcim and Ambuja Cements, are investing in LC3 production to meet the growing demand for sustainable building materials

Restraint/Challenge

High Initial Investment and Regulatory Complexities

- The high cost of setting up LC3 production facilities, including calcination equipment and quality control systems, poses a significant barrier, particularly in emerging markets with limited capital

- Integrating LC3 into existing cement production lines requires substantial modifications, increasing costs for manufacturers transitioning from traditional Portland cement

- Regulatory complexities surrounding clinker substitution rates and material standards vary across regions, complicating compliance for international manufacturers and limiting market expansion

- Availability of high-quality kaolinitic clay, essential for LC3 production, can be a constraint in some regions, impacting scalability and cost-effectiveness

- These challenges may slow adoption in cost-sensitive markets or regions with less developed regulatory frameworks for sustainable construction materials

Limestone Calcined Clay Cement market Scope

The market is segmented on the basis of product type, application, end-user, clinker substitution rate, and distribution channel.

- By Product Type

On the basis of product type, the global limestone calcined clay cement market is segmented into LC3 Blended Cements, LC3 Concrete, and LC3 Mortar. The LC3 Blended Cements segment dominated the largest market revenue share of 60.2% in 2024, driven by its widespread adoption in construction due to its ability to incorporate limestone and calcined clay with clinker, offering a lower carbon footprint while maintaining performance. This segment benefits from its compatibility with existing cement production infrastructure, making it a cost-effective and scalable solution.

The LC3 Concrete segment is expected to witness the fastest growth rate of 7.8% from 2025 to 2032, propelled by increasing demand for eco-friendly concrete in residential, commercial, and infrastructure projects. Advancements in mix design and the ability to achieve high compressive strength with lower clinker content enhance its appeal for sustainable construction.

- By Application

On the basis of application, the global limestone calcined clay cement market is segmented into Residential, Commercial, and Industrial. The Residential segment dominated with a market revenue share of 38.5% in 2024, driven by the growing use of LC3 in housing projects, particularly in urbanizing regions. Its cost-effectiveness and environmental benefits align with the global push for sustainable residential construction.

The Commercial segment is anticipated to experience the fastest growth from 2025 to 2032, with a CAGR of 8.2%, fueled by increasing adoption in commercial buildings, such as offices and retail spaces, where sustainability certifications and low-carbon materials are prioritized. The use of LC3 in high-profile projects enhances its market penetration.

- By End-User

On the basis of end user, the global limestone calcined clay cement market is segmented into Construction, Infrastructure, and Others. The Construction segment held the largest market revenue share of 45.3% in 2024, driven by the widespread use of LC3 in general construction activities, including buildings and precast elements, due to its ability to reduce CO2 emissions by up to 40% compared to traditional Portland cement.

The Infrastructure segment is expected to witness robust growth from 2025 to 2032, with a CAGR of 7.5%, driven by the increasing adoption of LC3 in large-scale infrastructure projects such as highways, bridges, and dams. The material’s durability and resistance to environmental factors such as chloride ingress make it ideal for infrastructure applications.

- By Clinker Substitution Rate

On the basis of clinker substitution rate, the global limestone calcined clay cement market is segmented into Low Substitution (15-30%), Medium Substitution (30-50%), and High Substitution (50% and above). The Medium Substitution (30-50%) segment dominated with a market revenue share of 52.7% in 2024, as it strikes a balance between environmental benefits and performance, making it suitable for a wide range of applications without compromising strength or durability.

The High Substitution (50% and above) segment is anticipated to grow at the fastest rate of 8.5% from 2025 to 2032, driven by advancements in LC3 technology that allow higher clinker replacement without sacrificing mechanical properties. This segment is particularly appealing in regions with stringent carbon reduction targets.

- By Distribution Channel

On the basis of distribution channel, the global limestone calcined clay cement market is segmented into Cement Suppliers, Construction Material Distributors, and Retail Outlets. The Cement Suppliers segment held the largest market revenue share of 55.8% in 2024, driven by their direct relationships with cement manufacturers and ability to supply large volumes to construction and infrastructure projects.

The Construction Material Distributors segment is expected to witness the fastest growth from 2025 to 2032, with a CAGR of 7.9%, as distributors play a critical role in expanding the reach of LC3 to diverse markets, particularly in emerging economies where sustainable construction materials are gaining traction.

Limestone Calcined Clay Cement Market Regional Analysis

- Europe dominates the limestone calcined clay cement market with the largest revenue share of 44.9% in 2024, driven by stringent environmental regulations, advanced construction practices, and widespread adoption of sustainable materials

- Consumers prioritize LC3 for its low carbon footprint, enhanced durability, and energy efficiency, particularly in regions with strong sustainability goals and urban development projects

- Growth is supported by advancements in LC3 technology, including higher clinker substitution rates and improved production processes, alongside rising adoption in both residential and infrastructure projects

U.K. Limestone Calcined Clay Cement Market Insight

The U.K. market for LC3 is expected to witness significant growth, driven by demand for sustainable construction materials and enhanced building performance in urban and suburban settings. Increased awareness of LC3’s environmental benefits, such as reduced CO2 emissions and energy efficiency, encourages adoption. Evolving regulations balancing clinker substitution with performance standards further influence consumer choices.

Germany Limestone Calcined Clay Cement Market Insight

Germany is a leading market for LC3 in Europe, attributed to its advanced construction sector and high consumer focus on sustainability and energy efficiency. German consumers prefer LC3 products with high clinker substitution rates that reduce carbon emissions and contribute to lower energy costs. The integration of LC3 in premium construction projects and aftermarket applications supports sustained market growth.

U.S. Limestone Calcined Clay Cement Market Insight

The U.S. limestone calcined clay cement market is expected to witness significant growth, fueled by increasing awareness of carbon emission reduction and strong demand in the construction sector. The trend towards sustainable construction practices and government incentives for eco-friendly materials further boost market expansion. The integration of LC3 in new construction and retrofit projects, coupled with aftermarket demand, creates a diverse product ecosystem.

Asia-Pacific Limestone Calcined Clay Cement Market Insight

The Asia-Pacific region is expected to witness rapid growth in the LC3 market, driven by expanding construction activities and rising environmental awareness in countries such as China, India, and Japan. Increasing demand for low-carbon cement solutions, coupled with government initiatives promoting sustainable infrastructure, boosts market penetration. The availability of abundant raw materials such as kaolinite clay further enhances market growth.

Japan Limestone Calcined Clay Cement Market Insight

Japan’s LC3 market is expected to experience strong growth due to consumer preference for high-quality, low-carbon cement solutions that enhance construction sustainability and performance. The presence of major construction firms and the integration of LC3 in infrastructure projects accelerate market adoption. Rising interest in eco-friendly construction materials also contributes to market expansion.

China Limestone Calcined Clay Cement Market Insight

China holds the largest share of the Asia-Pacific LC3 market, propelled by rapid urbanization, increasing construction activities, and a strong focus on sustainable building practices. The country’s growing infrastructure investments and emphasis on carbon reduction support the adoption of LC3 products. Competitive domestic manufacturing capabilities and cost-effective production enhance market accessibility.

Limestone Calcined Clay Cement Market Share

The limestone calcined clay cement industry is primarily led by well-established companies, including:

- HOLCIM (Switzerland)

- HeidelbergCement (Germany)

- CEMEX (Mexico)

- CRH (Ireland)

- Anhui Conch Cement Co., Ltd. (China)

- China National Building Material Group Corporatio (China)

- TAIHEIYO CEMENT CORPORATION (Japan)

- UltraTech Cement Ltd. (India)

- Dangote Cement Plc. (Nigeria)

- Buzzi S.p.A. (Italy)

- Votorantim Cimentos (Brazil)

- EUROCEMENT group. (Russia)

- TITAN CEMENT (Greece)

- SCG (Thailand)

- SSANGYONG C&E (South Korea)

- Shree Cement Limited (India)

- COLACEM (Italy)

- Grupo Argos S.A (Colombia)

What are the Recent Developments in Global Limestone Calcined Clay Cement Market?

- In July 2025, cement producers in Togo committed to a comprehensive roadmap to reduce CO₂ emissions by 2050, aligning with the country’s Paris Agreement goals. A key strategy involves the large-scale adoption of LC3 (Limestone Calcined Clay Cement), which will reduce the clinker factor in cement from 65% to 40%, potentially cutting emissions by up to 40% without compromising performance. The roadmap also includes replacing coal with agricultural and municipal waste as alternative fuels. These measures aim to curb emissions growth, which could otherwise double by 2050 due to rising demand

- In May 2025, Heidelberg Materials and CBI Ghana commissioned the world’s largest calcined clay plant in Tema, Ghana, with an annual capacity of 400,000 tonnes. The facility utilizes locally sourced raw materials, significantly reducing reliance on imported clinker and supporting the production of low-carbon cement. This initiative is a key part of Heidelberg’s global decarbonization strategy, aiming to cut CO₂ emissions by up to 40%. The project also created over 300 local jobs and serves as a blueprint for sustainable cement production in regions with limited limestone deposits

- In April 2025, Supacem (CBI Ghana) invested $100 million in a new LC3 (Limestone Calcined Clay Cement) plant in Tema, Ghana, aimed at addressing the country’s clinker shortage and rising import costs. The launch was made possible by the Ghana Standards Authority’s adoption of the GS PAS 5:2024 LC3 standard, developed in collaboration with local and international institutions. By using locally sourced raw materials, the plant reduces reliance on imported clinker, enhances cement supply stability, and supports environmental sustainability. The project also created over 160 direct jobs, contributing to economic growth and climate action

- In November 2023, JK Lakshmi Cement Ltd. announced its preparations to become the first cement company in India and Asia to begin commercial production of LC3 (Limestone Calcined Clay Cement). This milestone is part of a strategic partnership with Zurich Airport International AG for the Noida International Airport project, aiming to significantly reduce the airport’s carbon footprint. The LC3 mix design replaces up to 50% of clinker, contributing to up to 35% CO₂ savings. The initiative supports India’s climate commitments under the Paris Agreement and showcases Indo-Swiss collaboration in sustainable infrastructure

- In February 2023, Holcim inaugurated Europe’s first calcined clay cement factory at its Saint-Pierre-la-Cour plant in France. The facility produces ECOPlanet green cement using Holcim’s proprietary proximA Tech technology, delivering up to 500,000 tonnes per year of low-carbon cement with a 50% lower CO₂ footprint compared to conventional cement. Powered entirely by biomass-based fuels and waste heat recovery systems, the plant represents a major step in Holcim’s strategy to decarbonize construction and scale sustainable materials across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Limestone Calcined Clay Cement Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Limestone Calcined Clay Cement Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Limestone Calcined Clay Cement Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.