Global Limestone Market

Market Size in USD Billion

CAGR :

%

USD

85.08 Billion

USD

119.60 Billion

2025

2033

USD

85.08 Billion

USD

119.60 Billion

2025

2033

| 2026 –2033 | |

| USD 85.08 Billion | |

| USD 119.60 Billion | |

|

|

|

|

Limestone Market Size

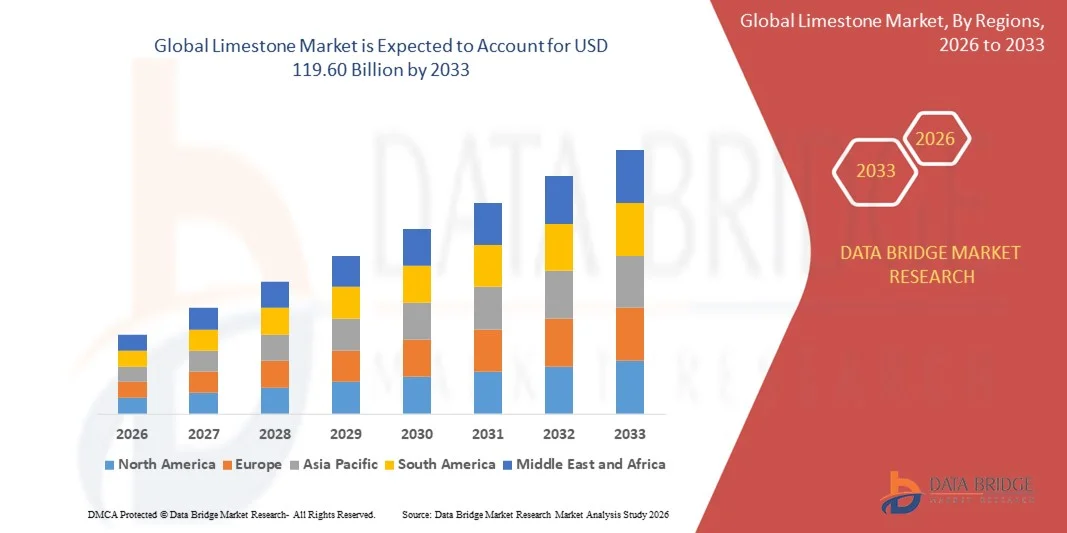

- The global limestone market size was valued at USD 85.08 billion in 2025 and is expected to reach USD 119.60 billion by 2033, at a CAGR of 4.35% during the forecast period

- The market growth is largely fueled by increasing demand from construction, cement, and steel industries, which are driving large-scale limestone consumption for infrastructure and industrial applications

- Furthermore, rising adoption of limestone in environmental applications such as water treatment, flue gas desulfurization, and soil stabilization is enhancing its strategic importance, thereby accelerating overall market expansion

Limestone Market Analysis

- Limestone, used extensively as a raw material in construction, cement production, metallurgy, and chemical industries, is a critical industrial mineral due to its versatility, high purity, and cost-effectiveness

- The escalating demand for limestone is primarily driven by rapid urbanization, expanding infrastructure projects, growth in steel and cement production, and increasing environmental regulations requiring limestone-based solutions for pollution control and industrial processes

- Asia-Pacific dominated the limestone market with a share of 56.5% in 2025, due to rapid infrastructure development, urbanization, and a growing construction sector

- North America is expected to be the fastest growing region in the limestone market during the forecast period due to strong demand from construction, infrastructure, and environmental sectors

- High-calcium limestone segment dominated the market with a market share of 62.5% in 2025, due to its extensive use in steel manufacturing, cement production, and construction applications. Industries often prefer High-Calcium Limestone due to its high purity, consistent chemical composition, and superior performance in neutralization and fluxing processes. The market also sees strong demand for High-Calcium Limestone because of its availability in large quantities and suitability for large-scale industrial applications. Its compatibility with various processing methods, such as calcination and grinding, further strengthens its dominance

Report Scope and Limestone Market Segmentation

|

Attributes |

Limestone Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Limestone Market Trends

Rising Demand from Construction and Infrastructure Projects

- A significant trend in the limestone market is the increasing demand driven by rapid infrastructure development, urbanization, and large-scale construction projects across residential, commercial, and industrial sectors. This trend is elevating limestone as a critical raw material in cement production, concrete aggregates, steel fluxing, and road construction due to its cost-effectiveness and availability

- For instance, UltraTech Cement and LafargeHolcim are actively sourcing high-quality limestone to meet the increasing requirements of mega infrastructure projects in India and Europe. Their procurement strategies ensure consistent supply for cement and concrete production while supporting urban development initiatives

- The rising focus on sustainable construction is further contributing to limestone demand, as the mineral is used in eco-friendly building materials and low-carbon cement formulations. This is positioning limestone as a key enabler for green infrastructure and industrial growth

- Growing industrialization in emerging economies is accelerating limestone consumption, with countries in Asia-Pacific and Latin America witnessing a surge in construction and manufacturing activity. The integration of limestone into multiple sectors is reinforcing its importance as a foundational industrial mineral, supporting long-term market expansion

- The environmental sector is also driving trend adoption, with limestone widely applied in water treatment, flue gas desulfurization, and soil stabilization projects. This cross-sector utility highlights limestone’s versatility and its increasing role in sustainable industrial and municipal applications

- Strong government investments in infrastructure, including roads, bridges, and public utilities, are contributing to sustained limestone demand globally. These projects require large quantities of cement, aggregates, and high-purity limestone, further strengthening its market position

Limestone Market Dynamics

Driver

Increasing Use in Cement, Steel, and Industrial Applications

- The growing adoption of limestone in cement, steelmaking, and other industrial applications is driving the market’s growth by providing a reliable, cost-effective, and high-purity raw material. Industries rely on limestone for its role as a flux in steel production, a neutralizing agent in chemical processes, and a primary ingredient in cement, which underscores its criticality across industrial supply chains

- For instance, LafargeHolcim and Carmeuse are expanding their limestone mining and processing operations to cater to increasing demand from large-scale cement plants and steel manufacturers in Europe and Asia. These expansions ensure steady raw material availability, reduce operational risks, and enable companies to meet growing infrastructure needs

- The rise in construction activity worldwide, particularly in urbanization and industrial hubs, is boosting limestone consumption for aggregates, cement production, and concrete applications

- Growing environmental regulations are further enhancing limestone demand, as industries increasingly adopt limestone for flue gas desulfurization, water treatment, and other emission control applications. This is positioning limestone as a sustainable solution across industrial and municipal sectors

- Continuous investments in mining technologies, processing facilities, and supply chain optimization are supporting increased production and availability, thereby sustaining growth momentum for limestone across multiple sectors

Restraint/Challenge

High Mining and Processing Costs

- The limestone market faces challenges due to the high costs associated with mining, transporting, and processing the mineral, particularly for high-purity and specialty grades. These costs can limit the profitability of operations and constrain the ability of smaller players to compete effectively

- For instance, Lhoist and Mississippi Lime Company face rising operational expenses in Europe and North America due to energy-intensive processing requirements, advanced crushing and grinding equipment, and stringent quality standards for industrial-grade limestone

- Environmental regulations and land acquisition complexities further add to operational costs, as companies must comply with sustainability guidelines, rehabilitation mandates, and mining permits

- Processing high-purity limestone for cement, steel fluxing, and chemical applications requires specialized equipment and energy-intensive methods, increasing production expenses and impacting pricing strategies

- The need to balance high-quality production with economic feasibility continues to challenge manufacturers while trying to meet increasing demand across construction, industrial, and environmental sectors

Limestone Market Scope

The market is segmented on the basis of type, size, end-use industry, and import and export.

- By Type

On the basis of type, the limestone market is segmented into Magnesian Limestone and High-Calcium Limestone. The High-Calcium Limestone segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its extensive use in steel manufacturing, cement production, and construction applications. Industries often prefer High-Calcium Limestone due to its high purity, consistent chemical composition, and superior performance in neutralization and fluxing processes. The market also sees strong demand for High-Calcium Limestone because of its availability in large quantities and suitability for large-scale industrial applications. Its compatibility with various processing methods, such as calcination and grinding, further strengthens its dominance.

The Magnesian Limestone segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing use in refractory materials, magnesium extraction, and environmental applications. For instance, companies such as Carmeuse Group are expanding production of Magnesian Limestone to meet rising demand in steel and chemical industries. Its unique properties, including higher magnesium content and thermal stability, make it suitable for specialized industrial processes. The segment benefits from growing awareness of its eco-friendly and efficient characteristics in high-performance applications. Rising investments in industrial infrastructure and metal processing plants further contribute to its accelerating adoption.

- By Size

On the basis of size, the limestone market is segmented into Crushed Limestone, Calcined Limestone (PCC), and Ground Limestone (GCC). The Crushed Limestone segment held the largest market revenue share in 2025, driven by its widespread use in road construction, concrete production, and aggregate applications. Industries prefer crushed limestone for its mechanical strength, ease of handling, and suitability in large-scale civil projects. The market also sees steady demand due to its role as a cost-effective filler and base material in infrastructure development. Its compatibility with various construction materials and ability to improve soil stabilization further supports its dominance.

The Calcined Limestone (PCC) segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing use in flue gas treatment, environmental remediation, and chemical manufacturing. For instance, companies such as Graymont are focusing on producing PCC to cater to growing demand in environmental and industrial applications. PCC offers high reactivity, superior purity, and consistent performance, making it ideal for specialized industrial uses. Rising environmental regulations promoting air quality control drive the adoption of calcined limestone in industrial processes. The segment also benefits from technological advancements in calcination and processing methods that enhance efficiency and output.

- By End-Use Industry

On the basis of end-use industry, the limestone market is segmented into Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, and Others. The Construction segment dominated the market with the largest revenue share in 2025, driven by rapid urbanization, infrastructure expansion, and residential and commercial construction projects. Limestone is extensively used in cement production, concrete aggregates, and road construction due to its structural properties, durability, and cost-effectiveness. The market also experiences strong demand because limestone enhances building material strength and longevity. Its versatility across both residential and large-scale projects further contributes to its market dominance.

The Metallurgy segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing steel production and fluxing requirements in metal processing. For instance, ArcelorMittal has been expanding limestone sourcing for steelmaking operations to meet rising global demand. Metallurgical limestone offers high purity, consistency, and efficient fluxing characteristics, making it essential for high-quality steel production. Growing industrialization in emerging economies drives demand for metallurgical limestone in primary and secondary metal industries. The adoption of modern steelmaking technologies further accelerates the need for high-quality limestone in metallurgical applications.

- By Import and Export

On the basis of import and export, the limestone market is segmented into import trends, import breakup by country, export trends, and export breakup by country. The import trends segment dominated in 2025 due to increasing demand in countries with limited domestic limestone reserves. Imported limestone is preferred for its quality consistency, chemical composition, and suitability in industrial applications requiring high-purity material. For instance, countries in the Middle East and Southeast Asia rely on imports to meet industrial and construction needs. The market also sees steady growth from imports because of the increasing trade of specialized limestone for cement, steel, and chemical industries.

The export trends segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising global demand for high-quality limestone in emerging economies. For instance, U.S.-based suppliers such as Lhoist are expanding limestone exports to Asia-Pacific and African markets. Export growth is supported by international trade agreements, logistics improvements, and rising demand from construction, metallurgy, and environmental applications. High-calcium and specialty limestones are increasingly shipped to regions with limited domestic production capacity. The market benefits from exporters focusing on tailored limestone grades to meet specific industrial and environmental standards.

Limestone Market Regional Analysis

- Asia-Pacific dominated the limestone market with the largest revenue share of 56.5% in 2025, driven by rapid infrastructure development, urbanization, and a growing construction sector

- The region’s cost-effective mining operations, availability of high-quality limestone reserves, and increasing demand from cement, steel, and chemical industries are accelerating market expansion

- Favorable government policies, rising industrial investments, and a skilled labor force across developing economies are contributing to higher limestone consumption for construction, metallurgy, and environmental applications

China Limestone Market Insight

China held the largest share in the Asia-Pacific limestone market in 2025, owing to its extensive construction activity, steel production, and cement manufacturing. The country’s strong industrial base, abundant high-quality limestone reserves, and government initiatives promoting infrastructure development are major growth drivers. Demand is also supported by growing exports of construction materials and rising use in metallurgical and chemical applications.

India Limestone Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding infrastructure projects, rapid urbanization, and increasing investments in cement and steel industries. For instance, companies such as UltraTech Cement are sourcing limestone to meet rising domestic construction demand. Government programs supporting road, rail, and urban development, along with increasing industrial activity, are further boosting market expansion. Rising environmental applications of limestone, including water treatment and flue gas desulfurization, are also contributing to growth.

Europe Limestone Market Insight

The Europe limestone market is growing steadily, supported by strong construction activity, environmental regulations, and high demand for high-purity limestone in steelmaking and chemical processes. The region emphasizes sustainability, quality standards, and energy-efficient production, particularly in cement, metallurgy, and paper industries. Increasing use of limestone in wastewater treatment and emissions control is further enhancing market demand.

Germany Limestone Market Insight

Germany’s limestone market is driven by advanced industrial infrastructure, a strong construction sector, and high-quality cement and steel production. The country has well-established supply chains, R&D networks, and partnerships between industrial players and academic institutions, fostering continuous innovation in limestone utilization. Demand is particularly high for high-purity limestone in metallurgy, environmental applications, and specialty chemicals.

U.K. Limestone Market Insight

The U.K. market is supported by a mature construction and infrastructure industry, growing environmental regulations, and increased demand for processed limestone in cement, chemical, and industrial applications. Rising emphasis on sustainable construction materials, local sourcing, and high-quality limestone production is strengthening market growth. The country’s focus on R&D, academic-industry collaboration, and development of innovative limestone-based solutions contributes to steady demand.

North America Limestone Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand from construction, infrastructure, and environmental sectors. A growing focus on cement, steel, and water treatment applications is boosting limestone consumption. Increasing investments in industrial and urban development projects, along with technological advancements in mining and processing, are supporting market expansion.

U.S. Limestone Market Insight

The U.S. accounted for the largest share in the North America limestone market in 2025, underpinned by extensive infrastructure projects, a robust construction industry, and high demand from the steel and chemical sectors. The country’s focus on quality, environmental compliance, and innovation is encouraging the use of high-purity limestone in multiple industrial and environmental applications. Presence of key players, well-established distribution networks, and advanced processing technologies further solidify the U.S.’s leading position in the region.

Limestone Market Share

The limestone industry is primarily led by well-established companies, including:

- Carmeuse (Belgium)

- Cemex (Mexico)

- GCCP Resources Limited (U.K.)

- Imerys (France)

- Holcim (Switzerland)

- Lhoist (Belgium)

- Minerals Technologies Inc. (U.S.)

- Mississippi Lime Company (U.S.)

- National Lime & Stone Company (U.S.)

- Natural Stone Impressions Private Limited (India)

- A B Impex (India)

- Heritage Marble Private Limited (India)

Latest Developments in Global Limestone Market

- In October 2025, the Government of India reclassified limestone as a major mineral, which centralizes its mining regulation and mandates that all limestone mining blocks be allocated through competitive auctions rather than at the discretion of individual states. This regulatory shift is expected to increase transparency and standardization in resource allocation, enhancing investor confidence and encouraging large-scale investments in limestone extraction. By formalizing mining operations, it also ensures a more consistent and secure supply of limestone for industrial users, particularly cement and steel manufacturers, thereby strengthening the overall market structure and supporting long-term growth in both domestic and export markets

- In August 2025, CALIDRA announced a USD 30 million investment to expand limestone operations in Argentina and Chile, targeting growth in Latin America’s mining, steel, and construction sectors. This investment strengthens CALIDRA’s regional presence and increases limestone production capacity to meet the rising demand for raw materials in key industrial sectors. By improving local supply chains and reducing dependency on imports, CALIDRA can offer more competitive pricing and timely delivery, supporting the expansion of downstream industries in Latin America. The initiative also reflects a broader trend of strategic investment in resource-rich regions to capitalize on industrial growth and infrastructure development

- In March 2025, Ambuja Cements expanded its limestone reserves by 275 million tonnes during the first quarter, reinforcing its focus on securing long-term raw material availability. This increase in reserves allows the company to better plan production, reduce dependency on external suppliers, and maintain a stable cost structure for cement manufacturing. The added capacity also positions Ambuja to meet rising infrastructure demand in India, while ensuring consistent quality for downstream industries that rely on high-purity limestone, such as steel production and chemical manufacturing. This strategic move enhances Ambuja’s competitive advantage and market resilience

- In April 2024, Longcliffe Quarries committed USD 3 million for two new ultra-fine grinding mills to meet tightening purity requirements in high-spec calcium carbonate applications while lowering energy intensity. These upgrades enable the company to produce higher-quality limestone products suitable for specialized industrial applications such as paper, plastics, and specialty chemicals. In addition, the new mills improve operational efficiency by reducing energy consumption, lowering production costs, and enhancing sustainability. This development strengthens Longcliffe’s position in high-value markets and reflects growing demand for premium limestone products with precise chemical and physical properties

- In August 2023, Ambuja Cements Ltd announced the acquisition of Sanghi Industries Ltd, increasing its limestone reserves by more than one billion tons. This acquisition significantly expanded Ambuja’s raw material base, ensuring long-term supply security for cement production and other industrial uses. By integrating Sanghi’s operations, Ambuja can optimize logistics, achieve economies of scale, and reduce production costs. The expanded reserve base also allows the company to support growing demand in infrastructure and construction projects while maintaining consistent quality, reinforcing its competitive position in the Indian limestone and cement market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Limestone Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Limestone Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Limestone Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.