Global Linear Alkyl Benzene Market

Market Size in USD Billion

CAGR :

%

USD

3.54 Billion

USD

4.77 Billion

2024

2032

USD

3.54 Billion

USD

4.77 Billion

2024

2032

| 2025 –2032 | |

| USD 3.54 Billion | |

| USD 4.77 Billion | |

|

|

|

|

Global Linear Alkyl Benzene Market Size

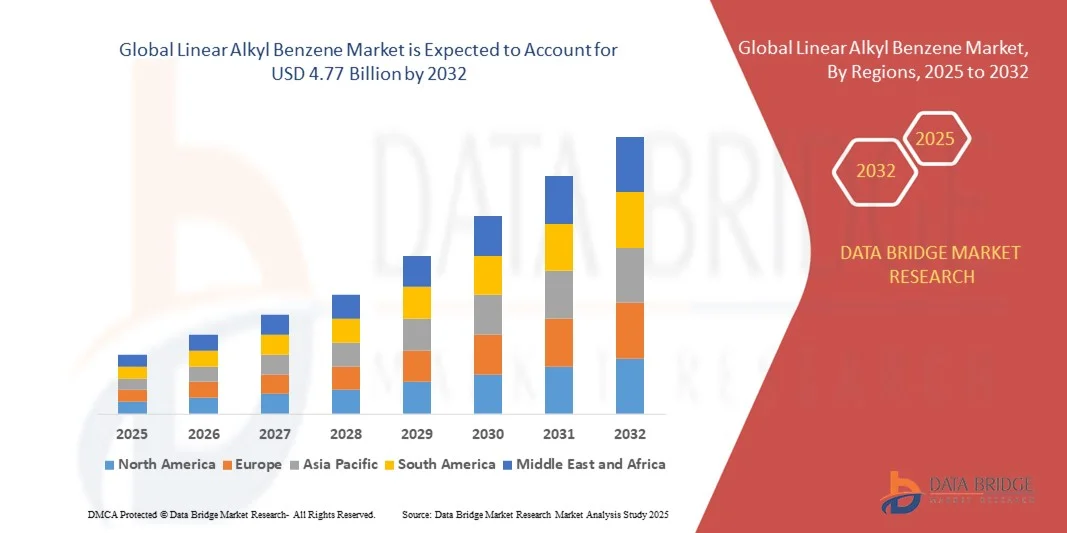

- The global linear alkyl benzene market size was valued at USD 3.54 billion in 2024 and is projected to reach USD 4.77 billion by 2032, growing at a CAGR of 3.80% during the forecast period.

- This robust growth is primarily driven by increasing demand for biodegradable surfactants in household and industrial cleaning products, as consumers and industries shift toward eco-friendly alternatives.

- Additionally, the expanding industrial sector and rising urbanization in emerging economies are contributing to higher consumption of LAB-based detergents, reinforcing market expansion across both developed and developing regions.

Global Linear Alkyl Benzene Market Analysis

- Linear Alkyl Benzene (LAB), a key raw material in the production of biodegradable detergents and industrial cleaners, is gaining prominence due to its excellent surfactant properties, cost-effectiveness, and compatibility with environmental regulations aimed at reducing non-biodegradable waste.

- The growing demand for LAB is primarily driven by the rising use of household and industrial cleaning products, increasing environmental awareness, and a global push toward sustainable and eco-friendly chemical formulations.

- Asia-Pacific dominated the global linear alkyl benzene market with the largest revenue share of 43.5% in 2024, fueled by rapid industrialization, population growth, and rising hygiene standards in countries like China and India, along with significant investment in detergent manufacturing infrastructure.

- North America is expected to be the fastest growing region in the linear alkyl benzene market during the forecast period, owing to rising household and industrial cleaner usage, economic development in emerging markets, and favorable government policies promoting chemical sector growth.

- The surfactants segment dominated the market in 2024 with the largest revenue share of 87.5%, driven by its widespread use in producing Linear Alkylbenzene Sulfonate (LAS) — a key active ingredient in household and industrial detergents.

Report Scope and Global Linear Alkyl Benzene Market Segmentation

|

Attributes |

Linear Alkyl Benzene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Linear Alkyl Benzene Market Trends

Sustainability and Innovation Driving Biodegradable Surfactant Demand

- A significant and accelerating trend in the global Linear Alkyl Benzene (LAB) market is the growing shift toward environmentally sustainable and biodegradable surfactants, driven by tightening regulations and increasing consumer awareness of eco-friendly cleaning products. This evolution is transforming how manufacturers develop and market LAB-based formulations.

- For Instance, companies like Sasol and Cepsa are investing in advanced technologies to produce high-purity LAB with lower environmental impact, ensuring compliance with international biodegradability standards while maintaining performance in detergent applications.

- Innovations in catalyst technologies and feedstock diversification—such as the use of bio-based or renewable feedstocks—are enabling producers to reduce carbon footprints and improve overall production efficiency. For instance, Farabi Petrochemicals is exploring advanced catalytic reforming to enhance yield and reduce emissions.

- The integration of LAB with next-generation detergent technologies is also supporting the formulation of concentrated and water-saving cleaning products. These modern LAB derivatives are designed to perform effectively in low-temperature and low-water wash cycles, aligning with global trends in energy and water conservation.

- This shift is reshaping product development strategies across the detergent industry. Key players are focusing on R&D to create more versatile, high-efficiency LAB formulations that can meet both environmental and performance demands. Producers are also partnering with FMCG companies to co-develop tailored surfactants for specific applications.

- The demand for eco-conscious, high-performance LAB is rising rapidly in both developed and emerging markets, as regulatory bodies push for sustainability and consumers increasingly prefer products that are both effective and environmentally responsible.

Global Linear Alkyl Benzene Market Dynamics

Driver

Growing Demand Due to Rising Hygiene Awareness and Industrial Applications

-

The increasing emphasis on hygiene and cleanliness across residential, commercial, and industrial sectors is a key driver propelling the global Linear Alkyl Benzene (LAB) market. Heightened awareness due to public health concerns, combined with regulatory pressure to adopt biodegradable cleaning agents, has led to a surge in demand for LAB-based detergents.

- For instance, Indian Oil Corporation Ltd has expanded its production of LAB to meet rising domestic and export demand for biodegradable surfactants used in household and industrial cleaning products. These strategic expansions by key players are expected to support industry growth throughout the forecast period.

- As consumers and businesses prioritize effective and sustainable cleaning solutions, LAB—used in the formulation of linear alkylbenzene sulfonate (LAS)—remains a preferred choice due to its strong cleansing properties and biodegradability. This is particularly critical in institutional and commercial settings such as hospitals, hospitality, and manufacturing facilities, where high-performance cleaning is essential.

- Furthermore, the growing urban population, rising disposable incomes, and lifestyle changes in emerging economies are leading to greater consumption of personal and home care products, further boosting the demand for LAB. Government initiatives promoting sanitation and cleanliness, particularly in countries like India and Indonesia, are also contributing to this trend.

- The increasing use of LAB in heavy-duty industrial cleaners, laundry powders, and dishwashing liquids—combined with its cost-effectiveness and environmental compliance—makes it indispensable for both manufacturers and end users. Investments in capacity expansion and modernization by companies such as Farabi Petrochemicals Co.and Cepsa are ensuring steady supply to meet growing global demand.

Restraint/Challenge

Volatility in Raw Material Prices and Environmental Regulations

- Fluctuations in the prices of key raw materials—particularly kerosene and linear paraffin, which are derived from crude oil—pose a significant challenge to the global LAB market. As crude oil prices are highly sensitive to geopolitical tensions, supply chain disruptions, and economic conditions, they directly impact the production costs of LAB.

- For Instance, supply instability in the Middle East or rising global energy demand can lead to price spikes, squeezing profit margins for LAB producers and deterring investment in new capacity, particularly in cost-sensitive regions.

- In addition, stringent environmental regulations regarding emissions, waste disposal, and biodegradability are becoming more rigorous across Europe and North America. These regulations require LAB producers to invest in cleaner technologies and more sustainable production methods, which can increase operational costs.

- Compliance with evolving environmental standards is essential to avoid penalties and maintain access to key export markets. However, smaller or regionally based manufacturers may struggle to meet these demands, limiting their competitiveness.

- Furthermore, growing competition from alternative surfactants, including bio-based and enzyme-based products, may present a long-term challenge if LAB manufacturers fail to innovate and adapt to green chemistry trends.

- To overcome these challenges, companies are focusing on backward integration to stabilize raw material supply, investing in R&D for cleaner production processes, and forming strategic alliances with FMCG companies to secure long-term contracts. Balancing regulatory compliance, cost-efficiency, and sustainability will be critical for ensuring the LAB market’s continued growth.

Global Linear Alkyl Benzene Market Scope

The linear alkyl benzene market is segmented on the basis of application and end user.

- By Application

On the basis of application, the Linear Alkyl Benzene (LAB) market is segmented into surfactants and non-surfactants. The surfactants segment dominated the market in 2024 with the largest revenue share of 87.5%, driven by its widespread use in producing Linear Alkylbenzene Sulfonate (LAS) — a key active ingredient in household and industrial detergents. Surfactants derived from LAB offer strong emulsifying, foaming, and cleaning properties, making them ideal for laundry, dishwashing, and surface cleaning products. The push for biodegradable and eco-friendly cleaning agents further boosts the demand for LAB-based surfactants in both developed and developing economies.

The non-surfactants segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing applications of LAB in niche sectors such as lubricants, ink solvents, and agricultural chemicals. As industrial processes evolve and sustainability becomes a central focus, the versatility of LAB in non-surfactant applications is increasingly being explored by manufacturers.

- By End User

On the basis of end user, the LAB market is segmented into laundry powder, heavy-duty laundry liquid, light-duty dishwashing liquid, household cleaner, industrial cleaner, and others. The laundry powder segment held the largest market revenue share in 2024 at 34.6%, supported by high global demand in emerging economies where powder detergents remain the most cost-effective and widely used form. LAB-based surfactants in laundry powder formulations offer strong cleaning power, particularly in hard water conditions, making them the preferred choice in bulk household detergent production.

The heavy-duty laundry liquid segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by rising consumer preference for liquid detergents in developed markets due to their ease of use, solubility, and compatibility with high-efficiency washing machines. In parallel, commercial and industrial users favor heavy-duty liquids for large-scale cleaning operations. As manufacturers innovate with concentrated and low-water formulations, LAB remains a key component for ensuring performance and biodegradability.

Global Linear Alkyl Benzene Market Regional Analysis

- Asia-Pacific dominated the linear alkyl benzene market with the largest revenue share of 43.5% in 2024, driven by rapid industrialization, increasing population, and growing demand for household and industrial cleaning products across emerging economies like China, India, and Indonesia.

- Consumers and manufacturers in the region are increasingly shifting toward biodegradable and cost-effective cleaning agents, with LAB-based surfactants playing a critical role in laundry detergents, dishwashing liquids, and surface cleaners.

- This high regional demand is further supported by expanding urbanization, rising disposable incomes, and strong investments in the detergent manufacturing sector. In addition, supportive government initiatives focused on hygiene and sanitation, particularly in rural areas, are accelerating the consumption of LAB-derived cleaning products, reinforcing the region’s dominance in the global market.

Japan Linear Alkyl Benzene Market Insight

The Japan linear alkyl benzene market is gaining traction due to the country's emphasis on environmental responsibility and high standards for household hygiene. With strong demand for high-efficiency, eco-friendly cleaning products, LAB continues to play a central role in detergent formulations. Japanese manufacturers are focusing on advanced production technologies that minimize environmental impact while maintaining product performance. Additionally, the aging population and growing demand for easy-to-use, effective cleaning solutions are encouraging broader adoption of LAB-based household cleaners and laundry products.

China Linear Alkyl Benzene Market Insight

The China linear alkyl benzene market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its massive consumer base, industrial expansion, and robust detergent manufacturing sector. China is one of the world’s top producers and consumers of LAB, supported by strong domestic production capabilities and the presence of major chemical companies. The country's growing middle class and rapid urban development are increasing demand for household and institutional cleaners. Moreover, national initiatives promoting environmental compliance and cleaner technologies are supporting the use of biodegradable surfactants, solidifying China’s dominance in the regional LAB market.

U.S. Linear Alkyl Benzene Market Insight

The U.S. linear alkyl benzene market captured the largest revenue share of 76.4% in 2024 within North America, driven by high demand for industrial and household cleaning agents. The country’s strong focus on hygiene and environmental sustainability is pushing manufacturers toward biodegradable surfactants such as Linear Alkylbenzene Sulfonate (LAS), derived from LAB. Increased awareness of eco-friendly cleaning solutions among consumers, combined with regulatory pressure from environmental agencies like the EPA, is contributing to consistent LAB consumption. Moreover, the presence of key detergent manufacturers and chemical processing firms continues to sustain the demand for LAB in various applications.

Europe Linear Alkyl Benzene Market Insight

The Europe linear alkyl benzene market is projected to expand at a steady CAGR over the forecast period, fueled by stringent environmental regulations that favor biodegradable and low-impact cleaning products. EU directives promoting sustainability are driving demand for LAB-based detergents, especially in Western Europe. Countries such as Germany, France, and the Netherlands are investing in cleaner production methods and green chemistry initiatives, encouraging the adoption of LAB as a primary surfactant in both household and industrial formulations. The region is also witnessing a growing shift toward concentrated detergents and low-water usage products, further boosting LAB demand.

U.K. Linear Alkyl Benzene Market Insight

The U.K. linear alkyl benzene market is expected to grow at a notable CAGR during the forecast period, propelled by increased focus on environmental sustainability and advanced cleaning solutions. As consumer preferences shift toward biodegradable cleaning agents, demand for LAB in laundry powders and dishwashing liquids is rising. The commercial cleaning sector, particularly in healthcare and hospitality, is also adopting LAB-based products for their proven effectiveness and regulatory compliance. With the U.K. government reinforcing sustainability goals, manufacturers are exploring LAB applications aligned with green product labeling and eco-certifications.

Germany Linear Alkyl Benzene Market Insight

The Germany linear alkyl benzene market is projected to expand at a considerable CAGR, supported by the country’s leadership in green manufacturing and innovation in chemical processing. German producers are increasingly investing in sustainable LAB production technologies and adopting feedstock alternatives that reduce carbon footprint. High demand for industrial-grade detergents in sectors such as automotive, manufacturing, and healthcare drives LAB consumption. Additionally, growing collaboration between detergent brands and chemical suppliers to offer biodegradable and high-efficiency formulations is contributing to market momentum.

Global Linear Alkyl Benzene Market Share

The linear alkyl benzene industry is primarily led by well-established companies, including:

- Cepsa (Spain)

- Deten Quimica S.A. (Brazil)

- Chevron Phillips Chemical Company (U.S.)

- Honeywell International Inc. (U.S.)

- Huntsman International LLC (U.S.)

- Reliance Industries Limited (India)

- Jingtung Petrochemical Corp., Ltd (Taiwan)

- Sasol (South Africa)

- PT Unggul Indah Cahaya Tbk (Indonesia)

- Desmet Ballestra (Belgium)

- Farabi Petrochemicals Co. (Saudi Arabia)

- S.B.K HOLDING (Turkey)

- Indian Oil Corporation Ltd (India)

- Qatar Petroleum (Qatar)

- JXTG Nippon Oil & Energy Corporation / ENEOS (Japan)

- ISU Chemical (South Korea)

What are the Recent Developments in Global Linear Alkyl Benzene Market?

- In May 2023, Cepsa, a global leader in LAB production, announced the expansion of its Puente Mayorga facility in Spain to increase its capacity for sustainable LAB manufacturing. This strategic move includes the integration of advanced technologies aimed at reducing carbon emissions and energy consumption. The expansion supports Cepsa's broader sustainability goals while addressing the growing global demand for biodegradable surfactants, reinforcing its leadership position in the evolving LAB market.

- In April 2023, Farabi Petrochemicals Co., based in Saudi Arabia, initiated the development of a new LAB production plant in Yanbu Industrial City. This facility is part of the company’s long-term strategy to cater to rising demand across the Asia-Pacific and Middle East regions. With a focus on cleaner production methods and technological innovation, Farabi’s expansion reflects the increasing importance of environmentally compliant LAB in the global cleaning and personal care industries.

- In March 2023, Indian Oil Corporation Ltd announced the successful commissioning of a new linear alkyl benzene unit at its Gujarat Refinery. This addition enhances domestic LAB production capacity, reducing reliance on imports and supporting India’s growing detergent and cleaning products sector. The project aligns with the government’s Make in India initiative and emphasizes IOCL’s commitment to meeting regional demand through self-sufficiency and innovation.

- In February 2023, Desmet Ballestra, a prominent engineering company specializing in LAB technology solutions, launched a next-generation LAB production system designed to improve yield efficiency and environmental performance. The system incorporates advanced process optimization features to reduce waste and lower emissions, supporting the industry’s shift toward greener manufacturing practices. The launch highlights Desmet Ballestra’s pivotal role in enabling sustainable growth within the global LAB market.

- In January 2023, Reliance Industries Limited revealed its plans to expand its LAB production capacity at the Jamnagar petrochemical complex in India. This expansion aims to meet the rising domestic and export demand for LAB in detergent and industrial cleaner applications. By leveraging economies of scale and cutting-edge process technologies, Reliance aims to maintain a competitive advantage in the global LAB market while contributing to regional economic development.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Linear Alkyl Benzene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Linear Alkyl Benzene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Linear Alkyl Benzene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.