Global Liner Hanger Systems Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

4.81 Billion

2024

2032

USD

2.92 Billion

USD

4.81 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 4.81 Billion | |

|

|

|

|

Liner Hanger Systems Market Size

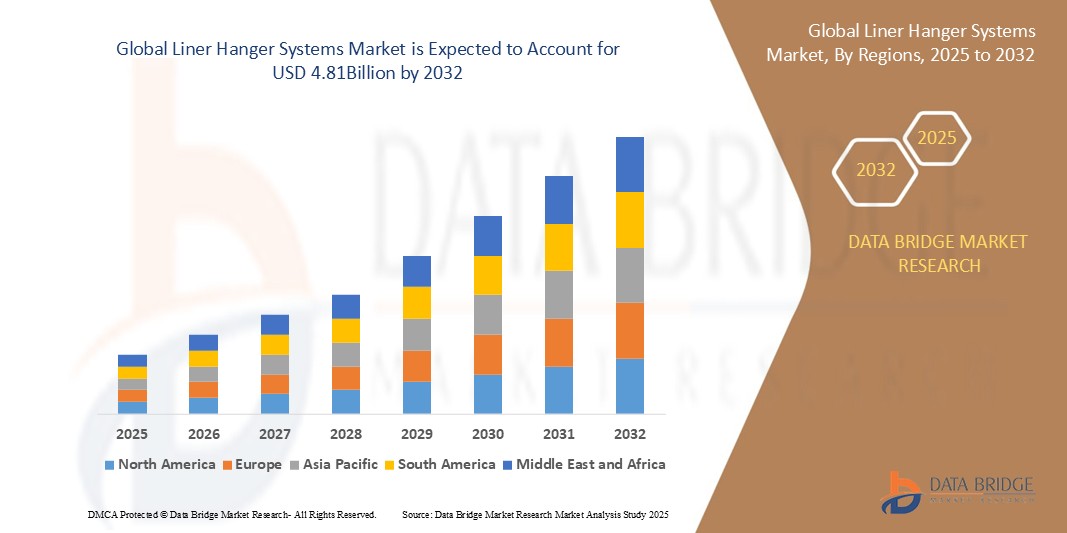

- The global liner hanger systems market size was valued at USD 2.92 billion in 2024 and is expected to reach USD 4.81 billion by 2032, at a CAGR of 6.40% during the forecast period

- This growth is driven by increase in global liquid fuel consumption

Liner Hanger Systems Market Analysis

- Liner Hanger Systems are critical downhole tools used in oil and gas well completions, designed to support and anchor casing liners within the wellbore, ensuring zonal isolation, well integrity, and optimized cementing operations across onshore and offshore environments

- The market demand for liner hanger systems is primarily driven by increased drilling activities, rising investments in deepwater and ultra-deepwater exploration, and the growing adoption of enhanced well construction technologies to reduce non-productive time and improve well efficiency

- North America is expected to dominate the liner hanger systems market with the largest market share of 40.76% in 2025, due to extensive shale oil and gas development, presence of advanced drilling infrastructure, and growing energy independence initiatives across the U.S. and Canada

- Asia-Pacific is projected to register the highest CAGR in the liner hanger systems market during the forecast period, driven by rising energy demand, increasing upstream investment in countries such as China, India, and Indonesia, and the expansion of national oil companies into complex well environments

- The onshore segment is expected to dominate the market with the largest share of 63.11% in 2025, supported by cost-effective drilling operations, ongoing development of mature fields, and growing need for efficient wellbore isolation technologies in land-based hydrocarbon extraction

Report Scope and Liner Hanger Systems Market Segmentation

|

Attributes |

Liner Hanger Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Liner Hanger Systems Market Trends

“Shift Toward High-Pressure, High-Temperature (HPHT) Well Applications”

- A prominent trend shaping the liner hanger systems market is the increasing demand for systems capable of withstanding high-pressure and high-temperature (HPHT) environments, particularly in deepwater and unconventional resource plays

- Modern liner hanger technologies now incorporate premium elastomers, metal-to-metal sealing mechanisms, and enhanced load-bearing structures for safe and efficient well completions in extreme conditions

- For instance, in March 2024, Baker Hughes introduced its next-gen HPHT liner hanger system with metal seal technology rated up to 30,000 psi and 500°F for ultra-deep applications

- This trend is expected to drive innovation in materials and design, allowing operators to extend the lifecycle and safety of complex well projects

Liner Hanger Systems Market Dynamics

Driver

“Expansion of Deepwater and Ultra-Deepwater Exploration”

- The rising depletion of onshore and shallow water reserves has led to increased investments in deepwater and ultra-deepwater exploration across regions such as the Gulf of Mexico, Brazil, and West Africa

- Liner Hanger Systems are critical in these projects for securing liners under extreme subsea pressure, minimizing fluid loss, and ensuring borehole stability

- Advancements in drilling technology, coupled with favorable government policies and offshore leasing rounds, are accelerating activity in this domain

- For instance, in November 2023, Petrobras announced a USD 6 billion investment plan focused on deepwater pre-salt fields, requiring advanced liner deployment technologies

- This offshore drilling boom is poised to significantly elevate demand for high-performance liner hanger systems globally

Opportunity

“Digital Monitoring and Smart Liner Hanger Technologies”

- The integration of digital sensors, telemetry systems, and real-time data analytics into liner hanger operations is emerging as a strong market opportunity

- These smart systems enable real-time tracking of downhole conditions, remote deployment verification, and improved cementing accuracy, reducing the risk of well failure

- Digitalization is paving the way for predictive maintenance, operational efficiency, and greater transparency in well construction

- For instance, in January 2024, Halliburton introduced a digital liner hanger solution with embedded pressure and temperature sensors for data-driven completions

- This trend is likely to enhance operator confidence, reduce non-productive time, and open new service-based revenue models for liner hanger providers

Restraint/Challenge

“Complexity in Installation and High Skill Requirement”

- Liner Hanger Systems, especially in challenging well environments, require precision installation, often needing specialized personnel and extensive training

- Improper deployment can result in costly well failures, re-runs, or zonal isolation loss, significantly affecting operational timelines and budgets

- This complexity limits adoption in regions with a shortage of skilled workforce or less mature oilfield infrastructure

- For instance, a 2023 report by the International Association of Drilling Contractors (IADC) identified skilled labor shortages as a top operational bottleneck in emerging oil markets such as East Africa and Southeast Asia

- To overcome this hurdle, vendors must invest in training programs, remote support tools, and simplified liner hanger designs to boost user adoption

Liner Hanger Systems Market Scope

The market is segmented on the basis of type and location of deployment.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Location of Deployment |

|

In 2025, the onshore is projected to dominate the market with a largest share in location of deployment segment

The onshore segment is expected to dominate the liner hanger systems market with the largest share of 63.11% in 2025 due to lower operational costs, easier accessibility for drilling operations, and increasing investments in onshore oil and gas projects, especially in regions such as North America, the Middle East, and Asia-Pacific.

Liner Hanger Systems Market Regional Analysis

“North America Holds the Largest Share in the Liner Hanger Systems Market”

- North America is expected to dominate the global liner hanger systems market with the largest market share of 40.76%, due to its robust shale gas exploration, extensive onshore drilling activities, and presence of major oilfield service providers

- The U.S. and Canada contribute significantly due to well-established oil & gas infrastructure and ongoing investments in unconventional hydrocarbon reserves

- Government support for energy independence and advancements in well completion technologies further fuel market dominance in this region

“Asia-Pacific is Projected to Register the Highest CAGR in the Liner Hanger Systems Market”

- Asia-Pacific is expected to grow at the fastest rate due to increasing energy demand, rising upstream investments, and exploration of untapped hydrocarbon reserves in countries such as China, India, and Indonesia

- National oil companies in the region are expanding drilling activities and adopting modern well completion technologies, driving the adoption of liner hanger systems

- Supportive government policies and infrastructure development in the oil & gas sector are further accelerating market growth

Liner Hanger Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Allamon Tool Company (U.S.)

- Baker Hughes Company (U.S.)

- Botil Oil Tools Pvt. Ltd. (India)

- DEW Wartungs und Reparatur GmbH (Germany)

- Dril-Quip Inc. (U.S.)

- Halliburton Co. (U.S.)

- Innovex International, Inc. (U.S.)

- Maximus OIGA (U.A.E.)

- NCS Multistage (U.S.)

- NOV (U.S.)

- Packers Plus Energy Services Inc. (Canada)

- Peak Completion Technologies Inc. (U.S.)

- Saga-PCE Pte. Ltd. (Singapore)

- SAZ Oilfield Equipment Inc. (U.A.E.)

- SLB (Schlumberger) (U.S.)

- Tangent Oil and Gas (U.K.)

- Tianjin Elegant Technology Co., Ltd. (China)

- Weatherford (U.S.)

- Well Innovation AS (Norway)

- Wellcare Oil Tools (India)

Latest Developments in Global Liner Hanger Systems Market

- In April 2024, Halliburton introduced the SuperFill II alignment tool, designed to be mounted above the casing/trip suspension tool to direct fluid flow from the landing string to the annulus, thereby enhancing the functionality of autofill floats and minimizing induced spatter, which is expected to improve operational efficiency during wellbore operations

- In August 2021, Dril-Quip, Inc. launched its Environmental, Social, and Governance (ESG) platform on its official website, reinforcing the company's commitment to sustainability and transparent corporate governance

- In May 2021, Schlumberger and NOV announced a strategic collaboration to drive the adoption of automated drilling technologies, allowing customers to integrate Schlumberger’s automation solutions with NOV’s rig automation platform, which is expected to optimize well construction and operational performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.