Global Linerless Labels Market

Market Size in USD Billion

CAGR :

%

USD

1.97 Billion

USD

2.93 Billion

2024

2032

USD

1.97 Billion

USD

2.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.97 Billion | |

| USD 2.93 Billion | |

|

|

|

|

Linerless Labels Market Size

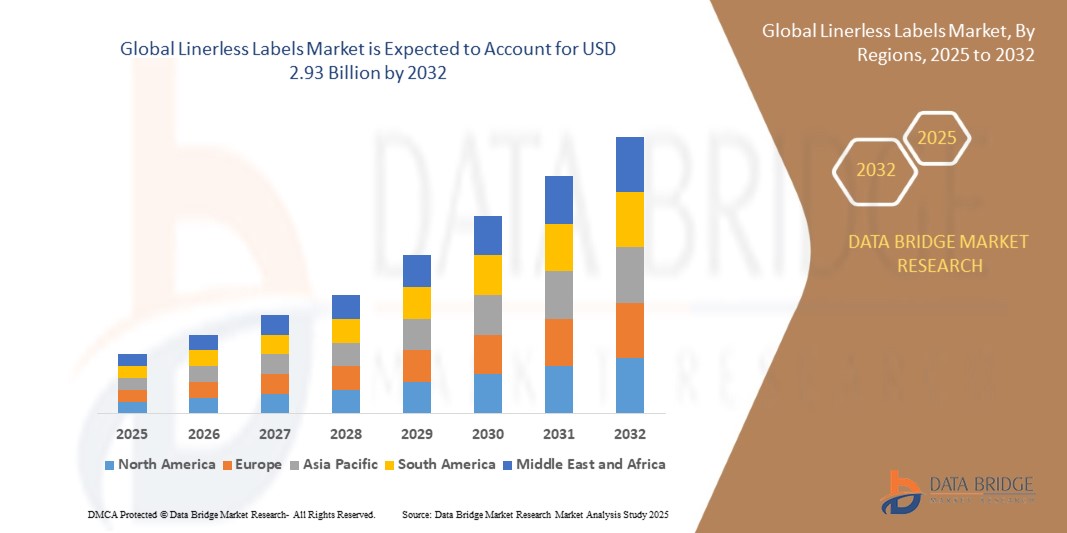

- The global Linerless Labels market was valued at USD 1.97 billion in 2024 and is expected to reach USD 2.93 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.10%, primarily driven by the increasing demand for sustainable packaging solutions

- This growth is driven by factors such as the rising focus on eco-friendly and cost-effective labeling options, advancements

Linerless Labels Market Analysis

- The shift towards eco-friendly packaging solutions has made linerless labels increasingly popular. These labels eliminate the need for a backing paper, reducing waste and contributing to a more sustainable supply chain

- The technology used in producing linerless labels has evolved, enabling high-quality printing and improved adhesion to a variety of surfaces. This advancement has made linerless labels suitable for a wider range of products, from food packaging to retail goods

- Cost-efficiency is another factor driving the market. Linerless labels offer cost savings by reducing material waste and simplifying the production process. This makes them an attractive option for businesses aiming to reduce both operational and environmental costs

- Consumer demand for more sustainable and transparent product packaging is increasing. As businesses seek ways to appeal to environmentally conscious consumers, linerless labels are becoming a preferred choice due to their minimalistic design and eco-friendly properties

- For instance, several companies in the food and beverage industry are adopting linerless labels to enhance the aesthetics of their packaging while minimizing their environmental footprint, demonstrating the market's ability to adapt to changing consumer preferences and regulatory pressures

Report Scope and Linerless Labels Market Segmentation

|

Attributes |

Linerless Labels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Linerless Labels Market Trends

Technological Advancements in Printing

- Technological advancements in printing have significantly transformed the linerless labels market, introducing innovations that enhance efficiency, sustainability, and customization

- This approach offers high-quality, customizable labels with shorter turnaround times, meeting the diverse needs of various industries. The capability for variable data printing allows for unique identifiers, barcodes, or personalized information on each label, enhancing product traceability and consumer engagement

- Advancements in printing have enabled the incorporation of QR codes and augmented reality (AR) into linerless labels, enriching consumer interaction. For instance, a wine label equipped with AR can narrate the vineyard's history or suggest food pairings, offering an immersive experience that traditional labels cannot provide

- The development of UV-curable inks has revolutionized linerless label printing by enabling rapid curing upon exposure to ultraviolet light. This innovation results in quick drying times and increased productivity, allowing for high-speed printing without the risk of smudging. UV inks also provide superior adhesion to various substrates, ensuring durability and vibrant colors, which are crucial for premium packaging applications

- Water-based inks have gained prominence due to their eco-friendly composition, emitting fewer volatile organic compounds and reducing environmental impact

- For Instance, these inks are compatible with a wide range of substrates, making them suitable for diverse applications across industries such as food and beverage, cosmetics, and pharmaceuticals

Linerless Labels Market Dynamics

Driver

Rising Demand for Sustainable Packaging Solutions

- The increasing global emphasis on environmental sustainability is a primary driver of the linerless labels market. Businesses across various sectors are actively seeking eco-friendly packaging alternatives to reduce their carbon footprint and meet consumer demand for green products

- Linerless labels, which eliminate the need for backing paper, align with these sustainability goals by minimizing waste and promoting recyclability

- This shift is particularly evident in industries such as food and beverage, pharmaceuticals, and retail, where adopting linerless labels has led to a 30% reduction in packaging material costs

- For instance, the confectionery manufacturing industry in the U.S. is projected to reach USD 10.89 billion by FY 2023, highlighting the growth in packaged food sectors and the corresponding demand for sustainable labeling solutions

Opportunity

Expansion into High-Value Markets and Customization

- The linerless labels market presents significant opportunities for growth through expansion into high-value markets and offering customized solutions

- While commonly used in retail and logistics, there's untapped potential in specialty applications within the pharmaceutical, cosmetics, and premium consumer goods sectors

- By leveraging the versatility of linerless labels, manufacturers can develop innovative solutions such as tamper-evident seals and promotional labels tailored to specific industry needs

- This approach not only differentiates products in competitive markets but also opens new revenue streams

- For Instance, integrating smart labeling technologies such as Radio Frequency Identification (RFID) with linerless labels enhances product tracking and consumer engagement, presenting a lucrative opportunity for market expansion

Restraint/Challenge

Integration Challenges with Existing Systems

- Despite their advantages, the adoption of linerless labels faces challenges, particularly in integrating with existing packaging systems. Approximately 15% of manufacturers report difficulties in adapting production lines to accommodate linerless labels, often requiring specialized equipment

- Additionally, around 10% of businesses encounter compatibility issues with printers, hindering seamless adoption. These technological barriers necessitate significant upfront investments, posing challenges for small and medium-sized enterprises (SMEs)

- Such integration complexities can slow the transition to linerless labeling, especially in developing markets where budget constraints are more prevalent

Linerless Labels Market Scope

The market is segmented on the basis of composition, product, printing ink type, printing ink technology, adhesive type, and application

|

Segmentation |

Sub-Segmentation |

|

By Composition |

|

|

By Product |

|

|

By Printing Ink Type |

|

|

By Printing Ink Technology |

|

|

By Adhesive Type |

|

|

By Application |

|

Linerless Labels Market Regional Analysis

Asia-Pacific the Dominant Region in the Linerless Labels Market

- Asia Pacific holds a significant share of the linerless labels market, driven by robust manufacturing and retail sectors

- The food and beverage industry in this region is a major consumer of linerless labels, with China, India, and Japan being key contributors

- Rapid urbanization in countries such as China has increased the demand for packaged and processed foods, thereby boosting the need for efficient labeling solutions

- The diverse manufacturing landscape, including electronics and automotive sectors, further propels the demand for linerless labels as sustainable and cost-effective solutions

- For Instance, in India, the government's allowance of 100% foreign direct investment in food processing is expected to enhance market growth, highlighting the region's potential

North America is Projected to Register the Highest Growth Rate

- North America is anticipated to experience substantial growth in the linerless labels market, attributed to market consolidation and the presence of key industry players

- A growing emphasis on sustainable packaging solutions among North American companies is driving the adoption of linerless labels

- Major retail chains in the U.S. are increasingly adopting linerless labels to reduce waste and enhance environmental responsibility in their packaging

- Continuous innovations in labeling technologies within North America contribute to the market's growth, offering enhanced efficiency and customization

- For Instance, U.S. market's valuation at USD 417.4 million in 2022 underscores its significant role in the global linerless labels industry

Linerless Labels Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Avery Dennison Corporation (U.S.)

- CCL Industries (Canada)

- Henkel Adhesives Technologies India Private Limited (India)

- ImageTek Labels (U.S.)

- UPM (Finland)

- LINTEC Corporation (Japan)

- tesa Tapes (India) Private Limited (India)

- Seiko Holdings Corporation (Japan)

- Mondi (U.K.)

- labelsandlabeling (U.K.)

- Chicago Tag & Label (U.S.)

- Honeywell International Inc. (U.S.)

- Intertronics (U.K.)

- Sika AG (Switzerland)

- Macfarlane Group Plc. (U.K.)

- H.B. Fuller Company (U.S.)

- Guangzhou Manborui Material Technology Co Ltd. (China)

- Constantia Flexibles (Austria)

- Coveris (U.S.)

- R.R. Donnelley & Sons Company (U.S.)

Latest Developments in Global Linerless Labels Market

- In September 2024, the three new solvent-based ink series was launched by Hubergroup Print Solutions. It was specially customized to the Asian Market needs for Gecko Gold, Gecko Platinum NT, and Gecko Platinum Plus

- In September 2024, the ‘industry-first’ linerless flash label solution was launched by RAVENWOOD. They used linerless labels which are designed for high throughput operations and ensured promotional labels which may be used in real-time at the time of the packaging process without slowing the production line

- In April 2024, a new thermal face stock designed especially for manufacturing linerless labels was launched by Lecta Group. By reducing traditional liner, linerless labels show an important opportunity for improving waste reduction in the labeling industry. This design of Ineris-certified phenol-free top-coated face stock is specifically suited for variable printing and barcode applications in retail and logistic sectors, which offer exceptional quality and high resistance

- In April 2024, the thermal labels and printers range was launched by the award-winning UK packaging supplier Kite Packaging. The advantages of linerless labels include enhanced safety and health, eliminating slip and trip hazards, using 40% less paper, flexibility in design and signing

- In August 2023, the first generation of decorative linerless label solutions named ‘AD LinrSave and LinrConver’ which help to reduce carbon footprint and waste was launched by Avery Dennison. Water is used in packaging production. This solution is allowed by patented micro-perforation technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Linerless Labels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Linerless Labels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Linerless Labels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.