Global Lipase Inhibitors Obesity Drugs Market

Market Size in USD Billion

CAGR :

%

USD

1.21 Billion

USD

3.61 Billion

2024

2032

USD

1.21 Billion

USD

3.61 Billion

2024

2032

| 2025 –2032 | |

| USD 1.21 Billion | |

| USD 3.61 Billion | |

|

|

|

|

Lipase Inhibitors Obesity Drugs Market Size

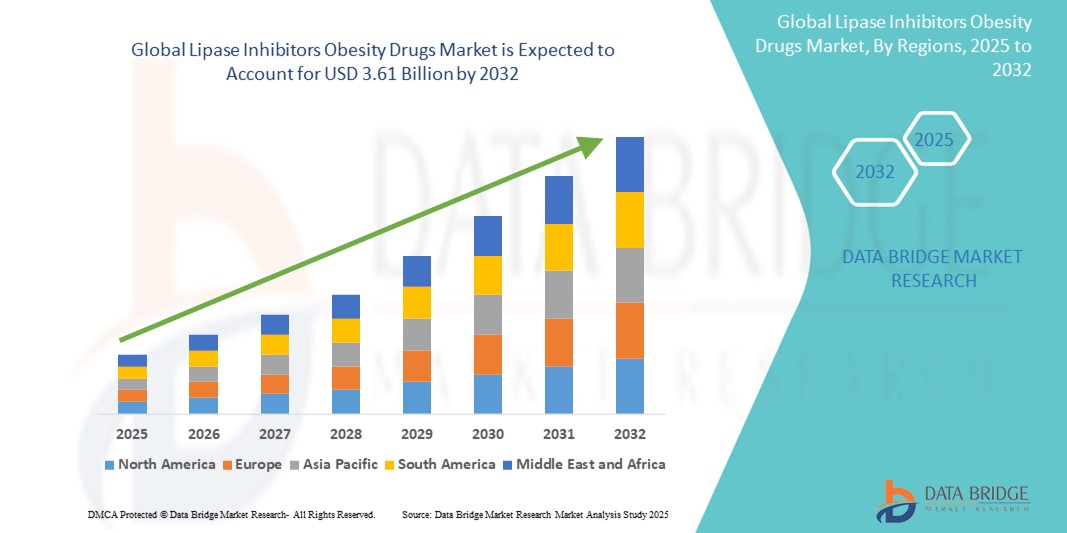

- The global lipase inhibitors obesity drugs market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 3.61 billion by 2032, at a CAGR of 14.68% during the forecast period

- The market growth is largely fueled by the increasing prevalence of obesity and overweight populations globally, coupled with heightened awareness regarding health risks associated with excess body weight. The demand for effective pharmaceutical interventions such as lipase inhibitors is rising as individuals seek clinically approved, non-invasive methods to manage weight

- Furthermore, a growing preference for targeted obesity treatments, along with advancements in drug formulation and delivery mechanisms, is establishing lipase inhibitors as a critical component in obesity management. These converging factors are accelerating the adoption of lipase inhibitor therapies, thereby significantly boosting the industry's growth

Lipase Inhibitors Obesity Drugs Market Analysis

- Lipase inhibitors, which work by blocking the absorption of dietary fats in the intestine, are becoming increasingly essential in the management of obesity due to their proven efficacy and minimal systemic absorption. These medications are particularly valued in both clinical and home-based obesity treatment programs for their safety profile and ease of use

- The escalating demand for lipase inhibitors is primarily driven by the global surge in obesity rates, changing dietary patterns, sedentary lifestyles, and an increased focus on non-invasive pharmaceutical interventions for weight management

- North America dominated the lipase inhibitors obesity drugs market with the largest revenue share of 42.76% in 2024. This dominance is attributed to a high prevalence of obesity, strong healthcare infrastructure, widespread use of prescription weight-loss drugs such as orlistat, and favorable reimbursement policies

- Asia-Pacific is expected to be the fastest-growing region in the lipase inhibitors obesity drugs market during the forecast period, with a projected CAGR of 10.4%, fueled by rising obesity rates in rapidly urbanizing countries such as China and India, increasing healthcare expenditure, and greater acceptance of pharmaceutical weight loss treatments

- The prescription drugs segment dominated the lipase inhibitors obesity drugs market with a market share of 48.7% in 2024, owing to its long-standing approval, broad availability in both prescription and over-the-counter forms, and widespread usage in clinical obesity management programs across both developed and emerging economies

Report Scope and Lipase Inhibitors Obesity Drugs Market Segmentation

|

Attributes |

Lipase Inhibitors Obesity Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lipase Inhibitors Obesity Drugs Market Trends

“Growing Preference for Non-Invasive Pharmaceutical Interventions”

- A significant and accelerating trend in the global lipase inhibitors obesity drugs market is the rising preference for non-invasive pharmaceutical options for weight management, particularly among individuals reluctant to undergo surgical procedures such as bariatric surgery. This shift is contributing to the increasing demand for lipase inhibitors, which act by blocking the absorption of dietary fat in the intestines

- For instance, Orlistat, a widely used lipase inhibitor, is available in both prescription and over-the-counter forms, allowing broader accessibility to individuals seeking convenient and clinically backed solutions for weight loss. Products such as Alli (60mg) and Xenical (120mg) have gained widespread popularity for providing effective fat reduction with minimal systemic absorption, which appeals to safety-conscious consumers

- These pharmacological agents provide a non-systemic mode of action, working locally within the gastrointestinal tract, which reduces the risk of serious side effects typically associated with systemic weight-loss medications. This characteristic makes lipase inhibitors particularly attractive for long-term use under medical supervision

- Increasing awareness of obesity-related health complications such as type 2 diabetes, cardiovascular disease, and hypertension is encouraging healthcare providers to recommend lipase inhibitors as part of a broader lifestyle and dietary intervention strategy. This supports market expansion, especially in clinical settings and wellness programs focused on preventive care

- Moreover, the availability of lipase inhibitors in generic versions is contributing to affordability and wider market penetration, particularly in price-sensitive regions across Asia-Pacific and Latin America. These generics are expanding access and creating competitive pricing structures that benefit both consumers and healthcare systems

- This rising inclination toward safe, affordable, and non-invasive pharmaceutical treatments is redefining the landscape of obesity management. Consequently, pharmaceutical companies are investing in research and development to enhance the efficacy, tolerability, and delivery methods of lipase inhibitors, catering to the evolving needs of the global weight-loss market

Lipase Inhibitors Obesity Drugs Market Dynamics

Driver

“Growing Need Due to Rising Obesity Prevalence and Preference for Non-Invasive Weight Loss”

- The increasing global prevalence of obesity, coupled with the rising demand for non-invasive pharmaceutical weight management options, is a significant driver fueling the growth of the lipase inhibitors obesity drugs market

- For instance, in March 2024, Hoffmann-La Roche Ltd. expanded its global distribution of Orlistat under the brand Xenical, targeting emerging markets in Asia and Latin America, where obesity rates are climbing rapidly. Such strategic moves by leading pharmaceutical players are expected to accelerate the growth of the lipase inhibitors segment over the forecast period

- As individuals become more aware of obesity-related health complications such as cardiovascular diseases, diabetes, and hypertension, there is a growing preference for clinically approved and accessible treatment options. Lipase inhibitors offer a safe and convenient solution for weight loss without the need for surgery or invasive procedures

- Furthermore, the rising popularity of telemedicine, e-prescriptions, and online pharmacies has enhanced access to lipase inhibitor products, especially in remote or underserved regions. These distribution channels offer consumers privacy and convenience, contributing to increasing adoption rates

- The non-systemic mechanism of lipase inhibitors—which act locally in the gastrointestinal tract—minimizes systemic side effects, making them a favorable choice for long-term obesity management in both clinical and homecare settings. In addition, the availability of generic formulations is increasing affordability and penetration in cost-sensitive markets

Restraint/Challenge

“Gastrointestinal Side Effects and Limited Efficacy in Monotherapy”

- Despite their benefits, lipase inhibitors are often associated with mild to moderate gastrointestinal side effects, such as oily stools, flatulence, and abdominal discomfort, which can affect patient compliance and satisfaction

- For instance, clinical data associated with Orlistat has shown that although the drug is effective in reducing fat absorption by up to 30%, the accompanying dietary restrictions and side effects can discourage long-term adherence to therapy

- Furthermore, lipase inhibitors may offer limited efficacy when used as monotherapy, especially in individuals with severe obesity or those requiring rapid weight reduction. In such cases, lipase inhibitors are often recommended as part of a broader treatment plan, including lifestyle modifications and behavioral therapy

- Another challenge is the lack of personalization in treatment regimens. Current lipase inhibitors follow a “one-size-fits-all” model, which may not adequately address metabolic differences among individuals. As a result, some patients may not experience significant weight loss, leading to treatment discontinuation or switching to alternative therapies

- To overcome these challenges, pharmaceutical companies are investing in the development of next-generation lipase inhibitors with improved tolerability, reduced side effects, and enhanced efficacy. In addition, patient education on proper use, dietary compliance, and expectations from treatment can help improve therapeutic outcomes and market retention

Lipase Inhibitors Obesity Drugs Market Scope

The market is segmented on the basis of type, source, route of administration, application, distribution channel, and end user.

• By Type

On the basis of type, the lipase inhibitors obesity drugs market is segmented into prescription drugs, over-the-counter (OTC) drugs, and natural/herbal lipase inhibitors. The prescription drugs segment dominated the market with the largest revenue share of 48.7% in 2024, owing to the strong clinical efficacy and physician preference for approved medications such as Orlistat. These drugs are often prescribed for patients with clinically diagnosed obesity and are supported by extensive clinical data.

The natural/herbal lipase inhibitors segment is anticipated to witness the fastest CAGR of 9.8% from 2025 to 2032, driven by the growing consumer inclination toward plant-based and organic alternatives with minimal side effects. This trend is also bolstered by increased availability of herbal supplements across retail and online channels.

• By Source

On the basis of source, the lipase inhibitors obesity drugs market is segmented into synthetic, microbial, and natural sources. The synthetic segment held the largest market share of 61.3% in 2024, supported by scalable manufacturing processes and established pharmacokinetic profiles. These drugs are widely used in clinical settings due to their standardized formulations.

The microbial source segment is projected to grow at the fastest CAGR of 8.7% during the forecast period, fueled by advancements in biotechnology and the increasing focus on enzyme-based therapeutics derived from microbial strains.

• By Route of Administration

On the basis of route of administration, the lipase inhibitors obesity drugs market is segmented into oral, injectable, and others. The oral segment accounted for the largest market share of 78.9% in 2024, due to the ease of administration, patient compliance, and availability of oral lipase inhibitors such as Orlistat in both prescription and OTC formats.

The injectable segment is expected to register the fastest CAGR of 10.2% from 2025 to 2032, driven by emerging formulations and pipeline candidates aimed at targeting metabolic pathways more effectively through parenteral delivery.

• By Application

On the basis of application, the lipase inhibitors obesity drugs market is segmented into obesity management, weight loss, and others. The obesity management segment held the largest market revenue share of 65.1% in 2024, as lipase inhibitors are primarily indicated for the clinical management of obesity and associated comorbidities such as type 2 diabetes and hypertension.

The weight loss segment is expected to witness a CAGR of 8.3% during the forecast period, driven by rising consumer demand for quick weight reduction solutions in the wellness and fitness sectors.

• By Distribution Channel

On the basis of distribution channel, the lipase inhibitors obesity drugs market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. Retail pharmacies accounted for the largest market share of 46.7% in 2024, owing to high consumer footfall, availability of OTC options, and widespread pharmacy networks in urban and semi-urban areas.

The online pharmacies segment is projected to grow at the fastest CAGR of 12.5% from 2025 to 2032, fueled by increasing e-commerce penetration, convenience, and availability of discounts on popular weight loss medications.

• By End User

On the basis of end user, the lipase inhibitors obesity drugs market is segmented into hospitals, clinics, homecare settings, fitness centers, and others. Hospitals held the largest revenue share of 38.9% in 2024, owing to the high volume of obesity-related consultations and drug prescriptions initiated within clinical settings.

The fitness centers segment is anticipated to grow at the fastest CAGR of 11.6%, driven by rising health consciousness, integration of diet plans with supplements, and demand for on-site weight loss programs using natural and herbal lipase inhibitors.

Lipase Inhibitors Obesity Drugs Market Regional Analysis

- North America dominated the lipase inhibitors obesity drugs market with the largest revenue share of 42.76% in 2024, driven by the high prevalence of obesity, growing health awareness, and a strong focus on weight management through pharmacological interventions

- The presence of key pharmaceutical companies and a strong focus on research and development contribute to the market's growth

- Consumers in the region are increasingly opting for medically approved weight loss solutions, including both prescription and over-the-counter lipase inhibitors, due to rising obesity-linked health concerns such as diabetes, cardiovascular disorders, and metabolic syndrome

U.S. Lipase Inhibitors Obesity Drugs Market Insight

The U.S. lipase inhibitors obesity drugs market captured the largest revenue share of 54.6% in 2024, positioning the country as the leading contributor to global sales. This dominance is primarily driven by the high prevalence of obesity across all age groups and the growing preference for pharmacological weight-loss treatments. Increased availability of both prescription and over-the-counter drugs—such as orlistat—along with strong consumer awareness regarding obesity-related health risks, continues to fuel market demand. In addition, a robust healthcare infrastructure, widespread insurance coverage, and the growing adoption of digital health platforms are making it easier for consumers to access lipase inhibitors, further boosting market expansion across the U.S.

Europe Lipase Inhibitors Obesity Drugs Market Insight

The Europe lipase inhibitors obesity drugs market accounted for 24% of global revenue in 2024 and is poised for steady growth over the forecast period. The region is experiencing rising obesity rates, especially in Western countries, and there is growing acceptance of structured medical weight-loss programs. Europe’s focus on preventive healthcare, supported by increasing healthcare spending and regulatory backing for anti-obesity therapeutics, is driving demand for lipase inhibitors. Moreover, the rising popularity of clean-label and plant-based treatments is accelerating interest in natural and herbal lipase inhibitors, aligning with the region’s health-conscious consumer trends.

U.K. Lipase Inhibitors Obesity Drugs Market Insight

The U.K. lipase inhibitors obesity drugs market contributed 5.5% of the global market in 2024, driven by the escalating burden of obesity-related illnesses such as cardiovascular diseases and type 2 diabetes. National health initiatives led by the NHS are encouraging early intervention through public awareness campaigns and access to structured weight-loss programs. In addition, a well-developed pharmacy infrastructure—both offline and online—is making it easier for patients to obtain prescription and OTC lipase inhibitors. The country’s increasing adoption of telehealth services is also supporting long-term weight management strategies through remote consultation and prescription fulfillment.

Germany Lipase Inhibitors Obesity Drugs Market Insight

The Germany lipase inhibitors obesity drugs market accounted for 4.2% of global revenue in 2024. The market in Germany is being propelled by increasing obesity rates, particularly among younger populations, and a strong national emphasis on public health initiatives. The integration of lipase inhibitors into multidisciplinary treatment plans—often involving dietitians, physicians, and fitness professionals—is gaining traction. Germany’s healthcare system supports reimbursement for generic obesity medications, further promoting widespread use. Consumer interest in evidence-based, physician-recommended weight-loss therapies also continue to drive demand.

Asia-Pacific Lipase Inhibitors Obesity Drugs Market Insight

The Asia-Pacific lipase inhibitors obesity drugs market held 28% of the global market share in 2024 and is projected to grow at the fastest CAGR of 10.4% from 2025 to 2032. Rapid urbanization, rising disposable incomes, and increasing adoption of sedentary lifestyles have significantly contributed to obesity growth in countries such as China, India, and Southeast Asia. Government health initiatives and broader access to healthcare services are propelling demand for pharmacological weight-loss solutions. The region's strong manufacturing base and growing e-commerce landscape are also enhancing affordability and accessibility of lipase inhibitors to a broader consumer population.

Japan Lipase Inhibitors Obesity Drugs Market Insight

The Japan lipase inhibitors obesity drugs market accounted for 10.4% of the global market in 2024. Although the country historically reports lower obesity rates, lifestyle changes and an aging population have contributed to rising demand for weight management solutions. Lipase inhibitors are gaining popularity as part of non-invasive and preventive care approaches. Urban centers are showing high uptake, particularly among middle-aged and elderly demographics. Japan’s focus on holistic wellness, combined with its technologically advanced healthcare system, is creating favorable conditions for the growth of lipase inhibitors as part of integrated wellness and treatment programs.

China Lipase Inhibitors Obesity Drugs Market Insight

The China lipase inhibitors obesity drugs market led the Asia-Pacific region by contributing 15% of the global market revenue in 2024. A rapidly expanding middle class, high obesity prevalence, and strong domestic pharmaceutical manufacturing base have made China a key growth engine. The market is being driven by public health awareness campaigns, affordability of locally produced lipase inhibitors, and broad acceptance of pharmacological weight-loss interventions. In addition, the widespread use of digital health platforms and mobile apps is improving the accessibility and distribution of lipase inhibitors across both urban and rural settings.

Lipase Inhibitors Obesity Drugs Market Share

The lipase inhibitors obesity drugs industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- GSK plc. (U.K.)

- Alvogen (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sandoz International GmbH (Germany)

- Viatris Inc. (U.S.)

- CHEPLAPHARM Arzneimittel GmbH (Germany)

- Dr. Reddy's Laboratories Ltd. (India)

- Zydus Group (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Sun Pharmaceutical Industries Ltd. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Taj Pharmaceuticals Ltd. (India)

- Pfizer Inc. (U.S.)

- Lupin Limited (India)

- Aurobindo Pharma (India)

- Apotex Inc. (Canada)

- Cipla Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Hubei Gedian Humanwell Pharmaceutical Co., Ltd. (China)

Latest Developments in Global Lipase Inhibitors Obesity Drugs Market

- In May 2025, a comprehensive review published in Nature reaffirmed the role of pancreatic lipase inhibitors, particularly orlistat, in obesity management. The report highlighted orlistat’s established mechanism of action—blocking dietary fat absorption—and its continued relevance in clinical use despite gastrointestinal side effects. The study further emphasized the potential for reformulations to enhance tolerability and efficacy

- In March 2025, a new wave of clinical interest emerged around cetilistat, a next-generation pancreatic lipase inhibitor. Phase 2 clinical trial data revealed that cetilistat demonstrated comparable weight loss outcomes to orlistat but with significantly fewer gastrointestinal side effects, positioning it as a more tolerable therapeutic option

- In April 2025, Fierce Biotech reported that over 120 novel obesity therapies are under development globally, including several formulations focused on lipase inhibition. Among them, natural and herbal combinations—such as flavonoids and alkaloids—are being explored for their synergistic effects with orlistat, potentially reducing adverse effects and improving patient compliance

- In February 2025, Medscape issued updated clinical guidance for the use of orlistat, highlighting the importance of pairing the drug with a low-fat diet and supplementing fat-soluble vitamins (A, D, E, and K) to mitigate potential nutritional deficiencies. These recommendations aim to optimize therapeutic outcomes while minimizing side effects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.