Global Lipoatrophy Treatment Injectable Fillers Market

Market Size in USD Million

CAGR :

%

USD

233.85 Million

USD

435.08 Million

2025

2033

USD

233.85 Million

USD

435.08 Million

2025

2033

| 2026 –2033 | |

| USD 233.85 Million | |

| USD 435.08 Million | |

|

|

|

|

Lipoatrophy Treatment Injectable Fillers Market Size

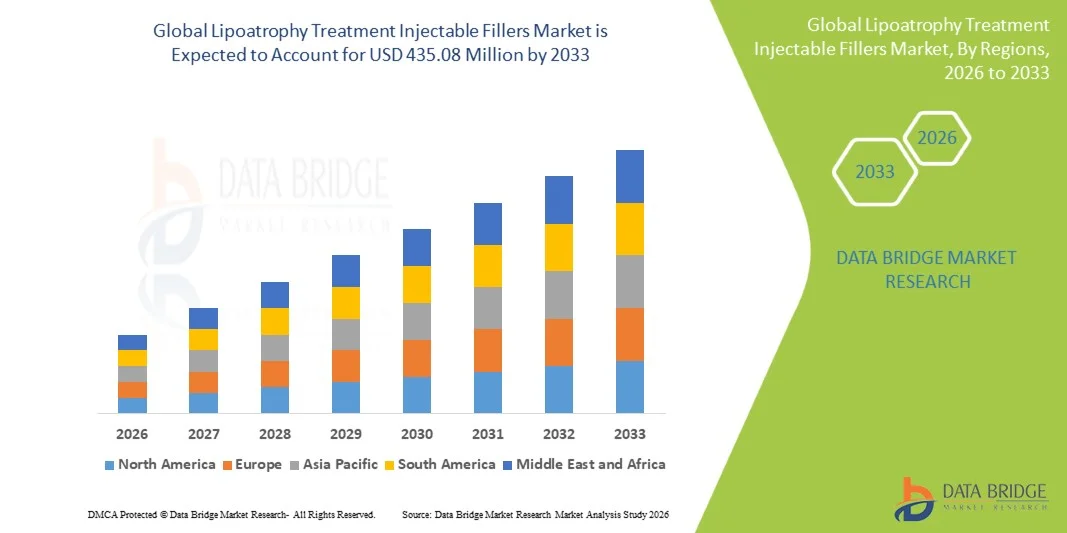

- The global lipoatrophy treatment injectable fillers market size was valued at USD 233.85 Million in 2025 and is expected to reach USD 435.08 Million by 2033, at a CAGR of 8.07% during the forecast period

- The market growth is largely fueled by the increasing prevalence of lipoatrophy, rising demand for minimally invasive cosmetic procedures, and growing awareness of injectable filler treatments across both medical and aesthetic applications

- Furthermore, advancements in filler formulations, improved safety profiles, and expanding access to dermatology and cosmetic clinics are driving higher adoption of lipoatrophy treatment injectable fillers solutions, thereby significantly boosting the industry's growth

Lipoatrophy Treatment Injectable Fillers Market Analysis

- Lipoatrophy Treatment Injectable Fillers, offering minimally invasive cosmetic and medical interventions, are increasingly vital components of modern dermatology and aesthetic treatment protocols in both clinical and hospital settings due to their effectiveness, safety profile, and ease of administration

- The escalating demand for injectable fillers is primarily fueled by the growing prevalence of lipoatrophy, rising patient awareness of aesthetic treatments, and increasing preference for non-surgical, rapid, and safe cosmetic solutions

- North America dominated the lipoatrophy treatment injectable fillers market with the largest revenue share of 38.7% in 2025, supported by advanced healthcare infrastructure, strong presence of cosmetic and pharmaceutical companies, and well-established dermatology and aesthetic treatment facilities. The U.S. experienced substantial growth in Lipoatrophy Treatment Injectable Fillers procedures, driven by increasing awareness of aesthetic treatments, rising disposable incomes, and the growing number of specialized clinics and cosmetic centers

- Asia-Pacific is expected to be the fastest-growing region in the lipoatrophy treatment injectable fillers market during the forecast period, projected to expand at a CAGR of 15.3% from 2026 to 2033, driven by high disease burden, improving healthcare access, rising awareness of aesthetic procedures, and increasing investment in dermatology and cosmetic clinics in countries such as India, China, and Southeast Asia

- The Hyaluronic Acid segment dominated the largest market revenue share of 48.3% in 2025, driven by its biocompatibility, versatility for facial contouring, and wide clinical adoption

Report Scope and Lipoatrophy Treatment Injectable Fillers Market Segmentation

|

Attributes |

Lipoatrophy Treatment Injectable Fillers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Lipoatrophy Treatment Injectable Fillers Market Trends

“Focus on Personalized and Combination Therapies”

- A significant and accelerating trend in the global lipoatrophy treatment injectable fillers market is the increasing emphasis on personalized and combination therapies. These approaches are aimed at addressing diverse patient needs and improving overall treatment outcomes

- Clinicians are increasingly employing regimens that combine injectable fillers with adjunctive therapies, such as dermal volumizers and fat grafting, to achieve more natural and sustained aesthetic results

- For instance, a 2024 study in the Journal of Cosmetic Dermatology reported improved mid-face volume restoration when fillers were combined with autologous fat transfer

- Research emphasizes tailored dosing schedules, particularly for patients with localized fat loss or age-related volume reduction, ensuring efficacy while minimizing side effects

- Clinical studies are exploring combination approaches, such as filler use alongside biocompatible scaffolds or regenerative solutions, aiming to enhance tissue integration and prolong effects

- There is a growing trend toward using patient-reported outcomes to guide therapy decisions, enabling more precise and customized treatment protocols

- Pharmaceutical and cosmetic companies are expanding focus on multi-product treatment kits, allowing clinicians to target various facial zones effectively

- Patient-centric innovations, including pre-filled syringes and adjustable viscosity formulations, are facilitating easier administration and improved satisfaction

- Professional societies and dermatology associations are promoting best practice guidelines for filler combinations, contributing to wider adoption and standardized care

- Advanced imaging techniques, such as 3D facial mapping, are increasingly used to plan treatment and monitor results, supporting more predictable outcomes

- Treatment innovations are gradually shifting from one-size-fits-all approaches to individualized protocols, reflecting a deeper understanding of tissue dynamics and patient expectations

Lipoatrophy Treatment Injectable Fillers Market Dynamics

Driver

“Growing Demand Due to Aesthetic Awareness and Aging Population”

- The increasing awareness of aesthetic treatments and a growing aging population are significant drivers for the Lipoatrophy Treatment Injectable Fillers market

- For instance, in March 2024, a leading dermatology clinic chain reported a 28% increase in filler procedures among patients aged 40–60, reflecting rising demand for facial rejuvenation. Similarly, Allergan introduced a new hyaluronic acid volumizer in North America in early 2025, specifically targeting mid-face and cheek augmentation, supporting the driver trend

- Patients seek minimally invasive options to restore facial volume, reduce wrinkles, and improve overall appearance, making injectable fillers a preferred choice

- Furthermore, the popularity of cosmetic procedures on social media platforms is encouraging younger demographics to explore preventative volumization treatments

- Technological advancements, such as long-lasting formulations and biocompatible materials, are enhancing treatment safety and efficacy

- The availability of combination therapies addressing multiple facial concerns simultaneously is driving higher patient adoption rates

- Rising disposable income and increasing acceptance of aesthetic procedures in emerging markets are further contributing to market growth

- Clinics are increasingly offering tailored consultation and treatment packages, improving patient experience and promoting repeat treatments

- Regulatory approvals for newer filler products with improved safety profiles are supporting market expansion

- Continuous innovation and awareness campaigns by dermatology associations are reinforcing the preference for injectable fillers over surgical interventions

Restraint/Challenge

“Concerns Regarding Side Effects and High Treatment Costs”

- Concerns regarding potential side effects, including swelling, bruising, and rare complications such as vascular occlusion, pose a significant challenge to market growth

- For instance, clinical case reports in 2023 highlighted instances of delayed onset swelling in sensitive facial zones, making some patients hesitant to undergo treatment. Similarly, the FDA in 2024 issued guidance on safe administration techniques for high-risk areas, underscoring regulatory attention to adverse event

- Ensuring proper administration techniques through clinician training and adherence to guidelines is crucial to mitigate adverse events

- In addition, the relatively high cost of injectable fillers compared to non-invasive skincare products can be a barrier for cost-sensitive patients, particularly in developing regions

- While prices vary depending on the type of filler and treatment area, premium products such as hyaluronic acid-based volumizers often come at a higher price point

- Patient education and transparent consultation regarding potential risks and realistic outcomes are vital to build confidence and encourage adoption

- The emergence of counterfeit or low-quality products in some regions can further discourage treatment uptake, emphasizing the importance of regulatory oversight

- Overcoming these challenges through clinician training, standardized protocols, and accessible pricing strategies will be essential for sustained growth in the Lipoatrophy Treatment Injectable Fillers market

Lipoatrophy Treatment Injectable Fillers Market Scope

The market is segmented on the basis of type, end-user, and distribution channel.

• By Type

On the basis of type, the Lipoatrophy Treatment Injectable Fillers market is segmented into Hyaluronic Acid, Poly-L-Lactic Acid, Calcium Hydroxylapatite, Collagen-Based, and Others. The Hyaluronic Acid segment dominated the largest market revenue share of 48.3% in 2025, driven by its biocompatibility, versatility for facial contouring, and wide clinical adoption. Hyaluronic acid fillers are preferred for mid-face volumization, wrinkle correction, and lip enhancement. Clinicians often favor it due to reversibility using hyaluronidase, predictable outcomes, and long-lasting yet temporary effects. Regulatory approvals in multiple regions, ease of administration, and a broad range of formulations contribute to its strong market position. Its established safety profile encourages repeated treatments, reinforcing dominance. The segment also benefits from marketing campaigns emphasizing natural-looking results and minimal downtime.

The Poly-L-Lactic Acid segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, owing to its collagen-stimulating properties and increasing adoption for gradual facial rejuvenation. Poly-L-Lactic Acid fillers are gaining traction among patients seeking long-term volumization and natural aging correction. For instance, in 2024, a leading dermatology clinic in the U.S. reported a 32% increase in Poly-L-Lactic Acid procedures for cheek augmentation, highlighting growing preference. Expanding applications in non-facial body contouring and combination therapy strategies also support growth. The segment is further driven by clinical evidence showing improvement in skin elasticity and thickness over multiple sessions, appealing to both patients and practitioners.

• By End-User

On the basis of end-user, the market is segmented into Hospitals, Aesthetic Clinics, Dermatology Centers, Cosmetic Surgery Centers, and Others. The Aesthetic Clinics segment dominated the largest market revenue share of 42.7% in 2025, supported by increasing outpatient cosmetic procedures and patient preference for specialized facilities. Clinics provide personalized consultations, treatment planning, and follow-up care, enhancing patient satisfaction and repeat visits. The rise of minimally invasive cosmetic procedures, combined with marketing campaigns targeting middle-aged consumers, has contributed to dominance. Clinics also benefit from the availability of skilled practitioners and adoption of the latest filler technologies. Collaborations with product manufacturers for training and promotions further reinforce clinic preference. The segment sees robust patient inflow due to accessibility, competitive pricing, and tailored service packages.

The Dermatology Centers segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by the increasing integration of aesthetic procedures within dermatology practices. Centers are offering comprehensive skin rejuvenation services, including filler treatments alongside laser and anti-aging therapies. For instance, in 2025, a dermatology chain in Europe reported enhanced patient engagement after introducing combined filler and skin resurfacing protocols. Rising patient trust in dermatologists for minimally invasive cosmetic interventions and expanding clinic networks contribute to rapid growth. Focus on evidence-based protocols and early intervention treatments further supports adoption.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, E-Commerce, and Others. The Hospital Pharmacy segment dominated the largest market revenue share of 45.1% in 2025, due to the centralized procurement of injectable fillers for hospital-based aesthetic departments and supervised administration. Hospitals ensure quality control, compliance with regulatory standards, and safe storage, which is crucial for injectable therapies. Programs in leading hospitals promoting facial rejuvenation for reconstructive or cosmetic purposes further support demand. Integration with patient management systems and trained clinical staff contributes to its strong market position. Hospitals also benefit from bundled treatment offerings, combining fillers with other therapies for patient convenience and revenue growth.

The E-Commerce segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, supported by rising online penetration, convenience of doorstep delivery, and increasing awareness of certified injectable products. In 2025, several online platforms in Southeast Asia began offering pre-packaged hyaluronic acid kits for aesthetic clinics, driving adoption in regions with limited physical access. Digital marketing campaigns, subscription-based delivery models, and improved logistics for cold-chain handling are key factors contributing to rapid growth. The segment is further propelled by teleconsultation integration, enabling patients to select products remotely under professional guidance.

Lipoatrophy Treatment Injectable Fillers Market Regional Analysis

- North America dominated the lipoatrophy treatment injectable fillers market with the largest revenue share of 38.7% in 2025, supported by advanced healthcare infrastructure, strong presence of cosmetic and pharmaceutical companies, and well-established dermatology and aesthetic treatment facilities

- Consumers in the region highly value specialized clinics, advanced treatment options, and the increasing availability of aesthetic procedures

- This widespread adoption is further supported by the U.S. experiencing substantial growth in Lipoatrophy Treatment Injectable Fillers procedures, driven by rising awareness of aesthetic treatments, growing disposable incomes, and the increasing number of specialized clinics and cosmetic centers

U.S. Lipoatrophy Treatment Injectable Fillers Market Insight

The U.S. lipoatrophy treatment injectable fillers market captured the largest revenue share in 2025 within North America, fueled by increasing adoption of aesthetic procedures and specialized treatment facilities. Rising patient awareness, disposable incomes, and the growing network of cosmetic and dermatology clinics are significantly driving market growth.

Europe Lipoatrophy Treatment Injectable Fillers Market Insight

The Europe lipoatrophy treatment injectable fillers market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing awareness of aesthetic procedures and the presence of advanced dermatology clinics. Urbanization, rising disposable incomes, and demand for minimally invasive treatments are fostering adoption across both residential and commercial healthcare facilities.

U.K. Lipoatrophy Treatment Injectable Fillers Market Insight

The U.K. lipoatrophy treatment injectable fillers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising patient awareness and the adoption of aesthetic procedures. The robust healthcare and cosmetic clinic infrastructure, alongside strong e-commerce and retail channels, continues to support market expansion.

Germany Lipoatrophy Treatment Injectable Fillers Market Insight

The Germany lipoatrophy treatment injectable fillers market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of dermatology and cosmetic procedures, well-developed healthcare infrastructure, and increasing investment in advanced treatment technologies. Adoption is strong across specialized clinics and hospitals.

Asia-Pacific Lipoatrophy Treatment Injectable Fillers Market Insight

The Asia-Pacific lipoatrophy treatment injectable fillers market is expected to be the fastest-growing region during the forecast period, projected to expand at a CAGR of 15.3% from 2026 to 2033. Growth is driven by high disease burden, improving healthcare access, rising awareness of aesthetic procedures, and increasing investment in dermatology and cosmetic clinics in countries such as India, China, and Southeast Asia.

Japan Lipoatrophy Treatment Injectable Fillers Market Insight

The Japan lipoatrophy treatment injectable fillers market is gaining momentum due to increasing adoption of aesthetic treatments, high awareness of cosmetic procedures, and a technologically advanced healthcare system. Rising demand for minimally invasive procedures and specialized dermatology clinics supports market growth.

China Lipoatrophy Treatment Injectable Fillers Market Insight

The China lipoatrophy treatment injectable fillers market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising patient awareness, expanding cosmetic and dermatology clinics, and increasing disposable incomes. The government’s push for healthcare access and investment in cosmetic procedures further fuels market expansion.

Lipoatrophy Treatment Injectable Fillers Market Share

The Lipoatrophy Treatment Injectable Fillers industry is primarily led by well-established companies, including:

- Revance Therapeutics (U.S.)

- Sinclair Pharma (U.K.)

- LG Chem Life Sciences (South Korea)

- Hugel, Inc. (South Korea)

- Medytox (South Korea)

- Ipsen Pharma (France)

- Sinclair Pharma (U.K.)

- Daewoong Pharmaceutical (South Korea)

- Bloomage Biotech (China)

- Croma-Pharma (Austria)

- Evolus, Inc. (U.S.)

- Kythera Biopharmaceuticals (U.S.)

- Mentor Worldwide (U.S.)

- Teoxane (Switzerland)

- Sinclair Pharma (U.K.)

- Anteis S.A. (Switzerland)

- LG Life Sciences (South Korea)

- RevitaLase (U.S.)

Latest Developments in Global Lipoatrophy Treatment Injectable Fillers Market

- In October 2023, a UK‑community survey reported that the long‑standing use of New‑Fill® (poly‑L‑lactic acid) for treating facial fat loss in people living with HIV continues to face regional access‑inequalities within the NHS system, underscoring unmet needs in specialist injectable filler services

- In July 2024, the US launch of Skinvive, a novel hyaluronic‑acid based “skin quality” injectable approved by the FDA for improving cheek smoothness, was described by dermatologists as representing a shift in filler use from volume restoration toward broader tissue‑quality enhancement, with implications for management of subtle facial fat‑loss

- In March 2025, Galderma unveiled its full aesthetic injectable portfolio at the 23rd Aesthetic & Anti‑Aging Medicine World Congress in Monaco, signalling its commitment to advance injectable filler therapies — including for volume‑loss conditions such as lipoatrophy — through research and practitioner education

- In January 2025, industry commentary highlighted how the “Ozempic‑face” phenomenon (rapid weight‑loss induced facial volume reduction) and boom‑generation demand have together caused a surge in demand for injectable fillers including volume‑restoration treatments originally indicated for lipoatrophy, as reported by the company Galderma

- In February 2025, a new hyaluronic acid filler branded Evolysse gained FDA approval for nasolabial‑fold correction and was cited as the first in a next wave of filler technologies using “Cold‑X” manufacturing aimed at longer‑lasting results and refined outcomes—offering potential relevance for patients with facial fat‑loss beyond traditional volume‑filler use

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.