Global Liquefaction Market

Market Size in USD Million

CAGR :

%

USD

855.15 Million

USD

1,342.54 Million

2024

2032

USD

855.15 Million

USD

1,342.54 Million

2024

2032

| 2025 –2032 | |

| USD 855.15 Million | |

| USD 1,342.54 Million | |

|

|

|

|

Liquefaction Market Size

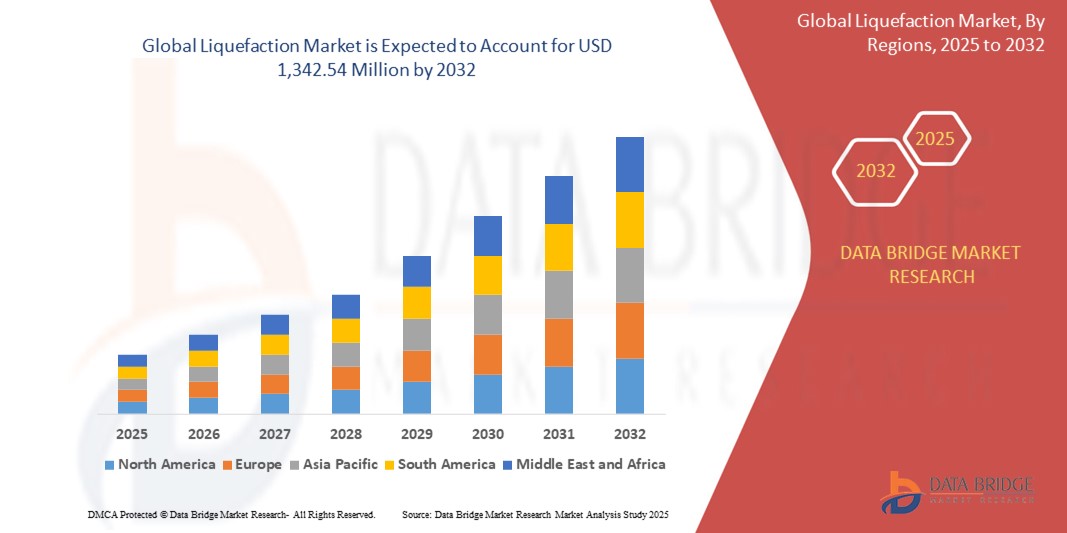

- The global liquefaction market size was valued at USD 855.15 million in 2024 and is expected to reach USD 1,342.54 million by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by the increasing demand for clean energy solutions, advancements in liquefaction technologies, and the growing need for efficient energy transportation and storage systems

- Rising investments in energy infrastructure and the shift toward sustainable energy sources are further propelling the adoption of liquefaction solutions across various industries, significantly boosting market expansion

Liquefaction Market Analysis

- Liquefaction technologies, which convert gases into liquid form for easier storage and transportation, are becoming critical in the energy sector, particularly for natural gas, hydrogen, and other industrial gases

- The demand for liquefaction is fueled by the global push for cleaner energy alternatives, increasing energy security concerns, and the need for efficient supply chains in remote and urban areas

- Asia-Pacific dominated the liquefaction market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, high energy demand, and significant investments in energy infrastructure, particularly in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period, driven by technological innovations, increasing adoption of renewable energy sources, and strong government support for clean energy initiatives

- The bunkering/ship segment dominated the largest market revenue share of 45% in 2024, driven by the increasing adoption of LNG as a marine fuel to comply with stricter environmental regulations and reduce emissions from maritime transport

Report Scope and Liquefaction Market Segmentation

|

Attributes |

Liquefaction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquefaction Market Trends

“Increasing Adoption of Advanced Liquefaction Technologies”

- The global liquefaction market is experiencing a significant trend toward the integration of advanced technologies to enhance efficiency and reduce costs in liquefied natural gas (LNG) production.

- Innovations in liquefaction processes, such as cryogenic and mixed-refrigerant technologies, are enabling higher production capacities and improved energy efficiency.

- These technologies allow for more precise control of the liquefaction process, optimizing gas cooling and reducing operational costs.

- For instances, companies are developing modular liquefaction units that can be deployed in remote areas, enabling small-scale LNG production for niche applications such as marine bunkering and off-grid power.

- This trend is making LNG more accessible and cost-effective, driving its adoption across various applications, including power generation and industrial feedstock.

- Advanced analytics and automation are also being used to monitor and optimize liquefaction plant operations, reducing downtime and improving output consistency.

Liquefaction Market Dynamics

Driver

“Rising Demand for Cleaner Energy and Energy Security”

- The growing global demand for cleaner energy alternatives, particularly liquefied natural gas (LNG) as a substitute for coal and oil, is a major driver for the global liquefaction market.

- LNG offers lower carbon emissions and enhanced energy security, making it a preferred choice for power generation, industrial processes, and transportation fuel.

- Government policies and regulations, especially in Asia-Pacific, are promoting LNG adoption to meet carbon neutrality goals and reduce environmental impact.

- The expansion of 5G and IoT technologies is facilitating faster and more reliable data transmission for real-time monitoring of LNG supply chains, enabling more efficient distribution through modes such as bunkering/ship, pipeline, truck, and rail.

- Energy companies are increasingly investing in liquefaction infrastructure to meet the rising demand for LNG in applications such as chemicals and petrochemicals, power generation, and industrial feedstock.

Restraint/Challenge

“High Capital Investment and Regulatory Complexities”

- The high initial costs associated with developing liquefaction facilities, including equipment, infrastructure, and integration, pose a significant barrier to market growth, particularly in emerging economies.

- Retrofitting existing infrastructure for LNG production or distribution can be technically complex and expensive, limiting scalability.

- Data security and environmental compliance concerns also present challenges, as liquefaction processes involve handling large volumes of sensitive operational data and managing environmental impacts.

- The global regulatory landscape for LNG production, storage, and transportation is fragmented, with varying standards across countries, complicating operations for international players.

- These factors can deter investment and slow market expansion, particularly in regions with stringent environmental regulations or limited financial

Liquefaction market Scope

The market is segmented on the basis of mode of supply and application.

- By Mode of Supply

On the basis of mode of supply, the global liquefaction market is segmented into bunkering/ship, pipeline, truck, and rail. The bunkering/ship segment dominated the largest market revenue share of 45% in 2024, driven by the increasing adoption of LNG as a marine fuel to comply with stricter environmental regulations and reduce emissions from maritime transport. The inherent flexibility and global reach of ship-based supply further contribute to its dominance.

The rail segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expansion of railway infrastructure in various regions and the increasing use of LNG as a cleaner and more cost-effective fuel for locomotives. This growth is further propelled by the rising demand for efficient and environmentally friendly transportation of goods over long distances.

- By Application

On the basis of application, the global liquefaction market is segmented into chemicals and petrochemicals, power generation, industrial feedstock, and others. The power generation segment is expected to hold the largest market revenue share of 47.9% in 2024, primarily driven by the global shift towards cleaner energy sources and the increasing demand for natural gas as a transitional fuel in electricity production. LNG offers a more environmentally friendly alternative to coal and oil, leading to significant investments in gas-fired power plants.

The industrial feedstock segment is anticipated to experience robust growth from 2025 to 2032. This growth is fueled by the expanding use of LNG as a raw material and energy source in various industrial processes, including the manufacturing of chemicals and petrochemicals, due to its cleaner burning properties and stable supply, supporting industrial decarbonization efforts.

Liquefaction Market Regional Analysis

- Asia-Pacific dominated the liquefaction market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, high energy demand, and significant investments in energy infrastructure, particularly in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period, driven by technological innovations, increasing adoption of renewable energy sources, and strong government support for clean energy initiatives

Japan Liquefaction Market Insight

Japan’s liquefaction market is experiencing robust growth, driven by strong demand for LNG in power generation and industrial applications. The country’s reliance on imported LNG, facilitated by bunkering/ship and pipeline supply, supports its energy security goals. Japanese consumers prioritize high-efficiency liquefaction technologies to reduce emissions and enhance energy efficiency. The integration of LNG in OEM vehicles and aftermarket solutions, coupled with government support for clean energy, accelerates market penetration.

China Liquefaction Market Insight

China holds the largest share of the Asia-Pacific liquefaction market, propelled by rapid urbanization, increasing vehicle ownership, and strong demand for LNG in power generation and industrial feedstock. The country’s growing middle class and focus on reducing air pollution drive the adoption of bunkering/ship and truck-based LNG supply. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, while government initiatives for energy efficiency and emissions reduction further boost growth.

North America Liquefaction Market Insight

North America is anticipated to emerge as the fastest-growing region during the forecast period, fueled by a dynamic combination of technological advancements, rapid adoption of renewable energy solutions, and robust policy frameworks. The region is witnessing a surge in clean energy investments, particularly in solar, wind, and green hydrogen technologies. Governments in the U.S. and Canada are actively promoting decarbonization through substantial funding, tax incentives, and regulatory mandates aimed at reducing greenhouse gas emissions. In addition, the presence of a well-established R&D ecosystem and strategic partnerships between private players and public institutions are accelerating innovation in energy storage, smart grid infrastructure, and next-generation power systems.

U.S. Liquefaction Market Insight

The U.S. liquefaction market is expected to witness significant growth, fueled by strong demand for LNG in bunkering, power generation, and industrial feedstock applications. The country’s extensive shale gas reserves and expanding liquefaction capacity, with facilities such as those in Texas and Louisiana, fuel its position as the world’s leading LNG exporter. Consumer awareness of environmental benefits and the adoption of LNG in transportation, supported by bunkering/ship and truck supply modes, boost both OEM and aftermarket segments.

Europe Liquefaction Market Insight

The Europe liquefaction market is witnessing steady growth, driven by the region’s focus on energy security and the transition from coal to cleaner LNG for power generation and industrial applications. Countries such as Norway and Russia contribute to LNG exports, with pipeline and bunkering/ship supply modes gaining traction. The market benefits from stringent environmental regulations and increasing regasification capacity, particularly in response to reduced Russian pipeline gas supplies. Growth is notable in both large-scale and small-scale LNG projects.

U.K. Liquefaction Market Insight

The U.K. market for liquefaction is experiencing moderate growth, driven by increasing demand for LNG in power generation and marine bunkering applications. The shift towards cleaner fuels, supported by bunkering/ship and pipeline supply modes, aligns with the U.K.’s decarbonization goals. Rising awareness of LNG’s environmental benefits and its role in reducing emissions in urban and industrial settings encourage adoption. Regulatory frameworks promoting energy efficiency further support market growth in both new and retrofit applications.

Germany Liquefaction Market Insight

Germany’s liquefaction market is growing steadily, driven by its focus on energy transition and the adoption of LNG for power generation and industrial feedstock. The country’s advanced industrial sector and commitment to reducing carbon emissions promote the use of pipeline and truck-based LNG supply. German consumers and industries prefer LNG for its efficiency and lower environmental impact, with significant uptake in both OEM integrations and aftermarket solutions, supported by investments in small-scale LNG infrastructure.

Liquefaction Market Share

The liquefaction industry is primarily led by well-established companies, including:

- Linde plc (U.K.)

- Air Products and Chemicals, Inc. (U.S.)

- Baker Hughes Company (U.S.)

- Shell plc (U.K.)

- Honeywell International Inc. (U.S.)

- Siemens Gas and Power GmbH & Co. KG (Germany)

- ENGIE (France)

- Excelerate Energy, Inc. (U.S.)

- Eni SpA (Italy)

- Kunlun Energy Company Limited (China)

- Bechtel Corporation (U.S.)

- TechnipFMC (U.K.)

- Chiyoda Corporation (Japan)

- Hyundai Heavy Industries (South Korea)

- JGC Corporation (Japan)

What are the Recent Developments in Global Liquefaction Market?

- In June 2025, the International Energy Agency (IEA) launched the Global LNG Capacity Tracker, a dynamic online tool designed to enhance transparency in the liquefied natural gas (LNG) sector. This publicly accessible platform provides detailed data on LNG liquefaction capacity additions through 2030, tracking final investment decisions (FIDs) and project ramp-up schedules. By offering real-time insights into ongoing and upcoming LNG export projects, the tracker empowers governments, investors, and industry stakeholders to better navigate the rapidly evolving global gas supply landscape. It marks a significant step toward improving market visibility and supporting strategic energy planning

- In May 2025, Honeywell International Inc. unveiled a major portfolio realignment strategy to align with global megatrends, particularly the Energy Transition. The company announced plans to fully separate its Aerospace Technologies division and spin off its Advanced Materials business into a new entity named Solstice Advanced Materials. This move is designed to sharpen Honeywell’s strategic focus and accelerate innovation in clean energy technologies, including liquefied natural gas (LNG) solutions. By streamlining its operations, Honeywell aims to better capitalize on the growing demand for sustainable energy systems and unlock long-term value for stakeholders

- In October 2024, the Copelouzos Group entered a strategic alliance with the Egyptian Natural Gas Holding Company (EGAS) to enhance LNG operations via a newly launched Floating Storage Regasification Unit (FSRU) terminal in Greece. This joint venture aims to facilitate the transport, supply, and regasification of liquefied natural gas across Greece and Eastern Europe. The partnership underscores the growing relevance of adaptable infrastructure such as FSRUs in expanding LNG trade routes and improving energy accessibility. It also reflects Egypt’s ambition to strengthen its role as a regional energy hub while deepening bilateral cooperation with Greece in the energy sector

- In July 2024, Woodside Energy announced the acquisition of Tellurian Inc. for securing full ownership of the Driftwood LNG project located in Calcasieu Parish, Louisiana. This strategic move grants Woodside access to a fully permitted, large-scale LNG export terminal with a planned capacity of 27.6 million tonnes per annum, expected to commence operations in 2029. The acquisition underscores Woodside’s ambition to expand its global LNG footprint and reflects broader industry trends of consolidation and long-term investment in liquefaction infrastructure to meet rising global energy demand

- In May 2024, NextDecade Corporation signed a 20-year liquefied natural gas (LNG) sale and purchase agreement with Japan’s largest power generator, JERA. The deal involves the supply of 2 million tonnes per annum (MTPA) of LNG from Train 5 of NextDecade’s Rio Grande LNG project in Brownsville, Texas. The agreement is contingent upon a positive final investment decision (FID) on Train 5. This long-term contract not only reflects Japan’s continued demand for U.S. LNG but also plays a pivotal role in enabling project financing and advancing the commercialization of new liquefaction infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquefaction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquefaction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquefaction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.