Global Liquefied Natural Gas Lng Carrier Market

Market Size in USD Billion

CAGR :

%

USD

13.70 Billion

USD

22.67 Billion

2025

2033

USD

13.70 Billion

USD

22.67 Billion

2025

2033

| 2026 –2033 | |

| USD 13.70 Billion | |

| USD 22.67 Billion | |

|

|

|

|

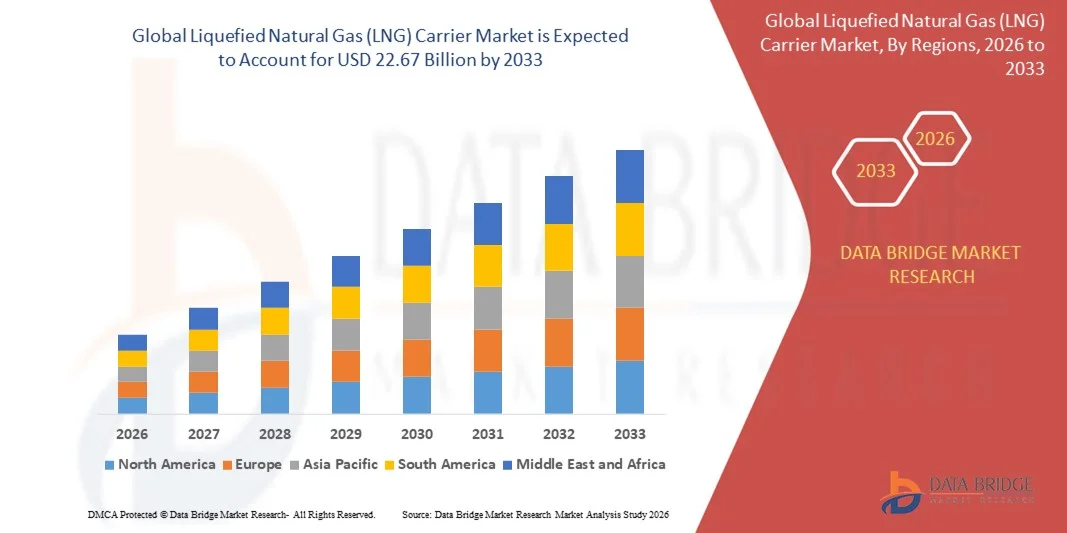

What is the Global Liquefied Natural Gas (LNG) Carrier Market Size and Growth Rate?

- The global liquefied natural gas (LNG) carrier market size was valued at USD 13.70 billion in 2025 and is expected to reach USD 22.67 billion by 2033, at a CAGR of6.50% during the forecast period

- Rise in application of liquefied natural gas (LNG) carriers for transportation is the root cause fuelling up the market growth rate. Rising industrialization coupled with ever-evolving demand for automobiles will also directly and positively impact the growth rate of the market

What are the Major Takeaways of Liquefied Natural Gas (LNG) Carrier Market?

- Growth and expansion of various end user verticals especially in the emerging economies coupled with surge in the power generation activities will further carve the way for the growth of the market. Ever-rising global population is other indirect determinant which will also foster the market growth rate

- However, COVID-19 pandemic posed a major challenge to the growth of the market. Fluctuations in the charter rates of the carriers will dampen the market growth rate. Also, stringent regulations imposed on the domestic and international trade will further derail the market growth rate

- Asia-Pacific dominated the liquefied natural gas (LNG) carrier market with a 46.8% revenue share in 2025, driven by strong LNG demand growth, large-scale shipbuilding capacity, and extensive investments in LNG import and export infrastructure across China, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 11.87% from 2026 to 2033, driven by rapid expansion of LNG export capacity, rising shale gas production, and increasing investments in LNG liquefaction and shipping infrastructure across the U.S. and Canada

- The Membrane Type segment dominated the market with a 72.6% share in 2025, driven by its higher cargo capacity utilization, lower construction weight, and superior fuel efficiency

Report Scope and Liquefied Natural Gas (LNG) Carrier Market Segmentation

|

Attributes |

Liquefied Natural Gas (LNG) Carrier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Liquefied Natural Gas (LNG) Carrier Market?

Increasing Shift Toward Large-Capacity, Fuel-Efficient, and Environment-Compliant LNG Carriers

- The liquefied natural gas (LNG) carrier market is witnessing a strong shift toward large-capacity vessels equipped with advanced containment systems to support long-distance LNG transportation and rising global gas trade

- Shipowners and shipbuilders are increasingly adopting membrane containment technologies and next-generation propulsion systems to improve fuel efficiency, cargo safety, and boil-off gas management

- Growing focus on decarbonization and emissions reduction is driving demand for LNG carriers powered by dual-fuel engines, ME-GI, and XDF propulsion technologies

- For instance, shipbuilders such as Hyundai Heavy Industries, Samsung Heavy Industries, and Mitsubishi Heavy Industries are delivering LNG carriers with improved energy efficiency, digital navigation systems, and enhanced cargo handling capabilities

- Rising investments in LNG liquefaction projects, floating storage units, and export terminals are accelerating demand for technologically advanced LNG carriers

- As global LNG trade expands and environmental regulations tighten, LNG carriers will remain critical for secure, efficient, and sustainable energy transportation

What are the Key Drivers of Liquefied Natural Gas (LNG) Carrier Market?

- Rising global demand for cleaner energy sources is increasing LNG consumption across power generation, industrial, and transportation sectors

- For instance, during 2024–2025, multiple long-term LNG supply contracts and export terminal expansions in the U.S., Qatar, and Australia increased demand for new LNG carrier fleets

- Expansion of LNG export infrastructure and cross-border gas trade is boosting demand for high-capacity, long-range LNG carriers

- Advancements in propulsion efficiency, hull design, and boil-off gas recovery systems have significantly improved vessel performance and operating economics

- Growing replacement of aging LNG fleets with modern, fuel-efficient vessels supports sustained market growth

- Supported by long-term energy transition strategies and investments in LNG infrastructure, the LNG Carrier market is expected to witness stable long-term expansion

Which Factor is Challenging the Growth of the Liquefied Natural Gas (LNG) Carrier Market?

- High capital costs associated with LNG carrier construction, advanced propulsion systems, and containment technologies limit adoption among smaller shipping operators

- For instance, during 2024–2025, rising steel prices, labor costs, and shipyard capacity constraints increased LNG carrier construction costs and delivery timelines

- Long vessel construction cycles and limited availability of specialized LNG shipyards create supply bottlenecks

- Stringent environmental regulations increase compliance costs related to emissions control, fuel systems, and safety standards

- Market exposure to LNG price volatility and geopolitical risks can impact fleet utilization and new vessel orders

- To address these challenges, industry players are focusing on long-term charter agreements, fuel-efficient vessel designs, and digital optimization solutions to enhance profitability and market resilience

How is the Liquefied Natural Gas (LNG) Carrier Market Segmented?

The market is segmented on the basis of containment type, storage capacity, propulsion type, and end user industry.

- By Containment Type

On the basis of containment type, the liquefied natural gas (LNG) carrier market is segmented into Moss Type and Membrane Type. The Membrane Type segment dominated the market with a 72.6% share in 2025, driven by its higher cargo capacity utilization, lower construction weight, and superior fuel efficiency. Membrane systems, such as GTT’s Mark III and NO96 designs, are widely preferred by shipowners for long-haul LNG transportation and large-capacity vessels. These systems enable optimized boil-off gas management and support compliance with stringent safety and environmental standards.

The Moss Type segment is expected to grow steadily but at a slower pace, supported by its robust structural design, operational reliability, and preference in niche applications requiring enhanced cargo safety. However, the Membrane Type segment is also projected to remain the fastest-growing from 2026 to 2033, supported by rising LNG trade volumes and increasing orders for large-capacity LNG carriers.

- By Storage Capacity

On the basis of storage capacity, the LNG Carrier market is segmented into Under 120,000 Cubic Meter, 120,000–160,000 Cubic Meter, and Above 160,000 Cubic Meter. The 120,000–160,000 Cubic Meter segment dominated the market with a 44.3% share in 2025, as this capacity range offers an optimal balance between operational efficiency, route flexibility, and port compatibility. These vessels are widely deployed for regional and intercontinental LNG trade.

The Above 160,000 Cubic Meter segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for long-distance LNG transportation, large-scale liquefaction projects, and cost-efficient bulk shipping. Expansion of LNG export terminals and long-term supply contracts is accelerating the adoption of ultra-large LNG carriers to reduce per-unit transportation costs and improve fleet economics.

- By Propulsion Type

On the basis of propulsion type, the market is segmented into Steam Turbines, DFDE/TFDE, Slow-Speed Diesel (SSD), ME-GI, XDF Two-Stroke Engine, Steam Re-heat, and Stage. The DFDE/TFDE segment dominated the market with a 34.8% share in 2025, owing to its operational flexibility, fuel efficiency, and ability to utilize boil-off gas effectively. These systems remain widely deployed in existing LNG fleets.

The ME-GI and XDF Two-Stroke Engine segments are expected to grow at the fastest CAGR from 2026 to 2033, driven by superior fuel efficiency, lower methane slip, and compliance with IMO emission regulations. Growing focus on decarbonization, reduced operating costs, and next-generation vessel designs is accelerating adoption of advanced propulsion technologies across newly built LNG carriers.

- By End User Industry

On the basis of end user industry, the liquefied natural gas (LNG) carrier market is segmented into Transport, Defense, and Others. The Transport segment dominated the market with an 81.2% share in 2025, driven by extensive use of LNG carriers for global energy trade, long-term supply contracts, and cross-border LNG transportation. Rising LNG consumption for power generation, industrial use, and cleaner fuel alternatives strongly supports this segment.

The Defense segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing use of LNG-powered naval vessels, strategic fuel transport, and energy security initiatives by defense organizations. Government investments in LNG infrastructure, fleet modernization, and alternative fuel adoption further enhance growth opportunities across defense and auxiliary applications.

Which Region Holds the Largest Share of the Liquefied Natural Gas (LNG) Carrier Market?

- Asia-Pacific dominated the liquefied natural gas (LNG) carrier market with a 46.8% revenue share in 2025, driven by strong LNG demand growth, large-scale shipbuilding capacity, and extensive investments in LNG import and export infrastructure across China, Japan, South Korea, and Southeast Asia. The region hosts the world’s leading LNG carrier shipyards and benefits from long-term LNG supply contracts, expanding liquefaction projects, and rising natural gas consumption for power generation and industrial use

- Major Asian shipbuilders are continuously advancing LNG carrier designs with higher storage capacities, improved fuel efficiency, and next-generation propulsion systems such as ME-GI and XDF engines, reinforcing the region’s market leadership

- Strong government support, established maritime ecosystems, skilled labor availability, and dominance in global shipbuilding further strengthen Asia-Pacific’s position in the LNG carrier market

China Liquefied Natural Gas (LNG) Carrier Market Insight

China is the largest contributor within Asia-Pacific, supported by rapid expansion of LNG import terminals, growing domestic gas consumption, and increasing investments in LNG carrier construction. State-backed shipyards and energy companies are accelerating fleet expansion to secure energy supply chains and support international LNG trade.

South Korea Liquefied Natural Gas (LNG) Carrier Market Insight

South Korea plays a critical role due to its global leadership in LNG carrier shipbuilding. Advanced engineering capabilities, innovation in containment systems, and strong order books from international operators continue to drive market dominance.

Japan Liquefied Natural Gas (LNG) Carrier Market Insight

Japan shows stable growth supported by its position as a major LNG importer, long-term charter agreements, and focus on high-reliability LNG transportation to ensure energy security.

North America Liquefied Natural Gas (LNG) Carrier Market

North America is projected to register the fastest CAGR of 11.87% from 2026 to 2033, driven by rapid expansion of LNG export capacity, rising shale gas production, and increasing investments in LNG liquefaction and shipping infrastructure across the U.S. and Canada. Growing LNG exports to Europe and Asia are accelerating demand for LNG carriers to support long-haul transportation and fleet renewal. Strategic focus on energy security, cleaner fuel adoption, and modernization of maritime logistics is strengthening regional market growth.

U.S. Liquefied Natural Gas (LNG) Carrier Market Insight

The U.S. leads North American growth due to large-scale LNG export projects, rising natural gas production, and increasing chartering of LNG carriers for international trade. Expansion of export terminals along the Gulf Coast continues to drive vessel demand.

Canada Liquefied Natural Gas (LNG) Carrier Market Insight

Canada contributes steadily through new LNG export terminals and growing participation in Asia-Pacific LNG trade routes. Supportive government policies and infrastructure development enhance long-term growth prospects.

Which are the Top Companies in Liquefied Natural Gas (LNG) Carrier Market?

The liquefied natural gas (LNG) carrier industry is primarily led by well-established companies, including:

- Shell Group of Companies (U.K.)

- NYK Line (Japan)

- Mitsui O.S.K. Lines (Japan)

- MISC Berhad (Malaysia)

- Teekay Corporation (Bermuda)

- STX Offshore & Shipbuilding Co., Ltd. (South Korea)

- Samsung Heavy Industries Co., Ltd. (South Korea)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- Hyundai Mipo Dockyard Co., Ltd. (South Korea)

- Imabari Shipbuilding Co., Ltd. (Japan)

- Hanjin Heavy Industries & Construction Holdings Co., Ltd. (South Korea)

- Hyundai Samho Heavy Industries Co., Ltd. (South Korea)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- GasLog Ltd. (Monaco)

- Dynagas Ltd. (Greece)

- China State Shipbuilding Corporation Limited (China)

- Hudong-Zhonghua Shipbuilding (Group) Co., Ltd. (China)

- Maran Gas Maritime Inc. (Greece)

- Japan Marine United Corporation (Japan)

What are the Recent Developments in Global Liquefied Natural Gas (LNG) Carrier Market?

- In June 2025, Penn America Energy Holdings (PAE) announced plans to develop a large-scale LNG export terminal along Pennsylvania’s Delaware River, with the facility designed to export nearly 7.2 million tons of liquefied natural gas annually, strengthening the U.S. LNG export infrastructure and enhancing the country’s role in global gas trade

- In June 2025, BP Singapore entered into a long-term LNG sales agreement with Torrent Power to supply up to 0.41 million metric tons per annum from 2027 to 2036, aimed at fueling Torrent’s 2,730 MW combined-cycle gas-based power plants and supporting India’s transition toward cleaner energy sources

- In May 2025, GAIL announced expansion plans for the Dabhol LNG terminal, with capacity expected to rise to 12.5 mtpa by 2031–32, reinforcing India’s LNG import capability and improving supply reliability for domestic gas markets

- In May 2025, the Government of Qatar revealed plans to significantly scale up LNG production to boost global LNG cargo trading to 30–40 million by 2030, with national production capacity projected to reach 160 million tons, further cementing Qatar’s leadership in the global LNG supply chain

- In April 2025, Woodside Energy approved a USD 17.5 billion LNG project in Louisiana, enabling the company to supply approximately 24 Mtpa of LNG by 2030 and substantially expanding its global LNG portfolio and export footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquefied Natural Gas Lng Carrier Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquefied Natural Gas Lng Carrier Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquefied Natural Gas Lng Carrier Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.