Global Liqueurs Market

Market Size in USD Billion

CAGR :

%

USD

119.66 Billion

USD

152.77 Billion

2024

2032

USD

119.66 Billion

USD

152.77 Billion

2024

2032

| 2025 –2032 | |

| USD 119.66 Billion | |

| USD 152.77 Billion | |

|

|

|

|

Liqueurs Market Size

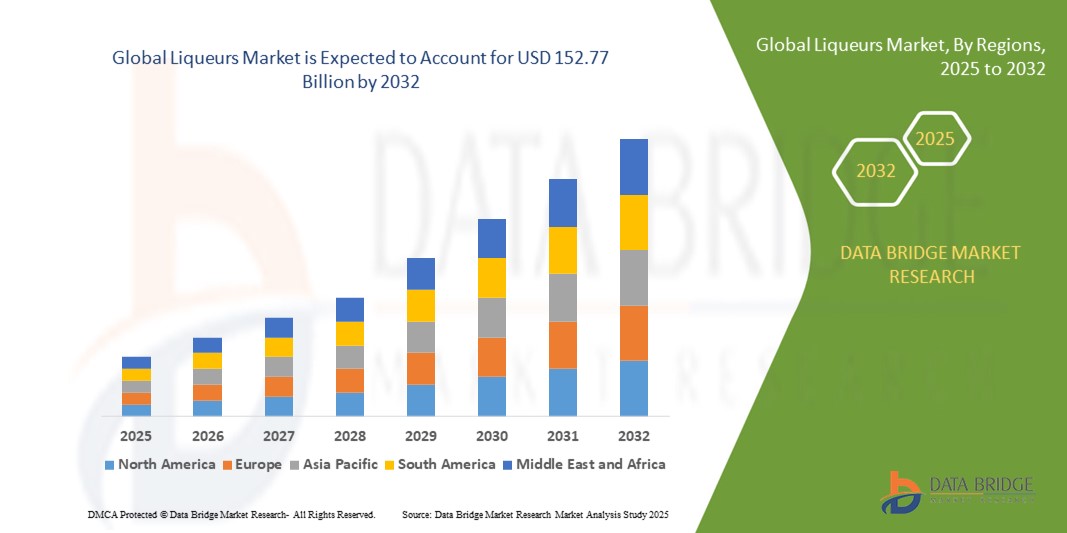

- The global liqueurs market size was valued at USD 119.66 billion in 2024 and is expected to reach USD 152.77 billion by 2032, at a CAGR of 3.1% during the forecast period

- The market growth is largely fuelled by the rising popularity of flavored alcoholic beverages, growing demand for premium and craft liqueurs, and increasing consumption among millennials and young adults

- Expanding nightlife culture, growing disposable incomes, and the influence of social media trends are also accelerating market expansion across both developed and emerging economies

Liqueurs Market Analysis

- The market is witnessing steady expansion due to the innovation in flavor profiles, product diversification, and expansion of distribution channels such as online retail and specialty stores

- The rise in cocktail culture, especially across urban regions, along with premiumization trends in the alcohol industry, is further contributing to the increasing consumption of liqueurs globally

- North America dominated the liqueurs market with the largest revenue share of 35.9% in 2024, driven by rising consumer interest in flavored spirits, cocktail culture, and the expansion of premium and artisanal liqueur brands

- Asia-Pacific region is expected to witness the highest growth rate in the global liqueurs market, driven by emerging middle-class consumers, expanding young demographic, and increasing influence of international drinking trends across countries such as China, India, and Southeast Asia

- The neutrals/bitters segment held the largest market revenue share of 39.6% in 2024, attributed to its wide usage in cocktails, strong consumer familiarity, and traditional consumption across Europe and North America. The versatility of bitter liqueurs as aperitifs and digestifs, coupled with the expanding bar culture, continues to support segment dominance globally.

Report Scope and Liqueurs Market Segmentation

|

Attributes |

Liqueurs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Premium and Craft Liqueurs |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liqueurs Market Trends

Premiumization and Rise of Craft & Artisanal Liqueurs

- The global liqueurs market is experiencing a notable shift toward premium and craft offerings, with consumers increasingly favoring high-quality, small-batch products that emphasize unique flavors, heritage, and authenticity. This trend is particularly strong among millennials and Gen Z, who are drawn to storytelling, artisanal ingredients, and local sourcing

- The demand for craft liqueurs is also fueled by growing cocktail culture and mixology trends in urban regions, where consumers seek personalized and elevated drinking experiences. Bars and restaurants are responding by expanding their premium liqueur offerings to cater to evolving tastes and enhance customer appeal

- Manufacturers are launching limited-edition and seasonal liqueurs to tap into exclusivity and experimentation, helping to boost brand recognition and consumer loyalty. These releases often include exotic infusions, botanical blends, and regionally inspired flavors that align with lifestyle preferences

- For instance, in 2023, several European distilleries reported a spike in exports of elderflower, honey, and herb-infused liqueurs following their promotion in premium cocktail recipes at international beverage expos. These products gained rapid popularity among connoisseurs and high-end hospitality establishments

- While premiumization is driving market value and differentiation, it also requires consistent quality, innovation, and strategic marketing. Producers must balance artisanal appeal with scalable operations to meet growing demand without compromising authenticity

Liqueurs Market Dynamics

Driver

Expanding Global Cocktail Culture and On-Trade Consumption

• The growing popularity of cocktail culture worldwide is significantly contributing to the demand for liqueurs. From classic drinks to signature concoctions, liqueurs are increasingly seen as essential ingredients for bartenders and mixologists in both commercial and at-home settings

• On-trade channels such as bars, clubs, and restaurants play a pivotal role in shaping consumption trends. The resurgence of socializing post-pandemic, combined with rising disposable income, is encouraging more consumers to explore diverse flavor profiles and premium liqueur brands

• Influencer marketing, mixology tutorials, and social media trends are further popularizing liqueur-based drinks, especially among younger consumers. Brands are actively collaborating with bartenders and event organizers to create experiential promotions and tasting events

• For instance, in 2022, the U.S. and parts of Europe witnessed a sharp rise in demand for coffee and cream-based liqueurs during festive seasons, supported by promotional campaigns across digital platforms and food pairing experiences in high-end bars

• While cocktail culture supports growth, continuous product education and consumer engagement are essential. Brands must also diversify flavor portfolios to cater to regional preferences and dietary shifts such as vegan or low-sugar options

Restraint/Challenge

Health Concerns and Shifting Preferences Toward Low-Alcohol Alternatives

• The rising awareness about alcohol-related health risks is leading some consumers to reduce their alcohol intake or avoid high-calorie liqueurs altogether. This trend is particularly evident among health-conscious and younger demographics exploring wellness-focused lifestyles

• Many traditional liqueurs are perceived as indulgent due to their sugar and alcohol content, which limits their appeal among fitness-oriented or sober-curious consumers. The growing popularity of non-alcoholic spirits and low-ABV beverages is reshaping category expectations

• The market also faces challenges from regulatory scrutiny and advertising restrictions in several countries that aim to curb alcohol consumption, impacting brand visibility and promotional efforts.

• For instance, in 2023, Australia and several Scandinavian nations tightened rules on alcohol labeling and digital marketing, affecting the launch timelines of new liqueur products and reducing outreach to younger audiences

• To overcome these hurdles, brands are developing low-alcohol or alcohol-free liqueur options, offering indulgent flavors with a healthier twist. Strategic innovation and transparent marketing will be key to retaining market share amid changing consumer priorities

Liqueurs Market Scope

The market is segmented on the basis of type, packaging, and distribution channel.

- By Type

On the basis of type, the liqueurs market is segmented into neutrals/bitters, creams, fruit flavored, and others. The neutrals/bitters segment held the largest market revenue share of 39.6% in 2024, attributed to its wide usage in cocktails, strong consumer familiarity, and traditional consumption across Europe and North America. The versatility of bitter liqueurs as aperitifs and digestifs, coupled with the expanding bar culture, continues to support segment dominance globally.

The fruit flavored segment is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, driven by evolving consumer taste preferences and the popularity of fruit-infused cocktails among younger demographics. Innovation in exotic and tropical flavor profiles, along with premium and artisanal offerings, is further driving adoption across emerging markets.

- By Packaging

On the basis of packaging, the liqueurs market is segmented into glass, PET bottle, metal can, and others. The glass segment accounted for the largest share in 2024, driven by its premium appeal, effective preservation of flavor and aroma, and consumer preference for traditional alcoholic beverage packaging. Glass packaging is especially popular in on-premises and specialty retail environments where aesthetics and perceived quality play a key role.

The PET bottle segment is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, supported by its lightweight, unbreakable nature, and increasing acceptance in travel retail and convenience segments. Cost efficiency in logistics and improvements in material safety and recyclability are boosting its popularity among manufacturers and consumers alike.

- By Distribution Channel

On the basis of distribution channel, the liqueurs market is segmented into convenience stores, on-premises, retailers, and supermarkets. The supermarkets segment dominated the market in 2024 with the largest revenue share due to high product visibility, wide brand assortment, and value-oriented offerings in bulk or promotional packaging. Consumers increasingly prefer supermarkets for their ease of access and availability of various liqueur types at competitive prices.

The on-premises segment is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, driven by rising alcohol consumption in social settings such as bars, hotels, and restaurants. Expanding nightlife culture and growing tourism in regions such as Southeast Asia and Latin America are contributing significantly to the growth of this segment.

Liqueurs Market Regional Analysis

• North America dominated the liqueurs market with the largest revenue share of 35.9% in 2024, driven by rising consumer interest in flavored spirits, cocktail culture, and the expansion of premium and artisanal liqueur brands.

• The region benefits from strong on-trade and off-trade distribution networks, along with increased consumption among millennials and Generation Z.

• The growing popularity of ready-to-drink cocktails and innovative flavor combinations has enhanced consumer engagement and contributed to consistent market growth.

U.S. Liqueurs Market Insight

The U.S. liqueurs market accounted for the largest revenue share in North America in 2024, supported by a mature spirits industry and high demand for cream, coffee, and fruit-based liqueurs. The rise in home mixology, craft cocktails, and low-alcohol indulgent beverages continues to drive consumption. In addition, robust e-commerce channels and premium packaging innovations are expanding product accessibility and appeal.

Europe Liqueurs Market Insight

The Europe liqueurs market is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, backed by deep-rooted cultural associations with liqueur consumption and a wide variety of traditional products. The region is home to numerous artisanal and heritage brands, with countries such as France, Italy, and Germany driving innovation in flavor and quality. Growing consumer interest in organic and low-sugar liqueurs is further shaping the regional market.

Germany Liqueurs Market Insight

The Germany liqueurs market held the largest share in Europe in 2024, supported by high per capita alcohol consumption and a strong demand for herbal and botanical-based liqueurs. The presence of established domestic brands and an expanding cocktail culture among younger demographics continue to fuel market expansion across both on-premise and retail segments.

U.K. Liqueurs Market Insight

U.K. is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, driven by a deep-rooted cocktail tradition, surging demand for low-alcohol and craft variants, and the growing trend of premiumization in spirits. Local producers are introducing a wide array of fruit-flavored and cream-based liqueurs, catering to evolving consumer palates. The expansion of on-premise consumption through bars and pubs also plays a key role in driving sales within the country.

Asia-Pacific Liqueurs Market Insight

The Asia-Pacific liqueurs market is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and rising adoption of Western drinking habits. Growth in premium alcohol consumption, alongside expanding distribution through e-commerce and duty-free channels, is supporting market expansion across countries such as China, India, and South Korea.

China Liqueurs Market Insight

The China liqueurs market captured the largest share in the Asia-Pacific region in 2024, bolstered by increasing acceptance of global spirit brands and strong urban demand for flavored alcoholic beverages. The growing cocktail culture and rising penetration of international bars and restaurants have boosted consumer exposure to liqueurs, especially among young professionals and affluent consumers.

Japan Liqueurs Market Insight

Japan is expected to witness the fastest growth rate during the forecast period of 2025 to 2032, owing to increasing adoption of Western-style drinking habits, rising popularity of cocktail-based drinks, and the proliferation of themed restaurants and bars. The growing demand for innovative flavors and the integration of liqueurs in both traditional and modern mixology practices further enhance market penetration across the country.

Liqueurs Market Share

The Liqueurs industry is primarily led by well-established companies, including:

- Bacardi (Bermuda)

- Beam Suntory (U.S.)

- Diageo (U.K.)

- Lucas Bols (Netherlands)

- Pernod Ricard (France)

- Rémy Cointreau (France)

- Brown-Forman (U.S.)

- Gruppo Campari (Italy)

- E. & J. Gallo Winery (U.S.)

- Luxardo (Italy)

- The Drambuie Liqueur (U.K.)

- Stock Spirits Group (Poland)

Latest Developments in Global Liqueurs Market

- In August 2021, Boston Beer partnered with PepsiCo in a strategic collaboration to develop and introduce Hard Mountain Dew, an alcoholic version of the popular soda. Under this initiative, Boston Beer handled the formulation and production, while PepsiCo launched a new company to manage the sales, distribution, and marketing. This move allowed both brands to capitalize on the growing ready-to-drink alcohol segment, expanding their consumer base and strengthening their presence in the flavored alcoholic beverages market

- In June 2022, Asahi Group Holdings, Ltd., through its subsidiary Asahi Breweries, Ltd., launched the Shibuya Smart Drinking Project in Japan. This initiative focuses on promoting "Smart Drinking"—a campaign that embraces alcohol consumption diversity and moderation. By collaborating with corporate and municipal partners, the project aims to address social concerns and foster a more inclusive and responsible drinking culture, potentially influencing trends in the low- and non-alcoholic beverages segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liqueurs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liqueurs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liqueurs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.