Global Liquid Applied Membrane Market

Market Size in USD Billion

CAGR :

%

USD

35.14 Billion

USD

57.07 Billion

2024

2032

USD

35.14 Billion

USD

57.07 Billion

2024

2032

| 2025 –2032 | |

| USD 35.14 Billion | |

| USD 57.07 Billion | |

|

|

|

|

Liquid Applied Membrane Market Size

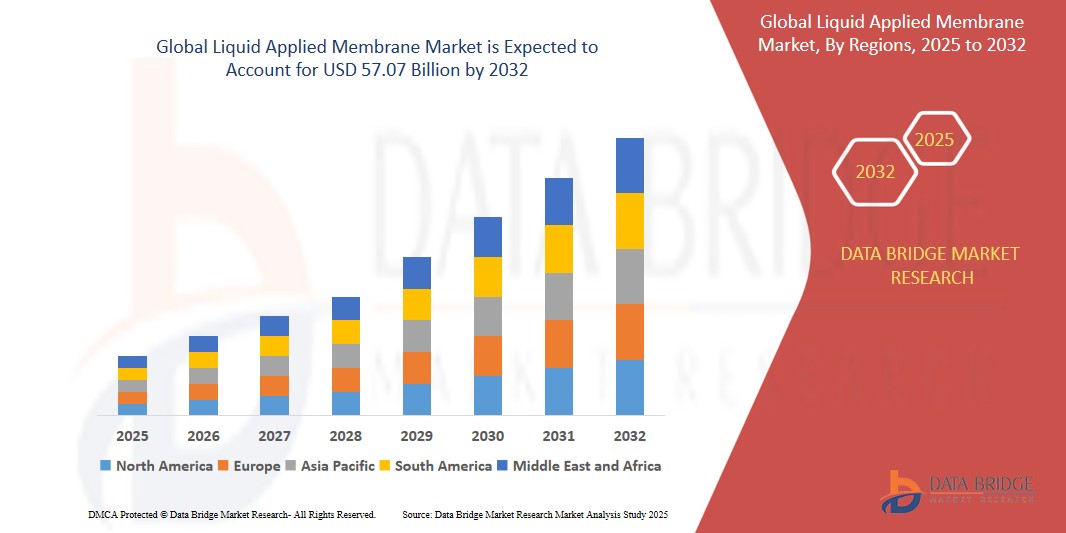

- The Global Liquid Applied Membrane Market was valued at USD 35.14 billion in 2024 and is expected to reach USD 57.07 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.3%, primarily driven by the increasing demand for waterproofing solutions in construction industry

- This growth is driven by factors such as rising concerns about environmental sustainability have led to the adoption of eco-friendly waterproofing materials

Liquid Applied Membrane Market Analysis

- Rapid urbanization and infrastructure development, particularly in emerging economies, are significant drivers of the global liquid applied membrane market.

- As urban populations increase, there is a heightened demand for durable and effective waterproofing solutions in residential, commercial, and infrastructure projects.

- Manufacturers are continuously innovating to develop more efficient and environmentally friendly liquid applied membranes.

Report Scope and Liquid Applied Membrane Market Segmentation

|

Attributes |

Liquid Applied Membrane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Applied Membrane Market Trends

“Shift Towards Sustainable and Energy-Efficient Waterproofing Solutions”

- With escalating energy costs and stringent environmental regulations, there is a growing emphasis on constructing energy-efficient buildings. Liquid applied membranes, especially elastomeric types, are increasingly used in roofing systems to reflect sunlight, thereby reducing the need for air conditioning and enhancing energy efficiency.

- These membranes contribute to the creation of energy-efficient buildings, resulting in long-term environmental and cost benefits.

- Manufacturers are focusing on developing advanced waterproofing solutions to enhance building durability and energy efficiency.

- For instance, Mapei introduced Polylastic water-based bitumen, a liquid-applied membrane that combines the properties of bitumen with advanced polymer technology to create a flexible and durable waterproofing solution. This innovative product is particularly effective in protecting roofs, foundations, and other structures from moisture damage, ensuring long-lasting performance and reliability.

To strengthen their market presence and expand product portfolios, the leading companies are engaging in strategic mergers and acquisitions

- For instance, in February 2024, MAPEI S.p.A. acquired Bitumat, a leading company in the manufacturing and marketing of waterproofing systems, significantly enhancing MAPEI's presence in the liquid-applied membrane market. This acquisition aligns with MAPEI's internationalization strategy and expands its market in the Middle East.

As the construction sector continues to prioritize sustainability, the adoption of liquid-applied membranes is expected to increase, offering durable and eco-friendly waterproofing solutions.

Liquid Applied Membrane Market Dynamics

Driver

“The Increasing Demand for Waterproofing Solutions in Construction Industry”

- The rise in urbanization and infrastructure development globally is driving demand for reliable waterproofing solutions. As construction activities increase, especially in high-rise buildings, industrial facilities, and bridges, the need for effective waterproofing systems becomes more critical to ensure long-term structural integrity.

- Liquid applied membranes offer significant advantages over traditional sheet membranes. They form seamless, flexible layers that adapt to the surface, providing excellent waterproofing and protection against water infiltration. Their ability to cover intricate areas, such as corners and joints, makes them a preferred choice for complex architectural designs.

- Rising concerns about environmental sustainability have led to the adoption of eco-friendly waterproofing materials. Liquid applied membranes, often low in VOCs (volatile organic compounds), offer more sustainable options compared to other methods, aligning with growing green building standards such as LEED (Leadership in Energy and Environmental Design).

For instance,

- As construction activity increases, especially in structures like high-rise buildings, industrial facilities, and bridges, effective waterproofing systems are crucial for maintaining structural integrity and longevity. These systems protect against water damage, which can weaken foundations, cause cracks, and compromise overall safety.

The combination of increasing construction demand and technological advancements in waterproofing materials has created a robust growth trajectory for the global liquid applied membrane market. This trend is expected to persist, driven by the need for long-lasting, cost-effective, and environmentally friendly solutions in the construction industry.

Opportunity

“Growing Adoption of Sustainable and Green Construction Practices”

- As the construction industry shifts towards sustainability, liquid-applied membranes (LAMs) offer environmentally friendly alternatives to traditional waterproofing materials.

- They are often solvent-free, low VOC (Volatile Organic Compounds), and can be applied with minimal waste, aligning with global efforts toward green building certifications such as LEED (Leadership in Energy and Environmental Design).

- LAMs are increasingly used in smart building designs that incorporate advanced insulation and energy-saving technologies.

- This integration is likely to increase demand as buildings aim for energy efficiency and long-term sustainability. LAMs help improve the thermal and moisture performance of buildings, contributing to overall energy conservation.

- As construction activity grows in emerging markets, particularly in Asia-Pacific and Latin America, LAMs are becoming a preferred choice due to their ease of application, cost-effectiveness, and suitability for a wide range of substrates (including concrete, metal, and wood).

- With rapid urbanization, demand for quick and efficient waterproofing solutions is on the rise.

For instance,

- In India, the demand for liquid-applied membranes is being spurred by infrastructure projects such as highways and smart cities, where materials like Sika's Sikaproof membranes are used for waterproofing

The growing emphasis on sustainable construction, coupled with increasing urbanization in emerging economies and the adoption of smart building technologies, presents a significant growth opportunity for the Global Liquid Applied Membrane Market

Restraint/Challenge

“High Cost of Liquid Applied Membranes (LAM)”

- Liquid Applied Membranes (LAM) generally come at a higher initial cost compared to traditional alternatives like sheet membranes or bituminous materials.

- The premium cost is driven by factors such as specialized raw materials, advanced formulations, and the complexity of production processes.

- The application of LAM requires skilled labor and specific equipment for proper installation, which increases labor costs.

- Ensuring uniform coverage and curing often requires expertise, contributing to the higher total project costs.

- The high cost of Liquid Applied Membranes remains a key challenge in their widespread adoption. While their long-term performance and durability make them valuable for certain projects, the initial cost and specialized application process can hinder broader market penetration.

Liquid Applied Membrane Market Scope

The market is segmented on the basis of product, application, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By End use |

|

Liquid Applied Membrane Market Regional Analysis

“Europe is the Dominant Region in the Liquid Applied Membrane Market”

- Europe dominates the Liquid Applied Membrane market, due to the rise in the concerns regarding the water and waste management

- The Germany holds a significant share due to its robust construction industry, stringent building regulations, and emphasis on sustainable building practices.

- The country's focus on infrastructure development, coupled with the presence of major players like Sika AG and Wacker Chemie AG, drives the adoption of advanced waterproofing solutions.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the Liquid Applied Membrane market, driven by the rise in the industrialization. Moreover, the increase in the infrastructure development

- India is expected to lead the growth due to country's rapid urbanization, substantial infrastructure investments, and government initiatives in housing and public works are key drivers.

Liquid Applied Membrane Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- Carlisle Companies Inc. (U.S.)

- GCP Applied Technologies Inc. (U.S.)

- Kemper System America Inc. (U.S.)

- Saint-Gobain (France)

- Sika AG (Switzerland)

- Soprema Private Limited (France)

- Dow (U.S.)

- Flynn Group of Companies (Canada)

- ARCAT, Inc. (U.S.)

- Johns Manville (U.S.)

- Triton Incorporated (U.S.)

- Liquid Applied Membranes Limited (UK)

- Everlast Group (U.S.)

- Henry Company (U.S.)

- GAF (U.S.)

- Paul Bauder GmbH & Co. KG (Germany)

- Fosroc, Inc. (U.S.)

- Pidilite Industries Ltd. (India)

- Louisiana Rural Water Association (U.S.)

- Key Resin Company (U.S.)

- Owens Corning (U.S.)

- W. R. Meadows, Inc. (U.S.)

- LATICRETE International, Inc. (U.S.)

Latest Developments in Global Liquid Applied Membrane Market

- In February 2024, MAPEI S.p.A. acquired Bitumat, a prominent manufacturer and marketer of waterproofing systems. This acquisition has significantly bolstered MAPEI's position in the liquid-applied membrane market, further supporting its internationalization strategy and expanding its footprint in the Middle East.

- In January 2024, Sika AG launched the new Sikalastic-701, the latest generation of polyurethane liquid applied membranes for roofing applications. The Sikalastic-701 is a high-performance hybrid topcoat, blending polyurethane and acrylic for superior resistance to ultraviolet (UV) rays and gloss retention

- In May 2023, Sika AG finalized the acquisition of MBCC Group, a global supplier of construction chemicals. This acquisition enhances Sika's capabilities in the construction sector.

- In December 2022, Sika AG opened a new facility in Chongqing, Southwest China, for the production of liquid membranes and mortar. This move strengthens Sika's presence in the rapidly developing Chongqing metropolitan area, which is part of the Chengdu-Chongqing business district development.

- In September 2022, Saint-Gobain, a leading manufacturer in the construction and industrial markets, acquired GCP Applied Technologies Inc. This acquisition expanded GCP's reach in the construction chemicals sector and broadened its portfolio of solutions, including liquid-applied membranes, in the North American market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Applied Membrane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Applied Membrane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Applied Membrane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.