Global Liquid Bioherbicides Market

Market Size in USD Billion

CAGR :

%

USD

3.78 Billion

USD

9.49 Billion

2025

2033

USD

3.78 Billion

USD

9.49 Billion

2025

2033

| 2026 –2033 | |

| USD 3.78 Billion | |

| USD 9.49 Billion | |

|

|

|

|

Global Liquid Bioherbicides Market Size

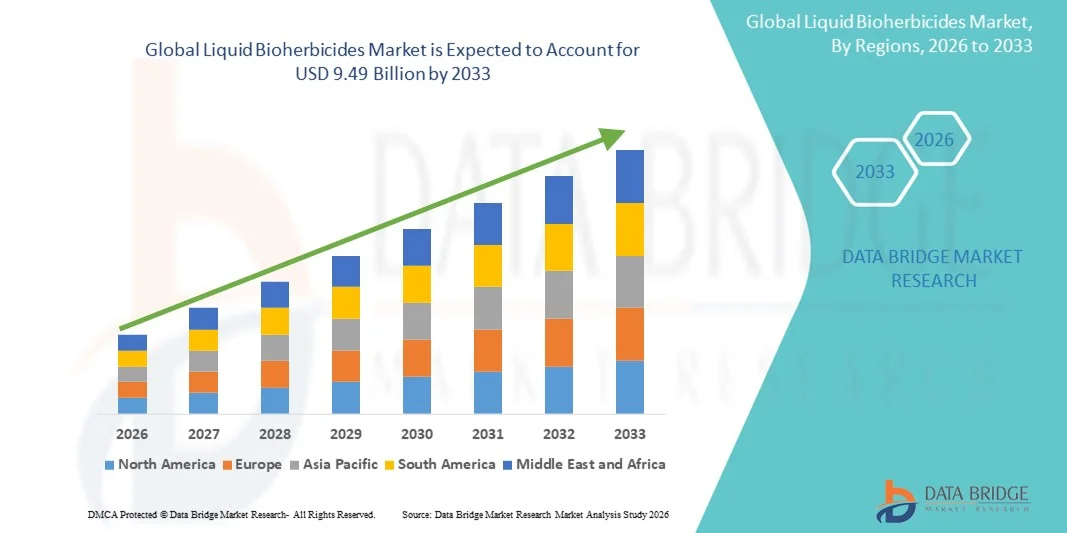

- The global Liquid Bioherbicides Market size was valued at USD 3.78 billion in 2025 and is expected to reach USD 9.49 billion by 2033, at a CAGR of 12.20% during the forecast period.

- The market growth is largely driven by the increasing demand for sustainable and eco-friendly agricultural practices, along with technological advancements in bio-based formulations and precision farming techniques.

- Furthermore, growing awareness among farmers regarding the harmful effects of chemical herbicides and the rising regulatory support for organic crop protection solutions are promoting the adoption of liquid bioherbicides. These converging factors are accelerating market penetration, thereby significantly boosting the industry’s growth.

Global Liquid Bioherbicides Market Analysis

- Liquid bioherbicides, offering environmentally friendly weed control solutions for crops, are increasingly vital components of sustainable agriculture in both large-scale and smallholder farming systems due to their reduced chemical residues, target-specific action, and compatibility with integrated pest management practices.

- The escalating demand for liquid bioherbicides is primarily fueled by growing awareness of the adverse effects of chemical herbicides, increasing regulatory support for organic farming, and rising adoption of sustainable agricultural practices.

- North America dominated the Global Liquid Bioherbicides Market with the largest revenue share of 35.3% in 2025, characterized by early adoption of sustainable farming practices, strong regulatory frameworks, and a high presence of key industry players, with the U.S. experiencing substantial growth in bioherbicide usage, particularly in row crops and specialty crops, driven by innovations from both established agrochemical companies and startups focusing on microbial and natural formulations.

- Asia-Pacific is expected to be the fastest growing region in the Global Liquid Bioherbicides Market during the forecast period due to increasing agricultural mechanization, rising awareness of sustainable farming, and growing demand for organic food products.

- The microbial segment dominated the market with the largest revenue share of 58.4% in 2025, driven by the widespread adoption of microbial strains such as Bacillus, Pseudomonas, and Trichoderma for their targeted weed suppression and eco-friendly profiles.

Report Scope and Global Liquid Bioherbicides Market Segmentation

|

Attributes |

Liquid Bioherbicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Bayer CropScience (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Liquid Bioherbicides Market Trends

Enhanced Efficiency Through Microbial and Biotechnological Innovations

- A significant and accelerating trend in the global Liquid Bioherbicides Market is the increasing integration of microbial and biotechnological innovations into crop protection solutions. These advancements are significantly enhancing the efficacy, selectivity, and environmental safety of herbicide applications.

- For instance, microbial formulations containing strains of Bacillus subtilis or Pseudomonas fluorescens are being developed to target specific weed species while leaving crops unharmed, offering farmers precise and eco-friendly weed control. Similarly, bioherbicides based on plant-derived allelochemicals are providing sustainable alternatives to chemical herbicides for row crops and specialty crops.

- Biotechnology integration in liquid bioherbicides enables features such as improved shelf life, enhanced stability under field conditions, and targeted mode of action, reducing overall chemical input. For example, certain formulations can be combined with precision spraying technologies to optimize coverage and efficacy, minimizing environmental runoff.

- The seamless integration of bioherbicides with modern farming practices, including precision agriculture and automated irrigation systems, facilitates centralized crop management and sustainable production. Through advanced monitoring and data-driven application strategies, farmers can optimize weed control while minimizing costs and environmental impact.

- This trend towards more effective, selective, and environmentally responsible bioherbicides is fundamentally reshaping farmer expectations for crop protection. Consequently, companies such as Novozymes, Marrone Bio Innovations, and Bayer CropScience are developing next-generation microbial and biotechnologically enhanced liquid bioherbicides with improved weed suppression and compatibility with integrated pest management programs.

- The demand for high-performance, sustainable liquid bioherbicides is growing rapidly across both large-scale and smallholder farms, as agricultural stakeholders increasingly prioritize crop safety, environmental stewardship, and long-term soil health.

Global Liquid Bioherbicides Market Dynamics

Driver

Growing Need Due to Environmental Regulations and Sustainable Farming Practices

- The increasing stringency of environmental regulations on chemical herbicides, coupled with the rising adoption of sustainable and organic farming practices, is a significant driver for the heightened demand for liquid bioherbicides.

- For instance, in 2025, Bayer CropScience launched new microbial bioherbicide formulations designed to comply with stricter EU and U.S. regulatory standards while reducing chemical residues in crops. Such initiatives by key companies are expected to drive the liquid bioherbicides market growth in the forecast period.

- As farmers become more aware of the adverse effects of chemical herbicides on soil health, water quality, and biodiversity, liquid bioherbicides offer effective and environmentally friendly alternatives, providing a compelling solution over traditional chemical options.

- Furthermore, the growing emphasis on integrated pest management (IPM) and sustainable crop production is making liquid bioherbicides an integral component of modern farming systems, allowing seamless integration with other biological and mechanical weed control methods.

- The advantages of target-specific action, reduced environmental impact, and compatibility with precision agriculture technologies are key factors propelling the adoption of liquid bioherbicides in both large-scale commercial farms and smallholder operations. The trend toward organic and eco-friendly farming practices, combined with increasing availability of cost-effective bioherbicide formulations, further contributes to market growth.

Restraint/Challenge

Concerns Regarding Efficacy, Shelf Life, and Higher Initial Costs

- Concerns surrounding the efficacy of some bioherbicide formulations under diverse field conditions, along with their comparatively shorter shelf life, pose a significant challenge to broader market penetration. Factors such as temperature sensitivity, storage conditions, and soil variability can affect product performance, raising hesitations among potential users.

- For instance, studies have reported inconsistent results for certain microbial bioherbicides under high rainfall or extreme temperature conditions, which can limit farmer confidence in switching from chemical herbicides.

- Addressing these challenges through improved formulation stability, rigorous field testing, and farmer education is crucial for building trust. Companies such as Novozymes, Marrone Bio Innovations, and BASF are investing in R&D to enhance product consistency and shelf life, while demonstrating efficacy across a wide range of crops and climatic conditions. Additionally, the relatively higher initial cost of some liquid bioherbicide products compared to conventional herbicides can be a barrier to adoption, particularly for price-sensitive farmers in developing regions.

- While costs are gradually decreasing with scale and technological advances, the perception of a premium for bio-based solutions can still hinder widespread adoption, especially for those who prioritize short-term cost savings over long-term sustainability.

- Overcoming these challenges through formulation improvements, cost optimization, farmer training programs, and clear demonstration of long-term environmental and economic benefits will be vital for sustained market growth.

Global Liquid Bioherbicides Market Scope

Liquid bioherbicides market is segmented on the basis of source, application, mode of application and mode of action.

- By Source

On the basis of source, the Global Liquid Bioherbicides Market is segmented into microbial and biochemical formulations. The microbial segment dominated the market with the largest revenue share of 58.4% in 2025, driven by the widespread adoption of microbial strains such as Bacillus, Pseudomonas, and Trichoderma for their targeted weed suppression and eco-friendly profiles. Farmers increasingly prefer microbial bioherbicides due to their soil-health benefits, low environmental toxicity, and compatibility with integrated pest management programs. Microbial formulations also demonstrate strong efficacy across a wide range of climatic conditions, further supporting their adoption.

The biochemical segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising demand for plant-derived compounds, allelochemicals, and natural metabolites that provide selective weed control. Biochemical bioherbicides appeal to organic producers and export-oriented farms seeking residue-free solutions and compliance with global organic certification standards.

- By Application

On the basis of application, the market is segmented into several crop types. The agricultural crops segment dominated the market with a 46.7% revenue share in 2025, largely driven by high adoption in cereals & grains, oilseeds & pulses, and fruit & vegetable farming. Growing restrictions on chemical herbicides and rising consumer demand for organic produce are accelerating the use of bioherbicides in mainstream agriculture. Among these, cereals & grains account for the largest sub-segment share, as large-acreage farms increasingly integrate bio-based solutions to maintain soil health and reduce residue accumulation.

The turf & ornamentals segment is expected to witness the fastest CAGR from 2026 to 2033, supported by expanding landscaping industries, urban greenery projects, and the need for safe, non-toxic weed management in public spaces. Bioherbicides offer an ideal alternative for gardens, golf courses, and parks where chemical herbicides may pose environmental or human health risks.

- By Mode of Application

On the basis of mode of application, the market is segmented into seed treatment, soil application, foliar application, and post-harvest. The soil application segment dominated the market with a 41.3% revenue share in 2025, driven by its efficiency in controlling early-stage weed growth and enhancing long-term field sustainability. Soil-applied bioherbicides integrate well with irrigation systems and precision farming tools, making them suitable for both large-scale and smallholder farms. Their ability to improve soil microbial balance and support root-zone health further contributes to their widespread use.

The foliar application segment is expected to witness the fastest CAGR from 2026 to 2033, as farmers favor rapid-action solutions that allow targeted weed suppression with minimal crop impact. Foliar sprays are particularly popular for high-value crops such as fruits, vegetables, and plantation crops, where quick and residue-free weed control is essential. Advancements in spray technologies and formulation stability further support this growth.

- By Mode of Action

On the basis of mode of action, the market is segmented into MOA involving photosynthesis inhibition, MOA targeting enzymes, and others. The MOA involving photosynthesis segment dominated the market with a 49.6% revenue share in 2025, as many widely used bioherbicides act by disrupting photosynthetic pathways in weeds, leading to effective suppression while maintaining crop safety. These formulations are valued for their broad-spectrum activity and minimal ecological impact, making them suitable for organic farming.

The MOA targeting enzymes segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing interest in selective weed control mechanisms. Enzyme-targeting bioherbicides offer crop specificity and reduced risk of weed resistance, attracting substantial investment from biotechnology firms. Novel modes of action—such as inhibition of amino acid synthesis or fatty acid pathways—are gaining traction as farmers seek innovative, sustainable alternatives to traditional chemical herbicides.

Global Liquid Bioherbicides Market Regional Analysis

- North America dominated the Global Liquid Bioherbicides Market with the largest revenue share of 35.3% in 2025, driven by strong regulatory support for reducing chemical herbicide usage and increasing adoption of sustainable farming practices.

- Farmers in the region highly value the environmental safety, soil health benefits, and crop protection efficiency offered by liquid bioherbicides, along with their compatibility with modern farming technologies such as precision application tools and integrated pest management systems.

- This widespread adoption is further supported by well-established agricultural infrastructure, high awareness of ecological sustainability, and growing consumer demand for organic and residue-free food products. These factors collectively position liquid bioherbicides as a preferred alternative to conventional herbicides across both large-scale commercial farms and smaller specialty crop producers.

U.S. Liquid Bioherbicides Market Insight

The U.S. liquid bioherbicides market captured the largest revenue share of 78% in 2025 within North America, driven by strong adoption of sustainable agricultural practices and increasing regulatory pressure to reduce chemical herbicide usage. Farmers are increasingly prioritizing soil health, environmental safety, and compliance with organic standards, leading to widespread utilization of microbial and plant-based weed control solutions. The rising demand for organic food, expansion of precision agriculture, and adoption of environmentally friendly inputs further propel market growth. Moreover, rapid advancements in bioherbicide formulations—improving stability, efficacy, and application convenience—are significantly contributing to the market’s expansion across both large-scale and specialty crop farming.

Europe Liquid Bioherbicides Market Insight

The Europe liquid bioherbicides market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent EU regulations on chemical pesticides and an accelerated transition toward sustainable agriculture. The expansion of organic farming acreage, coupled with increasing consumer demand for residue-free produce, is fostering rapid adoption of bioherbicides. European growers are also drawn to the environmental benefits and compatibility of bio-based herbicides with regenerative agricultural practices. The region is witnessing strong growth across cereals, horticulture, vineyards, and protected cultivation, with liquid bioherbicides being integrated into both conventional and organic production systems.

U.K. Liquid Bioherbicides Market Insight

The U.K. liquid bioherbicides market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising adoption of sustainable crop protection methods and growing concerns over the environmental impact of synthetic herbicides. Increasing restrictions on chemical formulations and a stronger push toward organic certification are encouraging farmers to adopt biological alternatives. The U.K.’s expanding horticulture, fresh produce, and greenhouse sectors also support demand for residue-free and eco-safe weed control solutions. Additionally, the adoption of precision sprayers and digital agriculture tools enhances the effectiveness of liquid bioherbicides, further stimulating market growth.

Germany Liquid Bioherbicides Market Insight

The Germany liquid bioherbicides market is expected to expand at a considerable CAGR, fueled by increasing awareness of ecological sustainability and strong demand for innovative, science-driven crop protection solutions. Germany’s advanced agricultural infrastructure, coupled with government support for regenerative farming and reduced pesticide dependency, promotes rapid uptake of bioherbicides. Farmers increasingly favor microbial and biochemical formulations due to their environmental safety, compatibility with organic farming, and ability to reduce long-term soil degradation. Integration with precision farming systems and digital field monitoring tools is further strengthening adoption across cereals, vegetables, and specialty crops.

Asia-Pacific Liquid Bioherbicides Market Insight

The Asia-Pacific liquid bioherbicides market is poised to grow at the fastest CAGR of 23.4% during 2026–2033, driven by rapid urbanization, rising disposable incomes, and the shift toward eco-friendly farming practices in countries such as China, Japan, and India. Government initiatives encouraging sustainable agriculture and reduced chemical inputs are further boosting adoption. As APAC emerges as a major production hub for microbial and biochemical agro-inputs, the availability of cost-effective bioherbicide products is expanding to a wider farming population. Demand is strong across rice, fruits & vegetables, and plantation crops, supported by rising consumer preference for organic and residue-free food.

Japan Liquid Bioherbicides Market Insight

The Japan liquid bioherbicides market is gaining momentum due to the country’s technologically advanced agricultural environment and strong emphasis on food safety. Japanese growers prioritize efficient, precise, and eco-friendly weed management solutions, driving adoption of microbial bioherbicides and advanced spraying systems. Integration with IoT-based farming tools, greenhouse automation, and smart irrigation systems is further fueling growth. Additionally, Japan’s aging farming population is likely to spur demand for easy-to-use, low-labor, and environmentally safe weed control methods that reduce dependency on chemical inputs.

China Liquid Bioherbicides Market Insight

The China liquid bioherbicides market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid agricultural modernization, strong government emphasis on reducing chemical pesticide usage, and the country’s expanding organic farming sector. China is one of the largest consumers of biological crop protection products, with liquid bioherbicides gaining popularity in vegetables, fruits, rice, and plantation crops. The push toward “green agriculture,” supported by subsidies and national sustainability programs, accelerates adoption. A strong domestic manufacturing base, coupled with rising demand for affordable and effective bio-based formulations, is significantly propelling the market’s growth in China.

Global Liquid Bioherbicides Market Share

The Liquid Bioherbicides industry is primarily led by well-established companies, including:

• Bayer CropScience (Germany)

• Syngenta (Switzerland)

• BASF SE (Germany)

• Corteva Agriscience (U.S.)

• Novozymes (Denmark)

• Marrone Bio Innovations (U.S.)

• Valent BioSciences (U.S.)

• UPL Limited (India)

• ADAMA Agricultural Solutions (Israel)

• Lallemand Plant Care (Canada)

• Bioworks, Inc. (U.S.)

• ISK Biosciences (Japan)

• Verdesian Life Sciences (U.S.)

• Andermatt Biocontrol (Switzerland)

• BioSafe Systems (U.S.)

• AgBiome (U.S.)

• Certis Biologicals (U.S.)

• Acadian Plant Health (Canada)

• Plant Health Care (U.K.)

• Futureco Bioscience (Spain)

What are the Recent Developments in Global Liquid Bioherbicides Market?

- In April 2024, Bayer CropScience, a global leader in agricultural innovation, launched a strategic initiative in South Africa aimed at strengthening sustainable weed management across smallholder and commercial farming systems through its advanced liquid bioherbicide technologies. This initiative underscores the company’s commitment to delivering eco-friendly, high-efficacy crop protection solutions tailored to regional agricultural needs. By leveraging its global R&D expertise and next-generation microbial formulations, Bayer is not only addressing local environmental challenges but also reinforcing its position in the rapidly expanding Global Liquid Bioherbicides Market.

- In March 2024, Marrone Bio Innovations (MBI) introduced an enhanced version of its flagship bioherbicide platform, specifically engineered for large-acre row crops and high-value horticulture. The new formulation delivers improved stability, wider weed spectrum control, and greater field compatibility. This advancement highlights MBI’s ongoing commitment to developing cutting-edge biological crop protection tools that enable farmers to manage weeds effectively while reducing reliance on synthetic chemicals, supporting safer and more sustainable farming practices.

- In March 2024, BASF SE successfully deployed a large-scale sustainable agriculture project in Bengaluru, India, focused on promoting the adoption of bio-based weed management solutions through advanced liquid bioherbicides. The initiative leverages BASF’s latest biological innovations to support healthier soil ecosystems and reduce environmental impact. This project reflects the growing importance of bioherbicides in urban and peri-urban farming areas, contributing to the development of more resilient, eco-friendly agricultural communities.

- In February 2024, Novozymes, a leading biotechnology company, announced a strategic partnership with the Chesapeake Bay Agricultural Council to expand access to microbial liquid bioherbicides across the region. The collaboration aims to enhance sustainable weed management for farmers through improved product availability, education, and field support. This initiative underscores Novozymes’ commitment to driving innovation in biological crop protection and supporting growers with effective, environmentally safe alternatives to chemical herbicides.

- In January 2024, UPL Limited introduced its next-generation liquid bioherbicide at the AgriTech International Expo 2024. The new solution, formulated with advanced plant-derived biochemical compounds, enables growers to achieve targeted weed suppression with minimal residue. The launch highlights UPL’s dedication to integrating biotechnology into sustainable crop protection, offering farmers greater control, convenience, and efficiency while maintaining high environmental stewardship standards.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.