Global Liquid Bioinsecticides Market

Market Size in USD Billion

CAGR :

%

USD

1.31 Billion

USD

4.78 Billion

2024

2032

USD

1.31 Billion

USD

4.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.31 Billion | |

| USD 4.78 Billion | |

|

|

|

|

Liquid Bioinsecticides Market Size

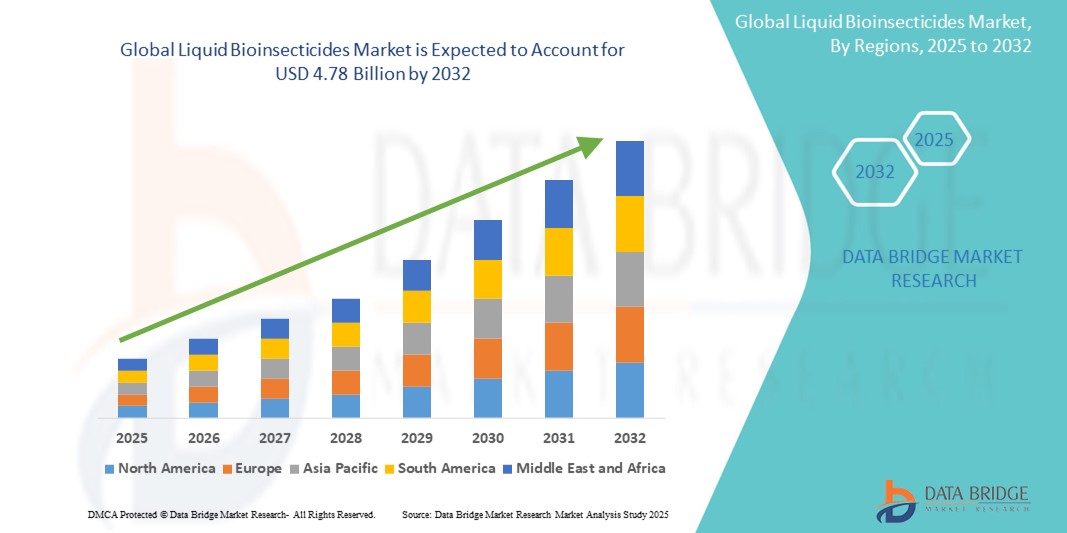

- The global liquid bioinsecticides market size was valued at USD 1.31 billion in 2024 and is expected to reach USD 4.78 billion by 2032, at a CAGR of 17.50% during the forecast period

- The market growth is largely fueled by the increasing shift toward organic and sustainable farming practices, coupled with rising concerns over the environmental and health impacts of synthetic pesticides. These concerns are driving regulatory bodies to impose stricter restrictions on chemical pesticide use, thereby boosting the demand for eco-friendly alternatives such as liquid bioinsecticides

- Furthermore, government support through subsidies and awareness campaigns, along with advancements in microbial formulation and delivery technologies, is accelerating the adoption of liquid bioinsecticides across diverse crop types, significantly contributing to market expansion

Liquid Bioinsecticides Market Analysis

- Liquid bioinsecticides are biologically derived formulations—typically based on bacteria, fungi, or plant extracts—that target specific insect pests while preserving beneficial organisms. These products are applied as foliar sprays, seed treatments, or soil drenches to provide pest control in a sustainable, residue-free manner

- The rising demand for liquid bioinsecticides is primarily driven by growing global emphasis on organic food production, regulatory support for biopesticides, and increasing awareness among farmers about the long-term benefits of sustainable pest management solutions

- North America dominated the liquid bioinsecticides market with a share of 37.09% in 2024, due to increasing consumer shift towards organic food production and the growing adoption of sustainable agricultural inputs

- Asia-Pacific is expected to be the fastest growing region in the liquid bioinsecticides market during the forecast period due to expanding organic agriculture, increasing awareness about the harmful effects of synthetic chemicals, and supportive government policies

- Foliar spray segment dominated the market with a market share of 50.2% in 2024, due to its direct contact mechanism, fast action, and ease of application across diverse crop types. Foliar application allows precise targeting of insect pests during outbreaks and offers visible results with minimal reapplication frequency, which boosts adoption among both smallholders and commercial farms

Report Scope and Liquid Bioinsecticides Market Segmentation

|

Attributes |

Liquid Bioinsecticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Bioinsecticides Market Trends

“Growing Demand for Organic Farming”

- A significant and accelerating trend in the liquid bioinsecticides market is the increasing demand for organic farming practices, as consumers, regulators, and producers seek safer and more sustainable alternatives to synthetic agrochemicals

- For instance, companies such as Certis Biologicals, Koppert Biological Systems, and Marrone Bio Innovations are expanding their portfolios of liquid bioinsecticides to meet the needs of organic growers, offering products that are OMRI-listed and compliant with international organic standards

- The shift toward organic and regenerative agriculture is being driven by rising consumer awareness of food safety, environmental health, and the negative impacts of chemical pesticide residues on ecosystems

- Government initiatives and subsidies promoting organic farming, especially in regions such as Europe, North America, and Asia-Pacific, are further fueling the adoption of bioinsecticides as essential tools for integrated pest management

- The trend is also supported by the growing popularity of farm-to-table movements, organic food certifications, and retailer commitments to sustainable sourcing, all of which are increasing demand for crop protection solutions that align with clean-label and eco-friendly values

- Companies are investing in research to develop more effective, broad-spectrum liquid bioinsecticides and innovative application technologies, enabling farmers to achieve reliable pest control while maintaining organic certification and market access

Liquid Bioinsecticides Market Dynamics

Driver

“Growing Resistance to Chemical Pesticides”

- The increasing resistance of pests to conventional chemical pesticides is a major driver for the liquid bioinsecticides market, as growers seek alternative solutions to manage evolving pest populations and maintain crop yields

- For instance, companies such as Bayer Crop Science, Syngenta Biologicals, and Valent BioSciences are developing and promoting liquid bioinsecticides based on naturally occurring bacteria, fungi, and plant extracts that offer novel modes of action and reduce the risk of resistance development

- The widespread use of chemical insecticides has led to the emergence of resistant pest species, prompting regulatory agencies to restrict or ban certain active ingredients and encouraging the adoption of biological alternatives

- Liquid bioinsecticides provide targeted control with minimal impact on beneficial insects and non-target organisms, making them valuable components of integrated pest management programs

- The market is also benefiting from advances in formulation science, which improve the stability, shelf life, and efficacy of liquid bioinsecticides, supporting their broader adoption across different crops and climatic conditions. As resistance management becomes a top priority for growers and regulators alike, the demand for innovative bioinsecticide solutions is expected to continue rising

Restraint/Challenge

“High Production Costs”

- High production costs remain a significant challenge in the liquid bioinsecticides market, affecting price competitiveness and large-scale adoption, particularly in cost-sensitive regions

- For instance, the manufacturing of liquid bioinsecticides often involves complex fermentation processes, stringent quality control, and specialized storage requirements, which can drive up costs for producers such as Marrone Bio Innovations and Certis Biologicals

- The need for cold chain logistics, shorter shelf life compared to chemical alternatives, and regulatory compliance further add to operational expenses, making it difficult for some growers to justify the switch despite the environmental benefits

- Scaling up production while maintaining product efficacy and consistency is another hurdle, especially for small and medium-sized manufacturers. Companies are responding by investing in process optimization, economies of scale, and partnerships with contract manufacturers to reduce costs and expand market reach

- Overcoming this challenge will require continued innovation in production technologies, improved distribution networks, and greater education on the long-term value and sustainability benefits of liquid bioinsecticides for both growers and the environment

Liquid Bioinsecticides Market Scope

The market is segmented on the basis of organism type, type, crop type, application, and insects.

- By Organism Type

On the basis of organism type, the liquid bioinsecticides market is segmented into Bacillus thuringiensis, Beauveria bassiana, and Metarhizium anisopliae. The Bacillus thuringiensis segment accounted for the largest market revenue share in 2024, owing to its proven efficacy against a broad spectrum of insect larvae and its long-standing acceptance in organic and conventional farming. It is widely favored for its safety profile, non-toxicity to humans and animals, and its ability to be integrated into integrated pest management (IPM) programs. Its compatibility with other biological and chemical inputs further strengthens its dominance across various crop systems.

The Metarhizium anisopliae segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its expanding use in soil insect control and increasing trials demonstrating its effectiveness against hard-to-manage pests such as termites and beetles. Its unique mode of action, which involves fungal infection and internal colonization of insect hosts, makes it highly attractive in sustainable agriculture practices seeking chemical-free alternatives.

- By Type

On the basis of type, the market is segmented into natural insecticides, pathogens, and parasites. The natural insecticides segment held the largest market share in 2024, supported by rising consumer demand for chemical-free agricultural inputs and stricter residue regulations on synthetic pesticides. Natural insecticides are favored for their environmentally benign profile and rapid biodegradability, which align well with the organic farming sector’s growth and sustainability goals.

The pathogens segment is anticipated to grow at the highest CAGR from 2025 to 2032 due to increasing research and deployment of microbial solutions that offer targeted pest control. Pathogens, especially entomopathogenic fungi and bacteria, are gaining traction for their specificity, minimal non-target impact, and ability to establish in diverse environmental conditions, which enhances their long-term pest suppression potential.

- By Crop Type

On the basis of crop type, the market is segmented into oilseeds and pulses, fruits and vegetables, and grains and cereals. The fruits and vegetables segment dominated the market in 2024, owing to the high value of these crops and their vulnerability to pest attacks throughout the growing season. Farmers in this segment increasingly prefer liquid bioinsecticides for their low pre-harvest intervals, minimal residue, and compliance with international export standards.

The oilseeds and pulses segment is expected to register the fastest growth during the forecast period, driven by government initiatives promoting bio-input adoption in legume cultivation and the increasing awareness among farmers regarding soil health and pollinator safety. The ability of bioinsecticides to offer both pest suppression and soil microbe enrichment adds further value in oilseed-based cropping systems.

- By Application

On the basis of application, the market is segmented into seed treatment, soil treatment, and foliar spray. The foliar spray segment held the largest revenue share of 50.2% in 2024 due to its direct contact mechanism, fast action, and ease of application across diverse crop types. Foliar application allows precise targeting of insect pests during outbreaks and offers visible results with minimal reapplication frequency, which boosts adoption among both smallholders and commercial farms.

The seed treatment segment is poised to grow at the highest rate from 2025 to 2032, as early pest protection gains importance in precision agriculture and integrated pest management strategies. Seed treatment with bioinsecticides offers long-term control from the initial growth stages, reducing the need for repeated field applications and contributing to lower input costs and improved yield outcomes.

- By Insects

On the basis of target pests, the market is segmented into insects and mites, caterpillars, and soil insects. The caterpillars segment dominated the market in 2024 due to the widespread infestation of lepidopteran larvae across major food crops, particularly in tropical and subtropical regions. Liquid bioinsecticides targeting caterpillars, especially those based on Bacillus thuringiensis, are extensively adopted due to their high specificity and minimal environmental persistence.

The soil insects segment is expected to witness the fastest CAGR during 2025–2032, driven by growing challenges in managing root-zone pests using traditional chemicals. Increased emphasis on soil health, combined with advances in formulation technologies that enhance microbial survivability in the rhizosphere, is supporting the accelerated adoption of bioinsecticides for below-ground insect control.

Liquid Bioinsecticides Market Regional Analysis

- North America dominated the liquid bioinsecticides market with the largest revenue share of 37.09% in 2024, driven by increasing consumer shift towards organic food production and the growing adoption of sustainable agricultural inputs

- The region shows a strong preference for environmentally friendly pest control solutions, supported by stringent pesticide regulations and increasing awareness regarding the harmful effects of synthetic chemicals

- Robust investment in research and favorable government support for biological crop protection programs further contribute to market expansion across both row crops and specialty crops

U.S. Liquid Bioinsecticides Market Insight

The U.S. liquid bioinsecticides market captured the largest revenue share in 2024 within North America, fueled by the rapid expansion of organic farming and heightened regulatory scrutiny of chemical crop protection products. Farmers are increasingly adopting microbial and fungal bioinsecticides to meet rising consumer demand for safe and sustainably grown food. The presence of major biocontrol companies, alongside supportive programs from USDA and EPA, continues to propel the growth of the market across diverse crop types.

Europe Liquid Bioinsecticides Market Insight

The Europe liquid bioinsecticides market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict EU pesticide regulations and increasing focus on ecological farming systems. The growing popularity of integrated pest management (IPM), coupled with rising consumer awareness of food safety and sustainability, is fostering the adoption of biological insect control products. The region is experiencing significant growth in horticulture, vineyards, and protected cultivation, where regulatory compliance and export requirements are driving the replacement of chemical insecticides with bioinsecticides.

U.K. Liquid Bioinsecticides Market Insight

The U.K. liquid bioinsecticides market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by policy-led shifts toward sustainable agriculture and increasing demand for chemical-free food products. The country's strong organic retail sector and public concern over biodiversity loss are encouraging farmers to integrate bioinsecticides into their crop protection strategies, especially in fruits, vegetables, and pulses.

Germany Liquid Bioinsecticides Market Insight

The Germany liquid bioinsecticides market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s leadership in organic farming and its focus on environmentally friendly agricultural inputs. Germany’s stringent regulatory framework and innovation-led approach in agricultural biotechnology are encouraging the adoption of liquid bioinsecticides across both conventional and organic farming systems.

Asia-Pacific Liquid Bioinsecticides Market Insight

The Asia-Pacific liquid bioinsecticides market is poised to grow at the fastest CAGRduring the forecast period of 2025 to 2032, driven by expanding organic agriculture, increasing awareness about the harmful effects of synthetic chemicals, and supportive government policies. The region’s rising food demand, along with initiatives promoting sustainable and residue-free farming, is propelling the adoption of biological pest control solutions. As Asia-Pacific emerges as both a high-demand and high-supply hub for bio-based agricultural inputs, increasing investments and domestic production capacity are broadening market reach across small and large farms.

India Liquid Bioinsecticides Market Insight

The India liquid bioinsecticides market is gaining momentum due to growing awareness among farmers about soil health, environmental safety, and the economic benefits of bio-based inputs. Government-led programs such as the National Mission on Sustainable Agriculture and subsidies on biopesticides are accelerating adoption, particularly in fruit, vegetable, and pulse cultivation.

China Liquid Bioinsecticides Market Insight

The China liquid bioinsecticides market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to policy-driven reductions in synthetic pesticide usage and increasing emphasis on green agricultural practices. China’s strong domestic manufacturing base, expansion of certified organic farmland, and rising consumer preference for clean-label produce are significantly contributing to market growth across key crop segments.

Liquid Bioinsecticides Market Share

The liquid bioinsecticides industry is primarily led by well-established companies, including:

- BASF (Germany)

- Bayer AG (Germany)

- BIOBEST GROUP NV (Belgium)

- Certis USA L.L.C (U.S.)

- Novozymes (Denmark)

- Marrone Bio Innovations (U.S.)

- Syngenta (Switzerland)

- Nufarm (Australia)

- Som Phytopharma India Ltd. (India)

- Valent BioSciences LLC (U.S.)

- BioWorks Inc. (U.S.)

- Camson Biotechnologies Ltd (India)

- Andermatt Biocontrol AG (Switzerland)

- Kan Biosys Pvt. Ltd. (India)

- Futureco Bioscience S.A. (Spain)

- Kilpest India Ltd (India)

- BioSafe Systems, LLC. (U.S.)

- Vestaron Corporation (U.S.)

- SDS Biotech K.K (Japan)

Latest Developments in Global Liquid Bioinsecticides Market

- In April 2024, Syngenta entered into a strategic collaboration with Lavie Bio from Israel, focusing on the exploration and development of innovative biopesticides. This partnership aims to accelerate the creation of biologicals, a critical need in the agriculture sector. By leveraging the computational biology infrastructure provided by Evogene, Lavie Bio seeks to identify microbial strains that address crop protection needs, significantly enhancing its market reach and capabilities through Syngenta's extensive network

- In November 2023, FMC introduced Ethos Elite LFR, a new insecticide/biofungicide premix crop protection product, set to launch in the U.S. market in 2024. This formulation combines the proven efficacy of the pyrethroid insecticide bifenthrin with two proprietary biological strains from FMC—Bacillus velezensis strain RTI301 and Bacillus subtilis strain RTI477—delivering broad-spectrum control against early-season diseases and soilborne pests

- In February 2023, Vestaron, a leading producer of peptide-based bioinsecticides, launched Spear RC, a new addition to its Spear series. This innovative insecticide is designed to target lepidopteran pests such as cotton bollworm, soybean looper, and armyworm in crops including cotton, soybean, and rice. Field trials have shown that Spear® RC delivers pest control performance comparable to that of conventional chemical insecticides

- In March 2022, Marrone Bio Innovations Inc. and Bioceres Crop Solutions Corp. announced a definitive agreement to merge in an all-stock transaction, aiming to create a global leader in sustainable agricultural solutions. This merger combines Bioceres' expertise in bio-nutrition and seed care products with Marrone Bio's innovations in biological crop protection. Together, they will enhance their capabilities in developing and commercializing eco-friendly agricultural products to support sustainable farming practices worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.