Global Liquid Bionematicides Market

Market Size in USD Billion

CAGR :

%

USD

1.75 Billion

USD

3.74 Billion

2025

2033

USD

1.75 Billion

USD

3.74 Billion

2025

2033

| 2026 –2033 | |

| USD 1.75 Billion | |

| USD 3.74 Billion | |

|

|

|

|

Liquid Bionematicides Market Size

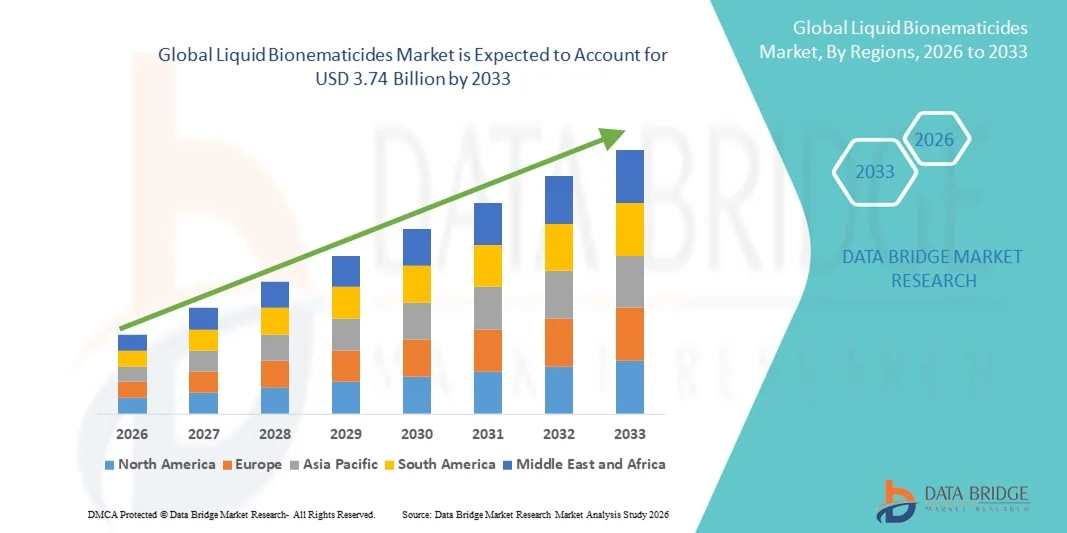

- The global liquid bionematicides market size was valued at USD 1.75 billion in 2025 and is expected to reach USD 3.74 billion by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely driven by the increasing adoption of sustainable and biological crop protection solutions, supported by stricter regulations on chemical nematicides and rising awareness of soil health management across global agricultural systems

- Furthermore, growing demand for residue-free food, expansion of organic farming practices, and the need to improve crop yield and quality are accelerating the adoption of liquid bionematicides, collectively strengthening market growth momentum

Liquid Bionematicides Market Analysis

- Liquid bionematicides, formulated using microbial and biochemical agents, are becoming essential components of modern integrated pest management programs due to their targeted action, environmental safety, and compatibility with sustainable agriculture practices across diverse crop types

- The rising demand for liquid bionematicides is primarily fueled by increasing nematode-related yield losses, regulatory pressure to reduce synthetic pesticide usage, and growing farmer preference for effective, eco-friendly, and soil-compatible nematode control solutions

- North America dominated the liquid bionematicides market with a share of 39% in 2025, due to high adoption of sustainable agricultural inputs and strong regulatory support for biological crop protection solutions

- Asia-Pacific is expected to be the fastest growing region in the liquid bionematicides market during the forecast period due to expanding agricultural activities, rising food demand, and increasing awareness of biological pest control

- Microbials segment dominated the market with a market share of around 60% in 2025, due to their proven efficacy against a wide range of nematode species and strong acceptance in integrated pest management programs. Microbial formulations based on bacteria and fungi provide targeted nematode control while maintaining soil health and microbial balance. Farmers increasingly prefer microbials due to their compatibility with organic farming standards and residue-free characteristics. The availability of commercially stable liquid formulations has improved shelf life and field performance. Growing regulatory restrictions on chemical nematicides further strengthen adoption. Strong backing from agri-input companies and extension services continues to reinforce dominance

Report Scope and Liquid Bionematicides Market Segmentation

|

Attributes |

Liquid Bionematicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Bionematicides Market Trends

Rising Adoption of Biological and Sustainable Nematode Control Solutions

- A key trend in the liquid bionematicides market is the growing shift toward biological and sustainable nematode management solutions as farmers and agribusinesses seek environmentally responsible alternatives to synthetic chemicals. This trend is driven by increasing concerns over soil degradation, biodiversity loss, and chemical residues in food crops, positioning liquid bionematicides as integral components of modern integrated pest management programs

- For instance, Bayer AG and BASF SE have expanded their biological crop protection portfolios to include microbial-based nematode control products, supporting the transition toward sustainable agriculture practices. These initiatives are strengthening farmer confidence in liquid bionematicides by demonstrating their effectiveness under commercial farming conditions

- The adoption of liquid formulations is increasing due to their ease of application, better soil penetration, and compatibility with existing irrigation and fertigation systems. This enhances uniform distribution in the root zone, improving nematode suppression across diverse crop systems

- High-value horticultural crops are increasingly relying on biological nematode control to maintain yield quality and export compliance. This is reinforcing the role of liquid bionematicides in fruits, vegetables, and protected cultivation systems

- Agricultural input companies are investing in education and field trials to demonstrate consistent performance of biological nematode solutions. These efforts are accelerating acceptance among conventional farmers

- Overall, the rising adoption of sustainable crop protection inputs is reshaping nematode management strategies, strengthening long-term demand for liquid bionematicides across global agriculture

Liquid Bionematicides Market Dynamics

Driver

Increasing Regulatory Restrictions on Chemical Nematicides

- The tightening of regulations on chemical nematicides across major agricultural regions is a primary driver for the liquid bionematicides market. Regulatory authorities are increasingly restricting or banning synthetic nematicides due to environmental toxicity and human health concerns, creating strong demand for biological alternatives

- For instance, the European Commission has implemented stringent approval requirements under EU pesticide regulations, prompting companies such as Certis USA L.L.C. and Valent BioSciences LLC to expand registrations for biological nematode control products. These regulatory shifts are directly accelerating adoption of liquid bionematicides in regulated markets

- Farmers are seeking compliant solutions that allow continued crop protection without risking regulatory non-compliance. Liquid bionematicides meet these requirements while supporting sustainable farming objectives

- The regulatory environment is also encouraging faster innovation and commercialization of microbial and biochemical formulations. This is expanding product availability across multiple crop types

- Government support for integrated pest management programs further reinforces demand for biological inputs. These combined factors are strongly driving market growth

Restraint/Challenge

Variable Field Performance and Limited Awareness Among Farmers

- A major challenge facing the liquid bionematicides market is variability in field performance due to differences in soil conditions, climate, and farming practices. Unlike chemical nematicides, biological solutions require precise application timing and favorable environmental conditions, which can impact consistency of results

- For instance, companies such as Marrone Bio Innovations and Koppert Biological Systems emphasize farmer training and field support to address performance variability. Despite these efforts, limited technical knowledge among small and medium-scale farmers continues to restrict widespread adoption

- In many regions, awareness of correct application methods and expected outcomes remains low. This can lead to misuse and reduced confidence in biological solutions

- The need for education, demonstrations, and advisory support increases adoption costs for manufacturers and distributors. This slows penetration in price-sensitive markets

- Addressing these challenges requires sustained investment in extension services and localized agronomic support. Until these gaps are bridged, variable performance perception remains a key restraint on market expansion

Liquid Bionematicides Market Scope

The market is segmented on the basis of type, infestation, mode of application, and crop type.

- By Type

On the basis of type, the liquid bionematicides market is segmented into microbials and biochemicals. The microbials segment dominated the market with the largest revenue share of around 60% in 2025, supported by their proven efficacy against a wide range of nematode species and strong acceptance in integrated pest management programs. Microbial formulations based on bacteria and fungi provide targeted nematode control while maintaining soil health and microbial balance. Farmers increasingly prefer microbials due to their compatibility with organic farming standards and residue-free characteristics. The availability of commercially stable liquid formulations has improved shelf life and field performance. Growing regulatory restrictions on chemical nematicides further strengthen adoption. Strong backing from agri-input companies and extension services continues to reinforce dominance.

The biochemicals segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for naturally derived nematode control solutions. Biochemical bionematicides act through repellence or disruption of nematode life cycles, offering preventive crop protection. Their suitability for high-value crops and precision application enhances adoption. Increasing investment in R&D to improve efficacy and consistency supports growth. Regulatory ease compared to synthetic chemicals accelerates commercialization. Expanding awareness among farmers regarding sustainable pest control further fuels uptake.

- By Infestation

On the basis of infestation, the liquid bionematicides market is segmented into root-knot nematodes, cyst nematodes, lesion nematodes, and others. The root-knot nematodes segment dominated the market in 2025 due to their widespread prevalence across major agricultural regions and severe impact on crop yields. Root-knot infestations affect a broad range of crops, increasing demand for effective liquid bionematicides. Liquid formulations enable uniform soil penetration, improving control efficiency. Farmers prioritize solutions targeting root-knot nematodes because of visible yield losses and quality degradation. Strong extension advisories emphasize early-stage management. This consistent demand sustains segment leadership.

The cyst nematodes segment is projected to grow at the fastest rate during the forecast period, driven by rising incidence in cereals and oilseed crops. Increasing monocropping practices elevate cyst nematode pressure, boosting demand for biological control. Liquid bionematicides offer improved contact with cyst stages in soil. Growing focus on resistance management encourages biological alternatives. Adoption is supported by compatibility with crop rotation systems. These factors collectively accelerate segment growth.

- By Mode of Application

On the basis of mode of application, the market is segmented into seed treatment, soil treatment, foliar spray, and others. The soil treatment segment dominated the market in 2025 owing to its direct effectiveness in targeting nematodes in their primary habitat. Liquid bionematicides applied to soil ensure better dispersion and root-zone coverage. This method supports preventive and curative control throughout crop growth stages. Farmers favor soil treatment for high infestation areas due to consistent performance. Compatibility with drip irrigation systems enhances application efficiency. These advantages underpin its leading position.

The seed treatment segment is anticipated to register the fastest growth from 2026 to 2033, driven by increasing adoption of preventive crop protection strategies. Treating seeds with liquid bionematicides provides early-stage protection against nematode attacks. This approach reduces overall chemical input and application costs. Rising use of treated seeds in commercial agriculture supports growth. Improved formulation stability ensures uniform seed coating. These benefits position seed treatment as a rapidly expanding segment.

- By Crop Type

On the basis of crop type, the liquid bionematicides market is segmented into cereals and grains, oilseeds and pulses, and fruits and vegetables. The fruits and vegetables segment dominated the market with the largest share in 2025, driven by the high economic value of these crops and their susceptibility to nematode damage. Growers prioritize bionematicides to maintain yield quality and marketability. Liquid formulations support frequent application schedules required for intensive cultivation. Strong demand from protected farming systems further boosts usage. Regulatory emphasis on residue-free produce strengthens adoption. This sustained demand supports segment dominance.

The oilseeds and pulses segment is expected to grow at the fastest pace during the forecast period, supported by expanding cultivation areas and rising nematode pressure. Farmers increasingly adopt bionematicides to protect root systems and improve nutrient uptake. Liquid products integrate well with existing farm practices in these crops. Growing focus on sustainable input use enhances acceptance. Yield stability concerns encourage preventive applications. These drivers collectively accelerate segment growth.

Liquid Bionematicides Market Regional Analysis

- North America dominated the liquid bionematicides market with the largest revenue share of 39% in 2025, driven by high adoption of sustainable agricultural inputs and strong regulatory support for biological crop protection solutions

- Farmers across the region increasingly prioritize residue-free nematode control and soil health improvement, encouraging the use of liquid bionematicides across high-value crops

- This widespread adoption is further supported by advanced farming practices, strong awareness of integrated pest management, and high spending capacity on premium agri-inputs, positioning liquid bionematicides as a preferred solution in both conventional and organic farming systems

U.S. Liquid Bionematicides Market Insight

The U.S. liquid bionematicides market accounted for the largest revenue share within North America in 2025, supported by extensive cultivation of fruits, vegetables, and row crops vulnerable to nematode infestation. Farmers increasingly adopt microbial-based liquid formulations to comply with strict residue regulations and sustainability goals. Strong presence of leading biological input manufacturers and widespread extension programs further accelerate market penetration. In addition, growing adoption of organic farming and regenerative agriculture practices continues to boost demand across major agricultural states.

Europe Liquid Bionematicides Market Insight

The Europe liquid bionematicides market is projected to grow at a steady CAGR during the forecast period, driven by stringent restrictions on chemical nematicides and strong emphasis on sustainable farming. Increasing adoption of biological crop protection solutions across cereals, oilseeds, and horticultural crops supports market expansion. European farmers show strong preference for environmentally safe inputs that align with EU Green Deal objectives. Rising awareness of soil biodiversity preservation further strengthens regional demand.

U.K. Liquid Bionematicides Market Insight

The U.K. liquid bionematicides market is expected to expand at a notable CAGR, supported by increasing focus on sustainable crop management and reduced chemical dependency. Regulatory pressure on synthetic nematicides has accelerated the shift toward biological alternatives. Farmers increasingly use liquid bionematicides to protect horticultural and field crops from yield losses caused by nematodes. The growth of organic and integrated farming practices continues to support market development in the country.

Germany Liquid Bionematicides Market Insight

The Germany liquid bionematicides market is anticipated to grow at a considerable CAGR, driven by strong environmental regulations and high awareness of sustainable agriculture practices. Germany’s emphasis on soil health and biodiversity conservation encourages adoption of microbial and biochemical nematode control solutions. The country’s well-developed agricultural infrastructure supports the integration of liquid bionematicides into modern crop protection programs. Increasing investment in biological inputs further contributes to market growth.

Asia-Pacific Liquid Bionematicides Market Insight

The Asia-Pacific liquid bionematicides market is expected to register the fastest CAGR from 2026 to 2033, driven by expanding agricultural activities, rising food demand, and increasing awareness of biological pest control. Rapid growth in horticulture and cash crop cultivation across countries such as China, India, and Japan supports adoption. Government initiatives promoting sustainable farming and reduced chemical usage further accelerate market expansion. The growing availability of cost-effective liquid formulations also enhances accessibility for small and medium-scale farmers.

Japan Liquid Bionematicides Market Insight

The Japan liquid bionematicides market is gaining traction due to high-value crop cultivation and strong focus on precision agriculture. Japanese farmers emphasize crop quality and soil health, driving adoption of biological nematode management solutions. Liquid bionematicides align well with advanced farming systems and controlled-environment agriculture prevalent in the country. Increasing concern over chemical residues further supports market growth across fruits and vegetables.

China Liquid Bionematicides Market Insight

The China liquid bionematicides market held the largest revenue share in Asia-Pacific in 2025, supported by extensive agricultural production and rising adoption of sustainable inputs. Rapid urbanization and increasing food safety concerns encourage farmers to shift toward biological crop protection solutions. Strong domestic manufacturing capacity and government support for green agriculture accelerate market penetration. Growing use of liquid bionematicides across vegetables, fruits, and cash crops continues to drive robust demand in China.

Liquid Bionematicides Market Share

The liquid bionematicides industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- BASF SE (Germany)

- FMC Corporation (U.S.)

- Valent BioSciences LLC (U.S.)

- Marrone Bio Innovations, Inc. (U.S.)

- Syngenta Group (Switzerland)

- Certis USA L.L.C. (U.S.)

- T. STANES & COMPANY LIMITED (India)

- UPL Limited (India)

- Koppert Biological Systems (Netherlands)

- Andermatt Group AG (Switzerland)

- Bioceres Crop Solutions Corp. (Argentina)

- Chr. Hansen Holding A/S (Denmark)

- Novozymes A/S (Denmark)

- Isagro S.p.A. (Italy)

Latest Developments in Global Liquid Bionematicides Market

- In October 2025, DPH Biologicals expanded its presence in Brazil with the launch of Companion Maxx, directly strengthening the penetration of liquid bionematicides in one of the world’s largest agricultural markets. This launch supports wider adoption among row crop and horticulture growers seeking effective biological alternatives to chemical nematicides. By improving access to proven microbial formulations, the development contributes to higher acceptance of liquid bionematicides and accelerates overall market expansion in Latin America

- In October 2025, UPL Limited commercially introduced Companion Maxx in Brazil as part of its broader biological crop protection strategy. The launch enhances UPL’s competitive positioning in the fast-growing biologicals segment while increasing farmer confidence in liquid bionematicide solutions. Expanded distribution and technical support associated with the product improve adoption rates, reinforcing demand growth and intensifying competition within the global market

- In March 2025, Certis Biologicals, through its partnership with Certis-Belchim, launched a Purpureocillium lilacinum–based liquid bionematicide across several European countries. This development strengthens market growth in regions with strict regulatory controls by offering compliant, effective biological nematode management solutions. The partnership accelerates commercialization, broadens geographic reach, and supports Europe’s transition away from synthetic nematicides toward sustainable crop protection

- In January 2025, Lesaffre launched Atroforce, a liquid bionematicide formulated with Trichoderma atroviride, targeting high-acreage crops such as corn, soybeans, cotton, and potatoes. This product introduction expands the availability of crop-specific biological solutions, addressing yield loss risks caused by nematode infestations. Improved formulation stability and versatility enhance farmer adoption, supporting steady market growth across field crop segments

- In September 2024, Bayer AG entered an exclusive distribution agreement with Ecospray to commercialize a garlic-based liquid bionematicide across Europe, the Middle East, and parts of Africa. This collaboration accelerates the market entry of plant-based nematode control solutions while leveraging Bayer’s extensive distribution network. The agreement supports broader adoption of residue-free biological inputs, strengthens regional market development, and reinforces the industry’s shift toward sustainable pest management solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.