Global Liquid Biopsy Market

Market Size in USD Billion

CAGR :

%

USD

2.69 Billion

USD

9.34 Billion

2024

2032

USD

2.69 Billion

USD

9.34 Billion

2024

2032

| 2025 –2032 | |

| USD 2.69 Billion | |

| USD 9.34 Billion | |

|

|

|

|

Liquid Biopsy Market Size

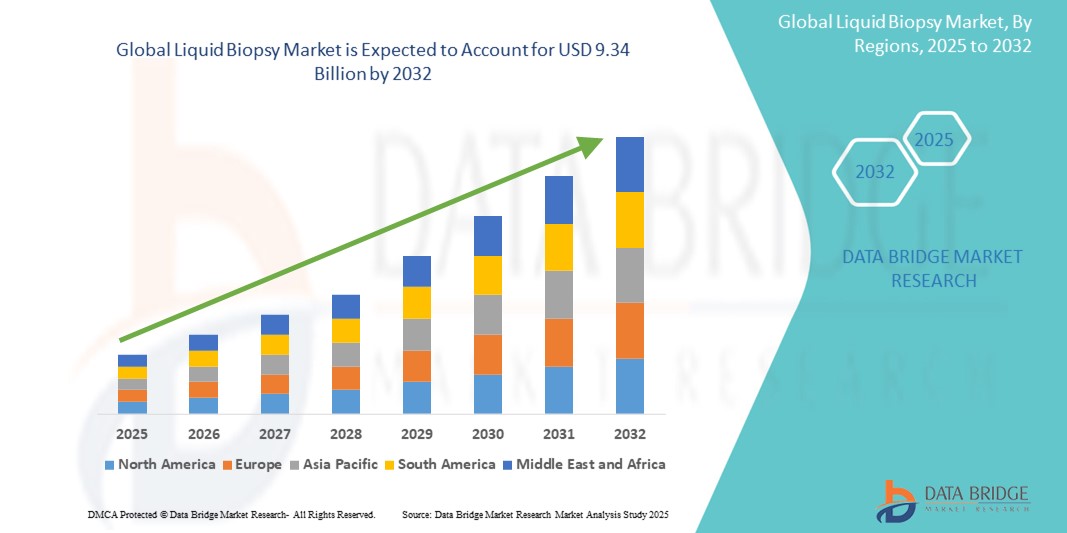

- The global liquid biopsy market was valued at USD 2.69 billion in 2024 and is expected to reach USD 9.34 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 16.80%, primarily driven by the increasing cancer incidence

- This growth is driven by factors such as growth invasive testing, personalized medicine, and advancements in ophthalmic technology

Liquid Biopsy Market Analysis

- Liquid biopsy is a revolutionary non-invasive diagnostic method used for detecting cancer and monitoring disease progression. Unlike traditional tissue biopsies, liquid biopsies analyze a patient’s blood, plasma, or other bodily fluids for biomarkers associated with cancer, offering several advantages, including early detection, minimal discomfort, and the ability to monitor treatment responses

- The demand for liquid biopsy is driven by the increasing incidence of cancer globally, as well as the growing need for early diagnosis and personalized treatment. Cancer, being one of the leading causes of death worldwide, has prompted a shift toward advanced diagnostic techniques that offer better accuracy and less invasiveness compared to traditional methods. Liquid biopsy is increasingly being seen as a promising tool to address these needs

- North America is the dominant region for the liquid biopsy market, owing to its advanced healthcare infrastructure, robust research and development in life sciences, and widespread adoption of cutting-edge technologies. The U.S. remains a major hub for innovation in the field of liquid biopsy, driven by significant investments from both the private sector and government institutions. Furthermore, favorable reimbursement policies and an established healthcare framework play a vital role in the market's growth in the region

- For instance, the U.S. has seen a steady rise in the number of liquid biopsy tests performed, particularly in oncology, where they are used for cancer screening, monitoring, and predicting treatment outcomes. The FDA’s approval of liquid biopsy technologies has also accelerated adoption in clinical settings, creating an environment ripe for market growth

- Globally, liquid biopsy ranks as one of the most important advancements in cancer diagnostics, following traditional biopsy methods, and plays a pivotal role in providing critical insights for the treatment of various cancers. As liquid biopsy technologies continue to evolve, they are expected to enhance early cancer detection, improve monitoring of treatment responses, and assist in the development of personalized therapeutic strategies

- The market for liquid biopsy is expected to experience significant growth due to increasing investments in research, improved technologies such as next-generation sequencing (NGS), and the growing trend toward precision medicine. In addition, advancements in artificial intelligence (AI) and machine learning are anticipated to further boost the capabilities of liquid biopsy, improving diagnostic accuracy and enabling faster decision-making in clinical settings

Report Scope and Liquid Biopsy Market Segmentation

|

Attributes |

Liquid Biopsy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Biopsy Market Trends

“Increasing Integration of Artificial Intelligence and Machine Learning”

- A prominent emerging trend in the global liquid biopsy market is the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies to enhance the accuracy and efficiency of biomarker detection and analysis

- AI and ML are revolutionizing the interpretation of complex genetic data by enabling faster and more precise identification of cancer-related mutations and biomarkers from liquid biopsy samples

- For instance, AI algorithms are being used to analyze blood, urine, and other fluid samples, allowing for better prediction of cancer progression, treatment response, and detection of minimal residual disease (MRD), improving early-stage diagnosis and personalized treatment plans

- These advancements enable liquid biopsy platforms to process large datasets with greater accuracy, ensuring that oncologists can make real-time, data-driven decisions for more effective patient management

- The integration of AI and ML into liquid biopsy technologies not only speeds up diagnostics but also increases the potential for early cancer detection, minimal invasive monitoring, and reducing the burden of traditional biopsy methods

Liquid Biopsy Market Dynamics

Driver

“Growing Prevalence of Cancer and Demand for Non-Invasive Diagnostic Solutions”

- The rising global prevalence of cancer, especially lung, breast, and colorectal cancers, is significantly contributing to the growing demand for liquid biopsy technologies

- Liquid biopsy, which allows for non-invasive testing through blood, urine, and other bodily fluids, is becoming a preferred method for cancer detection, monitoring, and treatment selection due to its ease of use and less invasive nature

- As patients and healthcare providers continue to prioritize early diagnosis and ongoing monitoring, the need for liquid biopsy technologies grows, enabling faster and more precise detection of cancer biomarkers

- The ability of liquid biopsy to detect minimal residual disease, monitor therapeutic responses, and track recurrence of cancer is propelling its adoption, especially in oncology

For instance:

- In June 2024, according to a study published by the National Cancer Institute, the accuracy of liquid biopsy in detecting non-small cell lung cancer (NSCLC) has increased significantly, leading to faster and less invasive detection compared to traditional biopsy methods, making it a key driver of market growth

- In March 2023, a report from the American Cancer Society highlighted that the growing adoption of liquid biopsy in colorectal cancer screening is expected to increase its market penetration, improving early-stage detection and patient survival rates

- The growing prevalence of cancer and the demand for non-invasive diagnostic solutions are driving the adoption of liquid biopsy technologies for early detection, monitoring, and treatment selection

Opportunity

“Advancements in Technology and Artificial Intelligence Integration in Liquid Biopsy”

- The integration of advanced technologies such as next-generation sequencing (NGS) and artificial intelligence (AI) into liquid biopsy platforms presents significant opportunities for improving detection sensitivity and accuracy

- AI-driven liquid biopsy technologies can enhance the identification of genetic mutations and cancer-related biomarkers, providing real-time insights for oncologists to make more informed decisions about treatment plans

- In addition, the growing trend of personalized medicine, which tailors’ treatments based on genetic profiles, is further driving the demand for liquid biopsy tools that offer detailed molecular insights

For instance:

- In January 2025, a report published by Bioinformatics Insights revealed that AI-powered platforms in liquid biopsy can analyze complex genetic data from blood samples with high accuracy, offering the potential for better early detection and real-time monitoring of cancer progression

- In November 2024, a study published in the Journal of Clinical Oncology demonstrated that AI algorithms could enhance the predictive capabilities of liquid biopsy platforms, allowing oncologists to better track treatment efficacy and detect early signs of recurrence in breast cancer patients

- The integration of AI and next-generation sequencing into liquid biopsy platforms is enhancing detection accuracy, enabling real-time insights, and driving the demand for personalized cancer treatment solutions

Restraint/Challenge

“High Costs and Limited Accessibility in Developing Regions”

- The high cost of liquid biopsy tests, including advanced sequencing techniques and diagnostic platforms, poses a significant challenge to widespread adoption, particularly in developing regions with limited healthcare budgets

- These costs can make liquid biopsy tests less accessible to patients in low-income regions, hindering the global growth of the market

- In addition, the technological complexity involved in liquid biopsy testing, coupled with the need for specialized equipment and highly trained personnel, adds to the barriers in expanding the use of liquid biopsy technologies in rural and underserved areas

For instance:

- In October 2024, a report from the World Health Organization indicated that the high price of next-generation sequencing required for liquid biopsy tests is limiting its adoption in low-income countries, where access to cancer screening technologies remains a significant challenge

- In July 2023, an article from the National Institutes of Health pointed out that while liquid biopsy technologies are advancing, the associated costs and the need for high-level infrastructure and expertise are key challenges in achieving equitable access to these diagnostic tools worldwide

- The high cost and technological complexity of liquid biopsy tests present significant barriers to their widespread adoption, particularly in low-income regions, limiting global market growth and access to advanced diagnostic solutions

Liquid Biopsy Market Scope

The market is segmented on the basis of product, biomarker type, sample type, analytical type, application, clinical application, technology, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Biomarker Type |

|

|

By Sample Type

|

|

|

By Analytical Type |

|

|

By Application Type |

|

|

By Clinical Application

|

|

|

By Technology |

|

|

By End User |

|

|

By Distribution Channel |

|

Liquid Biopsy Market Regional Analysis

“North America is the Dominant Region in the Liquid Biopsy Market”

- North America leads the liquid biopsy market, driven by cutting-edge healthcare infrastructure, rapid adoption of innovative medical technologies, and the presence of key industry players

- U.S. holds a significant share of the market, with a strong demand for non-invasive cancer diagnostic tools, rising prevalence of cancers such as lung, breast, and colorectal, and advancements in genetic sequencing technologies

- The region benefits from well-established reimbursement policies and continuous investments in research and development by leading biotech companies, further strengthening its position in the market

- In addition, the increasing focus on personalized medicine, which relies on liquid biopsy technologies for targeted therapies and early detection, is fueling market expansion across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is anticipated to experience the highest growth rate in the liquid biopsy market, driven by rapid advancements in healthcare infrastructure, increasing awareness of cancer diagnosis, and rising patient volumes

- Countries such as China, India, and Japan are emerging as key markets due to their growing aging populations and higher incidence of cancers, which require more effective diagnostic solutions such as liquid biops

- Japan is a crucial market for liquid biopsy technology, with its advanced medical technology and strong emphasis on early cancer detection, making it a leader in adopting non-invasive diagnostic solutions

- China and India, with their large populations and an increasing number of cancer cases, are witnessing greater investments in both public and private healthcare sectors, facilitating the adoption of liquid biopsy technologies for more accessible cancer detection and monitoring. The growth of global medical device manufacturers and improved healthcare access further drive the market's expansion in these countries

Liquid Biopsy Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Exact Sciences Corporation (U.S.)

- Menarini Silicon Biosystems (Italy)

- Epic Sciences (U.S.)

- NeoGenomics Laboratories (U.S.)

- mdxhealth (Belgium)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QIAGEN (The Netherlands)

- Oncocyte Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- PathAI, Inc. (U.S.)

- Guardant Health (U.S.)

- Labcorp (U.S.)

- ANGLE plc (U.K.)

- Natera, Inc. (U.S.)

- Sysmex Inostics Inc. (U.S.)

Latest Developments in Global Liquid Biopsy Market

- In January 2025, The National Health Service (NHS) in England began offering liquid biopsies to women with mutated breast cancer. This ultra-sensitive blood test detects tumor DNA, enabling personalized treatment with targeted therapies such as elacestrant

- In June 2024, Researchers unveiled a predictive blood test capable of detecting breast cancer recurrence up to three years before tumors are visible on scans. Utilizing whole genome sequencing, the test identifies specific mutations, enhancing early intervention strategies

- In March 2024, Guardant Health announced the launch of its new liquid biopsy test, Guardant360 CDx, which is now FDA-approved as a companion diagnostic for multiple cancer types. This blood-based test helps identify actionable mutations in cancer patients, providing physicians with insights into the most effective targeted therapies for individual patients

- In February 2024 Twist Bioscience Corporation introduced a cfDNA Library Preparation Kit to facilitate liquid biopsy research. This kit streamlines sample preparation for next-generation sequencing, enhancing the efficiency of liquid biopsy studies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.