Global Liquid Biopsy Tests Market

Market Size in USD Million

CAGR :

%

USD

673.20 Million

USD

2,347.79 Million

2025

2033

USD

673.20 Million

USD

2,347.79 Million

2025

2033

| 2026 –2033 | |

| USD 673.20 Million | |

| USD 2,347.79 Million | |

|

|

|

|

Liquid Biopsy Tests Market Size

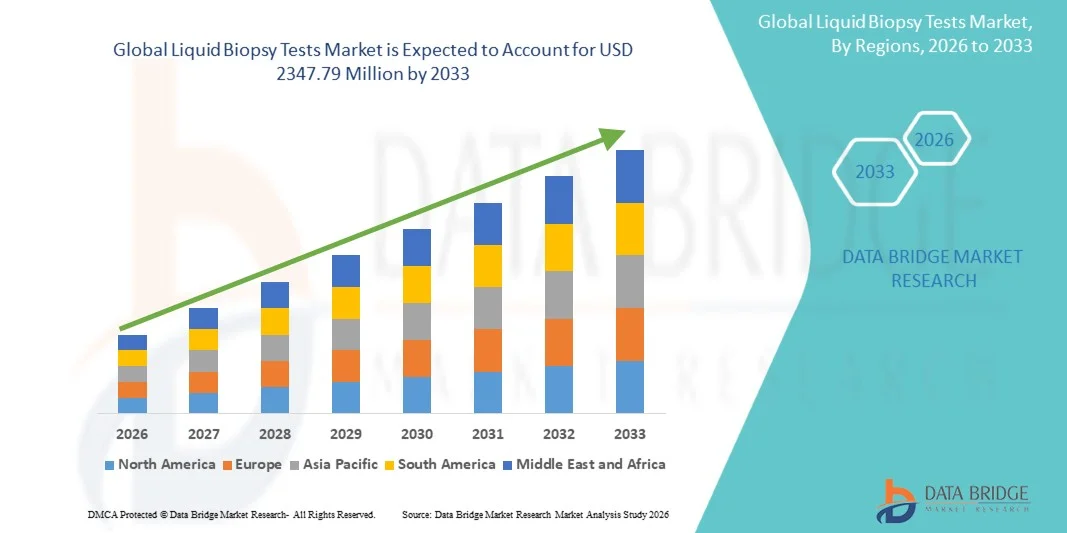

- The global liquid biopsy tests market size was valued at USD 673.2 Million in 2025 and is expected to reach USD 2347.79 Million by 2033, at a CAGR of 16.90% during the forecast period

- The market growth is largely fueled by increasing adoption of minimally invasive diagnostic techniques, growing prevalence of cancer, and rising demand for personalized medicine and early disease detection

- Furthermore, rising awareness among healthcare providers and patients about the advantages of liquid biopsy tests—such as real-time disease monitoring, early detection of tumor recurrence, and reduced need for invasive tissue biopsies—is accelerating the uptake of Liquid Biopsy Tests solutions, thereby significantly boosting the industry's growth

Liquid Biopsy Tests Market Analysis

- Liquid Biopsy Tests, offering minimally invasive diagnostic solutions for detecting and monitoring cancer and other genetic conditions, are increasingly vital components of modern healthcare due to their ability to provide real-time insights, enable early detection, and reduce the need for traditional tissue biopsies

- The escalating demand for liquid biopsy tests is primarily fueled by the rising prevalence of cancer, growing adoption of personalized medicine, and increasing awareness among healthcare providers and patients regarding the advantages of non-invasive diagnostic tools

- North America dominated the Liquid Biopsy Tests market with the largest revenue share of 46% in 2025, supported by advanced healthcare infrastructure, high adoption of precision medicine, strong clinical research activity, and increasing investments by key market players. The U.S. leads the region with substantial growth in liquid biopsy testing across oncology centers, hospitals, and diagnostic laboratories

- Asia-Pacific is expected to be the fastest-growing region in the liquid biopsy tests market during the forecast period, projected to expand at a CAGR of 11% from 2026 to 2033, driven by rising cancer incidence, improving healthcare infrastructure, growing awareness of advanced diagnostics, and expanding medical research initiatives in countries such as China, India, Japan, and South Korea

- The Circulating Tumor DNA (ctDNA) Tests segment dominated the largest market revenue share of 45.8% in 2025, driven by its high sensitivity, non-invasive nature, and proven clinical utility in detecting actionable mutations for personalized therapy

Report Scope and Liquid Biopsy Tests Market Segmentation

|

Attributes |

Liquid Biopsy Tests Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liquid Biopsy Tests Market Trends

“Rising Adoption of Minimally Invasive Cancer Diagnostic Techniques”

- A key trend in the global liquid biopsy tests market is the increasing adoption of minimally invasive diagnostic techniques, which allow for early cancer detection, disease monitoring, and treatment response assessment without the need for traditional tissue biopsies

- For instance, in 2024, Guardant Health launched its Guardant360 liquid biopsy test, enabling clinicians to detect multiple actionable mutations from a single blood sample, highlighting the shift toward minimally invasive diagnostics

- Liquid biopsy tests provide rapid and accurate molecular information from a simple blood sample, reducing patient discomfort and risk compared to surgical biopsies

- Advances in next-generation sequencing (NGS), digital PCR, and microfluidics are enabling highly sensitive and precise detection of circulating tumor DNA (ctDNA), exosomes, and circulating tumor cells (CTCs)

- The trend is further fueled by growing patient preference for less invasive procedures and shorter hospital stays

- Hospitals and oncology centers increasingly integrate liquid biopsy testing into standard workflows to complement imaging and tissue biopsy results. Pharmaceutical companies are leveraging liquid biopsy technologies in clinical trials for biomarker identification and therapy monitoring

- Increasing availability of companion diagnostic kits for targeted therapies is driving adoption among clinicians. Emerging economies are rapidly adopting liquid biopsy due to expanding oncology centers and improved healthcare infrastructure

- Technological innovations such as multi-gene panels and digital readouts are improving test reliability and speed

Liquid Biopsy Tests Market Dynamics

Driver

“Rising Cancer Prevalence and Need for Personalized Medicine”

- The increasing global burden of cancer is a major driver of the liquid biopsy tests market, as clinicians require accurate, rapid, and non-invasive diagnostic solutions for early detection and monitoring

- For instance, in March 2025, Roche announced the expansion of its Cobas EGFR Mutation Test, a liquid biopsy solution that helps select patients for targeted therapies, exemplifying the growing demand for personalized medicine

- The growing adoption of personalized and precision medicine approaches is further propelling demand, as liquid biopsies can guide targeted therapy selection and monitor treatment response

- Pharmaceutical companies are increasingly using liquid biopsies for biomarker-driven drug development, clinical trial monitoring, and companion diagnostics, supporting market expansion

- Expanding healthcare infrastructure in emerging markets, coupled with improved access to advanced diagnostics, fuels adoption. Government initiatives promoting early cancer detection programs, reimbursement support, and oncology screening campaigns strengthen market growth

- Technological advancements in high-throughput sequencing, digital PCR, and bioinformatics enhance test accuracy, reliability, and turnaround time. Clinician awareness and preference for less invasive procedures support increasing liquid biopsy adoption over traditional biopsies

- Research and development investments by key market players in novel liquid biopsy panels drive innovation and uptake. Availability of multiplex testing for multiple cancer types in a single assay increases clinical utility and market demand

- Patient preference for minimally invasive procedures contributes to growing adoption rates. Collaborations between diagnostic laboratories, hospitals, and biotechnology companies facilitate market penetration

Restraint/Challenge

“High Cost and Technical Standardization Issues”

- The high cost of liquid biopsy tests compared to conventional diagnostic methods poses a challenge to widespread adoption, especially in price-sensitive and developing regions

- For instance, in 2023, a study published in The Lancet Oncology highlighted that the average cost of multi-gene liquid biopsy panels exceeds USD 1,000 per test, limiting accessibility and clinician adoption in many regions

- In addition, the lack of standardization in sample collection, processing, and data interpretation can lead to variability in results, creating hesitancy among clinicians. Differences in detection sensitivity and assay specificity across providers may reduce confidence in test outcomes

- Regulatory and reimbursement hurdles in certain regions delay market expansion and increase operational complexity for manufacturers. Availability of trained personnel and certified laboratories is limited in emerging economies, restricting adoption

- High investment requirements for setting up advanced sequencing platforms in hospitals and research centers are a barrier. Clinical validation studies are required to ensure test accuracy and regulatory compliance, slowing market rollout

- Some patients and clinicians remain skeptical about the reliability of liquid biopsy results compared to tissue biopsy, affecting uptake. Technical limitations in detecting low-abundance mutations in early-stage cancers pose challenges

- Companies are addressing these restraints by offering cost-effective solutions, improving assay sensitivity, and providing training and support to labs

Liquid Biopsy Tests Market Scope

The market is segmented on the basis of type, technology, application, and end user.

• By Type

On the basis of type, the Liquid Biopsy Tests market is segmented into Circulating Tumor Cell (CTC) Tests, Circulating Tumor DNA (ctDNA) Tests, Exosome-Based Tests, MicroRNA-Based Tests, and Others. The Circulating Tumor DNA (ctDNA) Tests segment dominated the largest market revenue share of 45.8% in 2025, driven by its high sensitivity, non-invasive nature, and proven clinical utility in detecting actionable mutations for personalized therapy. ctDNA tests are widely used in oncology for treatment selection, disease monitoring, and recurrence detection. The segment benefits from extensive adoption in both hospital laboratories and commercial diagnostic centers due to reliable results, broad cancer coverage, and integration with next-generation sequencing (NGS) platforms. Clinicians often prefer ctDNA for monitoring therapy response and minimal residual disease (MRD). Continuous technological advancements in assay sensitivity, multiplex detection, and bioinformatics are strengthening ctDNA’s market leadership. The rising prevalence of cancer worldwide and the demand for precision medicine further support segment growth. Market players are increasingly offering cost-effective ctDNA panels, expanding accessibility in developed and emerging regions. Strategic collaborations between diagnostic companies and oncology centers are facilitating rapid adoption. Additionally, the availability of FDA-approved ctDNA tests has enhanced clinical confidence. Rising awareness among patients and healthcare professionals about minimally invasive options fuels adoption. Overall, ctDNA tests are considered the gold standard for liquid biopsy-based molecular profiling, maintaining dominance in revenue and clinical preference.

The Circulating Tumor Cell (CTC) Tests segment is anticipated to witness the fastest CAGR of 22.4% from 2026 to 2033, driven by their growing use in early-stage cancer detection, prognosis, and metastatic monitoring. CTC tests allow real-time tracking of tumor dynamics and provide insights into tumor heterogeneity, making them highly valuable for personalized therapy planning. Increasing clinical research on novel CTC enrichment and detection methods enhances adoption. Rising awareness about non-invasive diagnostics among patients and oncologists accelerates demand. CTC technologies are being integrated into clinical trials to monitor therapeutic efficacy and resistance mechanisms. Emerging applications in immunotherapy response monitoring are further boosting market growth. Strategic partnerships and R&D investments are enabling innovative CTC platforms with higher sensitivity and lower sample volume requirements. Expansion of oncology-focused diagnostic labs in North America, Europe, and Asia-Pacific contributes to rapid market penetration. Government initiatives and reimbursement support in certain regions encourage broader adoption. Continuous improvement in assay accuracy, reproducibility, and cost-effectiveness ensures widespread clinician acceptance. CTC tests complement ctDNA assays, creating a synergistic approach in liquid biopsy diagnostics. The growth trajectory is strengthened by increasing oncology screening programs and academic research collaborations. Overall, CTC tests are expected to witness the fastest revenue growth due to rising clinical relevance and technological advancements.

• By Application

On the basis of application, the Liquid Biopsy Tests market is segmented into Cancer Diagnosis, Treatment Monitoring, Early Detection & Screening, Prognostic Assessment, and Personalized Medicine. The Cancer Diagnosis segment accounted for the largest market revenue share of 42.6% in 2025, driven by the rising global cancer burden and the urgent need for accurate, minimally invasive diagnostic tools. Clinicians increasingly rely on liquid biopsy tests to detect actionable mutations, monitor disease progression, and complement tissue biopsy results. The adoption of ctDNA and CTC tests for various solid tumors, including lung, colorectal, breast, and prostate cancers, enhances the segment’s market leadership. The segment benefits from technological advancements, such as multiplex panels and high-throughput sequencing, which enable simultaneous detection of multiple biomarkers. Increasing collaborations between hospitals, research centers, and diagnostic companies promote widespread adoption. Patient preference for less invasive procedures further strengthens demand. Government and NGO initiatives promoting early cancer detection are creating favorable market conditions. Growing investments in oncology R&D, coupled with increasing healthcare infrastructure in emerging economies, further drive growth. Cancer diagnosis applications are prioritized in developed regions due to reimbursement support and clinical adoption. Academic publications and clinical guidelines increasingly endorse liquid biopsy for diagnosis, reinforcing credibility. Overall, the segment maintains dominance due to its critical clinical relevance, technological adoption, and broad applicability across cancer types.

The Treatment Monitoring segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, fueled by the increasing need for real-time assessment of therapeutic efficacy and early detection of drug resistance. Liquid biopsy tests allow clinicians to track tumor dynamics non-invasively, enabling therapy adjustments without repeated tissue biopsies. The growing use of targeted therapies and immunotherapies necessitates continuous monitoring, driving demand. Technological advancements in ctDNA quantification and CTC characterization enhance precision and reliability. Pharmaceutical companies increasingly incorporate liquid biopsy into clinical trials for monitoring treatment outcomes. Expansion of hospital-based molecular diagnostic labs in North America, Europe, and Asia-Pacific accelerates adoption. Rising patient awareness about personalized treatment benefits contributes to market growth. Increasing collaborations between biotech firms and oncology centers support innovation in monitoring assays. Emerging economies are adopting treatment monitoring to optimize limited healthcare resources. Improved reimbursement policies in developed regions encourage broader clinical use. Continuous research on predictive biomarkers strengthens segment credibility. Overall, treatment monitoring applications are the fastest-growing due to clinical necessity, technological progress, and the shift toward personalized oncology care.

Liquid Biopsy Tests Market Regional Analysis

- North America dominated the liquid biopsy tests market with the largest revenue share of 46% in 2025

- Supported by advanced healthcare infrastructure

- High adoption of precision medicine, strong clinical research activity, and increasing investments by key market players

U.S. Liquid Biopsy Tests Market Insight

The U.S. liquid biopsy tests market captured the largest revenue share within North America in 2025, driven by substantial growth in liquid biopsy testing across oncology centers, hospitals, and diagnostic laboratories. The market expansion is fueled by technological advancements in circulating tumor DNA (ctDNA) and circulating tumor cell (CTC) detection, as well as increasing applications in early cancer detection, monitoring treatment response, and minimal residual disease assessment. The country’s strong regulatory support, rising investments in precision medicine, and growing collaborations between diagnostic companies and research institutions further reinforce market growth.

Europe Liquid Biopsy Tests Market Insight

The Europe liquid biopsy tests market is projected to expand at a substantial CAGR during the forecast period, driven by the increasing prevalence of cancer, adoption of precision medicine, and supportive healthcare policies promoting early diagnostic testing. Collaborations between diagnostic companies and research institutes, along with the expansion of clinical laboratories offering advanced molecular testing solutions, are further boosting growth.

U.K. Liquid Biopsy Tests Market Insight

The U.K. liquid biopsy tests market is expected to grow at a noteworthy CAGR, fueled by the rising incidence of cancer, growing adoption of non-invasive diagnostic methods, and increasing investments in clinical research. The country’s robust healthcare infrastructure and emphasis on early detection and personalized treatment continue to drive the uptake of liquid biopsy technologies.

Germany Liquid Biopsy Tests Market Insight

The Germany liquid biopsy tests market is anticipated to expand steadily, supported by a well-established healthcare system, high clinical research activity, and increasing adoption of advanced molecular diagnostic platforms. The demand for minimally invasive cancer diagnostics and real-time monitoring of disease progression is further bolstering market growth.

Asia-Pacific Liquid Biopsy Tests Market Insight

Asia-Pacific liquid biopsy tests market is expected to be the fastest-growing region in the Liquid Biopsy Tests market during the forecast period, projected to expand at a CAGR of 11% from 2026 to 2033. Growth is driven by rising cancer incidence, improving healthcare infrastructure, growing awareness of advanced diagnostics, and expanding medical research initiatives in countries such as China, India, Japan, and South Korea. Government initiatives supporting precision medicine, increasing adoption of next-generation sequencing (NGS) platforms, and the expansion of oncology diagnostic centers are key growth factors.

Japan Liquid Biopsy Tests Market Insight

The Japan liquid biopsy tests market is gaining momentum due to the country’s high prevalence of cancer, technologically advanced healthcare system, and increasing use of non-invasive diagnostic tests. Ongoing R&D investments and adoption of cutting-edge molecular diagnostic tools further support market growth, particularly in oncology and personalized medicine applications.

China Liquid Biopsy Tests Market Insight

The China liquid biopsy tests market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by increasing cancer prevalence, expanding healthcare infrastructure, government initiatives promoting early cancer detection, and growing adoption of molecular diagnostic technologies. The presence of domestic diagnostic companies offering cost-effective solutions and rapid technological advancements in liquid biopsy platforms are key factors propelling market expansion.

Liquid Biopsy Tests Market Share

The Liquid Biopsy Tests industry is primarily led by well-established companies, including:

- Guardant Health (U.S.)

- Roche (Switzerland)

- Illumina (U.S.)

- Exact Sciences (U.S.)

- Thermo Fisher Scientific (U.S.)

- Foundation Medicine (U.S.)

- Sysmex Corporation (Japan)

- Natera (U.S.)

- F. Hoffmann-La Roche (Switzerland)

- Sophia Genetics (Switzerland)

- Cancer Genetics, Inc. (U.S.)

- Singlera Genomics (China)

- Personal Genome Diagnostics (U.S.)

- Freenome (U.S.)

- ArcherDX (U.S.)

- Chronix Biomedical (Germany)

- Guardant Health (U.S.)

- Bio-Rad Laboratories (U.S.)

- Burning Rock Biotech (China)

Latest Developments in Global Liquid Biopsy Tests Market

- In July 2024, Guardant Health, Inc. announced the launch of a major upgrade to its market‑leading Guardant360 liquid biopsy test, featuring an expanded 739‑gene panel that enables broader biomarker evaluation and improved sensitivity for advanced cancer characterization, strengthening its position in precision oncology diagnostics

- In October 2024, Guardant Health received U.S. FDA approval for its Guardant360 CDx liquid biopsy test as a companion diagnostic for identifying EGFR mutations in non‑small cell lung cancer (NSCLC), marking one of the first FDA approvals for an NGS‑based liquid biopsy companion diagnostic in a solid tumor indication

- In May 2024, Mercy BioAnalytics, Inc. received Breakthrough Device Designation from the U.S. FDA for its Mercy Halo Ovarian Cancer Screening Test — an extracellular vesicle‑based liquid biopsy designed for early cancer detection in asymptomatic postmenopausal women — highlighting regulatory support for innovative non‑invasive diagnostics

- In August 2024, Labcorp announced that it had received De Novo marketing authorization from the U.S. FDA for PGDx elio plasma focus Dx, the first FDA‑authorized kitted liquid biopsy test for pan‑solid tumors, enabling clinicians to identify targeted therapy eligibility across multiple cancer types

- In March 2025, Belay Diagnostics partnered with GenomOncology to integrate GO Pathology Workbench into its liquid biopsy “Summit” test analysis, optimizing variant interpretation workflows and supporting high‑throughput sample processing for clinical decision‑making in cancer care

- In May 2025, the National Health Service (NHS) of England rolled out a pioneering liquid biopsy‑based ctDNA test as a first‑line diagnostic tool for suspected lung and advanced breast cancer patients, providing non‑invasive genomic profiling to guide personalized therapy and reduce the need for invasive tissue biopsies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.