Global Liquid Cooling Systems Market

Market Size in USD Billion

CAGR :

%

USD

7.02 Billion

USD

12.03 Billion

2024

2032

USD

7.02 Billion

USD

12.03 Billion

2024

2032

| 2025 –2032 | |

| USD 7.02 Billion | |

| USD 12.03 Billion | |

|

|

|

|

Liquid Cooling Systems Market

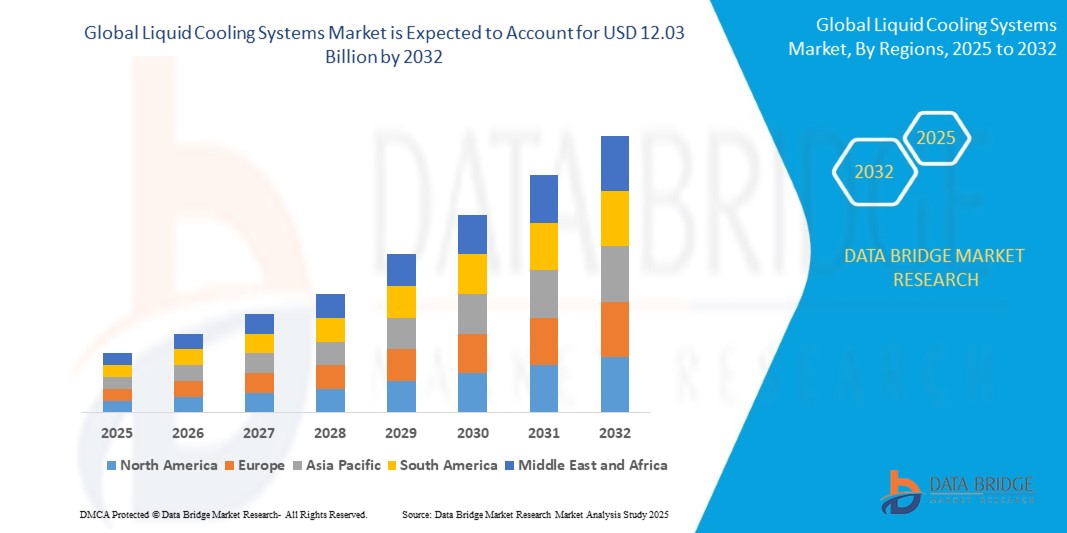

- The Liquid Cooling Systems Market was valued at USD 7.02 billion in 2024 and is projected to reach USD 12.03 billion by 2032, growing at a CAGR of 7.9% during the forecast period.

- Growth is driven by rising demand for energy-efficient and high-performance thermal management solutions, especially in data centers, automotive electronics, industrial machinery, and telecommunications infrastructure. The adoption of advanced computing, AI workloads, and sustainability initiatives is accelerating the transition from traditional air cooling to liquid-based systems.

Liquid Cooling Systems Market Analysis

- Liquid cooling systems offer superior thermal management performance compared to traditional air cooling, especially for high-performance computing environments and power-dense equipment.

- Data centers are the leading adopters, driven by the need to improve energy efficiency, reduce power usage effectiveness (PUE), and manage increasing heat loads from AI, HPC, and edge computing infrastructure.

- Automotive and industrial sectors are integrating liquid cooling in electric vehicles (EVs), power electronics, and high-load machinery to ensure operational reliability and thermal protection.

- Emerging cooling technologies, such as direct-to-chip and immersion cooling, are gaining traction due to their space-saving design, reduced noise levels, and ability to handle extreme workloads with low energy input.

- Rising environmental regulations and the push for sustainable operations are prompting enterprises to shift to liquid-based systems that support closed-loop cooling, lower emissions, and better heat recovery capabilities.

Report Scope and Liquid Cooling Systems Market Segmentation

|

Attributes |

Liquid Cooling Systems Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Cooling Systems Market Trends

Immersion Cooling, Sustainability, and AI Workloads Driving Adoption

- A key and rapidly advancing trend in the Liquid Cooling Systems Market is the rise of immersion cooling in high-density data centers, driven by the need to support AI, machine learning, and HPC workloads that generate intense heat.

- Growing pressure on organizations to meet sustainability goals is pushing the transition from traditional air cooling to energy-efficient liquid cooling, which significantly reduces power consumption and improves PUE.

- The demand for modular and scalable cooling systems that can adapt to changing IT loads is accelerating adoption, particularly among edge computing and telecom deployments.

- Automotive and electronics manufacturers are adopting compact liquid cooling systems for electric vehicles (EVs), onboard computing, and semiconductor components, reflecting the push toward higher performance and thermal efficiency.

- Integration of IoT sensors and AI-driven thermal management is enabling predictive maintenance, adaptive cooling control, and real-time diagnostics, thereby increasing operational reliability and system lifespan.

Liquid Cooling Systems Market Dynamics

Driver

Surge in heat generation from high-performance computing and GPUs

- The proliferation of high-performance computing (HPC), AI training models, and GPU-intensive workloads is creating unprecedented levels of heat in data centers and enterprise IT environments—necessitating advanced cooling technologies.

- Traditional air cooling methods are increasingly insufficient for handling the thermal load from modern server infrastructure, leading to accelerated adoption of liquid-based thermal management systems.

- Hyperscale cloud providers and colocation facilities are prioritizing direct-to-chip and immersion cooling to optimize performance while reducing energy consumption and improving Power Usage Effectiveness (PUE).

- The growing trend of rack densification and space constraints in data centers further supports demand for compact, high-efficiency liquid cooling that can deliver superior heat extraction in confined environments.

- In industries like automotive electronics and industrial manufacturing, the shift toward electrification and intelligent systems is also boosting the need for reliable, high-capacity thermal solutions to protect sensitive electronic components.

Restraint/Challenge

Need for skilled workforce for deployment and maintenance

- The adoption of advanced liquid cooling technologies, such as immersion and direct-to-chip cooling, often requires specialized expertise for installation, calibration, and system integration, which is not yet widespread across all regions and industries.

- Limited availability of skilled professionals with experience in fluid dynamics, closed-loop cooling systems, and coolant chemistry increases reliance on external service providers—raising operational costs and complicating large-scale rollouts.

- In facilities retrofitting from air cooling to liquid systems, integration with legacy IT infrastructure poses technical challenges, demanding customized system redesigns and compatibility testing.

- Ongoing maintenance and fluid management require precision to avoid leaks, corrosion, and performance degradation, which adds to the technical burden on in-house IT and engineering teams.

- As adoption expands beyond data centers into automotive, industrial, and telecom sectors, the shortage of trained personnel may slow down deployment and limit scalability, especially in emerging markets with less exposure to advanced thermal technologies.

Liquid Cooling Systems Market Scope

The market is segmented on the basis of component, type and end user.

• By Component

Component types include Cold Plates, Pumps, Tubing, Coolants, Heat Exchangers, and Others. Cold Plates hold the largest market share in 2025, widely adopted for direct cooling of high-performance CPUs, GPUs, and power electronics in data centers and automotive applications. Pumps and Coolants are essential for continuous liquid circulation and efficient heat dissipation. Heat Exchangers are gaining demand in industrial and telecom cooling for transferring heat from the system to ambient air or secondary fluids. Tubing and other accessories support customizable, modular system configurations.

• By Type

Types include Liquid Heat Exchanger Systems and Compressor-Based Systems.

Liquid Heat Exchanger Systems dominate the market due to their energy efficiency, compact form factor, and lower operational costs. These systems are ideal for data centers and electronics cooling. Compressor-Based Systems are used in scenarios requiring precise temperature regulation, such as semiconductor manufacturing, medical imaging equipment, and defense systems.

• By End User

End users include Healthcare, Analytical Equipment, Industrial, Data Centers, Telecommunications, Automotive, and Military. Data Centers lead the market share in 2025, driven by the growing demand for energy-efficient cooling to support AI and cloud computing infrastructure. Automotive applications are rising rapidly due to electric vehicle battery and power electronics thermal management. Healthcare and Analytical Equipment rely on liquid cooling for MRI machines, CT scanners, and lab automation systems. Industrial, Telecom, and Military users increasingly adopt advanced cooling solutions for reliability, precision, and performance in mission-critical environments.

Liquid Cooling Systems Market Regional Analysis

- North America dominates the Liquid Cooling Systems Market with the largest revenue share in 2025, driven by strong demand across data centers, telecommunications, and industrial sectors. The region benefits from early adoption of immersion and direct-to-chip cooling technologies, particularly to meet the thermal demands of high-performance computing (HPC), AI workloads, and edge infrastructure. Government support for energy-efficient IT infrastructure and the presence of global cloud providers further propel regional growth.

- Additionally, significant investments in AI, cloud computing, and 5G technologies are pushing data center operators and enterprises to adopt advanced liquid cooling systems for improved performance and reduced power consumption. Government support for sustainable infrastructure and presence of major players like Vertiv, Schneider Electric, and Asetek further bolster regional market growth.

- The Europe Liquid Cooling Systems Market is projected to grow steadily through the forecast period. Stringent energy efficiency regulations, carbon neutrality targets, and growing demand for green data centers are driving adoption of high-efficiency liquid cooling technologies. The region’s focus on electrification in automotive, digital manufacturing, and healthcare diagnostics further contributes to increased deployment of compact, modular liquid cooling systems.

- The Asia-Pacific Liquid Cooling Systems Market is poised to grow at the fastest CAGR through 2032, supported by the rapid growth of hyperscale data centers, smartphone and electronics production, and a shift toward AI-driven manufacturing. Countries such as China, Japan, and India are investing in cloud infrastructure, EV development, and precision medical devices—all requiring advanced liquid cooling technologies.

- The MEA market is expected to witness steady growth through 2032, fueled by increased adoption of high-performance computing in oil & gas, smart city development, and data center expansion in countries such as the UAE and Saudi Arabia. Government investments in digital transformation and AI-integrated infrastructure are driving demand for efficient thermal management systems like liquid cooling.

- South America's market is experiencing growing demand for liquid cooling systems, driven by rising digitization, increased deployment of edge data centers, and growing automotive electronics. Brazil, in particular, is emerging as a hub for tech innovation and cloud infrastructure, which necessitates advanced cooling technologies for reliable and sustainable operations.

- Saudi Arabi

- Driven by Vision 2030, Saudi Arabia is pushing forward with large-scale tech infrastructure projects including NEOM and digital transformation in energy and healthcare. These initiatives rely heavily on thermal management solutions such as liquid cooling for data centers and industrial AI applications.

United States

The U.S. Liquid Cooling Systems Market captured the largest revenue share within North America in 2025, owing to widespread implementation of advanced cooling systems in data centers and semiconductor manufacturing. The country sees high adoption of immersion cooling and pump-based systems, supported by robust IT infrastructure, environmental regulations, and domestic innovation in thermal management. Leading OEMs and cloud companies headquartered in the U.S. further boost domestic consumption.

Germany

Germany is one of the key markets in Europe, driven by its leadership in automotive innovation and industrial automation. The country’s strong focus on EV thermal management, process cooling in high-tech manufacturing, and Industry 4.0 standards boosts demand for precision liquid cooling solutions. Data centers in Germany are also shifting to liquid cooling to meet sustainability and space-efficiency benchmarks.

China

China dominates the Asia-Pacific region in terms of revenue share in 2025, driven by rapid growth in data center infrastructure, EV battery production, and smart factory expansion. Government-led digitalization and sustainability programs are fueling investment in localized liquid cooling solutions. Domestic innovation in cooling hardware and component manufacturing also enhances China’s position in the global market.

Saudi Arabia

Driven by Vision 2030, Saudi Arabia is pushing forward with large-scale tech infrastructure projects including NEOM and digital transformation in energy and healthcare. These initiatives rely heavily on thermal management solutions such as liquid cooling for data centers and industrial AI applications.

Brazil

Brazil is the largest technology hub in South America, with growing investments in cloud services, IoT, and EV production. The demand for liquid cooling systems is rising across data centers and advanced manufacturing facilities to ensure high-efficiency performance and energy conservation.

Liquid Cooling Systems Market Share

The Liquid Cooling Systems Market is primarily led by a combination of global thermal management providers, cooling component manufacturers, and data center infrastructure specialists. Key players are investing in innovations such as immersion cooling, direct-to-chip solutions, and modular liquid-cooled racks to meet rising heat loads in data centers, industrial automation, and electric vehicles.

Prominent companies operating in the market include:

- Asetek Inc (Denmark)

- Boyd Corporation (US)

- CoolIT Systems (Canada)

- Emerson Electric Co (US)

- Fujitsu (Japan)

- Green Revolution Cooling Inc (US)

- HUBER+SUHNER (Switzerland)

- Koolance (US

- Lytron Inc (US)

- MillerWelds (US)

- Newegg (US)

- Parker NA (Parker Hannifin) (US)

- Rittal GmbH & Co. KG (Germany)

- Schneider Electric SE (France)

- Watteredge (US)

Latest Developments in Liquid Cooling Systems Market

- In February 2025, CoolIT Systems introduced its next-generation CHx750 Coolant Distribution Unit (CDU), designed for high-density data centers. The unit features improved thermal efficiency and remote monitoring capabilities for scalable HPC environments.

- In January 2025, Schneider Electric unveiled its EcoStruxure Liquid Cooling for Edge solution, enabling edge data centers to manage increasing heat loads from AI and IoT workloads using rack-based liquid cooling technologies.

- In November 2024, Asetek Inc. partnered with a major U.S. university to implement its direct-to-chip liquid cooling systems in supercomputing labs, aiming to reduce energy use by up to 50% compared to air cooling.

- In September 2024, Green Revolution Cooling (GRC) announced the global expansion of its ICEraQ immersion cooling systems, including a new compact model optimized for small- to mid-sized enterprises seeking sustainable data center infrastructure.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Cooling Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Cooling Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Cooling Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.