Global Liquid Crop Protection Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

46.57 Billion

USD

61.33 Billion

2025

2033

USD

46.57 Billion

USD

61.33 Billion

2025

2033

| 2026 –2033 | |

| USD 46.57 Billion | |

| USD 61.33 Billion | |

|

|

|

|

Liquid Crop Protection Chemicals Market Size

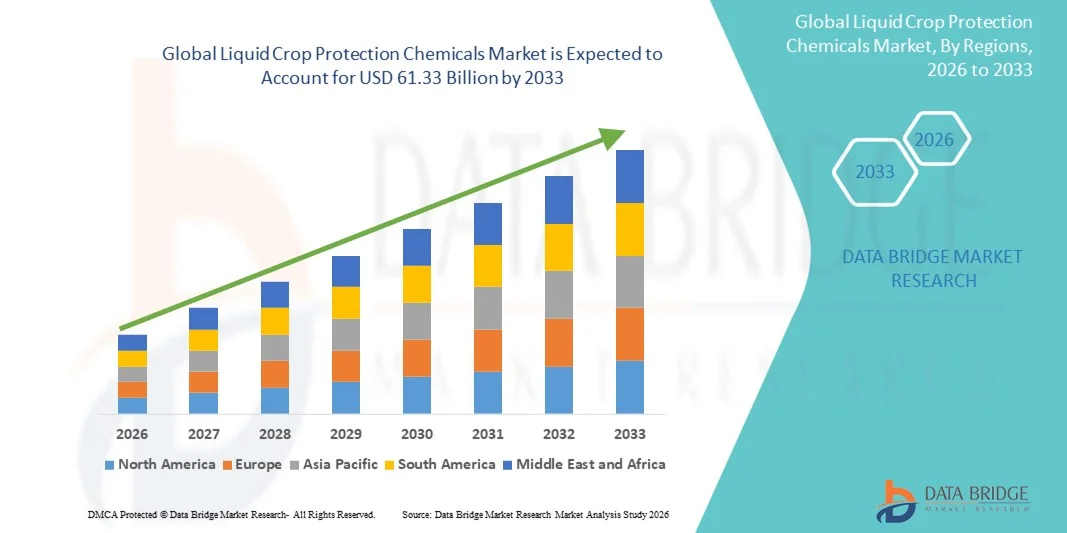

- The global liquid crop protection chemicals market size was valued at USD 46.57 billion in 2025 and is expected to reach USD 61.33 billion by 2033, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the increasing adoption of liquid formulations for efficient pest and disease control, rising demand for higher crop yields, and the preference for easy-to-apply solutions among farmers

- Growing awareness regarding precision agriculture and sustainable farming practices is further driving the demand for liquid crop protection products

Liquid Crop Protection Chemicals Market Analysis

- The market is witnessing a shift toward more effective and environmentally friendly liquid formulations, replacing traditional solid or granular products

- Technological advancements in formulation chemistry, including micro-encapsulation and controlled-release solutions, are enhancing product efficacy and safety

- North America dominated the liquid crop protection chemicals market with the largest revenue share in 2025, driven by increasing adoption of modern farming practices, high awareness of sustainable agriculture, and advanced agrochemical infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global liquid crop protection chemicals market, driven by expanding agricultural activities, favorable government initiatives, and increasing adoption of advanced crop protection solutions

- The Herbicides segment held the largest market revenue share in 2025, driven by the high adoption of liquid herbicides for efficient weed management and their compatibility with modern spraying equipment. Herbicides offer precise targeting, reduced wastage, and enhanced crop yield, making them a preferred choice for large-scale and smallholder farms

Report Scope and Liquid Crop Protection Chemicals Market Segmentation

|

Attributes |

Liquid Crop Protection Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Crop Protection Chemicals Market Trends

Rise of Liquid Formulations in Crop Protection

- The growing shift toward liquid crop protection chemicals is transforming the agricultural sector by enabling faster, more uniform application of herbicides, insecticides, and fungicides. The ease of mixing and spraying reduces labor and equipment requirements, leading to improved operational efficiency and crop yield. In addition, liquid formulations allow precise dosage adjustments, minimizing environmental contamination and chemical runoff while ensuring targeted pest and disease management.

- Increasing demand for precision agriculture and targeted crop treatment is accelerating the adoption of liquid formulations. These products are particularly effective in reducing chemical waste, improving absorption, and enhancing overall pest and disease management, supported by government and NGO initiatives promoting sustainable farming practices. Liquid products also enable integration with drones and automated spraying systems, further improving efficiency and reducing human error.

- The affordability, versatility, and compatibility of liquid crop protection products with modern spraying equipment are making them attractive for large-scale and smallholder farms, allowing for efficient use of agrochemicals without compromising crop health. These solutions also support multi-crop operations and mixed-farming practices by being compatible with different tank mixes and application methods, enhancing their market appeal.

- For instance, in 2023, several farms across Brazil and the U.S. reported improved pest control and crop uniformity after adopting liquid formulations from leading agrochemical companies, reducing chemical residues while enhancing productivity. This adoption also led to better crop quality, lower operational costs, and increased compliance with sustainable farming standards.

- While liquid formulations are driving market expansion, their impact depends on continued innovation in bio-based solutions, regulatory approvals, and farmer awareness. Manufacturers must focus on product diversification and tailored solutions for different crops to fully capitalize on growing demand, while addressing environmental safety and scalability challenges to sustain long-term growth.

Liquid Crop Protection Chemicals Market Dynamics

Driver

Rising Demand for Efficient and Sustainable Crop Protection Solutions

- The global emphasis on sustainable agriculture is driving farmers to prioritize liquid crop protection chemicals due to their efficiency, reduced wastage, and compatibility with precision spraying technologies. These formulations help improve productivity while minimizing environmental impact. Furthermore, liquid solutions allow for better integration with smart agriculture monitoring systems, enabling data-driven decision-making.

- Agrochemical companies are increasingly investing in research and development to produce high-performance liquid products that are safer, biodegradable, and compatible with integrated pest management systems. This trend is supported by government programs encouraging sustainable practices. Innovation in bio-based and environmentally friendly formulations is expanding the product portfolio, enhancing adoption in eco-sensitive regions.

- Growing adoption of modern farming techniques and mechanized spraying systems is further boosting the demand for liquid formulations, offering faster coverage and better crop protection than granular or powder alternatives. Liquid formulations also enable consistent application under varied weather conditions, improving crop resilience and yield predictability.

- For instance, in 2022, several large farms in the U.S. and Europe integrated liquid herbicide and insecticide products into precision agriculture systems, achieving higher yield and reduced chemical usage. This integration also enhanced operational efficiency, reduced labor costs, and supported compliance with sustainability certifications.

- While efficiency and sustainability are driving market demand, continuous efforts are needed to ensure regulatory compliance, farmer education, and quality standards for long-term adoption. Ongoing collaboration with local authorities and extension services helps build trust and ensures safe, effective usage of liquid crop protection solutions.

Restraint/Challenge

High Cost and Regulatory Constraints Limiting Adoption

- The higher cost of advanced liquid crop protection formulations compared with traditional solid or granular products restricts adoption, particularly among smallholder farmers in developing regions. These costs include not only the chemicals themselves but also investment in compatible spraying equipment and training for safe handling. High upfront expenses can delay the switch from conventional products.

- Strict regulatory frameworks and complex approval processes for new liquid chemicals limit the introduction of innovative products, delaying market expansion. Companies must invest significant resources in trials, documentation, and compliance checks, which can increase time-to-market and limit the availability of novel solutions for farmers.

- Limited access to proper spraying equipment in remote or under-resourced regions further hampers effective utilization, reducing the overall impact and penetration of liquid crop protection products. Inefficient or outdated equipment can result in uneven application, chemical wastage, and lower pest control efficacy.

- For instance, in 2023, reports from Sub-Saharan Africa and parts of Southeast Asia highlighted that many small-scale farmers continued using conventional formulations due to cost and equipment constraints, despite liquid products offering better efficacy. This situation underscores the need for affordable and scalable solutions, as well as support for equipment access and maintenance.

- While technological advancements continue, addressing cost, equipment access, and regulatory hurdles remains essential. Stakeholders must focus on affordable, scalable, and compliant liquid crop protection solutions to unlock long-term growth potential, including partnerships with local governments, NGOs, and cooperatives to drive adoption.

Liquid Crop Protection Chemicals Market Scope

The market is segmented on the basis of type, origin, mode of application, and crop application.

- By Type

On the basis of type, the liquid crop protection chemicals market is segmented into Herbicides, Insecticides, Fungicides, and Others. The Herbicides segment held the largest market revenue share in 2025, driven by the high adoption of liquid herbicides for efficient weed management and their compatibility with modern spraying equipment. Herbicides offer precise targeting, reduced wastage, and enhanced crop yield, making them a preferred choice for large-scale and smallholder farms.

The Insecticides segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising pest infestations and the demand for effective, eco-friendly liquid formulations. Liquid insecticides enable uniform coverage, rapid absorption, and integration with precision agriculture systems, supporting sustainable pest management and reducing crop losses.

- By Origin

On the basis of origin, the market is segmented into Synthetic and Biopesticides. The Synthetic segment captured the largest share in 2025 due to its established efficacy, availability, and cost-effectiveness for various crops. Synthetic liquid formulations are widely used in mechanized farming for their quick action and consistent performance.

The Biopesticides segment is expected to register the fastest growth from 2026 to 2033, driven by increasing demand for sustainable and environmentally friendly solutions. Biopesticides reduce chemical residues, support integrated pest management, and comply with stricter regulatory norms, enhancing adoption among eco-conscious farmers.

- By Mode of Application

Based on mode of application, the market is categorized into Foliar Spray, Seed Treatment, Soil Treatment, and Others. Foliar Spray dominated the market in 2025, owing to its ease of use, uniform distribution, and compatibility with liquid formulations. Foliar application improves pest and disease control efficiency and reduces the time and labor required for spraying.

Seed Treatment is expected to register the fastest growth from 2026 to 2033, as it provides targeted protection to seeds and emerging seedlings, reduces chemical use, and enhances crop establishment, ultimately improving yield and productivity.

- By Crop Application

On the basis of application, the market is segmented into Soya Bean, Cereals and Grain Rice, Fruits, Vegetables and Nuts, Oilseeds and Pulses, Rapeseed, Sugarcane, Corn, Cotton, Wheat, and Others. The Cereals and Grain Rice segment accounted for the largest share in 2025 due to the high consumption of liquid crop protection products in major rice-producing regions. Effective weed and pest management in staple crops ensures higher productivity and quality.

The Fruits, Vegetables, and Nuts segment is expected to register the fastest growth from 2026 to 2033, supported by the increasing adoption of high-value crops, precision agriculture practices, and the need for residue-free, uniform crop protection using liquid formulations.

Liquid Crop Protection Chemicals Market Regional Analysis

- North America dominated the liquid crop protection chemicals market with the largest revenue share in 2025, driven by increasing adoption of modern farming practices, high awareness of sustainable agriculture, and advanced agrochemical infrastructure

- Farmers and agribusinesses in the region highly value the efficiency, uniform application, and reduced chemical wastage offered by liquid formulations, which improve crop yield and quality

- The widespread adoption is further supported by government initiatives promoting precision agriculture, access to advanced spraying equipment, and the presence of leading agrochemical manufacturers, establishing liquid crop protection chemicals as a preferred choice for both large-scale and smallholder farms

U.S. Liquid Crop Protection Chemicals Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by the increasing adoption of precision agriculture and high-performance liquid formulations. Farmers are increasingly prioritizing efficient pest and disease management while reducing environmental impact. The integration of liquid herbicides, insecticides, and fungicides with mechanized spraying systems is further propelling the market. Government programs promoting sustainable farming and crop productivity are significantly contributing to market expansion.

Europe Liquid Crop Protection Chemicals Market Insight

The Europe market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent environmental regulations and growing demand for sustainable crop protection solutions. Farmers are adopting liquid formulations to improve coverage, reduce chemical residues, and enhance crop yield. The trend is further supported by rising awareness of precision agriculture and bio-based solutions across both large commercial farms and smallholder operations.

U.K. Liquid Crop Protection Chemicals Market Insight

The U.K. market is expected to witness significant growth from 2026 to 2033, driven by increasing mechanization in agriculture and growing awareness of sustainable farming practices. The adoption of liquid formulations for foliar sprays, soil treatment, and seed treatment is encouraged by the need for efficient pest and disease control. Farmers and agribusinesses are leveraging these solutions to improve productivity while minimizing environmental impact.

Germany Liquid Crop Protection Chemicals Market Insight

Germany’s liquid crop protection chemicals market is expected to witness strong growth from 2026 to 2033, fueled by government support for precision agriculture, sustainability initiatives, and technological advancements in application equipment. Adoption of liquid herbicides and biopesticides is increasing across cereal, grain, and vegetable cultivation. The focus on crop yield optimization and reduced chemical wastage is driving widespread acceptance of liquid formulations.

Asia-Pacific Liquid Crop Protection Chemicals Market Insight

The Asia-Pacific market is expected to witness the highest growth rate from 2026 to 2033, driven by rising population, increasing food demand, and the modernization of agriculture in countries such as China, India, and Japan. Farmers are adopting liquid formulations to enhance pest and disease control efficiency and improve crop productivity. Government initiatives, growing awareness of sustainable farming, and increasing availability of mechanized spraying solutions are supporting market expansion.

Japan Liquid Crop Protection Chemicals Market Insight

The Japan market is expected to witness significant growth from 2026 to 2033, driven by technological advancements in agriculture, high adoption of precision farming, and demand for sustainable crop protection solutions. Farmers are increasingly using liquid herbicides, insecticides, and fungicides to optimize application efficiency and improve crop quality. The integration of automated spraying systems and government programs promoting eco-friendly agriculture further supports market growth.

China Liquid Crop Protection Chemicals Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding agricultural sector, rapid adoption of mechanized farming, and high demand for efficient crop protection solutions. Liquid formulations are increasingly preferred due to their uniform application, faster absorption, and reduced chemical wastage. Government initiatives promoting sustainable agriculture and strong domestic agrochemical manufacturing capabilities are key factors driving market growth.

Liquid Crop Protection Chemicals Market Share

The Liquid Crop Protection Chemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Dow (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- Syngenta Crop Protection AG (Switzerland)

- Bayer AG (Germany)

- FMC Corporation (U.S.)

- Nufarm Ltd (Australia)

- ADAMA Ltd. (Israel)

- UPL (India)

- AMVAC Chemical Corporation (U.S.)

- BioWorks Inc. (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Corteva (U.S.)

- ROTAM (Taiwan)

- Isagro S.p.A. (Italy)

- ISK Biosciences Corporation (U.S.)

- Marrone Bio Innovations (U.S.)

- NIPPON SODA CO., LTD. (Japan)

- EuroChem Group (Switzerland)

- Yara (Norway)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.