Global Liquid Crystal Electro Optic Modulators Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

3.58 Billion

2024

2032

USD

1.60 Billion

USD

3.58 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 3.58 Billion | |

|

|

|

|

Liquid Crystal Electro Optic Modulators Market Size

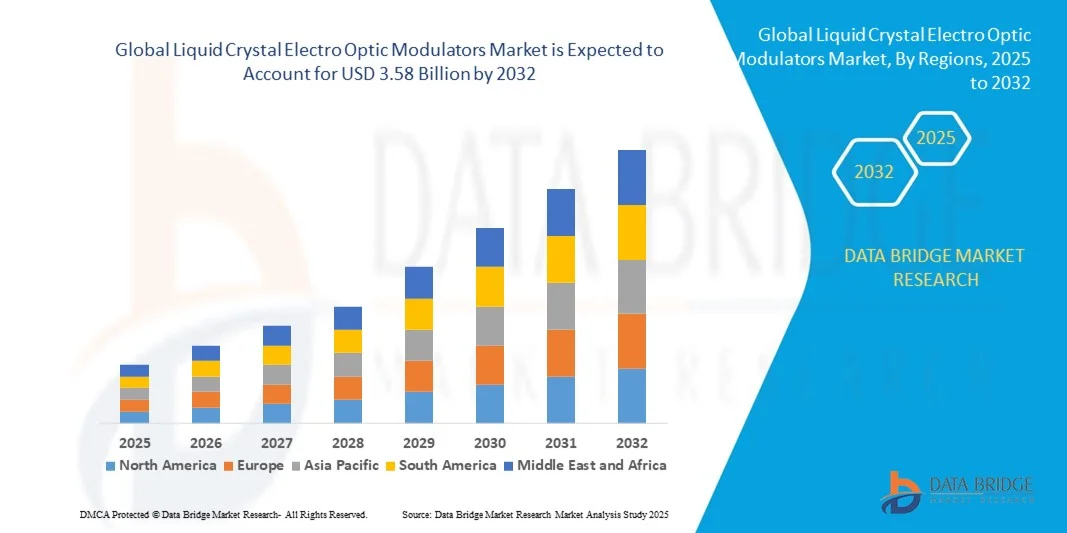

- The global liquid crystal electro optic modulators market size was valued at USD 1.6 billion in 2024 and is expected to reach USD 3.58 billion by 2032, at a CAGR of 10.60% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-speed optical communication systems, advancements in photonics and display technologies, and rising adoption across defense, aerospace, and telecommunications sectors

Liquid Crystal Electro Optic Modulators Market Analysis

- The market is witnessing growth due to the integration of LCoS (Liquid Crystal on Silicon) modulators in LiDAR systems, optical switches, and imaging applications, providing precise light modulation and improved performance

- Rising investments in research and development for compact, energy-efficient, and high-speed modulators are supporting market expansion across various industries

- North America dominated the liquid crystal electro optic modulators (LC-EOMs) market with the largest revenue share in 2024, driven by increasing adoption in telecommunications, aerospace, and industrial sensing applications

- Asia-Pacific region is expected to witness the highest growth rate in the global liquid crystal electro optic modulators market, driven by rapid industrialization, increasing demand for optical sensing and telecommunication systems, and expansion of manufacturing capabilities in countries such as China, Japan, and South Korea

- The optical telecommunications segment held the largest market revenue share in 2024, driven by the increasing deployment of high-speed fiber-optic networks and demand for precise light modulation in long-haul and metro networks. LC-EOMs in this segment enhance signal fidelity, reduce latency, and support high-bandwidth data transmission across telecommunication systems

Report Scope and Liquid Crystal Electro Optic Modulators Market Segmentation

|

Attributes |

Liquid Crystal Electro Optic Modulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Liquid Crystal Electro Optic Modulators Market Trends

Increasing Adoption of LC-EOMs in Optical Communication and Sensing Systems

- The growing integration of liquid crystal electro optic modulators (LC-EOMs) is transforming the optical and photonics landscape by enabling high-speed, precise modulation of light signals. These modulators support advanced applications in optical communication, LiDAR, and laser systems, improving data transfer rates and signal quality. Their use is further expanding in scientific instrumentation and imaging systems, where precise light control is critical for accurate measurements and enhanced resolution

- Rising demand for compact, low-power, and high-performance modulators is accelerating adoption in telecommunications, aerospace, and industrial sensing applications. LC-EOMs are particularly valuable where precise phase and amplitude control is required for high-speed optical networks and adaptive optical systems. In addition, their ability to operate across multiple wavelengths enhances versatility in multiplexed systems and advanced optical computing platforms

- The affordability, reliability, and scalability of modern LC-EOM devices are making them increasingly attractive for OEMs and system integrators. Manufacturers can deploy these modulators in fiber-optic networks, LiDAR systems, and photonic instrumentation, enhancing system efficiency and performance. In addition, growing standardization and modular design trends allow for easier integration into both new and existing optical setups, reducing deployment time and costs

- For instance, in 2023, several telecommunication providers in Europe and North America reported significant improvements in network bandwidth and signal fidelity after implementing LC-EOM modules in long-haul fiber-optic links and advanced LiDAR systems. Similarly, research labs observed enhanced imaging precision in adaptive optics applications, confirming the technology’s broader applicability in high-end photonic solutions

- While LC-EOMs are driving advancements in optical systems, their success depends on continued material innovation, precision fabrication, and integration with emerging photonic technologies. Continuous R&D and collaboration between component manufacturers and end-users are crucial to fully capitalize on this growing demand. Future developments in liquid crystal formulations, faster switching mechanisms, and compact form factors will further enhance adoption

Liquid Crystal Electro Optic Modulators Market Dynamics

Driver

Rising Demand for High-Speed Optical Communication and Advanced Sensing

- The increasing deployment of high-speed fiber-optic networks and optical communication systems is driving the adoption of LC-EOMs. These devices enable precise light modulation required for high-bandwidth data transfer, low latency, and reliable signal transmission. Growing demand for 5G/6G backhaul, metro networks, and data center interconnects is further accelerating market adoption

- The expansion of LiDAR, optical sensing, and adaptive optics in aerospace, defense, and industrial automation is encouraging manufacturers to integrate LC-EOMs for accurate phase and amplitude control. Such applications require modulators with fast response times and high optical quality. Moreover, emerging applications in autonomous vehicles, satellite imaging, and environmental monitoring are generating additional demand for precision light modulators

- System integrators and OEMs are increasingly adopting compact, low-power LC-EOM solutions, which simplify design, reduce costs, and improve system reliability. This trend supports wider deployment in both urban and remote optical networks and sensing applications. The trend of miniaturized, plug-and-play LC-EOM modules is enabling faster installation and reducing the need for complex calibration in large-scale optical systems

- For instance, in 2022, several aerospace and defense firms in North America implemented LC-EOMs in advanced LiDAR and imaging systems, enhancing detection accuracy, system stability, and operational efficiency. At the same time, telecommunication providers reported improved signal-to-noise ratios in high-capacity optical links, demonstrating the cross-industry benefits of these modulators

- While high-speed communication and sensing growth are driving market adoption, ensuring device scalability, thermal stability, and precise modulation remains essential for sustained market expansion. Continuous efforts in device optimization, integration with emerging photonic technologies, and standardization are critical to meeting future industry requirements

Restraint/Challenge

High Manufacturing Costs and Material Complexity

- The high cost of advanced LC-EOM devices, particularly those using custom liquid crystal materials and precision optical components, limits adoption among cost-sensitive applications. Pricing challenges are a significant barrier for widespread deployment in emerging markets. Additional costs associated with testing, certification, and specialized packaging further increase barriers for new entrants

- In many regions, limited access to skilled engineers and specialized fabrication facilities capable of producing high-quality modulators restricts large-scale production. Achieving precise alignment, low optical loss, and high-speed modulation requires expertise and advanced equipment. Shortage of trained personnel in emerging markets further hinders adoption, delaying project timelines and increasing operational risks

- Supply chain challenges and integration complexity with optical systems can delay product rollout. Ensuring consistent performance across diverse applications, including telecommunication networks, LiDAR, and adaptive optics, adds operational and engineering challenges. Volatility in the supply of high-purity liquid crystal materials and precision glass substrates can also affect production schedules and costs

- For instance, in 2023, several photonics startups in Asia-Pacific reported delays in commercializing LC-EOM solutions due to high material costs and limited access to precision fabrication infrastructure. In addition, fluctuating component quality and lack of standardized testing protocols caused further setbacks, affecting reliability and market confidence

- While technology continues to advance, addressing cost, material, and manufacturing challenges is critical. Collaboration among material suppliers, optical component manufacturers, and system integrators is necessary to unlock the full potential of the liquid crystal electro optic modulators market. Investment in automated fabrication techniques, modular design, and material innovation will play a pivotal role in overcoming these restraints and supporting long-term market growth

Liquid Crystal Electro Optic Modulators Market Scope

The market is segmented on the basis of application and sales channel.

- By Application

On the basis of application, the liquid crystal electro optic modulators (LC-EOMs) market is segmented into fiber optic sensors, space and defense, optical telecommunications, and instruments and industrial systems. The optical telecommunications segment held the largest market revenue share in 2024, driven by the increasing deployment of high-speed fiber-optic networks and demand for precise light modulation in long-haul and metro networks. LC-EOMs in this segment enhance signal fidelity, reduce latency, and support high-bandwidth data transmission across telecommunication systems.

The fiber optic sensors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of LC-EOMs in sensing applications requiring high sensitivity and accuracy. These modulators are particularly valuable for structural health monitoring, environmental sensing, and industrial process control, providing precise phase and amplitude modulation for advanced sensor systems.

- By SalesChannel

On the basis of sales channel, the market is segmented into direct channel and distribution channel. The direct channel segment held the largest market revenue share in 2024, fueled by strong relationships between LC-EOM manufacturers and system integrators, as well as customized solutions for high-performance optical systems. Direct sales allow manufacturers to provide technical support, integration services, and tailored product configurations for clients.

The distribution channel segment is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding global reach and increasing demand in emerging markets. Distributors facilitate faster delivery, localized support, and access to a wider customer base, enabling the adoption of LC-EOMs across multiple industries including aerospace, defense, and industrial automation.

Liquid Crystal Electro Optic Modulators Market Regional Analysis

- North America dominated the liquid crystal electro optic modulators (LC-EOMs) market with the largest revenue share in 2024, driven by increasing adoption in telecommunications, aerospace, and industrial sensing applications

- Key factors contributing to growth in the region include the presence of advanced optical communication infrastructure, strong R&D capabilities, and high adoption of LiDAR and adaptive optical systems in defense and commercial sectors

- The widespread integration of LC-EOMs in fiber-optic networks, photonic instrumentation, and precision sensing applications further strengthens market demand across North America

U.S. Liquid Crystal Electro Optic Modulators Market Insight

The U.S. LC-EOM market captured the largest revenue share in North America in 2024, fueled by rapid deployment of high-speed optical networks and advanced sensing systems. Adoption is driven by telecommunications providers, aerospace companies, and industrial integrators seeking high-precision modulators for data transmission, LiDAR, and adaptive optics. The country’s strong focus on innovation, presence of leading component manufacturers, and investments in smart infrastructure significantly contribute to market expansion.

Europe Liquid Crystal Electro Optic Modulators Market Insight

The Europe LC-EOM market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by government initiatives promoting high-speed optical networks, defense modernization, and advanced sensing systems. Increasing adoption in industrial automation, research laboratories, and space applications is fostering demand for LC-EOMs. European countries’ emphasis on photonics innovation, quality standards, and eco-friendly optical solutions is further encouraging market penetration.

U.K. Liquid Crystal Electro Optic Modulators Market Insight

The U.K. LC-EOM market is expected to witness robust growth from 2025 to 2032, driven by the expansion of defense, telecommunications, and scientific research applications. The nation’s commitment to optical communication infrastructure, R&D investments in photonics, and adoption of high-precision modulators in industrial systems support market growth. The integration of LC-EOMs in LiDAR, fiber-optic sensors, and adaptive optical instruments is accelerating adoption across multiple sectors.

Germany Liquid Crystal Electro Optic Modulators Market Insight

The Germany LC-EOM market is projected to witness significant growth from 2025 to 2032, fueled by strong industrial automation, aerospace, and defense sectors. Germany’s emphasis on innovation, high-quality manufacturing standards, and adoption of advanced optical systems promotes market uptake. The growing use of LC-EOMs in precision instrumentation, LiDAR, and optical sensing for industrial and defense applications reinforces demand.

Asia-Pacific Liquid Crystal Electro Optic Modulators Market Insight

The Asia-Pacific LC-EOM market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing optical network deployment, industrial automation, and aerospace development in countries such as China, Japan, and India. The region’s technological advancements, rising investment in photonics research, and growing demand for LiDAR and optical sensing systems support LC-EOM adoption. In addition, APAC’s emergence as a manufacturing hub for optical components is improving accessibility and reducing costs.

Japan Liquid Crystal Electro Optic Modulators Market Insight

The Japan LC-EOM market is expected to witness strong growth from 2025 to 2032 due to the country’s high-tech culture, advanced telecommunications infrastructure, and demand for precision optical components. Adoption is fueled by industrial automation, defense, and scientific research applications. The integration of LC-EOMs with LiDAR, adaptive optics, and fiber-optic systems, combined with a strong focus on R&D, is accelerating market expansion.

China Liquid Crystal Electro Optic Modulators Market Insight

The China LC-EOM market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid deployment of optical communication networks, defense modernization, and industrial automation. China’s expanding photonics manufacturing ecosystem, government initiatives promoting smart infrastructure, and increasing adoption of LiDAR and fiber-optic sensors are driving market growth. Affordable, locally manufactured LC-EOM solutions further enhance market accessibility and adoption across multiple applications.

Liquid Crystal Electro Optic Modulators Market Share

The Liquid Crystal Electro Optic Modulators industry is primarily led by well-established companies, including:

- Thorlabs, Inc. (U.S.)

- Conoptics, Inc. (U.S.)

- QUBIG GMBH (Germany)

- Inrad Optics (U.S.)

- Newport Corporation (U.S.)

- RP Photonics Consulting GmbH (Germany)

- G&H Group (U.S.)

- APE Angewandte Physik und Elektronik GmbH (Germany)

- Brimrose Corporation (U.S.)

- Schäfter + Kirchhoff GmbH (Germany)

- Photonwares Co. (U.S.)

- Cisco (U.S.)

- Fujikura Ltd. (Japan)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- JENOPTIK AG (Germany)

- Lumentum Operations LLC (U.S.)

- MKS Instruments, Inc. (U.S.)

- Versawave Technologies Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- AMS Technologies AG (Germany)

- Hamamatsu Photonics K.K. (Japan)

- Lightwave Logic, Inc. (U.S.)

- AA Opto Electronic (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Crystal Electro Optic Modulators Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Crystal Electro Optic Modulators Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Crystal Electro Optic Modulators Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.